The Lego Pokémon Line Shows Toys Are Only for Rich Adults Now

XRP is trading near $1.89–$1.91 as January draws to a close, holding a well-defined triple-bottom support around $1.88 after slipping below the $2.00 mark earlier this week. The pullback has coincided with ETF outflows and a sharp drop in trading volume, but price action suggests stabilization rather than renewed selling pressure.

With volatility compressing and buyers repeatedly defending the same demand zone, XRP is approaching a technical decision point that could define its next directional move.

Short-term pressure has been driven largely by institutional flows. According to data reported by CryptoQuant, U.S. spot XRP ETFs recorded their first weekly net outflows, totaling approximately $40.6 million toward the end of January. Trading volume has also declined sharply, with some estimates showing a 50%+ drop in 24-hour activity, signaling trader hesitation rather than aggressive selling.

That said, the flow data points to rotation and profit-taking, not abandonment. XRP remains one of the few large-cap tokens with clear regulatory positioning in the US, and earlier ETF inflows north of $1 billion underscore that institutional interest hasn’t disappeared. The current reset appears more about leverage clearing than confidence breaking.

Fundamentally, Ripple’s long-term thesis remains unchanged. XRP continues to underpin on-demand liquidity (ODL) across Ripple’s global payments network, offering faster and cheaper settlement compared to legacy systems.

More than 300 financial institutions remain connected to RippleNet, and ongoing regulatory clarity following 2025 rulings continues to distinguish XRP from many peers.

While no major partnership headlines have emerged this week, the absence of negative ecosystem news reinforces the view that the current weakness is market-driven, not fundamental.

From a technical perspective, XRP price prediction remains cautiously neutral near term. On the 2-hour chart, price is stabilizing inside a descending channel, capped by a falling trendline near $1.95. XRP is trading below the 50-EMA and 100-EMA, while the 200-EMA near $1.99 continues to act as firm resistance.

Support is clearly defined between $1.88 and $1.85, where repeated long lower wicks suggest responsive buying. RSI has recovered into the mid-40s after oversold readings, indicating easing downside pressure. Volatility has contracted, forming a descending wedge, a structure that often resolves higher if support holds.

A successful break above $1.95 would expose $2.03–$2.06, signaling structural repair. Conversely, a decisive loss of $1.85 would open downside toward $1.80 and $1.77.

XRP Trade setup: Accumulate near $1.88–$1.85, target $2.03–$2.06, invalidation below $1.80.

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.9 million, with tokens priced at just $0.013635 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the PresaleThe post XRP Price Prediction: $1.88 Triple-Bottom Support as ETF Money Pulls Back – What’s Next? appeared first on Cryptonews.

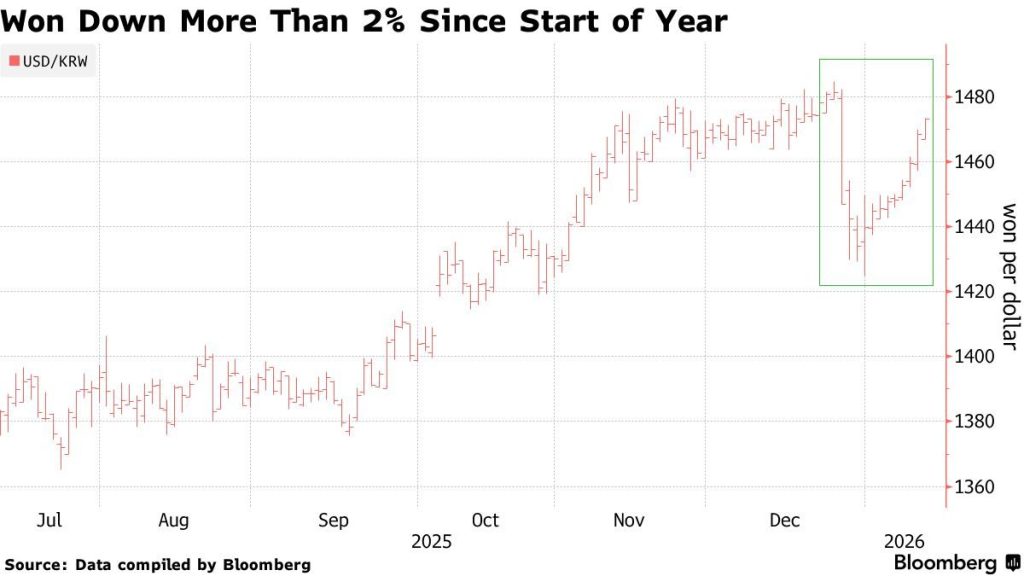

South Korean crypto exchanges recorded a 62% surge in stablecoin trading volumes as the won fell to multi-year lows against the dollar, prompting platforms to intensify marketing campaigns around dollar-pegged tokens.

