Epoch Ventures Predicts Bitcoin Hits $150K in 2026, Declares End of 4-Year Halving Cycle

Bitcoin Magazine

Epoch Ventures Predicts Bitcoin Hits $150K in 2026, Declares End of 4-Year Halving Cycle

Epoch, a venture firm specializing in Bitcoin infrastructure, issued its second annual ecosystem report on January 21, 2026, forecasting robust growth for the asset despite a subdued 2025 performance.

The 186-page document analyzes Bitcoin’s price dynamics, adoption trends, regulatory outlook, and technological risks, positioning the cryptocurrency as a maturing monetary system. Key highlights include a prediction that Bitcoin will reach at least $150,000 USD by year-end, driven by institutional inflows and decoupling from equities. The report also anticipates the Clarity Act failing to pass, though its substance on asset taxonomy and regulatory authority may advance through SEC guidance. Additional forecasts cover gold rotations boosting Bitcoin by 50 percent, major asset managers allocating 2 percent to model portfolios, and Bitcoin Core maintaining implementation dominance.

Eric Yakes, CFA charterholder and managing partner at Epoch Ventures, brings over a decade of finance expertise to the Bitcoin space, having started his career in corporate finance and restructuring at FTI Consulting before advancing to private equity at Lion Equity Partners, where he focused on buyouts. He left traditional finance in recent years to immerse himself in Bitcoin, authoring the influential book “The 7th Property: Bitcoin and the Monetary Revolution,” which explores Bitcoin’s role as a transformative monetary asset, and has since written extensively on its technologies and ecosystem. Yakes holds a double major in finance and economics from Creighton University, positioning him as a key voice in Bitcoin venture capital through Epoch, a firm dedicated to funding Bitcoin infrastructure.

