GameStop Transfers $420M in Bitcoin to Coinbase, Sparking Exit Speculation

GameStop has transferred its entire Bitcoin stash to Coinbase Prime, triggering fresh speculation that the video game retailer may be preparing to unwind its short-lived Bitcoin treasury strategy.

Key Takeaways:

- GameStop moved its entire 4,710 BTC stash to Coinbase Prime, sparking speculation of a potential exit from its Bitcoin treasury.

- If sold near current prices, the company would realize an estimated $75M–$85M loss on its Bitcoin holdings.

- The transfer comes as corporate crypto treasury strategies face pressure amid falling digital asset prices.

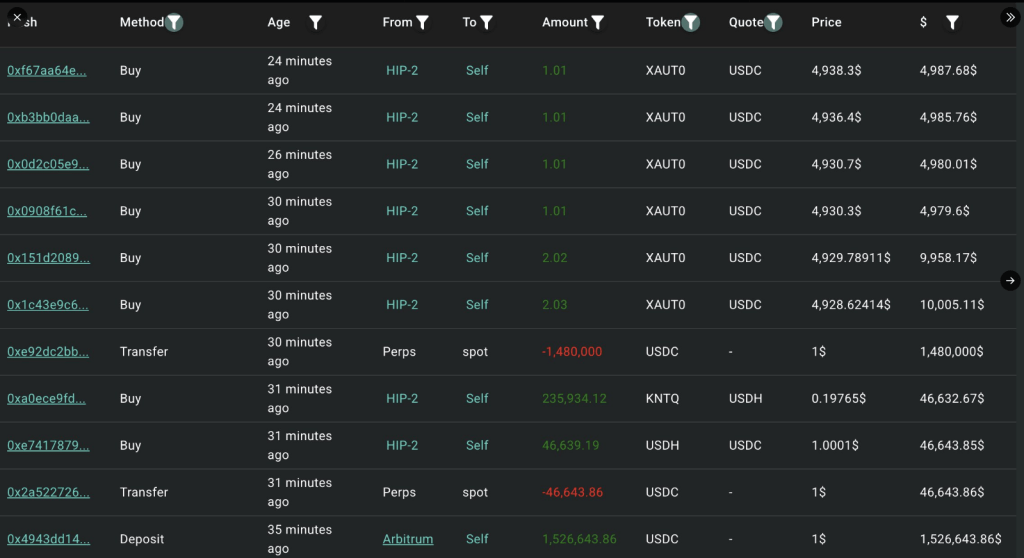

Blockchain analytics firm CryptoQuant flagged the move on Friday after identifying a wallet labeled as belonging to GameStop that sent all 4,710 BTC, worth roughly $420 million at current prices, to Coinbase’s institutional trading platform.

“GameStop throws in the towel?” CryptoQuant asked in a post on X, suggesting the transfer was “likely to sell.”

GameStop Faces Potential $75M–$85M Loss on Bitcoin Bet if Sold

If liquidated near recent market prices, the sale would lock in a sizable loss.

CryptoQuant estimates GameStop accumulated its Bitcoin in May at an average price of around $107,900 per coin, implying unrealized losses of roughly $75 million to $85 million, depending on execution price.

GameStop announced its Bitcoin purchase earlier this year after CEO Ryan Cohen met with Strategy chairman Michael Saylor in February to discuss corporate crypto treasury models.

At the time, the move aligned the meme-stock retailer with a growing group of public companies experimenting with digital assets as balance-sheet holdings.

GameStop throws in the towel?

— CryptoQuant.com (@cryptoquant_com) January 23, 2026

Their on-chain wallets just moved all BTC holdings to Coinbase Prime, likely to sell.

Between May 14–23, 2025, they bought 4,710 BTC at an avg. price of $107.9K, investing ~$504M.

Now selling for around $90.8K, potentially realising approximately… pic.twitter.com/Bp7MwRVQ43

Since the transfer, GameStop has not publicly confirmed whether it has sold or intends to sell the Bitcoin.

While moving funds to Coinbase Prime often precedes a sale, given the platform’s deep liquidity and execution tools, such transfers do not always signal imminent liquidation.

Coinbase Prime also provides custody and wallet management services through its regulated trust business, leaving open the possibility of an internal restructuring.

The timing has fueled debate. Corporate Bitcoin treasuries surged in popularity throughout 2024 and early 2025, but the model has faced growing scrutiny as crypto prices pulled back sharply in recent months.

Several firms that adopted similar strategies are now sitting on steep paper losses, prompting some to trim holdings to shore up balance sheets.

Ethereum-focused ETHZilla, for example, recently disclosed selling part of its Ether reserves to reduce debt.

Cohen Stock Purchase Lifts GameStop Shares as Bitcoin Questions Swirl

The transfer also coincides with renewed activity from Cohen himself.

A regulatory filing this week revealed the CEO purchased an additional 500,000 GameStop shares worth more than $10 million, helping push GME shares up over 3% on Thursday.

The stock move added another layer of intrigue, with some investors viewing the buy as a vote of confidence amid uncertainty around the company’s crypto exposure.

Despite the recent pressure, corporate crypto treasuries remain embedded in traditional markets.

Earlier this month, MSCI opted not to remove digital asset treasury companies from its indexes, a decision that spared firms like Strategy from potential billions in passive outflows.

The post GameStop Transfers $420M in Bitcoin to Coinbase, Sparking Exit Speculation appeared first on Cryptonews.