According to The Korea Times, trading volume in Tether (USDT) across the nation’s five major won-based exchanges climbed to 378.2 billion won ($261 million) when the exchange rate exceeded 1,480 won per dollar last Wednesday, citing CryptoQuant data.

The spike follows mounting currency pressures that pushed the won through nine consecutive days of declines against the dollar, marking its longest losing streak since 2008, Bloomberg reported.

Major exchanges, including Korbit, Coinone, Upbit, and Bithumb, launched aggressive promotional campaigns centered on stablecoins, including USDC and USDe, waiving trading fees and distributing rewards to boost volumes during what industry officials described as a downturn in broader crypto markets.

According to The Chosun Daily, South Korea’s major commercial banks slashed dollar deposit interest rates to near zero in response to government pressure to defend the exchange rate.

Shinhan Bank cut its annual rate from 1.5% to 0.1% starting January 30, while Hana Bank reduced rates from 2% to 0.05% for its Travelog Foreign Currency Account.

The coordinated move followed the authorities’ summoning of bank executives and their request that they “refrain from excessive marketing that encourages foreign currency deposits such as dollars.”

Banks responded by introducing incentives for won conversion, with Shinhan offering a 90% preferential rate for customers converting dollar deposits back to won, plus an additional 0.1 percentage point rate boost for those subscribing to won-term deposits afterward.

Dollar deposit balances at the five major banks fell 3.8% from month-end to 63.25 billion dollars as of January 22, marking the first decline after three consecutive months of surges.

Corporate deposits, which account for 80% of all dollar holdings, dropped sharply from 52.42 billion dollars at year-end to 49.83 billion dollars, suggesting that the authorities’ recommendation to sell dollars spot, combined with perceptions that the exchange rate had peaked, was driving the decline.

Individual dollar deposits grew at a significantly slower pace, rising just 109.64 million dollars, compared with the previous month’s 1.09 billion dollar surge.

President Lee Jae-myung delivered a rare verbal intervention on the exchange rate during a January 21 press conference, stating authorities predicted the rate would drop to around 1,400 won within one to two months.

The won-dollar rate immediately fell from 1,481.4 won to 1,467.7 won following his remarks, closing at 1,471.3 won.

Market observers noted the unprecedented nature of a sitting president specifying both an exchange rate target and timeline, with Lee’s statement carrying significantly more weight than U.S. Treasury Secretary Scott Bessent’s earlier comment that the won’s recent decline was “inconsistent with Korea’s strong fundamentals.”

Meanwhile, demand for dollar exchange slowed as average daily won-to-dollar conversions reached 16.54 million dollars from January 1-22, while dollar-to-won conversions surged to 5.2 million dollars daily, significantly exceeding last year’s 3.78 million dollar average and indicating increased profit-taking.

In fact, according to CNBC, South Korea’s fourth-quarter GDP growth slowed to 1.5% year over year, missing economists’ forecasts of 1.9%, as construction investment shrank 3.9% and exports pulled back 2.1% from the previous quarter.

The won has lost nearly 2% against the greenback this year, making it one of Asia’s worst-performing currencies, while South Korean retail investors bought approximately 2.4 billion dollars of U.S. equities on a net basis through mid-January, up roughly 60% from the same period last year.

The broader economic slowdown comes as Seoul advances major crypto policy reforms despite regulatory gridlock over stablecoin governance.

Earlier this month, South Korea ended its nine-year corporate crypto trading ban, permitting listed companies to invest up to 5% of equity capital in top-20 cryptocurrencies, while lawmakers passed amendments to the Capital Markets Act and Electronic Securities Act establishing legal frameworks for tokenized securities trading beginning January 2027.

— Cryptonews.com (@cryptonews) January 12, 2026

South Korea has launched guidelines, allowing listed companies and professional investors to invest up to 5% of their equity capital crypto.#SouthKorea #CorporateCryptoInvestment #CryptoInvestmenthttps://t.co/d55u3TDsBF

Korea Exchange Chairman Jeong Eun-bo pledged to launch spot Bitcoin ETFs and extend trading hours to 24/7 as part of efforts to eliminate the “Korea discount,” though comprehensive digital asset legislation remains stalled amid disputes between the Financial Services Commission and the Bank of Korea over stablecoin issuance rules.

The post Stablecoin Trading Surges 62% in Korea as Dollar Strengthens Against Won appeared first on Cryptonews.