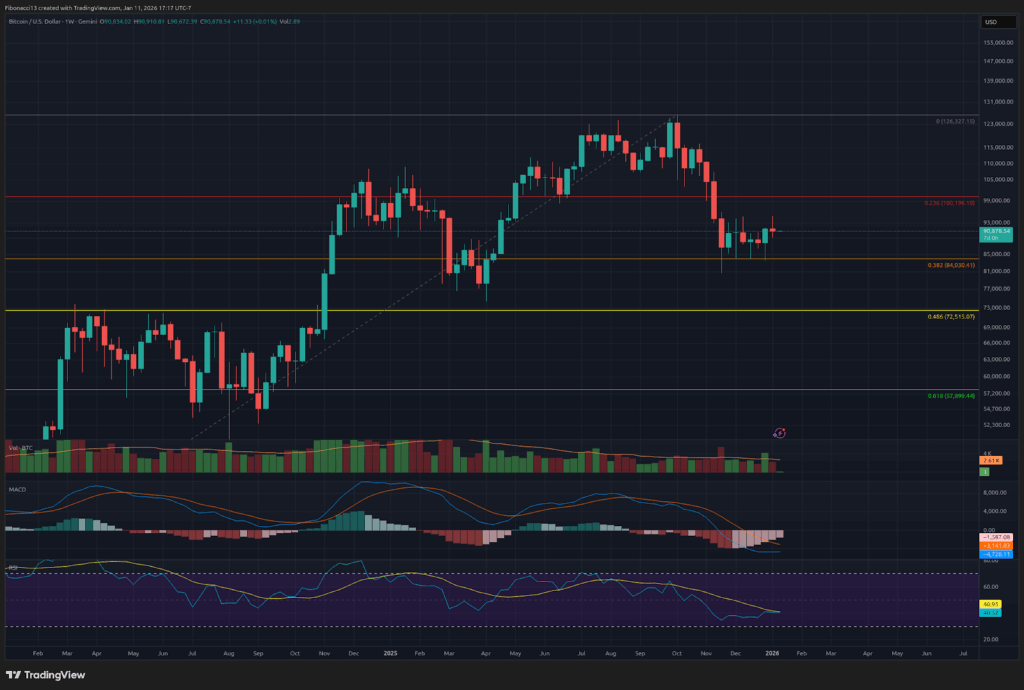

The Death of the Four-Year Cycle

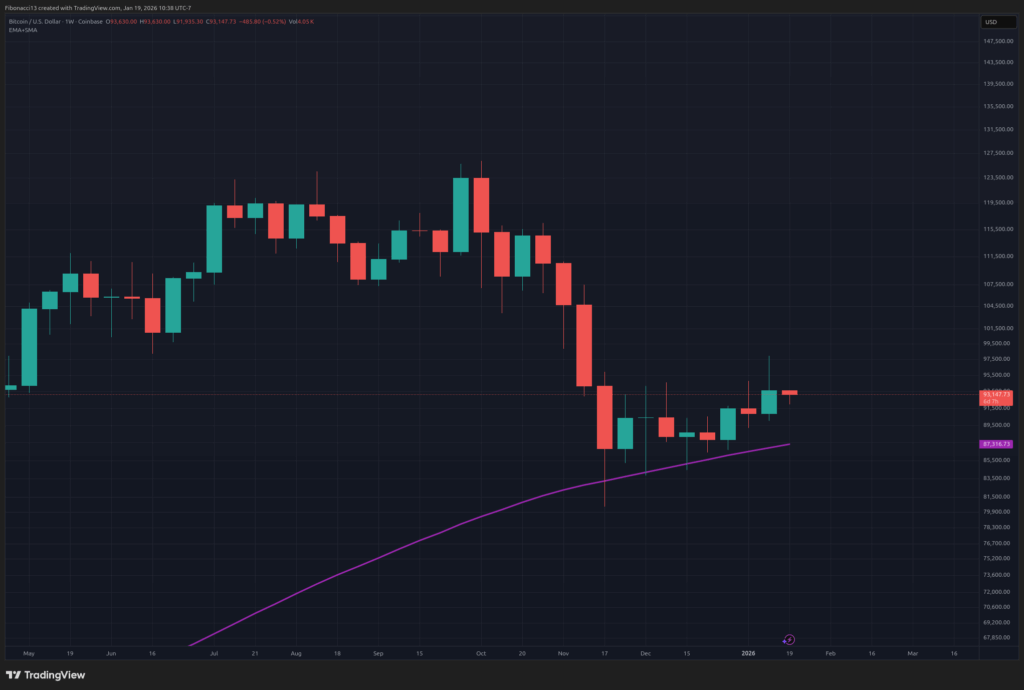

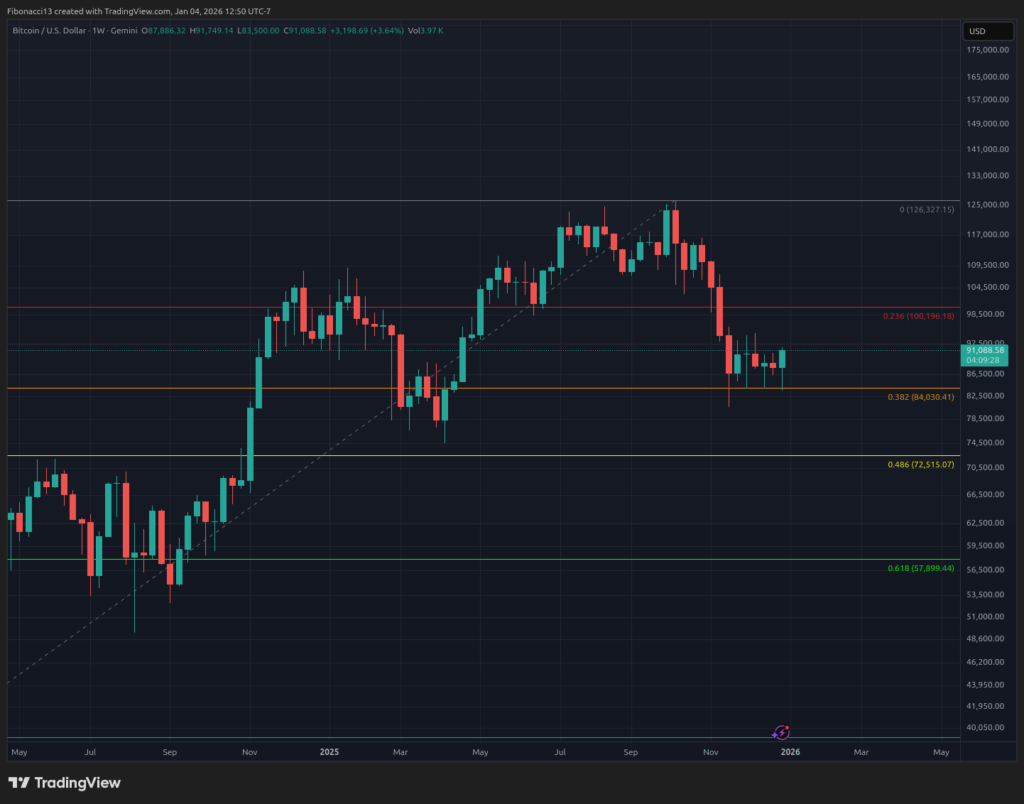

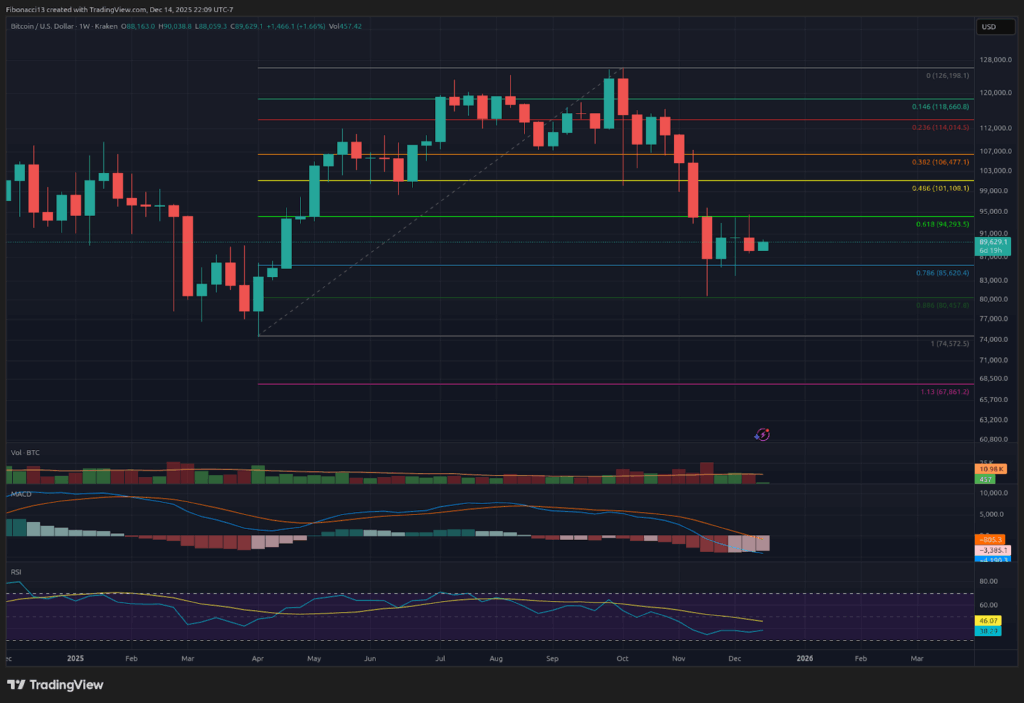

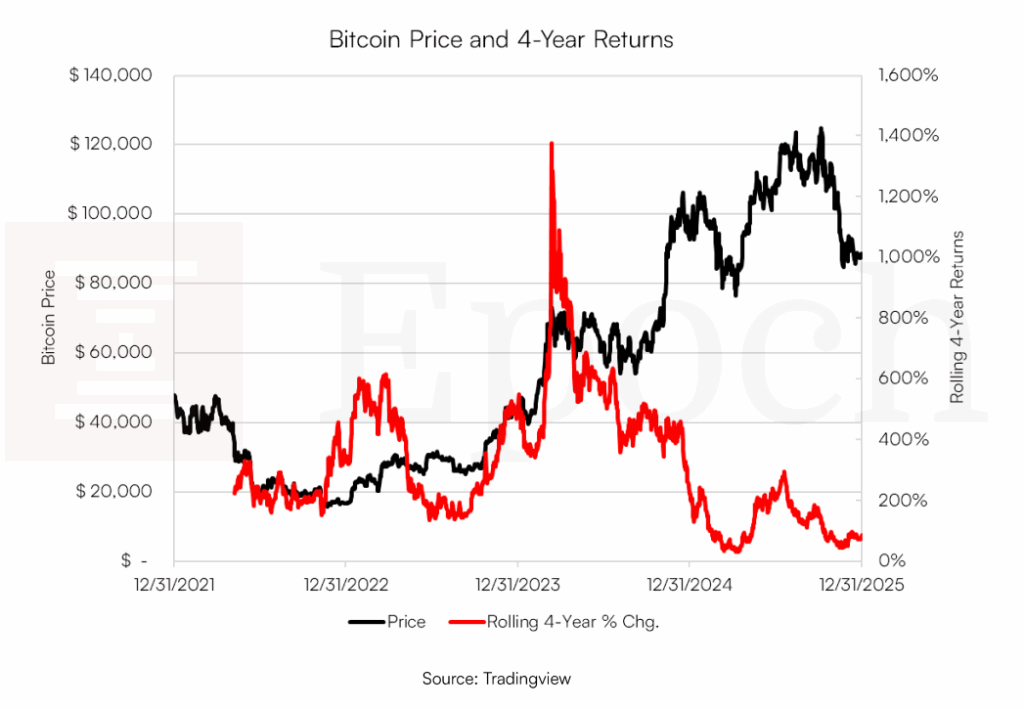

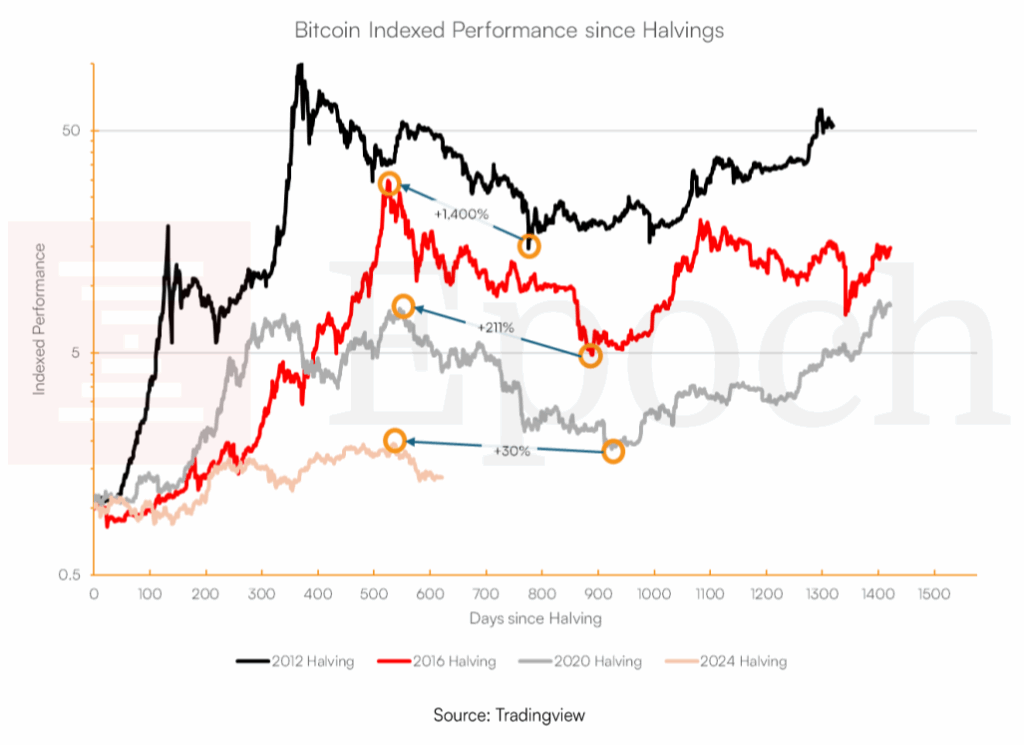

Bitcoin closed 2025 at $87,500, marking a 6 percent annual decline but an 84 percent four-year gain that ranks in the bottom 3 percent historically. The report states the death of the 4-year cycle in no uncertain terms: “We believe cycle theory is a relic of the past, and the cycles themselves probably never existed. The fact is that Bitcoin is boring and growing gradually now. We make the case for why gradual growth is precisely what will drive a ‘gradually, then suddenly’ moment.”

The report goes on to discuss cycle theory in depth, presenting a view of the future that’s becoming the new market expectation: less volatility to the downside, slow and steady growth to the upside.

