Senate Democrats, Crypto Industry to Resume Talks After Market Structure Bill Delay

Bitcoin Magazine

Senate Democrats, Crypto Industry to Resume Talks After Market Structure Bill Delay

U.S. Senate Democrats are reportedly set to reopen talks with representatives from the cryptocurrency industry on Friday, according to people familiar with the plan speaking to CoinDesk.

All this comes less than two days after a last-minute postponement of a key Senate Banking Committee hearing on sweeping digital asset legislation.

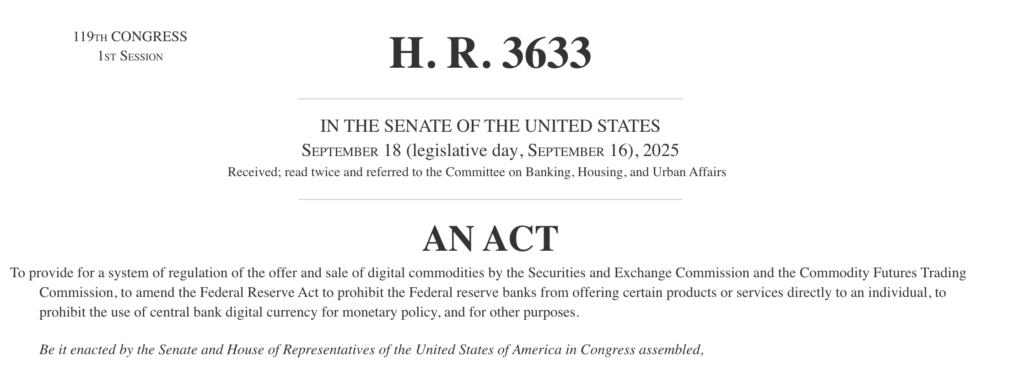

The call follows Wednesday night’s abrupt cancellation of the committee’s planned markup of the long-negotiated crypto market structure bill, which had been expected to divide regulatory oversight of digital assets between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

The delay came after Coinbase, the largest U.S.-based crypto exchange, withdrew its support for the draft legislation, citing concerns over stablecoin rewards programs and what it viewed as excessive authority granted to the SEC.

Coinbase CEO, Brian Armstrong, said that banks are trying to “kill their competition” with the crypto market structure legislation. “Crypto companies should be allowed to compete and offer loans just like banks,” Armstrong said.

Thursday marked a pause in public activity after the cancellation, but lawmakers and industry participants say negotiations are far from over.

Democrats from both the Senate Banking Committee and the Senate Agriculture Committee — which oversees the CFTC — are expected to join Friday’s call, along with representatives from crypto policy advocacy groups in Washington, according to reports.

The Banking Committee had been scheduled to hold an all-day session Thursday to debate amendments and vote on whether to advance the bill.

That plan unraveled late Wednesday after Coinbase CEO Brian Armstrong said the company could not support the current version of the legislation. Shortly thereafter, Senate Banking Committee Chair Tim Scott, R-S.C., postponed the hearing.

Lummis: Senate is closer than ever

Despite the setback, several lawmakers involved in the negotiations said discussions will continue. In a post on X, Sen. Cynthia Lummis, R-Wyo., a leading crypto advocate in the Senate, said lawmakers were “closer than ever” to reaching agreement.

“Everyone is still at the negotiating table, and I look forward to partnering with [Chairman Scott] to deliver a bipartisan bill the industry — and America — can be proud of,” Lummis wrote Thursday.

Sen. Bill Hagerty, R-Tenn., echoed that optimism, saying he remained “confident” that lawmakers could reach a consensus “in short order.”

“I am fully committed to continuing this important work with my colleagues on market structure and look forward to passing legislation that ensures this innovative technology flourishes in the United States for decades to come,” Hagerty said.

Industry reaction to Coinbase’s withdrawal has been mixed. While Armstrong’s comments intensified scrutiny of the bill, other crypto executives and advocacy groups urged lawmakers to keep pushing forward.

Kraken co-CEO Arjun Sethi said abandoning negotiations now would worsen regulatory uncertainty for U.S. crypto firms. “Walking away now would not preserve the status quo in practice,” Sethi said in a post on X. “It would lock in uncertainty while the rest of the world moves forward.”

A major point of contention in recent negotiations has been whether stablecoin issuers should be permitted to offer rewards or yield programs — an issue that has drawn pushback from bank lobbyists and some Democrats concerned about consumer protection and competition with traditional deposits.

While the Banking Committee’s markup has been postponed, the Senate Agriculture Committee is still expected to hold a hearing on the legislation on January 27, after previously pushing back its own earlier session. Ultimately, both committees’ work would need to be merged before the bill could advance to the full Senate.

Some analysts see the delay as a strategic pause, with Benchmark’s Mark Palmer saying it could help lawmakers build broader bipartisan support and ultimately strengthen what he called a potentially historic overhaul of U.S. financial regulation.

Others are more doubtful: TD Cowen warned that bridging Democratic demands and Coinbase’s objections may be difficult, especially since some disputed provisions were already concessions to Democrats, while election-year timing and the Senate’s 60-vote threshold add further hurdles.

This post Senate Democrats, Crypto Industry to Resume Talks After Market Structure Bill Delay first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

US Senate Banking Committee postpones Bitcoin and crypto market structure legislation markup after Coinbase and others withdrew their support for the bill

US Senate Banking Committee postpones Bitcoin and crypto market structure legislation markup after Coinbase and others withdrew their support for the bill