Ethereum Traders Chase Upside With Historic Leverage – Breakout Fuel Or Fragile Setup?

Ethereum has been struggling to regain traction below the $3,000 level since Monday, with repeated rejection attempts reinforcing a fragile market structure. Bulls continue to lose ground as upside momentum fades, while sentiment across the market remains dominated by apathy and underlying fear.

Trading activity has thinned, relief rallies have been short-lived, and many participants appear hesitant to commit capital in a market that lacks clear directional conviction. As price drifts sideways under key resistance, the broader narrative has shifted from optimism to caution.

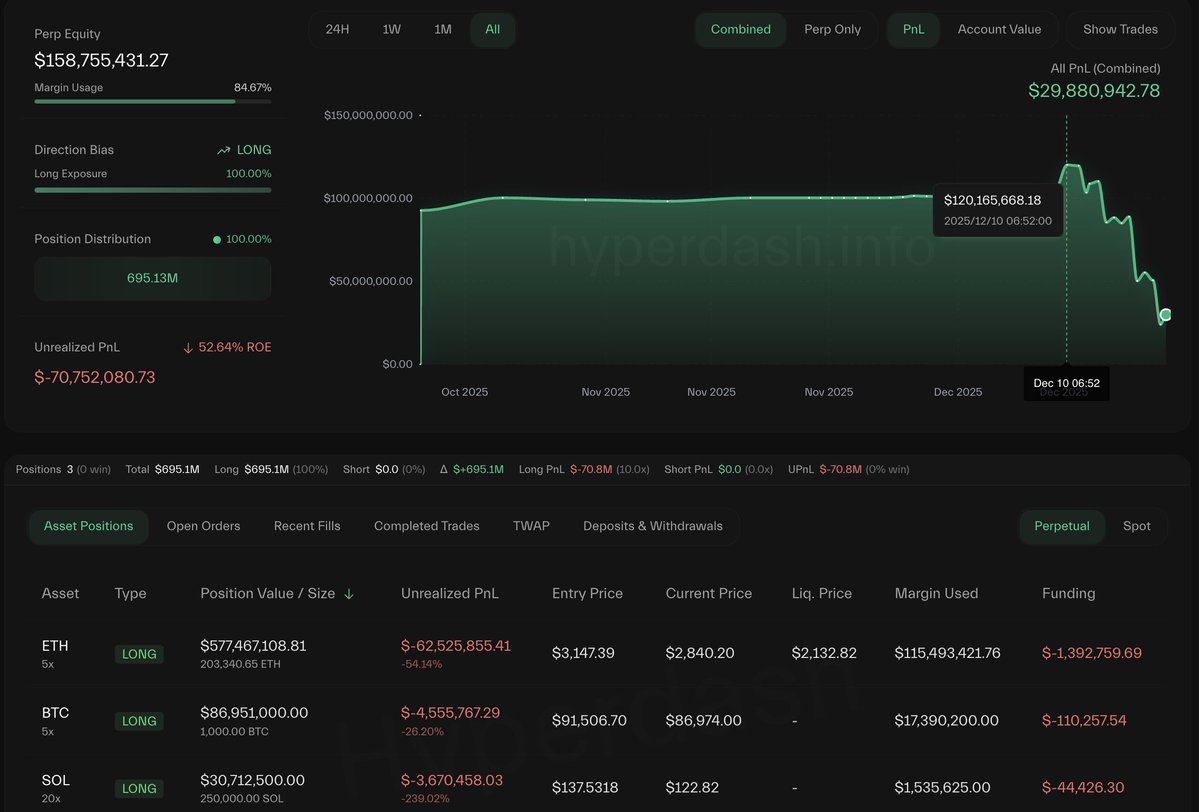

Despite this weak price action, on-chain derivatives data tells a more complex story. According to a CryptoQuant report, Ethereum’s derivatives market on Binance is reaching record levels, highlighting a sharp rise in risk appetite and speculative positioning among traders.

Leverage across ETH contracts has expanded significantly, suggesting that market participants are increasingly willing to take on risk in anticipation of a directional move. This behavior points to growing optimism beneath the surface, even as spot price struggles to reflect it.

The divergence between subdued price action and rising derivatives exposure creates a tense market environment.

Ethereum Leverage Reaches Extreme Levels

The CryptoQuant analysis by CryptoOnchain highlights a critical shift in Ethereum’s derivatives landscape, underscoring how speculative positioning has reached extreme levels. According to the data, Ethereum’s Estimated Leverage Ratio (ELR) on Binance has surged to 0.611, marking a new all-time high for this metric.

A rising ELR indicates that traders are taking on increasingly large leveraged positions relative to the exchange’s reserves.

At the same time, the report explains that buying aggression has intensified. On December 19, the Taker Buy Sell Ratio spiked to 1.13, a level not observed since September 2023. A ratio above one indicates that aggressive buyers are dominating order flow, with traders actively lifting offers rather than passively waiting.

This combination of elevated leverage and strong taker buying reflects a market leaning heavily toward bullish expectations.

The convergence of these two indicators sends a clear message: traders are not only optimistic about Ethereum’s price trajectory, but they are also willing to assume substantial risk to express that view.

However, this structure comes with meaningful downside risks. While high leverage can amplify upside momentum and fuel a breakout through resistance, it also creates fragility. With leverage at historic highs, even a modest price pullback could trigger cascading liquidations, increasing the probability of a sharp “long squeeze” and sudden volatility.

ETH Price Struggles Below as Bearish Structure Persists

Ethereum’s price action on the daily chart reflects a market attempting to stabilize after a prolonged corrective phase, but still trapped below critical resistance levels. ETH is currently trading around the $2,950 area after a short-term rebound, yet the broader structure remains fragile.

The recent bounce has pushed price back toward the descending short-term moving average, but ETH continues to trade below both the 100-day and 200-day moving averages, which are now acting as dynamic resistance rather than support.

Structurally, Ethereum has formed a series of lower highs since the October peak near $4,800, confirming a clear downtrend on the medium-term timeframe. The failure to reclaim the $3,200–$3,300 zone is particularly notable, as this area previously acted as strong support during the uptrend and has now flipped into resistance. As long as ETH remains below this range, bullish attempts are likely to be sold into.

While the latest rebound came with a modest increase in volume, it remains well below the levels observed during impulsive upside moves earlier in the year. This suggests short-covering or tactical buying rather than strong spot demand.

On the downside, the $2,800–$2,750 region stands out as immediate support. A decisive break below this zone would expose ETH to a deeper retracement toward the $2,500 area. For the bearish structure to weaken meaningfully, Ethereum must reclaim the $3,200 level and hold above its key moving averages with expanding volume.

Featured image from ChatGPT, chart from TradingView.com