XRP At ‘Critical Inflection Point’: Analyst Signals Major Expansion If This Level Holds

As XRP attempts to climb to higher levels, an analyst affirmed that the altcoin is “doing what it needs to do” to continue its bullish rally, highlighting multiple key structures in key timeframes.

XRP Enters Inflection Point

After retesting the $1.90 area on Friday morning, XRP saw a 4.6% intraday bounce toward the mid-zone of its local range. Over the past five days, the cryptocurrency has been hovering in the $1.85-$2.00 price range, failing to hold the upper zone of this range.

Market watcher ChartNerd pointed out a key reversal pattern that could signal a massive price expansion may be around the corner, noting that the altcoin is at a “critical inflection point” as it retests a macro support zone.

He explained that a running flat ABC correction formation is “a sophisticated structure where the failure of the ‘C’ wave to breach previous lows signals underlying bullish strength.”

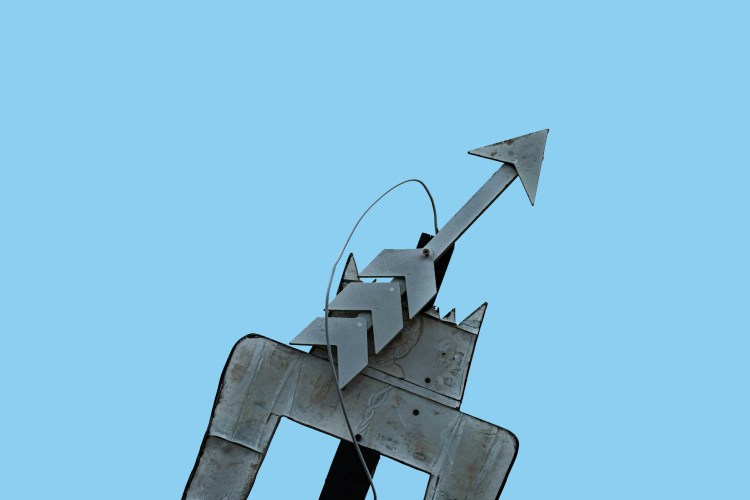

XRP has been mirroring the same structure over the past 400 days, which would point “toward a structural breakout, marking the transition from a yearly long base into a new primary uptrend” if it resolves.

As the chart shows, “the wave counts repeating toward the structure are evident in XRP’s price action,” and as long as the macro support holds, around the $1.80 area, the C wave “could be working in the bulls’ defense.”

We could be just building a base above $1.80, marking the C wave in this running flat correction before the major breakout.

ChartNerd added that there could be a scenario in which XRP deviates below its major support before a V-shape recovery. However, he warned that losing this area would not be healthy, detailing that the only way to invalidate the pattern would be for the price to close below the structure’s support, retest it as resistance, and drop to lower levels.

XRP’s Price Defends Macro Support

The analyst emphasized the importance of the $1.80 level, noting that XRP has been defending this territory for over a year and could lead to a new all-time high (ATH) rally.

“This is a macro accumulation zone, and we evidently also have two major levels of descending resistance for XRP,” he detailed, highlighting that when the first multi-month descending resistance broke, the altcoin rallied to a new all-time high.

It’s pretty simple: we have descending resistance on our heads at the moment, and we once had a point of contact on this resistance at the $2.40 high (…) So, at this moment in time, the simplicity tells us: break the descending resistance, and this is where XRP really starts gearing up for further expansion.

Based on this, ChartNerd asserted that if the altcoin defends the $1.80 macro support, then a similar rally is likely. Similarly, he pointed to a bullish reversal structure building below the key $2.70 resistance on XRP’s chart.

Per the post, the cryptocurrency formed a three-month falling wedge pattern that was broken out of during the early January rally. Now, the price is retesting the pattern’s breakout level as support and could be preparing to climb toward the level it started forming.

“So XRP just needs to defend the guard at $1.80, and this is where we could be looking for that sort of major expansion and looking to press back up to the target of $2.70,” before potentially challenging its pre-Q4 range, he concluded.