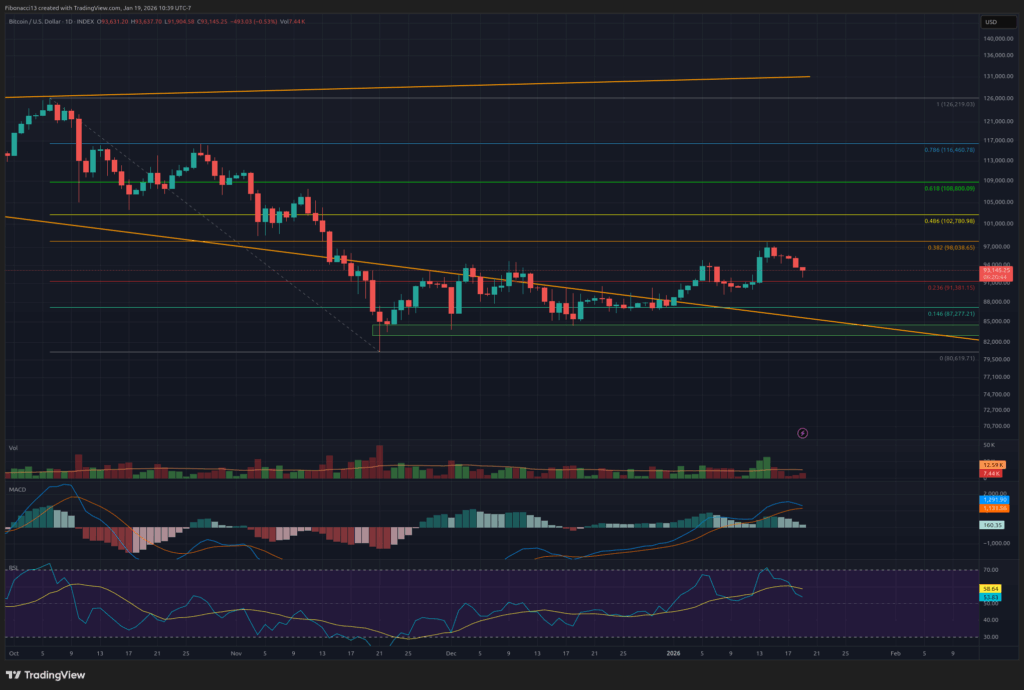

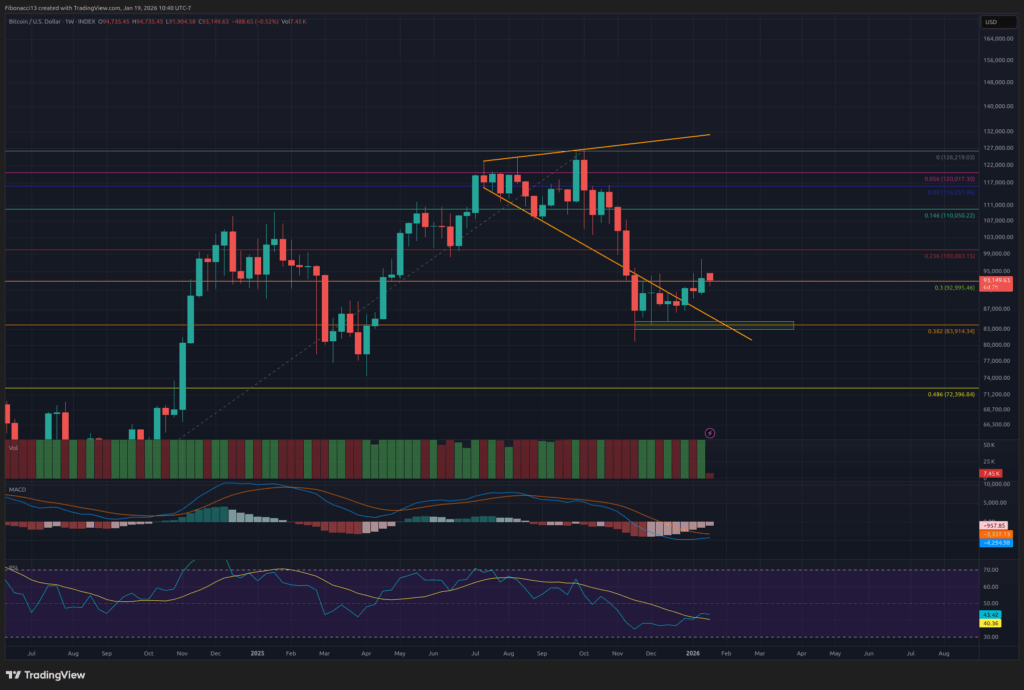

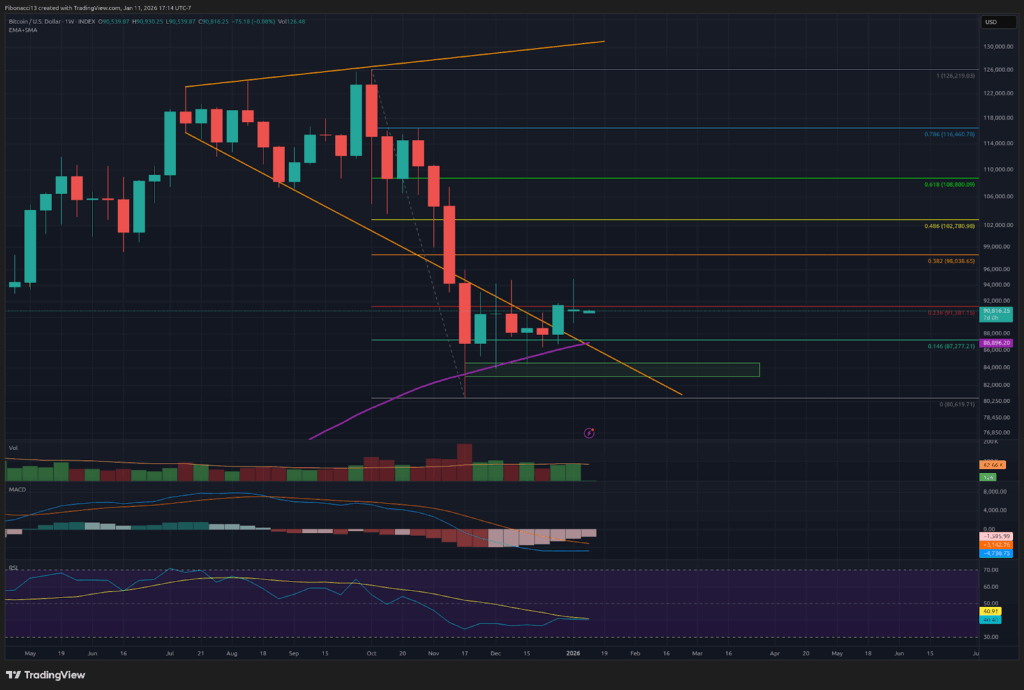

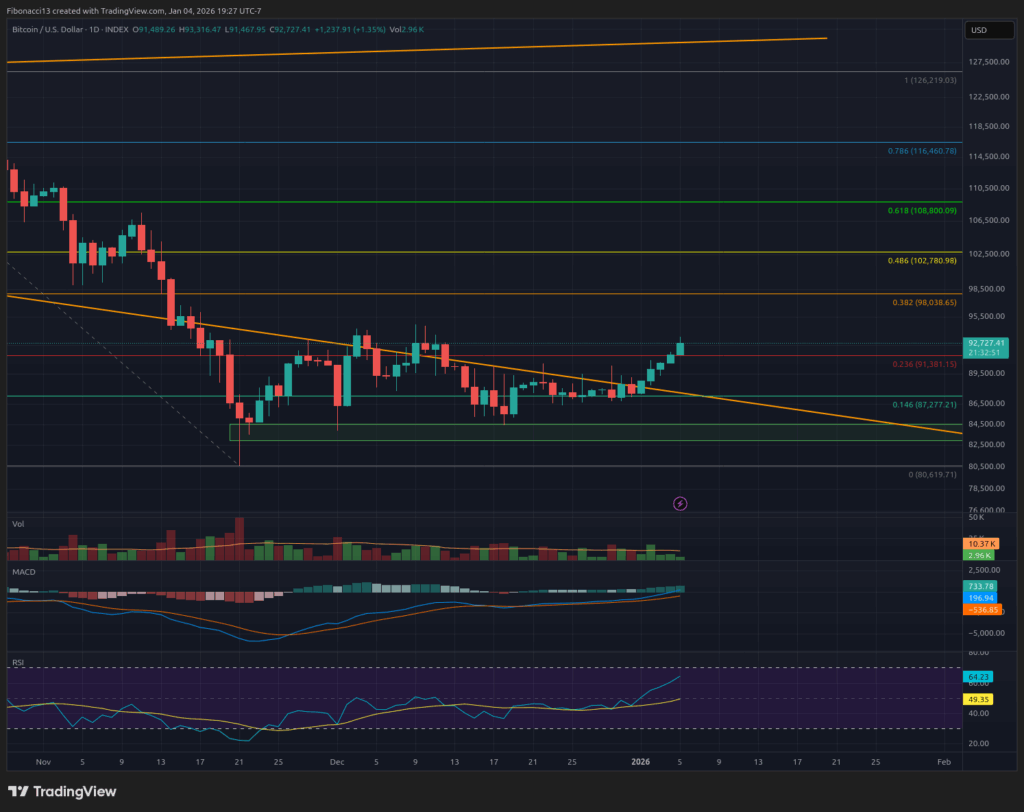

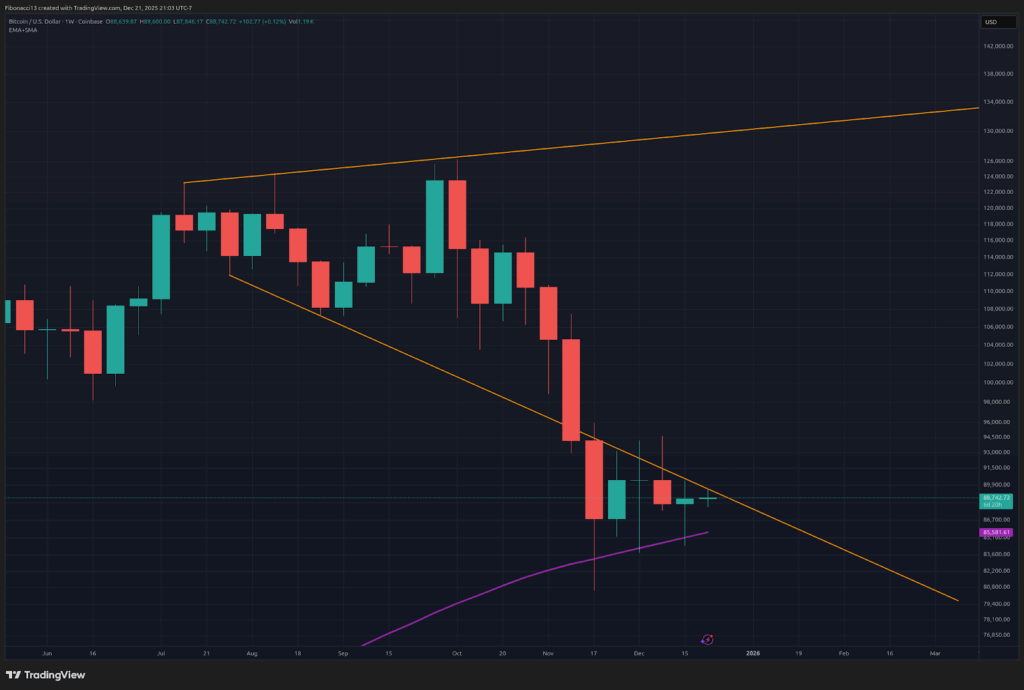

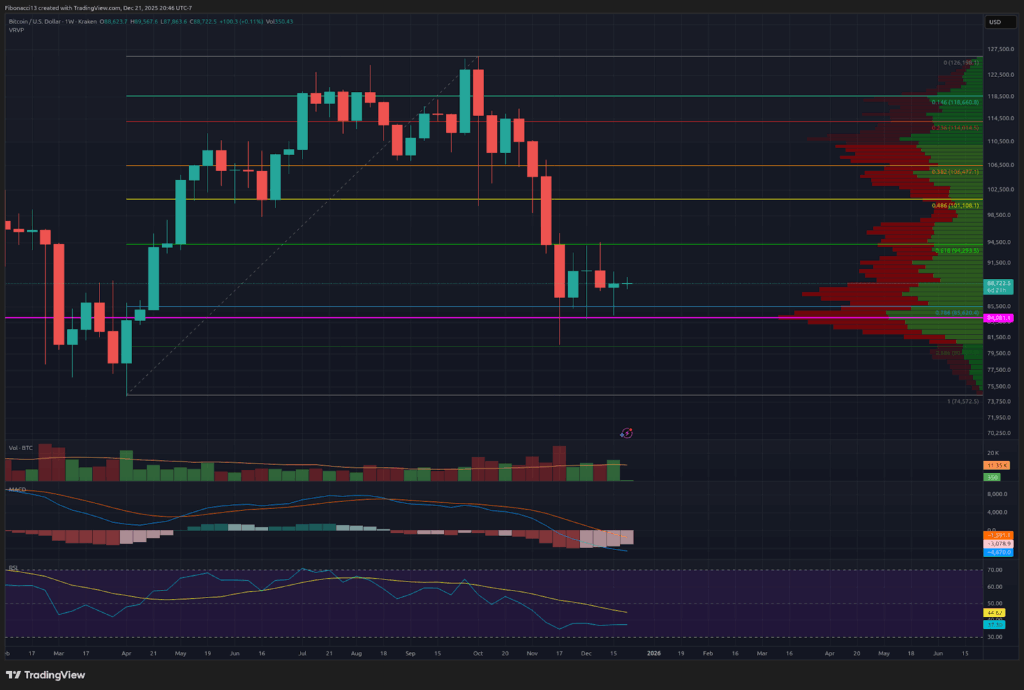

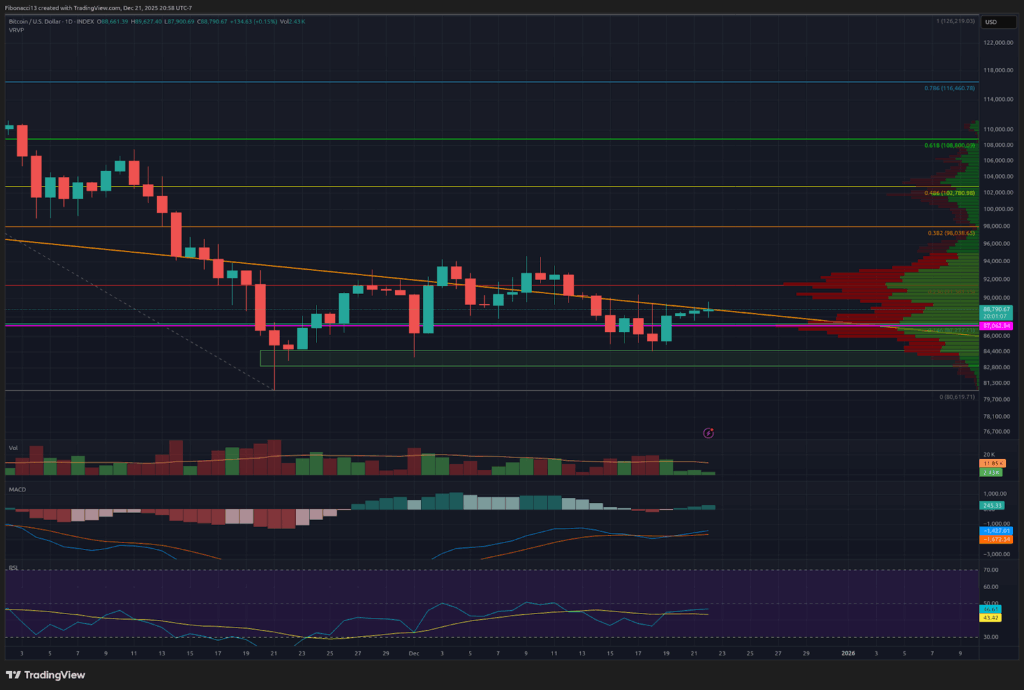

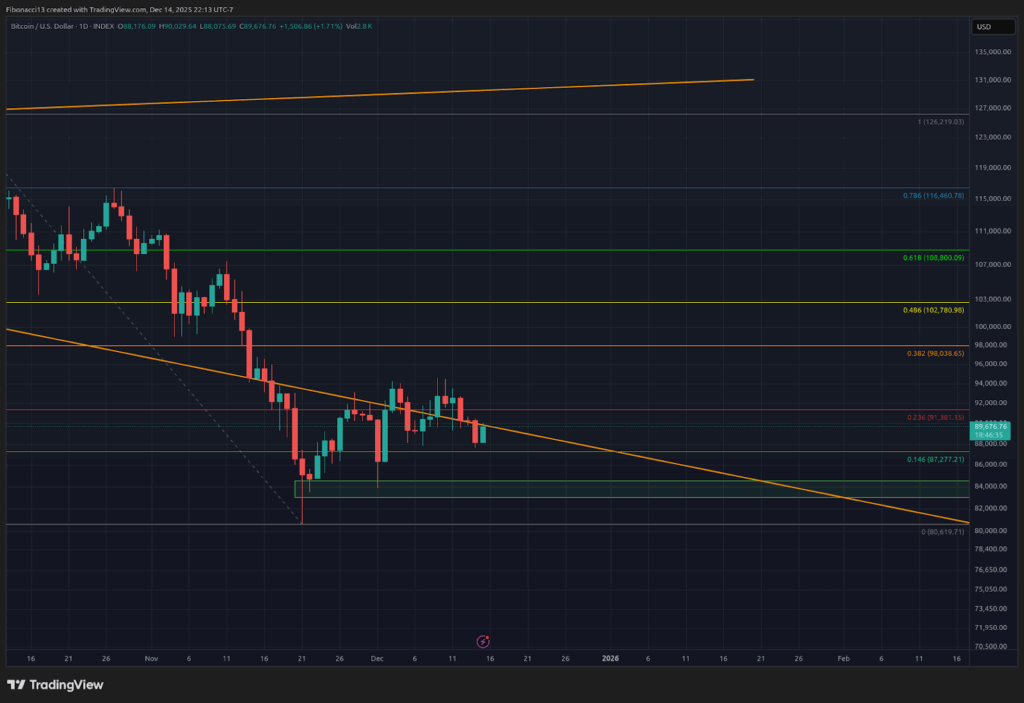

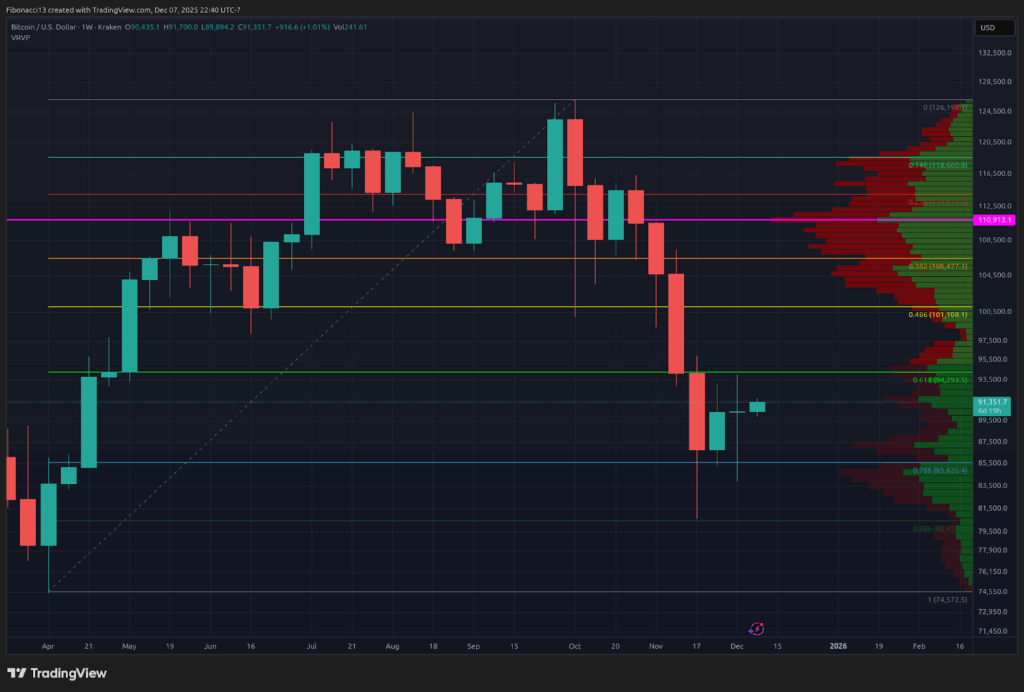

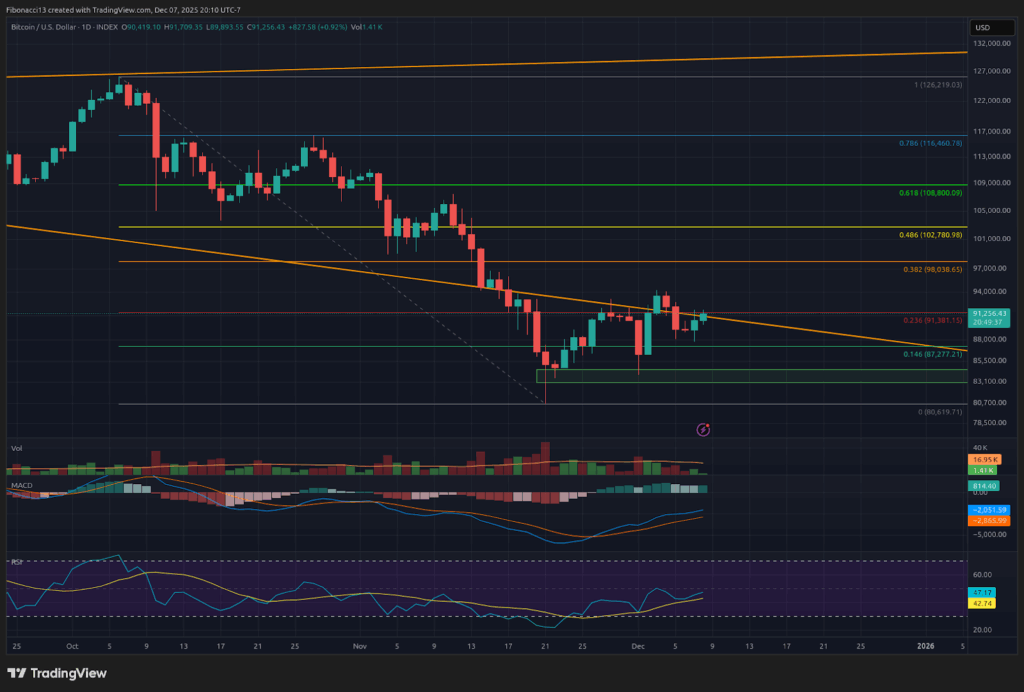

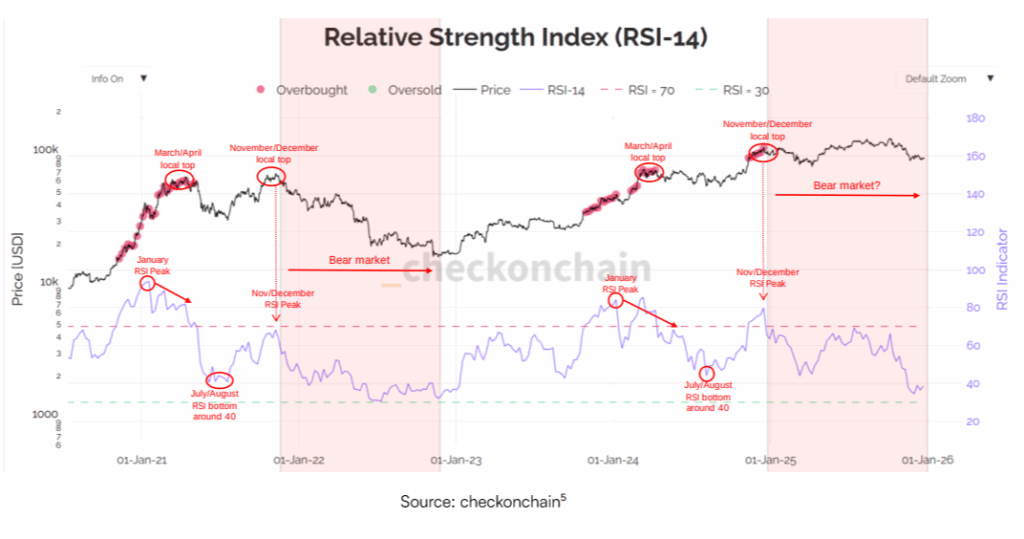

