Bitcoin Whale Deposits $445 Million, Is Another Sell-Off And Crash Coming?

Large on-chain movements involving Bitcoin whales have a way of putting the market on edge, especially when they involve transfers to centralized exchanges. A new transaction involving 5,152 BTC moving into Binance has now raised questions around potential sell pressure at a time when Bitcoin’s price action is fragile, highly reactive, and struggling to get a hold of bullish momentum.

Bitcoin Whale Moves 5,152 BTC Worth $445 Million To Binance

On-chain data identified by whale transaction tracker Lookonchain has revealed that a long-term Bitcoin holder deposited 5,152 BTC, valued at approximately $444.73 million, into Binance. The data, sourced from Arkham Intelligence, shows the wallet belongs to an entity tagged as Bitcoin OG (1011short), a trader known to hold a massive combined long position estimated at around $695 million across Bitcoin, Ethereum, and Solana.

The size and destination of the transfer immediately drew attention, as coins sent to exchanges are typically interpreted as becoming available for trading activity. Moving such a large amount of BTC onto Binance increases immediate sell-side liquidity and shows that the whale address is in preparation for selling. This follows the recent trend of whale addresses selling their Bitcoin holdings and a general lack of buying pressure for the cryptocurrency.

Interestingly, Lookonchain data shows that the same Bitcoin OG (1011short) wallet recently added another 12,406 ETH to its long exposure, pushing its current holdings to 203,341 ETH worth about $577.5 million, alongside 1,000 BTC valued near $87 million and 250,000 SOL worth roughly $30.7 million. Despite increasing exposure, the wallet is now down more than $70 million, having seen profits fall from over $120 million to less than $30 million at the time of writing.

Bearish Whale Behavior Is Not Isolated

This Binance deposit is not occurring in isolation. Lookonchain also noted activity from another whale address, 0x94d3, which has taken explicitly bearish action over the past several hours. According to the data, the whale sold 255 BTC worth approximately $21.77 million at an average price of $85,378 before opening a 10x leveraged short position on 876.27 BTC, valued at about $76.3 million. The same wallet also initiated a leveraged short on 372.78 ETH worth roughly $1.1 million.

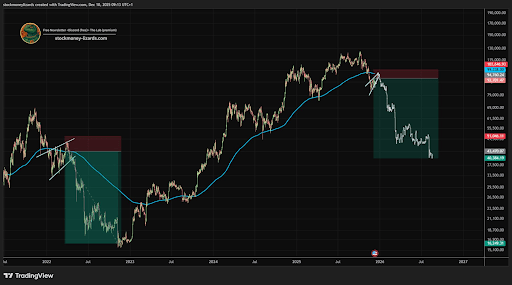

Bitcoin’s recent price action makes these whale moves especially impactful. The leading cryptocurrency has failed to hold above $90,000 again and recently fell to a 24-hour low of $84,581. This movement has seen Bitcoin trading in a volatile range, repeatedly revisiting support zones around the mid-$80,000 region. Upside follow-through above $90,000 has been limited, and this has left the cryptocurrency vulnerable.

Interestingly, a careful look at on-chain data shows that any movement that looks like accumulation in recent days is not organic buying but only reshuffling among wallets.