XRP Price At $10 Too Low? Pundit Says That’s For Retail, Reveals Institutional Targets

Crypto pundit XRP Queen has described an XRP price target of $10 as being too low, claiming that this target was from a retail investor’s perspective. She also suggested how high the altcoin could go from an institutional standpoint.

Pundit Claims XRP Price Target Of $10 Is Too Low

In an X post, XRP Queen stated that people predicting XRP price targets of between $10 and $25 are still thinking of retail price targets. This came as she claimed that Ripple has been thinking about global infrastructures. The pundit highlighted the firm’s moves, including its acquisition of payment and custody infrastructure.

Furthermore, XRP Queen noted that Ripple has integrated with banks, funds, and institutions, which she claimed is positioning the altcoin for real-time global settlement. The pundit also believes that the crypto firm has secured regulatory clarity where it actually matters, which is bullish for the XRP price. Lastly, she mentioned that Ripple is actively pursuing a full banking license, having secured conditional approval from the Office of the Comptroller of the Currency (OCC).

XRP Queen declared that Ripple’s moves are how one builds financial plumbing. “Systems don’t move in pennies. They move in orders of magnitude. Lock in,” she added. Regarding how high the XRP price could rise based on institutional targets, XRP Queen suggested the altcoin could reach $100.

In an X post, she stated that people laugh at an XRP price target of $100 because they price it like a meme, but that institutions price the altcoin like infrastructure. As such, she believes the altcoin could reach these price targets based on its utility, especially as it gains traction as a token for real-time global settlement.

Canary Capital CEO Makes Bullish Case For XRP

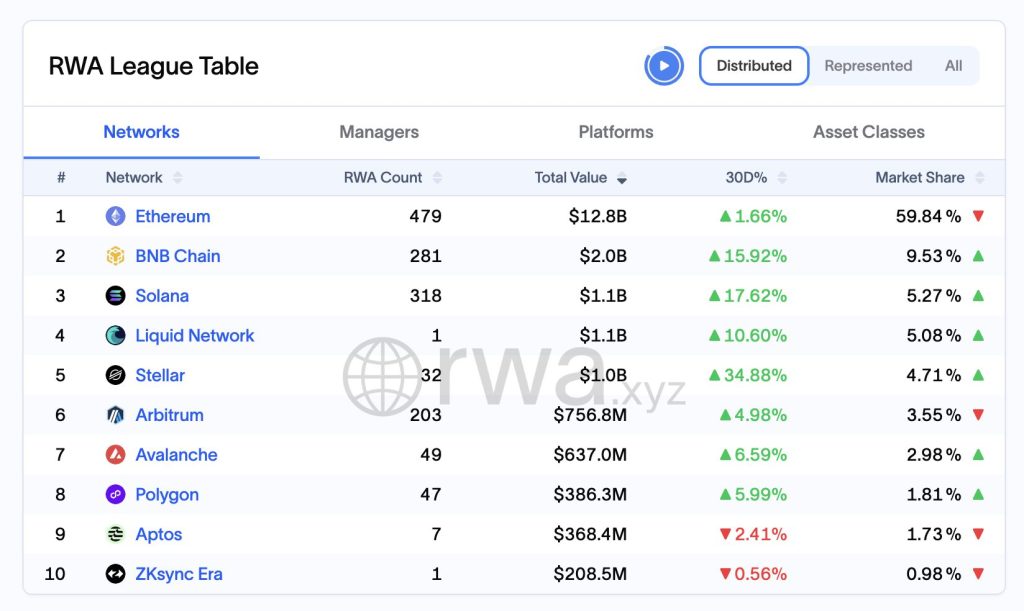

In a YouTube video, crypto pundit Cheeky Crypto highlighted a statement from Canary Capital’s CEO, Steven McClurg, in which he said that an XRP price target of between $5 and $10 may sound like a lot to a retail trader. However, he believes that these price targets are a rounding error when one considers the trillions of dollars in liquidity required to settle global real-world assets (RWAs) at scale.

Cheeky Crypto also highlighted McClurg’s statement, in which he said the XRP Ledger is already processing real financial transactions and boasts real-world financial use cases, which he claims are drawing institutions’ attention.

Notably, the Canary Capital CEO had recently predicted that XRP would dominate the RWA industry, which is projected to become a trillion-dollar industry at some point. This could boost the altcoin’s utility as the XRP Ledger processes more RWA transactions, sending the XRP price higher in the process.

At the time of writing, the XRP price is trading at around $1.95, down in the last 24 hours, according to data from CoinMarketCap.