Price action suggests a new bull market commenced in 2026, with 2025’s drop from $126,000 to $81,000 potentially being a self-fulfilling prophecy due to cycle expectations, as RSI remained below overbought since late 2024, suggesting bitcoin already went through a bear market and we are commencing a new kind of cycle.

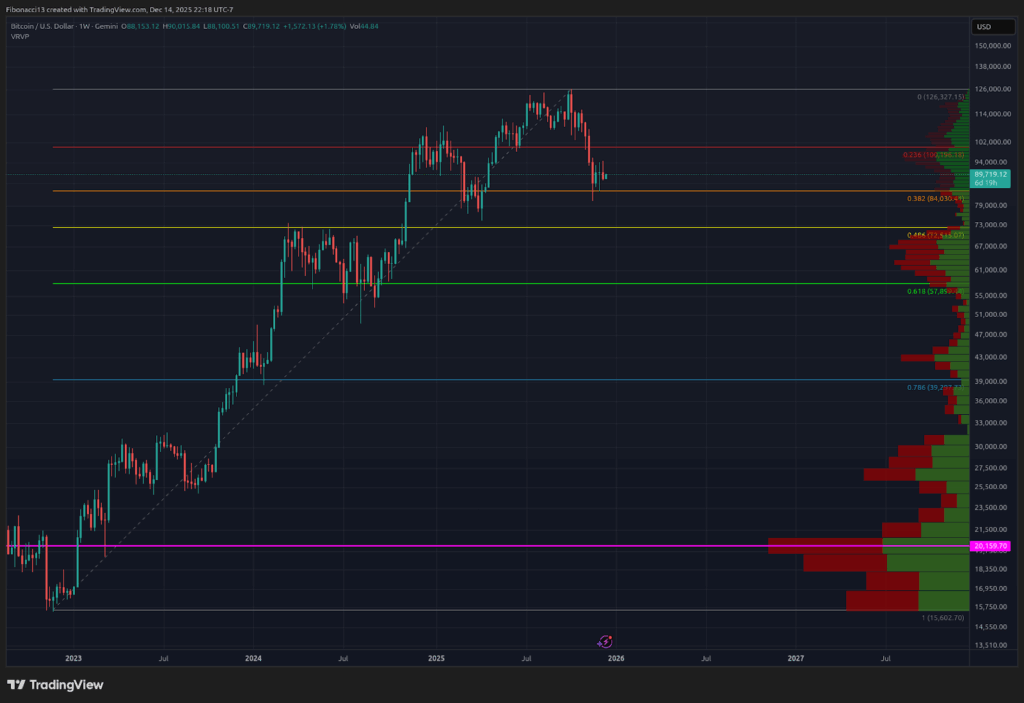

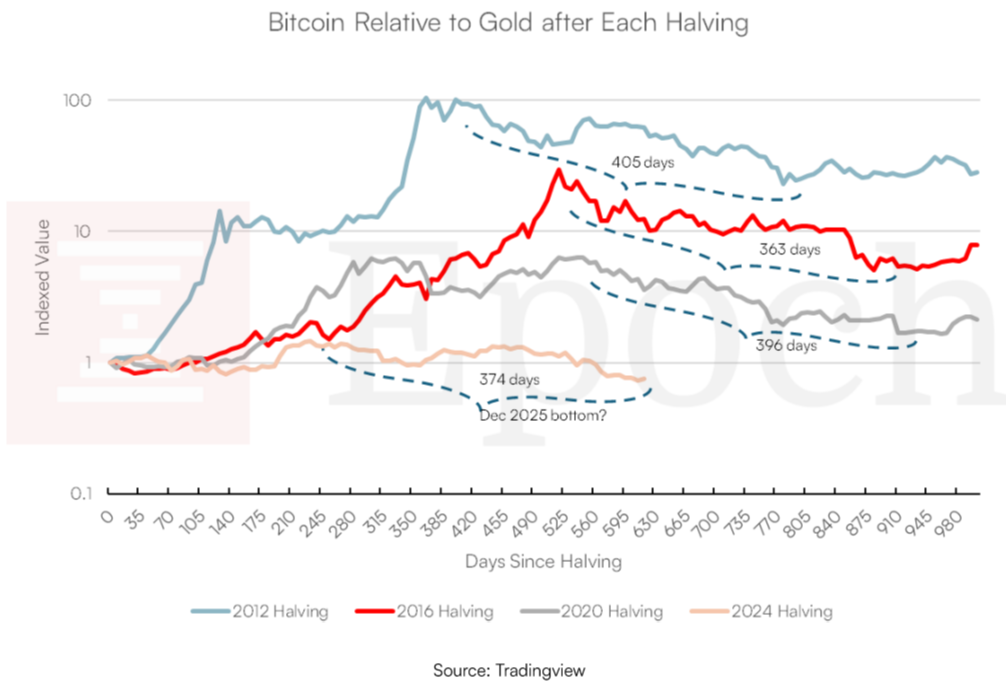

Versus gold, Bitcoin is down 49 percent from its highs, in a bear market since December 2024. Gold’s meteoric rise presents a potential price catalyst for bitcoin; a small rebalancing reallocation from gold of 0.5% would induce greater inflows than the U.S. ETFs; at 5.5%, it would equal bitcoin’s market capitalization. Gold’s rise makes bitcoin more attractive on a relative basis, and the higher gold goes, the more likely a rotation into bitcoin. Timing analysis, as seen in the chart below, which counts days from the local top, suggests Bitcoin might be nearing a bottom versus Gold.

