Volatility Expands, But Bitcoin Whales And Sharks Aren’t Selling — They’re Buying More

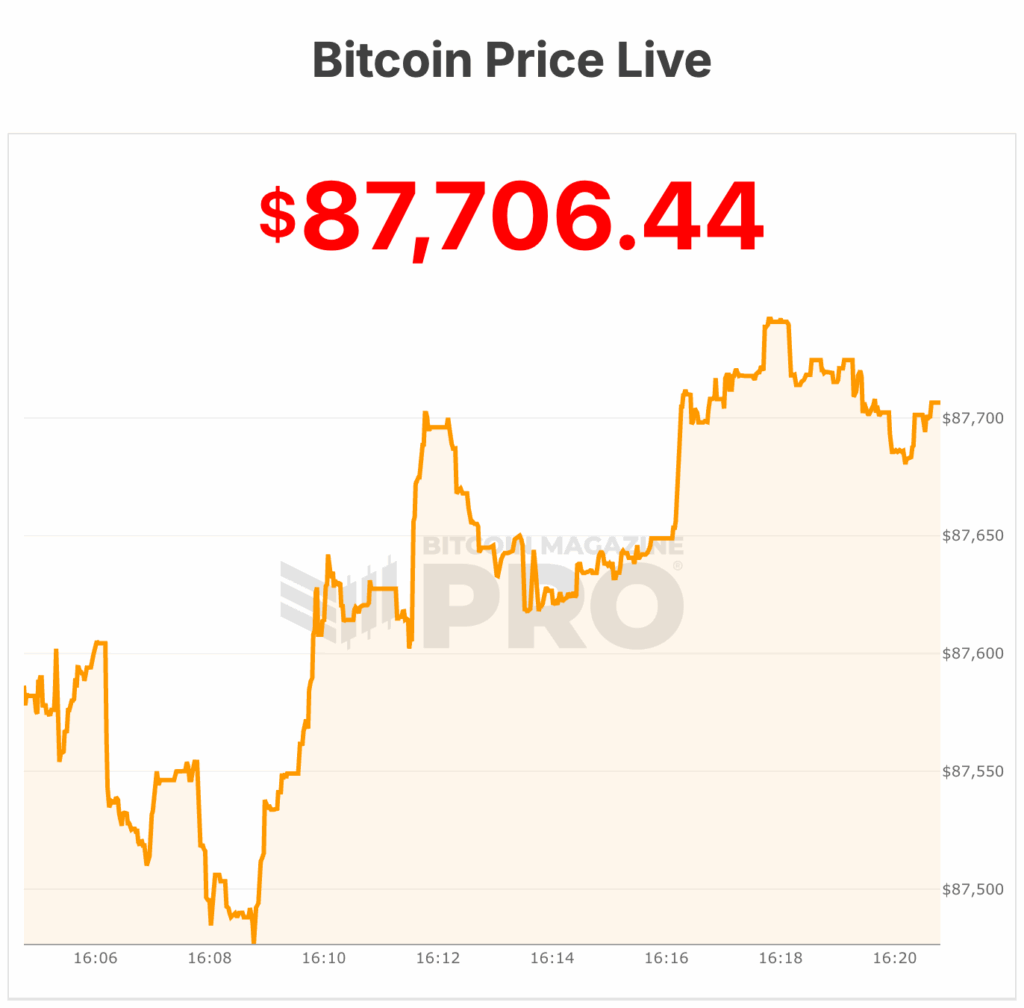

Bitcoin briefly reclaimed the pivotal $90,000 price mark once again after a brief bounce, but volatility still lingers around the largest cryptocurrency asset. During the ongoing volatile landscape, investors appear to have found a new niche, and that is buying BTC at a significant and fast rate.

Large Bitcoin Holders Are Buying In The Noise

The ongoing market volatility may have significantly impacted the Bitcoin price direction, but this is not the same for investors’ sentiment and activity. In the current bearish state, BTC investors are now sending a clear bullish signal, especially as indicated in the activity of the largest holders.

Sentiment observed among BTC large holders has shifted toward buying once again. According to research shared by Santiment, a leading on-chain data analytics platform, whales and sharks continue to accumulate more BTC even as market volatility intensifies.

During the ongoing bearish market, BTC’s price fell back to the $89,400 level, and assets like Silver and Gold experienced a steady spike. Instead of being shaken out by the pullback, these high-net-worth investors are persistently building positions, indicating a great level of confidence beneath the surface.

When these key investors start to buy BTC at a rapid rate again while the broader market signals caution, it is often viewed as a strategic move or repositioning ahead of a potential price spike. This kind of behavior is typically seen during transitional phases.

Data shows that wallet addresses holding between 10 and 10,000 BTC have purchased an additional +36,322 BTC, representing an over 0.27% rise in the past 9 days. Should this renewed buying pressure from big investors continue, it is likely to play a role in determining BTC’s next major move as it reshapes its supply and price dynamics.

While whale investors steadily add to their positions, wallet addresses holding 0.01 BTC have been dumping to the noise. This group, regarded as shrimp holders, has offloaded over 132 BTC within the same timeframe, indicating a -0.28% drop.

Santiment highlighted that it is considered an optimal condition for a crypto breakout when smart money accumulates, and retailers dump. In the absence of a geopolitical issue, this pattern continues to demonstrate a long-term bullish divergence.

Risk Around BTC Is Becoming High

Following the bearish reaction on Wednesday, the Bitcoin Risk Index metric experienced a surge, reaching the 21 level and hovering just below the High Risk zone at level 25. This uptick suggests that the continuation of the consolidation phase is highly likely and will be bolstered by the massive high-risk environment seen over the past few months.

Despite the surge, the market is still technically in a low-risk environment, and buyers are struggling to hold the pivotal support level at $89,200. At this level, the market is presented with two different scenarios.

The first, which is the bullish scenario, tells that BTC could undergo a clear push toward $94,800 and possibly $99,000 if $89,200 support holds in the short term. Meanwhile, in the bearish scenario, a continued consolidation below the support level driven by sellers would cause a drop to $84,500, marking the next line of defense for buyers.