The United States is preparing Misawa Air Base in northern Japan to support the future deployment of F-35A stealth fighter aircraft, as part of a broader effort to modernize U.S. air power in the western Pacific. According to the report by Newsweek journalist Ryan Chan, the Pentagon plans to deploy 48 F-35A Lightning II jets […]

The United States is preparing Misawa Air Base in northern Japan to support the future deployment of F-35A stealth fighter aircraft, as part of a broader effort to modernize U.S. air power in the western Pacific. According to the report by Newsweek journalist Ryan Chan, the Pentagon plans to deploy 48 F-35A Lightning II jets […]  The United States Navy’s Independence-variant littoral combat ship USS Cincinnati (LCS 20) arrived at Cambodia’s Ream Naval Base for a temporary port visit on January 24, 2026, marking the first visit by a U.S. warship since the base was expanded with Chinese support. According to the U.S. Navy, USS Cincinnati docked at the base in […]

The United States Navy’s Independence-variant littoral combat ship USS Cincinnati (LCS 20) arrived at Cambodia’s Ream Naval Base for a temporary port visit on January 24, 2026, marking the first visit by a U.S. warship since the base was expanded with Chinese support. According to the U.S. Navy, USS Cincinnati docked at the base in […]  Russia has replaced the leadership of its strategic aircraft manufacturer Tupolev, appointing 37-year-old Yuri Ambrosimov as chief executive to replace 76-year-old Aleksandr Bobryshev, according to a report by Defense Express citing Russian industry sources. The personnel change took place roughly one year after the previous round of management rotations at Tupolev in 2024 and comes […]

Russia has replaced the leadership of its strategic aircraft manufacturer Tupolev, appointing 37-year-old Yuri Ambrosimov as chief executive to replace 76-year-old Aleksandr Bobryshev, according to a report by Defense Express citing Russian industry sources. The personnel change took place roughly one year after the previous round of management rotations at Tupolev in 2024 and comes […]

For most of the week, the Ethereum price has remained in a range-bound spell, putting in no significant movement outside of the $3,000 and $2,880 price boundaries. Amid rising speculations, an on-chain analysis has recently been put out, which provides an answer to the question.

In their latest QuickTake post on CryptoQuant, analytics platform Arab Chain reveals that there has been a fall in active Ethereum derivatives contracts across major exchanges, as indicated by data from the Ethereum: Open Interest-All Exchanges, All Symbol metric. Typically, rising Open Interest (OI) across exchanges indicates that more traders are entering leveraged positions. On the other hand, falling OI reflects more exits of leveraged positions, and by extension, reduced aversion to risk.

In the Quicktake post, Arab Chain highlights that open interest across exchanges has dipped to about $16.9 billion, marking the lowest level reached since mid-December last year. This, in turn, reflects an overall reduction in risk appetite across the Ethereum derivatives market. Because there is less speculative activity, there are also reduced risks of liquidations. Hence, the Ethereum price stands a higher chance of consolidating.

While exchanges in general are recording significant pull-outs from the derivatives market, Binance has shown an outlier performance. Arab Chain highlights that the world’s largest exchange by trading volume has instead recorded about $7.5 billion in Open Interest. Interestingly, this reading slightly exceeds the December average range of $6.8–$7.4 billion.

The divergence between the Open Interest values across all exchanges and that of Binance suggests that, while market participants are reducing their risk exposure, there is still liquidity in the derivatives market. Rather than a blatant exit, it has been repositioned toward the deeper and more liquid venue.

Arab Chain also explains that this behavior indicates a change in market operations from a higher-risk trading environment to one more price and risk efficient. In conclusion, the large traders are yet to make their exits but are merely reducing their exposure, while holding high-quality positions on Binance.

In addition, Ethereum’s proximity to the $3,000 price — especially as OI declines — shows that the market has been absorbing the deleveraging events while showing little selling pressure. Ultimately, Binance’s OI retaining levels above December’s support the idea that the market still has strong derivatives backing. Hence, the broader picture remains bullish. As of this writing, Ethereum trades at $2,958, reflecting a 0.33% growth since the past day, according to CoinMarketCap data.