In terms of volatility bitcoin has aligned with mega-caps like Tesla, with 2025 averages for Nasdaq 100 leaders exceeding Bitcoin’s, suggesting a risk-asset decoupling and limiting drawdowns. Long-term stock correlations persist, but maturing credit markets and safe-haven narratives may pivot Bitcoin toward gold-like behavior.

The report goes in-depth into other potential catalysts for 2026, defending its bullish thesis, such as:

- Consistent ETF Inflows

- Nation State Adoption

- Mega-cap Companies Allocating to Bitcoin

- Wealth Managers Allocating Clients

- Inheritance Allocation

FUD, Sentiment and Media Analysis

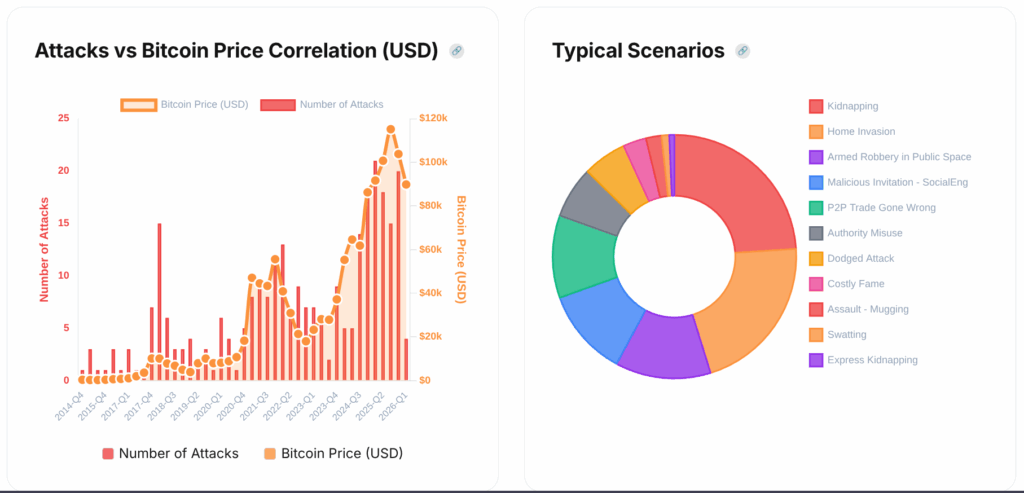

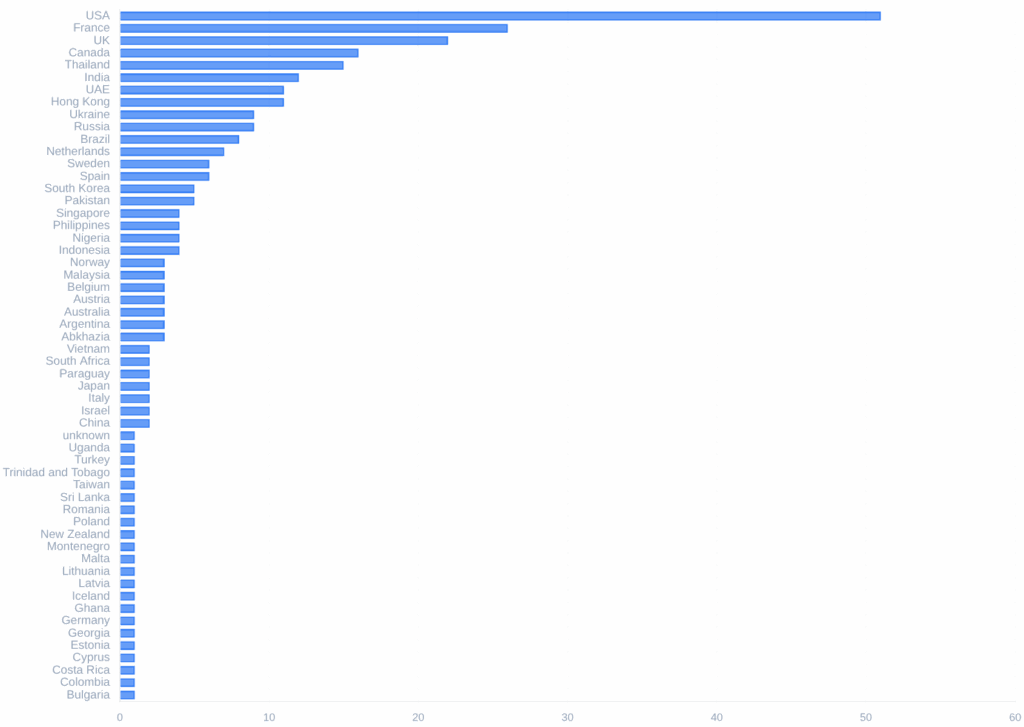

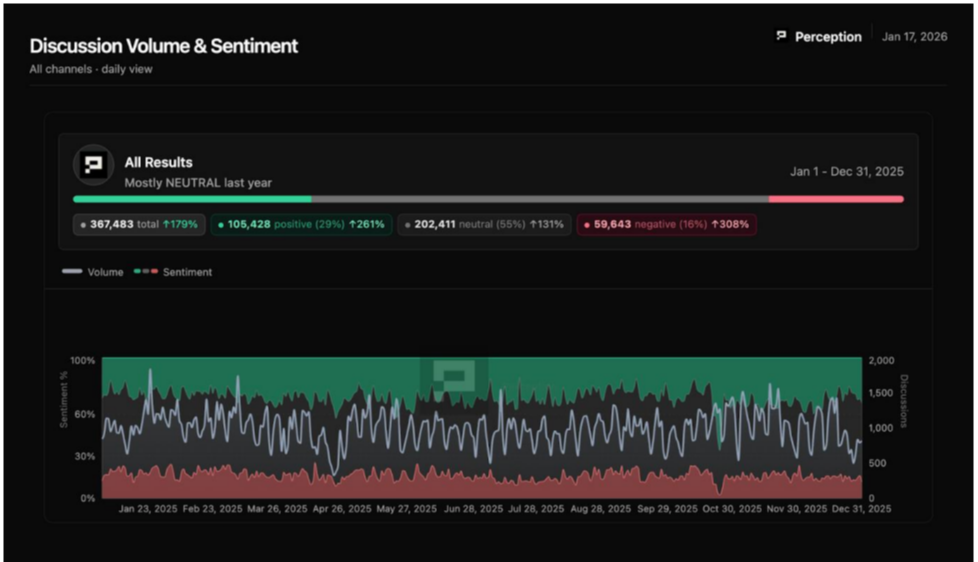

Analysis of 356,423 datapoints from 653 sources reveals a fractured sentiment landscape, with “Bitcoin is dead” narratives concluded. FUD is stable at 12-18 percent but the topics rotate, crime and legal themes are up 277 percent, while environmental FUD is down 41 percent.

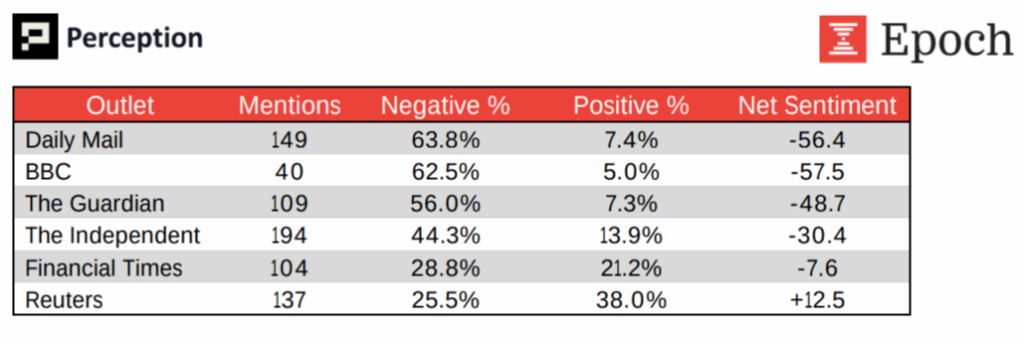

A 125-point perception gap exists between conference attendees (+90 positive) while tech media is generally negative at (-35). UK outlets show 56-64 percent negativity, 2-3 times international averages.

