French Crypto Tax Platform Waltio Hit by 50,000-User Data Breach

French authorities have opened a preliminary investigation into a data breach at Waltio, a cryptocurrency tax reporting platform used by tens of thousands of investors.

This occurred when hackers reportedly got access to sensitive user information and tried to blackmail the company.

The event has brought up new issues regarding the exposure of personal data in the crypto industry, as target fraud and physical attacks against holders are becoming more and more frequent in France.

Authorities Link Waltio Breach to Shiny Hunters’ Extortion Attempt

In a statement released this week, French cybersecurity institutions confirmed that, via its cybercrime division, the Paris Public Prosecutor’s Office had issued an order to the National Cyber Unit of the Gendarmerie to establish the extent of the breach and identify exposed users.

Officials advised that users whose information might have been stolen should be wary of scammers who claim to be genuine service providers or other officials and force them to give up their digital assets using the stolen information.

The law enforcement agencies reported that some more recent fraudsters posed as crypto businesses, bank anti-fraud units, or even law enforcement officers and magistrates.

French newspaper Le Parisien stated that the attack at Waltio was associated with a ransom demand by a hacking organization called Shiny Hunters.

The group purportedly had obtained personal information of approximately 50,000 Waltio users, most of whom reside in France, and said it had samples of the stolen information as proof.

Waltio later filed a complaint of attempted extortion and unauthorized access to the automated data system.

Waltio said its initial internal assessment showed that the attackers accessed tax reports for the 2024 period. These documents included users’ email addresses, information on crypto profits or losses, and asset balances at the end of the year.

The company stated that banking details, administrative records, and tax identification data were not affected and that its core infrastructure was not compromised.

Waltio added that its services remain operational and that client funds are not at risk.

France Tightens Oversight After Crypto Data Breach Amid Rise in Kidnapping Cases

Waltio was founded in France and is headquartered in Clermont-Ferrand. It serves roughly 150,000 users and focuses on simplifying crypto tax compliance for European investors, particularly in France, Spain, and Belgium.

The platform aggregates transaction data from more than 700 exchanges, wallets, and blockchains to calculate capital gains, losses, and staking income, and generates tax-compliant reports for local filings.

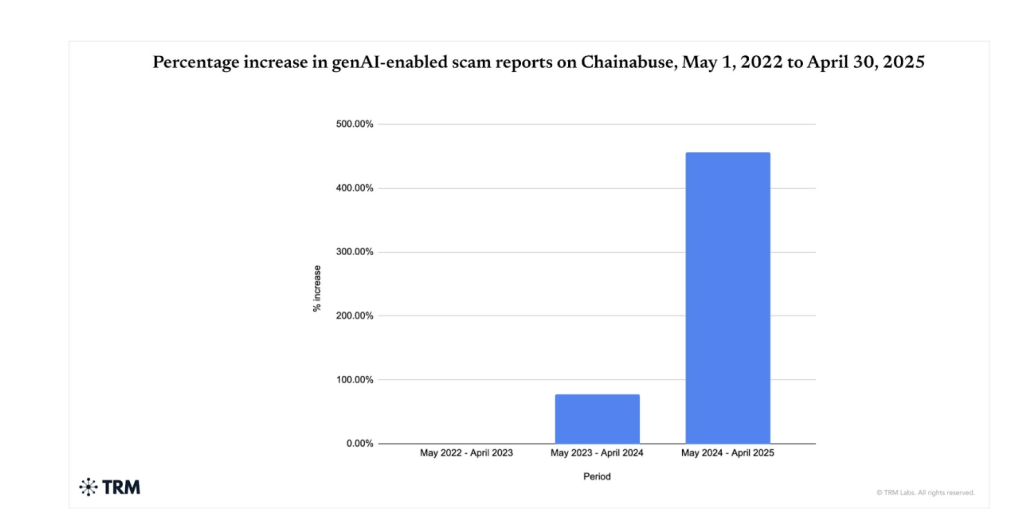

The investigation comes amid heightened scrutiny of crypto-related data leaks in France.

In the last year, police have attributed a number of home invasions, kidnappings, and attempted kidnappings to the criminals who intended to use the knowledge of the victims having digital assets.

Although the leakage of data has not been directly linked to these crimes, the investigation teams have not eliminated the chances of the data being used to establish potential targets.

— Cryptonews.com (@cryptonews) January 9, 2026

Masked gunmen steal crypto USB in France as prosecutors reveal tax official sold government database access identifying crypto investors to criminal gangs for 800 euros per operation.#Crypto #Attack #Francehttps://t.co/GmfOkwsE6E

Fraud victims have been cautioned to keep evidence, report to the police, and address the data protection authority in France in instances where they feel that their personal data has not been sufficiently safeguarded.