Featured image from Pexels, chart from Tradingview.com

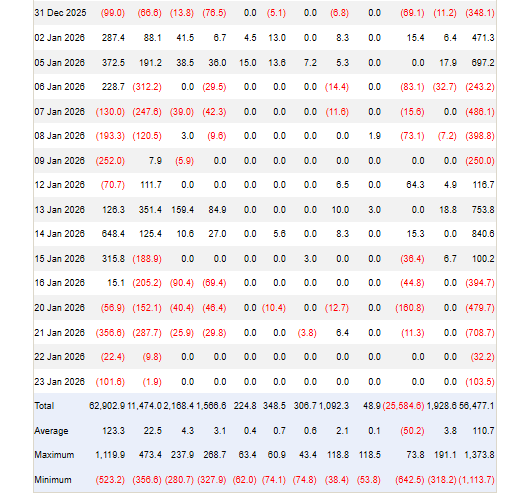

US-based spot Bitcoin exchange-traded funds pulled funds for a fifth straight trading day, and the totals added up quickly. According to Farside data, about $103.5 million left on Friday, bringing the five-day sum to roughly $1.72 billion.

Bitcoin was trading near $89,160 at the time of these reports — still well below the $100,000 mark it last reached on November 13. This movement has sent a clear signal: many investors are stepping back right now.

Reports note that ETF flows are often on the radar as a quick read on investor mood, but the picture is not always simple. Large outflows can reflect institutional rebalancing or tactical moves by funds, not only mass retail selling.

The US market had a four-day trading week because of Martin Luther King Jr. Day on Monday, which may have concentrated trades into fewer sessions and amplified the numbers. Still, losing more than a billion dollars in a few days will get attention.

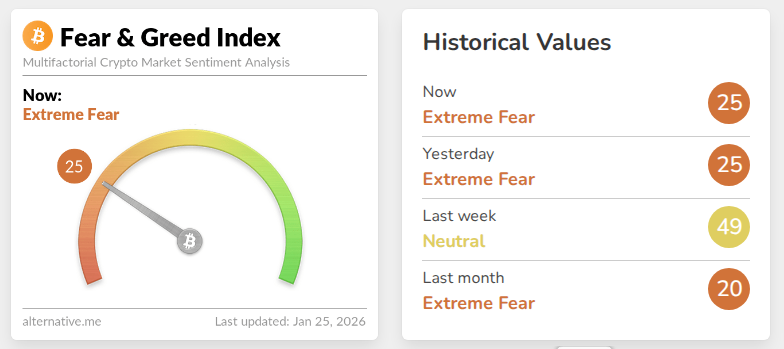

The wider mood has soured. The Crypto Fear & Greed Index registered an Extreme Fear score of 25, and sentiment trackers have been flashing caution. Reports say Santiment believes retail traders are pulling back while attention drifts toward more traditional assets.

Meanwhile, metals have been strong. Reports disclose that with gold trading near $5,000 and silver approaching $100, some market players feel Bitcoin has been left out of a rally that lifted metals, which has weighed on confidence in the crypto market.

Bitcoin has struggled to find a steady rhythm over the past week. Prices slipped below the $89,000 to $90,000 range as traders reacted to fresh geopolitical tension and renewed trade worries, before stabilizing as nerves eased.

This was driven higher after some soft political indicators around tariff threats, only to substantiate the idea that markets rarely react to conflict but rather to changes in tone and expectations.

These movements illustrate how Bitcoin behaves more like a risk asset rather than an asset shelter, falling in tandem with equities when unexpected financial shocks hit the globe, before rebounding when the fever subsides to gather fresh buyers.

Current price patterns indicate caution, where traders are weighing short-term political risks against medium- and long-term macro patterns, as well as institutional interests.

There are some quieter indications that the rout could be losing steam. To this effect, there are assertions suggesting that supply distribution on-chain and social chatter can be circumstantial evidence showing there is less selling pressure.

Featured image from Money; Shutterstock, chart from TradingView

In the past three days, the price of Bitcoin has moved between $88,000 to $90,000, indicating a rather stable market with little volatility. This ongoing price consolidation comes after the leading cryptocurrency suffered a significant setback in its goal to reclaim its psychological six-figure valuation.

During the week, Bitcoin prices fell from around $96,000 to below $88,000, establishing a new yearly low for 2026. However, amid this discouraging price action, the underlying on-chain data suggests a developing exhaustion among market bears, thus hinting at a highly-anticipated trend reversal.

In a recent QuickTake post, popular analyst Burak Kesmeci shares insight on a potential bullish reversal in the Bitcoin market following recent changes in the Growth Rate Difference – an on-chain metric that measures variation between the asset’s market cap growth rate and realized cap growth rate.

For context, the market cap reflects the total market value of an asset, determined by price and circulating supply. Therefore, it’s often a speculative indicator. Conversely, the realized cap measures the actual capital inflows to an asset. It’s a slow-moving, structural metric, and it’s best for ascertaining capital commitment and the underlying market strength.

