Riyad Bank’s Jeel Partners With Ripple to Advance Blockchain Payments and Tokenization

Jeel, a subsidiary of Riyad Bank, has signed a partnership with Ripple to explore advanced blockchain applications aimed at strengthening financial services across Saudi Arabia.

More big news from the Middle East! @Ripple is partnering with @Jeelmovement, the innovation arm of @RiyadBank, to advance Saudi Arabia’s financial future through blockchain innovation

— Reece Merrick (@reece_merrick) January 26, 2026

The Kingdom’s visionary leadership has established Saudi Arabia as a forward-thinking… pic.twitter.com/KhQ7giluhE

In a press release shared with CryptoNews, the firm said the partnership will focus on developing secure and transparent digital infrastructure that can support the Middle East.

The agreement is part of growing institutional interest in blockchain payment systems and digital asset technologies as Saudi Arabia continues positioning itself as a regional leader.

Cross-Border Payments, Custody and Tokenization in Focus

The deal will also assess how blockchain technology can improve the speed, cost efficiency and transparency of cross-border payments, a key area of opportunity for the Gulf region’s remittance and trade corridors.

Beyond payments Jeel and Ripple will also explore use cases in digital asset custody and tokenization. These technologies are increasingly viewed as foundational components of next-generation financial markets, allowing the storage of digital assets and the representation of real-world assets on blockchain networks.

Regulatory Sandbox Testing to Support Responsible Innovation

Jeel and Ripple will also jointly develop proofs-of-concept within Jeel’s regulatory sandbox allowing Ripple’s blockchain solutions to be tested in a controlled and compliant environment.

The firm’s will examine how blockchain-enabled payment corridors can improve international remittance experiences while also evaluating custody frameworks.

“This partnership with Ripple reflects our strategy of using the Jeel Sandbox to responsibly explore next-generation financial infrastructure,” said George Harrak CEO of Jeel.

“By combining regulated experimentation with global blockchain expertise, we are building the foundations to evaluate scalable use cases that enhance cross-border payments and digital asset capabilities in line with the Kingdom’s long-term digital ambitions,” adds Harrak.

The sandbox approach is expected to help demonstrate scalable and interoperable digital financial infrastructure that could contribute to the modernization of Saudi Arabia’s banking ecosystem.

Value for Both Jeel and Ripple

For Jeel, the partnership strengthens its position as a pioneer in regulated blockchain experimentation, expanding its innovation capabilities beyond traditional fintech acceleration programs. The collaboration also supports Riyad Bank’s broader ambition to evaluate future-ready digital financial services.

Ripple, meanwhile, gains strategic access to Saudi Arabia’s fast-growing fintech landscape through Jeel’s institutional network and innovation platform.

“Saudi Arabia’s visionary leadership has established the Kingdom as a forward-thinking global hub for digital transformation,” said Reece Merrick, Managing Director for the Middle East and Africa at Ripple. “Ripple has signed an MOU with Jeel to explore integrating secure, efficient blockchain solutions into the national financial architecture.”

The post Riyad Bank’s Jeel Partners With Ripple to Advance Blockchain Payments and Tokenization appeared first on Cryptonews.

Senate Judiciary leaders oppose blockchain developer protections in crypto bill, warning exemptions modeled on Lummis-Wyden BRCA could block money laundering prosecutions.

Senate Judiciary leaders oppose blockchain developer protections in crypto bill, warning exemptions modeled on Lummis-Wyden BRCA could block money laundering prosecutions. Crypto market structure bill – Clarity Act – has been further delayed by the US Senate Banking Committee until late February or March.

Crypto market structure bill – Clarity Act – has been further delayed by the US Senate Banking Committee until late February or March. Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.

Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.

The SEC opened just 13 crypto enforcement cases in 2025, down 60% from 2024, with most new actions under Chair Paul Atkins focused on fraud.

The SEC opened just 13 crypto enforcement cases in 2025, down 60% from 2024, with most new actions under Chair Paul Atkins focused on fraud.