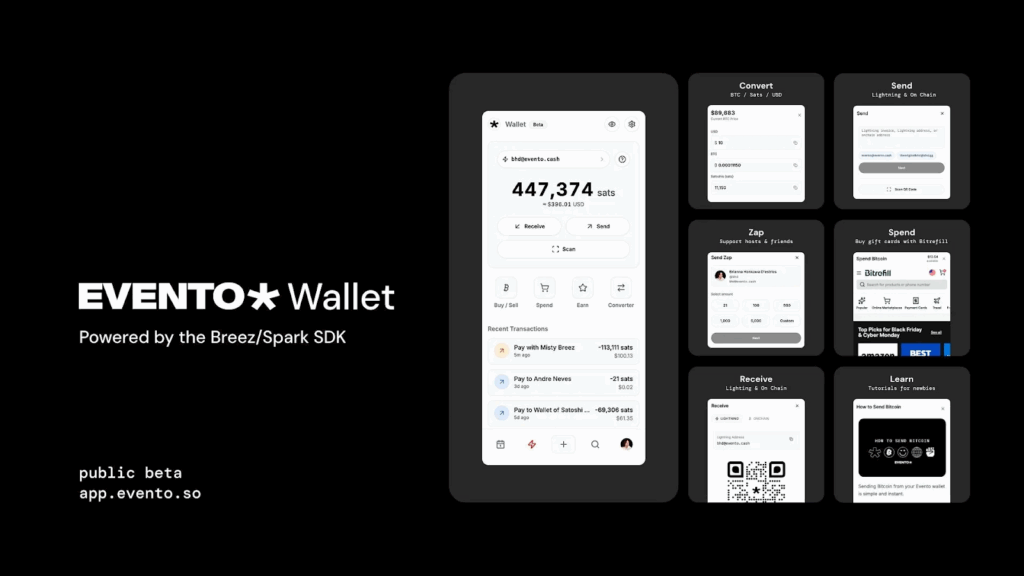

The Lightning Network coverage dominates podcasts at 33 percent but garners only 0.28 percent mainstream coverage, a 119x disparity. Layer 2 solutions are not zero-sum, with Lightning at 58 percent mentions and Ark up 154 percent.

Media framing has caused mining sentiment to swing 67 points: mainstream outlets cover the sector at 75.6 percent positive, while Bitcoin communities view it at only 8.4 percent positive, underscoring the importance of narrative and audience credibility for mining companies.

Bitcoin Treasury Companies

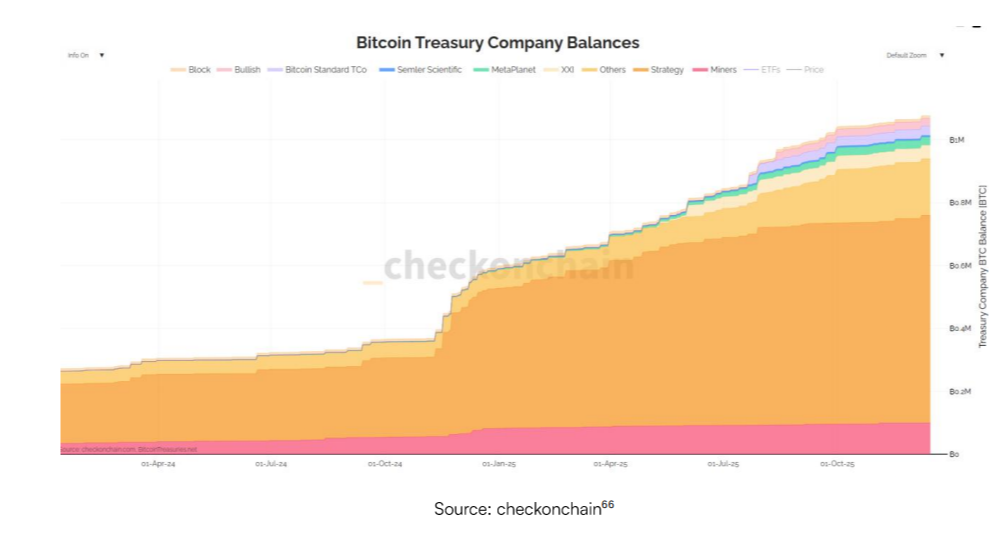

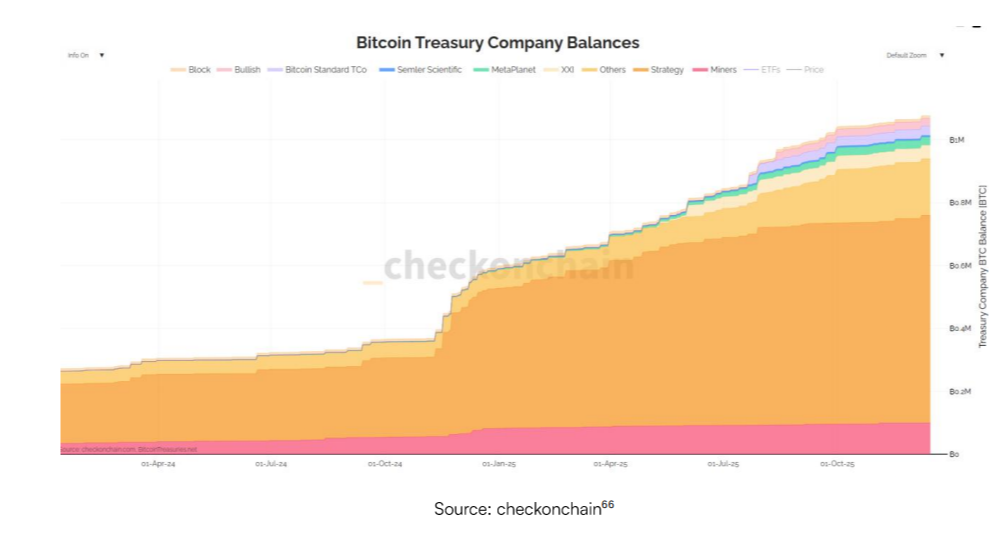

More companies added Bitcoin to their balance sheets in 2025 than in any previous year, marking a major step in corporate adoption. Established firms that already held Bitcoin—known as Bitcoin treasury companies, or BtcTCs—bought even larger amounts, while new entrants went public specifically to raise money and purchase Bitcoin. According to the report, public company bitcoin holdings increased 82% y/y to ₿1.08 million and the number of public companies holding bitcoin grew from 69 to over 191 throughout 2025.65 Corporations own at least 6.4% of total Bitcoin supply – public companies 5.1% and private companies 1.3%. This created a clear boom-and-bust pattern throughout the year.

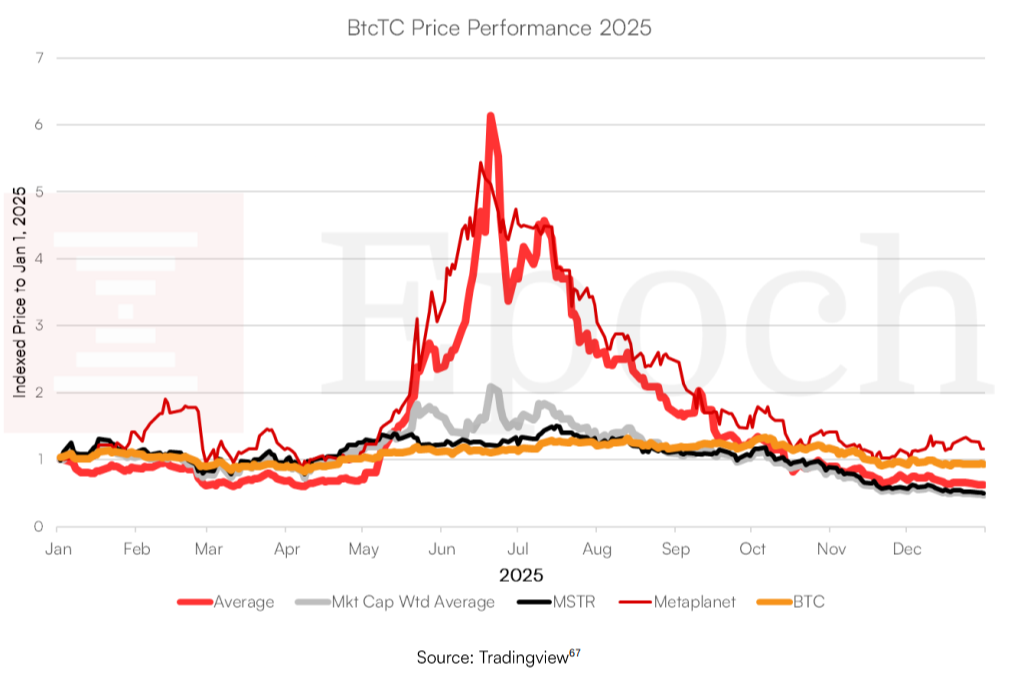

Company valuations rose sharply through mid-2025 before pulling back when the broader Bitcoin price corrected. The report explains that these public treasury companies offer investors easier access through traditional brokers, the ability to borrow against holdings, and even dividend payments, though with dilution risks. In contrast, buying and holding Bitcoin directly remains simpler and preserves the asset’s full scarcity.