When the Bitcoin Growth Rate Difference is positive, it indicates a bull market, as speculative demand exceeds actual capital inflows. On the other hand, a negative value suggests that price growth is slower than real money inflows, which are characteristic of a bearish or consolidatory market.

According to Kesmeci, the Bitcoin Growth Rate Difference has been negative since October 30, suggesting investors have been in a bear market over the last three months. During this time, prices have famously crashed by over 17%.

However, the Growth Rate Difference has also increased from -0.0013 on November 22nd to -0.0009 on January 24, suggesting a budding resurgence in speculation and price growth. Moreover, this development also indicates that bearish fatigue is setting in, paving the way for a bullish market rebound. Nevertheless, a clean break above the 0 midline to confirm entry into bull territory and on-chain support for upside momentum.

At press time, Bitcoin is valued at $89,223, reflecting a minor loss of 0.25% in the last day. Meanwhile, the daily trading volume is down by 58.72,% indicating that most market participants are less willing to engage the market at the moment, thus explaining the sluggish price action.

In a major development, the US Securities and Exchange Commission has filed a joint stipulation with defendant Gemini Trust Company, LLC to terminate its long-running civil enforcement action with prejudice, effectively ending the three-year legal battle over the Gemini Earn crypto lending program.

In January 2023, the SEC instituted one of the most controversial crypto-related lawsuits against Gemini Trust Company and its partner, Genesis Global Capital LLC, accusing both parties of illegally offering and selling unregistered securities through the Gemini Earn lending program, a financial product that operated between 2021 and 2022, which allowed customers to lend crypto for interest at 7.4% per annum.

Following the FTX crash in 2022, Genesis, which had a significant financial exposure to the now-defunct crypto exchange, halted withdrawals on the Gemini Earn Program, effectively locking up $940 million in investor assets. Since then, a series of events has unfolded, including Genesis entering bankruptcy proceedings, and through that process, all Earn investors ultimately recovered 100 percent of their crypto assets in kind. In addition, Gemini has settled related matters with state and federal regulators, paying over $50 million in civil fines.

In the joint stipulation filed this week, the SEC noted that its decision to seek dismissal “in the exercise of its discretion” took into account the full investor recovery and those regulatory settlements. The dismissal is with prejudice, preventing the SEC from re-filing the same claims, and represents the formal end of one of the most high-profile enforcement actions in the US crypto industry.

The dismissal of the Gemini case comes amid a broader recalibration of the US crypto regulatory approach under the Donald Trump administration. Several high-profile SEC actions against major platforms, involving Coinbase, Kraken, and Binance, have been dropped or paused, reflecting a shift from a forceful regulatory approach seen under the former chairman, Gary Gensler.

At the same time, Congress and the White House continue to pursue pro-crypto legislative and policy initiatives. In July 2025, US President Donald Trump signed the GENIUS Act into law, a landmark bill establishing a comprehensive federal framework for stablecoins, aimed at boosting consumer protection and supporting broader adoption of digital assets.

Alongside the GENIUS Act, the highly anticipated Clarity Act, passed by the US House, aims to delineate regulatory responsibilities between agencies like the SEC and the Commodity Futures Trading Commission (CFTC) based on how digital assets function. The US Senate Agriculture Committee is set to observe a markup session of the bill on January 27, indicating steady progress despite recent concerning events, including public outrage by Coinbase founder Brian Armstrong and the Banking Committee’s continued postponement of its own hearing session.

The Bitcoin Spot ETFs continue to witness a volatile start to 2026, with back-to-back weeks showing sharply contrasting performance. After netting a staggering $1.42 billion in weekly netflows on January 16, market momentum soon swung the opposite way in line with a Bitcoin decline, forcing a net outflow of $1.33 billion over the last week. A similar phenomenon was seen in the first two weeks of the year, after an initial net deposit of $458.77 million by January 2 was followed by a net outflow of $681.01 million by January 9. This investor behavior suggests a highly reactive market with little long-term confidence.

In analyzing the most recent wave of withdrawals in the Bitcoin Spot ETF market, data from SoSoValue shows that the fourth trading week of January recorded no single day with a positive netflow. The heaviest outflows totaled $708.71 million on January 21, followed by the smallest daily outflow of $32.11 million on January 22.

Looking at individual funds, BlackRock’s IBIT, the market leader, suffered the largest net outflows valued at $537.49 million. As usual, Fidelity’s FBTC ranks a close second with redemptions surpassing deposits by $451.50 million. Other Bitcoin Spot ETFs with heavy net outflows also included Grayscale’s GBTC, Bitwise’s BITB, and Ark Invest’s ARKB, which suffered losses estimated at $172.09 million, $66.25 million, and $76.19 million, respectively.