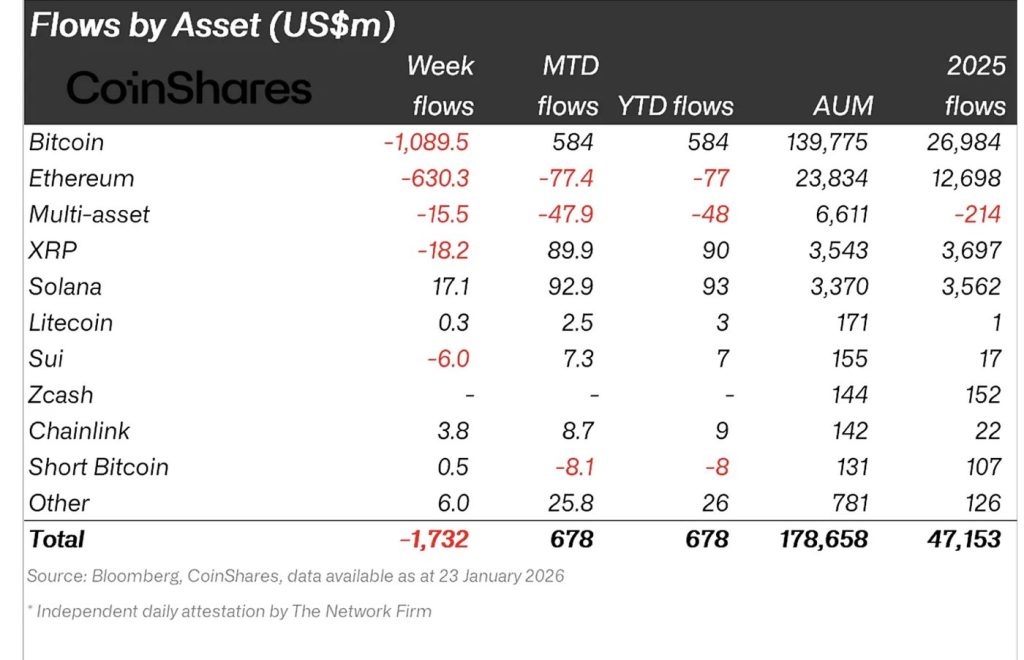

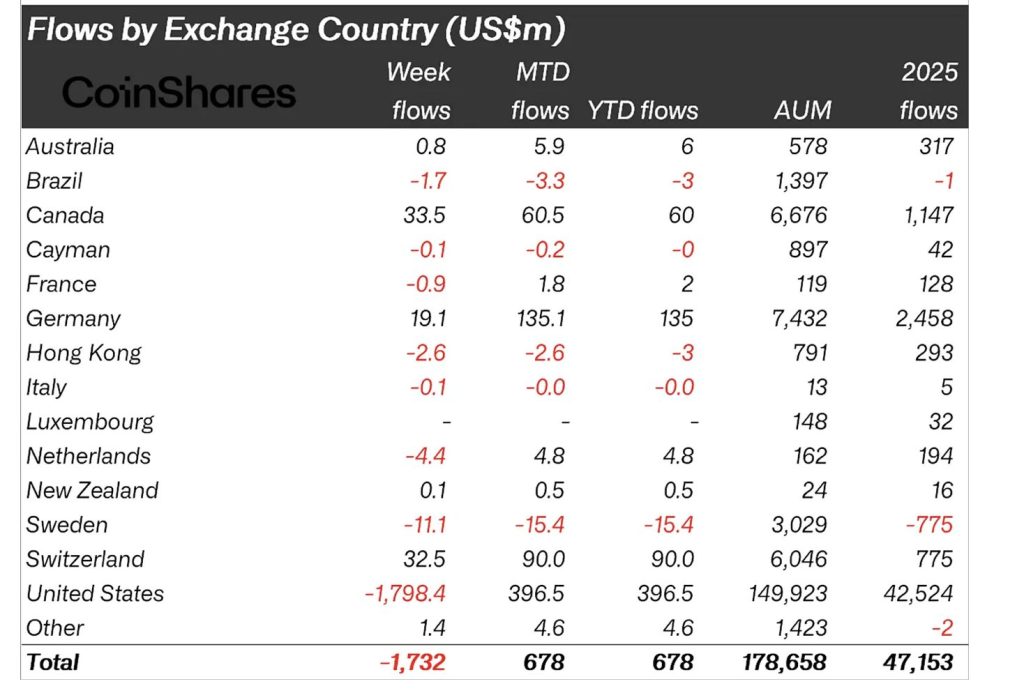

Digital asset investment products saw $2.17bn in weekly inflows, the strongest since Oct 2025, according to CoinShares.

Digital asset investment products saw $2.17bn in weekly inflows, the strongest since Oct 2025, according to CoinShares.

France conducts AML inspections on Binance and Coinhouse among 100+ entities for MiCA licenses with only 4 firms approved before June 2026 deadline.

France conducts AML inspections on Binance and Coinhouse among 100+ entities for MiCA licenses with only 4 firms approved before June 2026 deadline.

Nomura’s Swiss-based unit Laser Digital is seeking a license in Japan to offer institutional crypto trading, signaling confidence in the country’s digital asset market.

Nomura’s Swiss-based unit Laser Digital is seeking a license in Japan to offer institutional crypto trading, signaling confidence in the country’s digital asset market.

BitGo has expanded its institutional OTC trading platform to support derivatives, strengthening its push to offer regulated infrastructure for digital asset strategies.

BitGo has expanded its institutional OTC trading platform to support derivatives, strengthening its push to offer regulated infrastructure for digital asset strategies.

(@nansen_ai)

(@nansen_ai)