Looking ahead, Epoch expects Japan’s Metaplanet to post the highest multiple on net asset value (mNAV)—a key valuation metric—among all treasury companies with a market cap above $1 billion. The firm also predicts that an activist investor or rival company will force the liquidation of one underperforming treasury firm to capture the discount between its share price and the actual value of its Bitcoin holdings.

Over time, these companies will stand out by offering competitive yields on their Bitcoin. In total, treasury companies acquired roughly 486,000 BTC during 2025, equal to 2.3 percent of the entire Bitcoin supply, drawing further corporate interest in Bitcoin. For business owners considering a Bitcoin treasury, the report highlights both the growth potential and the risks of public-market volatility.

The Bitcoin Treasury Companies section of the report explores:

- The fundamentals of a Bitcoin treasury allocation including the potential benefits and risks of Bitcoin treasury company investing.

- The 2025 timeline of Bitcoin Treasury companies.

- Current valuations of BtcTCs.

- Our opinion on BtcTCs broadly, and how we view them compared to owning Bitcoin directly.

- Commentary on specific BtcTCs.

- Predictions on Bitcoin treasury companies in the coming years.

Regulation Expectations for 2026

Epoch predicts the Clarity Act—a proposed bill to clarify digital asset oversight by dividing authority between the SEC and CFTC—will not pass Congress in 2026. However, the report expects the bill’s main ideas, including clear definitions for asset categories and regulatory jurisdiction, to advance through SEC rulemaking or guidance instead. The firm also forecasts Republican losses in the midterm elections, which could trigger new regulatory pressure on crypto, most likely in the form of consumer protection measures aimed at perceived industry risks. On high-profile legal cases, Epoch does not expect pardons for the founders of Samurai Wallet or Tornado Cash this year, though future legal appeals or related proceedings may ultimately support their defenses.

The report takes a critical view of recent legislative efforts, arguing that bills like the GENIUS Act (focused on stablecoins) and the Clarity Act prioritize industry lobbying over the concerns of everyday Bitcoin users, especially the ability to hold and control assets directly without third-party interference (self-custody).

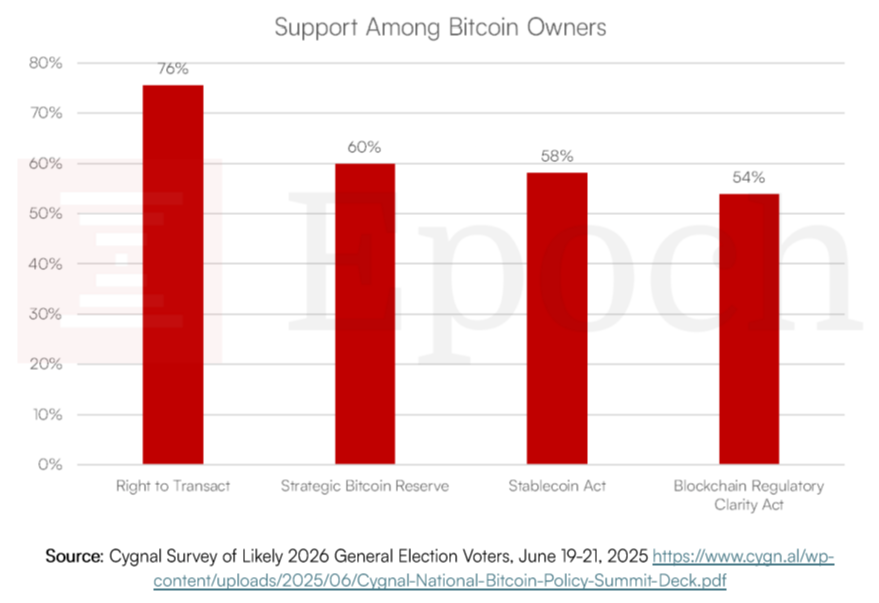

The report points out a discrepancy between what crypto-owning voters want — a majority preferring above all, the right to transact. While the Clarity and Genius Acts focus on less popular special interests, they just fall within the 50% support range. Epoch warns that “This deviation between the will of the voters and the will of the largest industry players is an early warning sign of the potential harm from regulatory capture (intentional or otherwise)”.

The report is particularly critical of the way the GENIUS Act set up the regulatory structure for stablecoins. The paragraph on the topic is so poignant that it merits being printed in its entirety:

“Meet the new boss, same as the old boss:

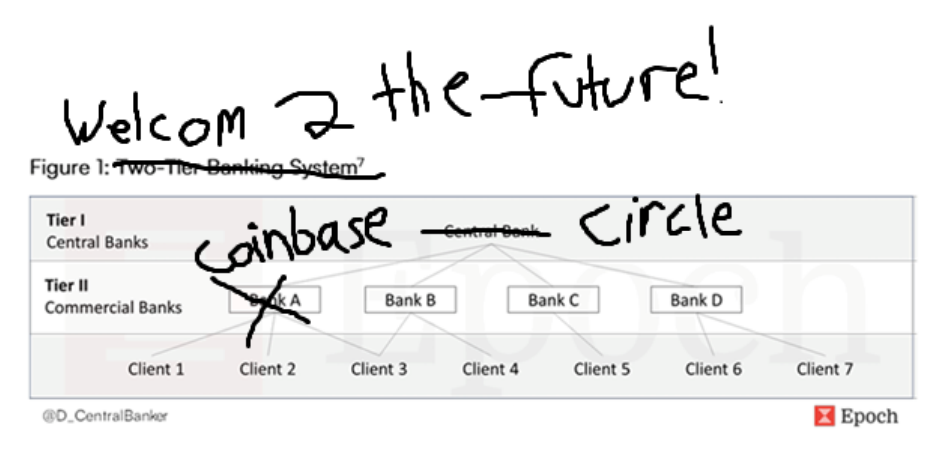

Last year, in our Bitcoin Banking Report, we discussed the structure of the 2-tier banking system in the US (see figure below). In this system, the Central Bank pays a yield on the deposits it receives from the Tier II Commercial banks, who then go on to share a portion of that yield with their depositors. Sound familiar?

The compromise structure in the GENIUS Act essentially creates a parallel banking system where stablecoin issuers play the role of Tier I Central Banks and the crypto exchanges play the role of Tier II Commercial Banks.

To make matters worse, stablecoin issuers are required to keep their reserves with regulated Tier II banks and are unlikely to have access to Fed Master accounts. The upshot of all this is that the GENIUS act converts a peer-to-peer payment mechanism into a heavily intermediated payment network that sits on top of another heavily intermediate payment network.”

The report goes into further depth on topics of regulation and regulatory capture risk, closing the topic with an analysis of how the CLARITY Act might and, in their opinion, should take shape.

Quantum Computing Risk

Concerns about quantum computing potentially breaking Bitcoin’s cryptography surfaced prominently in late 2025, in part contributing to institutional sell-offs as investors reacted to headlines about rapid advances in the field. The Epoch report attributes much of this reaction to behavioral biases, including loss aversion—where people fear losses more than they value equivalent gains—and herd mentality, in which market participants follow the crowd without independent assessment. The authors describe the perceived threat as significantly overhyped, noting that claims of exponential progress in quantum capabilities, often tied to “Neven’s Law,” lack solid observational evidence to date.

“Neven’s law states that the computational power of quantum computers increases at a double exponential rate of classical computers. If true, the timeline to break Bitcoin’s cryptography could be as short as 5 years.

However, Moore’s law was an observation. Neven’s law is not an observation because logical qubits are not increasing at such a rate.

Neven’s law is an expectation of experts. Based on our understanding of expert opinion in the fields we are knowledgeable about, we are highly skeptical of expert projections,” the Epoch report explained.

They add that current quantum computers have not succeeded in factoring numbers larger than 15, and error rates increase exponentially with scale, making reliable large-scale computation far from practical. The report argues that progress in physical qubits has not yet translated into the logical qubits or error-corrected systems needed for factorization of the large numbers underpinning Bitcoin’s security.

Implementing quantum-resistant signatures prematurely — which do exist — would introduce inefficiencies, consuming more block space on the network, while emerging schemes remain untested in real-world conditions. Until meaningful advances in factorization occur, Epoch concludes the quantum threat does not warrant immediate priority or network changes.

Mining Expectations

The report forecasts that no company among the top ten public Bitcoin miners will generate more than 30 percent of its revenue from AI computing services during the 2026 fiscal year. This outcome stems from significant delays in the development and deployment of the necessary infrastructure for large-scale AI workloads, preventing miners from pivoting as quickly as some market narratives suggested.

Media coverage of Bitcoin mining shows a stark divide depending on who is framing the discussion. Mainstream outlets tend to portray the industry positively—75.6 percent of coverage is favorable, often emphasizing energy innovation, job creation, or economic benefits—while conversations within Bitcoin communities remain far more skeptical, with only 8.4 percent positive sentiment. This 67-point swing in net positivity highlights how framing and audience shape perceptions of the same sector, with community credibility remaining a critical factor for mining companies seeking to maintain support among Bitcoin holders.

The report has a lot more to offer including analysis of layer two systems and Bitcoin adoption data on multiple fronts, it can be read on Epoch’s website for free.

This post Epoch Ventures Predicts Bitcoin Hits $150K in 2026, Declares End of 4-Year Halving Cycle first appeared on Bitcoin Magazine and is written by Juan Galt.