Meanwhile, VanEck’s HODL, Valkyrie’s BRRR, and Franklin Templeton’s EZBC also experienced net outflows between $6 million and $11 million. Notably, Grayscale’s BTC, Invesco’s BTCO, WisdomTree’s BTCW, and Hashdex’s DEFI recorded the least activity with zero netflows. At press time, total net assets for the Bitcoin Spot ETFs stand at $115.88 billion, with BlackRock’s IBIT accounting for over 54% of these holdings, as the undisputed market leader. Meanwhile, total cumulative net inflow is presently valued at $56.49 billion.

Related Reading: Monero, Zcash, And Dash Prohibited In India Amid Money-Laundering Crackdown

According to more data from SoSoValue, the Ethereum Spot ETFs also witnessed massive levels of redemptions in the last trading week, resulting in a net outflow of $611.17 million. Similar to its Bitcoin counterpart, the BlackRock ETHA also produced the largest net withdrawals valued at $431.50 million. Presently, the total net assets for the Ethereum Spot ETFs are valued at $17.70 billion, representing 4.99% of Ethereum’s market cap. Meanwhile, the cumulative total net inflow is valued at $12.30 billion.

When shopping for a Valentine's Day gift for the woman in your life, remember that romance doesn't stem from the amount of money you spend (or the number of stems in the bouquet).

The real sparks fly when your gift shows that you pay attention. Think about what type of gift could satisfy her latest obsession, or what type of gift could alleviate her latest pet peeve. Of course, heart-shaped or romantic Valentine's Day gifts are never a bad idea — we're just here to make sure they're not too cliché. Here are our picks for the best Valentine's Day gifts for her in 2026. Thoughtful, practical, whimsical, or appropriately mushy, these unique gift ideas go beyond the classic flowers and jewelry that you've already thought of.

TL;DR: Get more done with this Microsoft Office Professional 2021 for Windows lifetime license, now $34.97 (reg. $219.99) until Feb. 22.

From creating a standout resume to building a budget or drafting an invoice, there are some tasks that are just easier on your PC. If you’re looking to make them even easier, a Microsoft Office Professional 2021 for Windows lifetime license can help. Now you can own eight powerful Microsoft tools for life for just $34.97 (reg. $219.99) through Feb. 22.

Got an endless to-do list piling up? Knock it out with Microsoft Office Professional 2021 for Windows. This lifetime license gives you eight apps that make life a little easier — from finishing work tasks to answering emails — and there are no subscription fees required. You’ll get these eight Microsoft essentials for less than $5 each with this license, including new and familiar favorites.

Draft documents in Word, manage correspondence in Outlook, put together powerful presentations in PowerPoint, and build budgets in Excel. You can also stay connected to others with Teams, manage large databases with Access, take notes more efficiently with OneNote, and create professional documents in Publisher.

Don’t let the year of this edition give you pause — all the apps have been redesigned to help things work smoothly. There’s a ribbon-based interface so you can access features, tools, and customizations more easily. Just make sure your PC is running Windows 10 or 11 before your purchase, as Windows 7 and 8 won’t support the apps.

Get this Microsoft Office Professional 2021 for Windows lifetime license for only $34.97 (reg. $219.99) now through Feb. 22.

StackSocial prices subject to change.

TL;DR: Live stream Denver Nuggets vs. Memphis Grizzlies in the NBA for free with a 30-day trial of Amazon Prime. Access this free live stream from anywhere in the world with ExpressVPN.

It's been an action packed week of NBA action for both the Denver Nuggets and Memphis Grizzlies, with multiple games played across a number of arenas.

But this Sunday afternoon fixture should favor the Nuggets, who are riding high in the Western Conference while the Grizzles are scrambling in the bottom half. Can the Grizzlies pull off an unexpected win? Or will the Nuggets notch up another victory in what's shaping up to be a solid season?

If you want to watch Nuggets vs. Grizzlies in the NBA for free from anywhere in the world, we have all the information you need.

Denver Nuggets vs. Memphis Grizzlies in the NBA starts at 3.30 p.m. ET on Jan. 25. This game takes place at the FedExForum in Memphis, TN.

Denver Nuggets vs. Memphis Grizzlies in the NBA is available to live stream for free with a 30-day trial of Amazon Prime.

This free live stream is geo-restricted to the UK, but anyone can secure access with a VPN. These tools can hide your real IP address (digital location) and connect you to a secure server in the UK, meaning you can access free live streams of the NBA from anywhere in the world.