The Waltio incident is not the first case of data exposure in the crypto industry in the past.

Hardware wallet manufacturer Ledger announced earlier this month that a breach of a third-party payment processor, Global-e, took place, exposing the data of its customers.

Last month, crypto tax software developer Koinly also notified users of a potential email data breach related to the use of a third-party analytics platform.

The post French Crypto Tax Platform Waltio Hit by 50,000-User Data Breach appeared first on Cryptonews.

@RevolutApp may buy a US bank with a national charter to fast-track its American expansion and bypass the lengthy process of obtaining its own licence.

@RevolutApp may buy a US bank with a national charter to fast-track its American expansion and bypass the lengthy process of obtaining its own licence. The OCC has conditionally approved five crypto firms, including

The OCC has conditionally approved five crypto firms, including  Revolut launches zero-fee stablecoin swaps for its 65 million users as crypto trading drives 298% revenue growth in its wealth division.

Revolut launches zero-fee stablecoin swaps for its 65 million users as crypto trading drives 298% revenue growth in its wealth division.

Telegram CEO Pavel

Telegram CEO Pavel  Governments are expected to start treating AI data centers and energy-backed computing power as strategic infrastructure in 2026, similar to how oil reserves are managed.

Governments are expected to start treating AI data centers and energy-backed computing power as strategic infrastructure in 2026, similar to how oil reserves are managed.

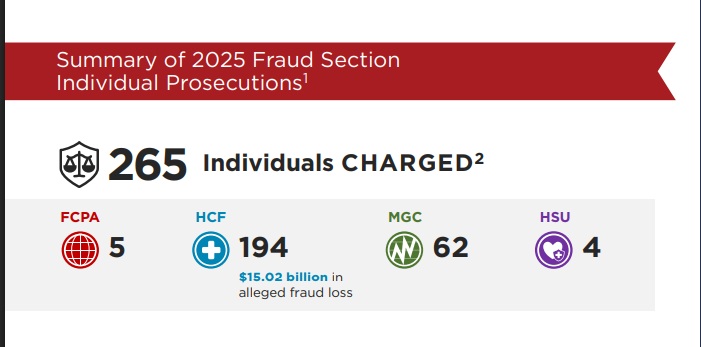

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

ANNOUNCING

ANNOUNCING

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure.

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure. BNB (@cz_binance)

BNB (@cz_binance)  The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

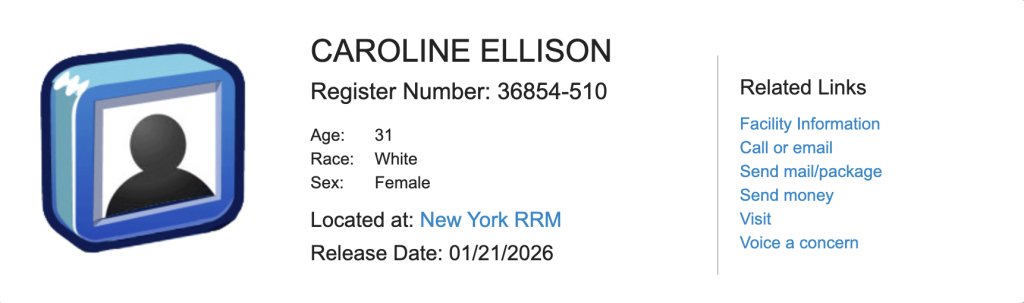

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

OneCoin’s legal chief pleaded guilty to money laundering and wire fraud charges, according to a statement released today from the U.S. Attorney’s Office for the Southern District of New York.

OneCoin’s legal chief pleaded guilty to money laundering and wire fraud charges, according to a statement released today from the U.S. Attorney’s Office for the Southern District of New York.

The

The  Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

(@suji_yan)

(@suji_yan)

Tom Lee

Tom Lee

The Senate finally confirms

The Senate finally confirms  Michael Selig becomes CFTC chairman as Caroline Pham exits agency after implementing major crypto regulatory reforms including spot trading approval and prediction market relief.

Michael Selig becomes CFTC chairman as Caroline Pham exits agency after implementing major crypto regulatory reforms including spot trading approval and prediction market relief.

Multiple major platforms — including Snapchat, Amazon, Coinbase, — went down early Monday due to an AWS outage.

Multiple major platforms — including Snapchat, Amazon, Coinbase, — went down early Monday due to an AWS outage.