Stream the NBA for free by following these simple steps:

Sign up for a 30-day trial of Amazon Prime (if you're not already a member)

Subscribe to a VPN (like ExpressVPN)

Download the app to your device of choice (the best VPNs have apps for Windows, Mac, iOS, Android, Linux, and more)

Open up the app and connect to a server in the UK

Watch the NBA from anywhere in the world on Prime Video

The best VPNs for streaming are not free, but they do tend to offer money-back guarantees or free trials. By leveraging these offers, you can watch NBA live streams without actually spending anything. This clearly isn't a long-term solution, but it does mean you can watch select games from the NBA before recovering your investment.

ExpressVPN is the best service for accessing free live streams on platforms like Prime Video, for a number of reasons:

Servers in 105 countries

Easy-to-use app available on all major devices including iPhone, Android, Windows, Mac, and more

Strict no-logging policy so your data is secure

Fast connection speeds free from throttling

Up to 10 simultaneous connections

30-day money-back guarantee

A two-year subscription to ExpressVPN is on sale for $139 and includes an extra four months for free — 61% off for a limited time. This plan also includes a year of free unlimited cloud backup and a generous 30-day money-back guarantee. Alternatively, you can get a one-month plan for just $12.95 (with money-back guarantee).

Live stream the NBA for free with ExpressVPN.

TL;DR: Live stream Rams vs. Seahawks for free on TVNZ+. Access this free live stream from anywhere in the world with ExpressVPN.

We're at a crucial stage in the NFL playoffs, as the Conference Championship games go down this weekend. In the NFC Championship game, the Los Angeles Rams clash with the Seattle Seahawks.

The Rams, the No. 5 seed, have had an exciting playoff run and defeated the Chicago Bears in overtime drama. But they'll face the toughest competition in the entire conference. The Seahawks are the No. 1 seed and they absolutely dominated the San Francisco 49ers in the Divisional Round.

The winner of this game with face either the Denver Broncos or New England Patriots in the Super Bowl. The Seahawks look like the obvious pick on paper, but — as the Seahawks proved themselves in the last game with a 13-second touchdown — anything can happen at this stage And there was just one point between these teams when they met last month, a game won by Seattle.

If you want to watch Rams vs. Seahawks in the NFL playoffs for free from anywhere in the world, here's all the information you need.

Los Angeles Rams vs. Seattle Seahawks takes place at 6.30 p.m. ET on Jan. 25. This fixture will be played at Lumen Field in Seattle, Washington.

Los Angeles Rams vs. Seattle Seahawks in the NFL is available to live stream for free on TVNZ+.

TVNZ+ is geo-restricted to New Zealand, but you can access this free streaming platform from anywhere by using a VPN. These handy tools can hide your real IP address (digital location) and connect you to a secure server in New Zealand, allowing you to unblock TVNZ+ from anywhere in the world. Access free live streams of the NFL by following these simple steps:

Subscribe to a streaming-friendly VPN (like ExpressVPN)

Download the app to your device of choice (the best VPNs have apps for Windows, Mac, iOS, Android, Linux, and more)

Open up the app and connect to a server in a location with free coverage of the NFL

Register with TVNZ+

Watch the NFL for free from anywhere in the world

The best VPNs for streaming do require a subscription, but the leading VPN services also offer free-trial periods or money-back guarantees. You can leverage these deals to get access to live streams of the NFL without committing any cash in the long run. This is obviously a short-term fix, but it will give you time to watch Rams vs. Seahawks and other NFL fixtures before you reclaim any upfront investment.

ExpressVPN is the best service for bypassing geo-restrictions to stream the NFL, for a number of reasons:

Servers in 105 countries

Easy-to-use app available on all major devices including iPhone, Android, Windows, Mac, and more

Strict no-logging policy so your data is always secure

Fast connection speeds

Up to 10 simultaneous connections

30-day money-back guarantee

A one-year subscription to ExpressVPN is on sale for $99.95 — a saving of 49% — which includes a bonus three months usage at no extra cost. This plan also includes a year of unlimited cloud backup and a 30-day money-back guarantee. Alternatively, you can get a one-month plan for just $12.95 (also with a money-back guarantee).

Live stream the NFL for free from anywhere in the world with ExpressVPN.

TL;DR: Live stream Patriots vs. Broncos for free on TVNZ+. Access this free live stream from anywhere in the world with ExpressVPN.

Does it get any more exciting than the NFL playoffs? And we're now deep into the postseason. It's time for the Championship Conference games, which means we're just one game away from the Super Bowl. Yes, it's all pretty exciting.

The AFC Championship Game sees the Patriots go on the road for a showdown with the Denver Broncos, with the winner set to face the victor of the Seattle Seahawks vs. Los Angeles Rams NFC Championship Game.

The Broncos are the AFC No. 1 seed and boast a record of 14-3 this season. But they scraped past the Divisional Round thanks to a controversial call against the Buffalo Bills. Meanwhile, the Patriots, the No.2 seed, scored a convincing win over the Houston Texans, including a sensational touchdown pass from MVP contender Drake Maye. Can New England continue that momentum and regain their former glory?

If you want to watch Patriots vs. Broncos in the NFL playoffs for free from anywhere in the world, here's all the information you need.

New England Patriots vs. Denver Broncos takes place at 3 p.m. ET on Jan. 25. This fixture will be played at Empower Field at Mile High in Denver, Colorado.

New England Patriots vs. Denver Broncos in the NFL is available to live stream for free on TVNZ+.

TVNZ+ is geo-restricted to New Zealand, but you can access this free streaming platform from anywhere by using a VPN. These handy tools can hide your real IP address (digital location) and connect you to a secure server in New Zealand, allowing you to unblock TVNZ+ from anywhere in the world. Access free live streams of the NFL by following these simple steps:

Subscribe to a streaming-friendly VPN (like ExpressVPN)

Download the app to your device of choice (the best VPNs have apps for Windows, Mac, iOS, Android, Linux, and more)

Open up the app and connect to a server in a location with free coverage of the NFL

Register with TVNZ+

Watch the NFL for free from anywhere in the world

The best VPNs for streaming do require a subscription, but the leading VPN services also offer free-trial periods or money-back guarantees. You can leverage these deals to get access to live streams of the NFL without committing any cash in the long run. This is obviously a short-term fix, but it will give you time to watch Patriots vs. Broncos and other NFL fixtures before you reclaim any upfront investment.

ExpressVPN is the best service for bypassing geo-restrictions to stream the NFL, for a number of reasons:

Servers in 105 countries

Easy-to-use app available on all major devices including iPhone, Android, Windows, Mac, and more

Strict no-logging policy so your data is always secure

Fast connection speeds

Up to 10 simultaneous connections

30-day money-back guarantee

A one-year subscription to ExpressVPN is on sale for $99.95, and includes a bonus three months usage at no extra cost. This plan also includes a year of unlimited cloud backup and a 30-day money-back guarantee. Alternatively, you can get a one-month plan for just $12.95 (also with a money-back guarantee).

Live stream the NFL for free from anywhere in the world with ExpressVPN.

At present, I think the best Windows laptop for most people is the 13.8-inch Microsoft Surface Laptop 7 powered by the Snapdragon X Elite chip. It's a stylish workhorse with enough power to handle demanding workloads and has a premium build as well as an amazing all-day battery life (outdone by just two other models). Even the M4 MacBooks can't keep up. Beyond that, I have other picks for users with different budgets, use cases, and design preferences.

I chose my picks based on hands-on testing conducted by myself and other Mashable staff and contributors. We've reviewed dozens of PCs on the basis of performance, build quality, battery life, and value over the years, and the ones I'm recommending are the cream of recent-gen crops. Most of them scored high enough to secure a Mashable Choice Award, the highest honor we give to the gadgets we review.

Every major PC maker announced new Windows laptops at the Consumer Electronics Show (CES) in early January. They'll all be powered by new Intel, AMD, and Qualcomm processors, and many of them feature modular or ultra-ultraportable designs. Six of them will succeed some of the current top picks on this list (noted above). We'll be testing as many as possible in the coming months to see what's worthy of our recommendation, so stay tuned.

Relatedly, a word of caution: Next-gen Windows laptops could be significantly more expensive than their predecessors. It's because AI data centers have gobbled up DDR5 RAM and SSDs in recent months, leading to a shortage of such components for laptops and other consumer devices. Experts predict that PCs will get pricier over the coming months or ship with lesser specs, as Mashable's Alex Perry reported.

Very few PC makers have confirmed pricing and availability for their 2026 Windows laptops, so we don't know exactly how the shortage affects them just yet. The good news is that it might be up to a year before we see prices start to skyrocket. In a recent interview with Tom's Guide, a higher-up at Intel said that PC makers have “about nine to 12 months of inventory" on hand as a buffer.

Whether you're buying one of the excellent past-gen models on this list or sticking it out for something newer, I would strongly recommend upgrading your device with as much RAM and storage as your budget allows. You'll add some extra future-proofing while avoiding any potential price hikes down the road.