Cardano Enters New Phase, Hoskinson Touts ‘ChatGPT For Privacy’

Charles Hoskinson says Cardano is entering a new phase centered on what he described as a “ChatGPT for privacy,” positioning the Midnight project as a cross-ecosystem application layer designed to make advanced cryptography usable at scale.

Cardano Is Entering A New Phase

Speaking in a Dec. 18 livestream titled “Rays of Sunshine in 2026,” the Cardano founder argued that Midnight marks a shift away from incremental performance battles toward privacy-first, hybrid applications that can plug into Ethereum, Solana, Bitcoin, and beyond.

“I wanted to make a video to talk about the good stuff and talk about the fact that we’re leading the market for the first time in a long time,” Hoskinson said. “And it feels right. This time really does.”

The heart of the pitch was that Midnight’s early traction is not just a hype spike, but a sign the market is tired of the usual crypto incentive loop and looking for a new “paradigm.” “People deep down inside, they know that a new generation is starting,” he said. “We need a new paradigm and we have to have a reset and we have to launch things and do things differently. And they’re just tired of the way things have happened before. They’re tired of it.”

Hoskinson spent time distinguishing Midnight from the category it will inevitably be filed under. “When you looked at Midnight, Midnight is not a privacy coin,” he said. “Midnight is what will enable rational privacy and selective disclosure, but it’s so much more. It’s the platform for intents. It’s the platform for hybrid applications. It’s the platform for capacity exchange, for dual tokenomics. It’s the platform for multi-resource consensus.”

He acknowledged the underlying toolkit—“snarks,” “roll-ups,” “recursion and folding”—but argued those buzzwords miss the point. “It’s never been about roll-ups, recursion, folding, snarks from a scalability perspective,” he said. “It’s about real world applications.” The claim, in his telling, is that Midnight is one of the few projects positioned to handle “trillions of dollars worth of transactions,” precisely because it targets applications where selective disclosure and privacy are features, not trade-offs.

To make the case that Midnight is already outperforming comparable narratives, Hoskinson cited market-cap and volume figures for other ZK and privacy-adjacent projects and contrasted them with Midnight’s reported activity. He cited Starkware at $410 million market cap with $72 million volume, zkSync at $279 million market cap with $29 million volume, and Mina at $97 million market cap—before highlighting his own project: “Midnight, $1 billion market cap, $1.8 billion trading. It doesn’t even have Binance Spot yet.”

A major reason he believes the market has leaned in, Hoskinson argued, is launch structure—specifically, avoiding the standard fear that insiders will overwhelm liquidity. “And they said, well, can I believe in it? Is there an ICO? Is there an insider? Who the f*** is going to dump on me?” he said. “They just gave it away. Eight different ecosystems, seven chains. All the VCs wanted in, they got nothing. They didn’t get in. We gave it to the people.”

He later tied distribution directly to observed trading intensity. “We have about 1.5 million people that got night tokens,” he said. “That’s why the volume is so f***ing high.”

Midnight Is The ‘ChatGPT For Privacy’

For Cardano itself, Hoskinson’s most pointed strategic claim was that “better, faster, cheaper” is not a durable wedge—even if upcoming upgrades land. “Let’s say Leios ships and Hydra ships and we’re better, faster, and cheaper. Great,” he said. “What reason does someone have to leave Solana? And what reason does someone have to leave Ethereum? Because the transaction fee is 3% less. Okay.”

Instead, he argued Cardano can win by being first to build hybrid applications that route through Midnight and unlock privacy-first financial primitives. “They could go through midnight to Cardano and they get privacy,” he said. “They do something new and different […] private prediction markets, private DEXs, private stablecoins.”

He extended that thinking to Bitcoin-adjacent flows: “Maybe just maybe all those Bitcoin people are going to want to trade on a private DEX instead of a public DEX,” he said. “And maybe we’ll have volumes in the billions of dollars of turnaround every single day.”

Hoskinson repeatedly returned to a simplifying metaphor: Midnight as an abstraction layer that makes heavy cryptography usable. “Everybody else gets jealous. So they’ll go use Midnight too because it’s the ChatGPT of privacy,” he said. “Just send stuff and stuff comes out.” He later described a product-like cadence of improvement: “You basically just have this API. You send something in, you get something back. And every six months it gets better.”

He also framed 2026 as an execution year, sketching an outward-facing expansion plan where Midnight is integrated across major ecosystems in tight succession: “We’re going to do Cardano Midnight. Show them how it’s done. Then we’re gonna do Midnight Ethereum. Two months later, three months later, Midnight Solana… Midnight Avalanche… Midnight Bitcoin.”

The broader ambition, he said, is to move crypto past siloed tribal finance toward one interoperable market. “This is the last generation,” Hoskinson said. “It’s gonna unify the marketplaces and it’s gonna get rid of DeFi and TradFi. And there’s just going to be Fi.”

At press time, Cardano traded at $0.36.

➤➤ Conservative: $0.47 e-8

➤➤ Primary: $0.00014

➤➤ Conservative: $0.47 e-8

➤➤ Primary: $0.00014  ➤➤ Blow-Off: $0.00035

➤➤ Blow-Off: $0.00035

(@david_eng_mba)

(@david_eng_mba)

$SHIB 0X95,” referencing a superficial similarity between contract/address prefixes highlighted by the Hachiko account: “Only $HACHI contract created on November 2nd: … Starting X95 … $SHIB starts 0x95.”

$SHIB 0X95,” referencing a superficial similarity between contract/address prefixes highlighted by the Hachiko account: “Only $HACHI contract created on November 2nd: … Starting X95 … $SHIB starts 0x95.”

(@DocumentingBTC)

(@DocumentingBTC)

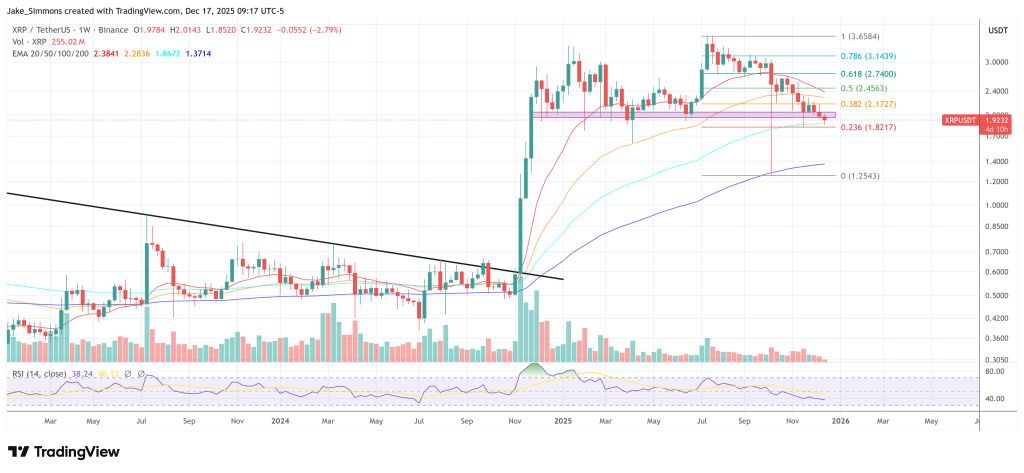

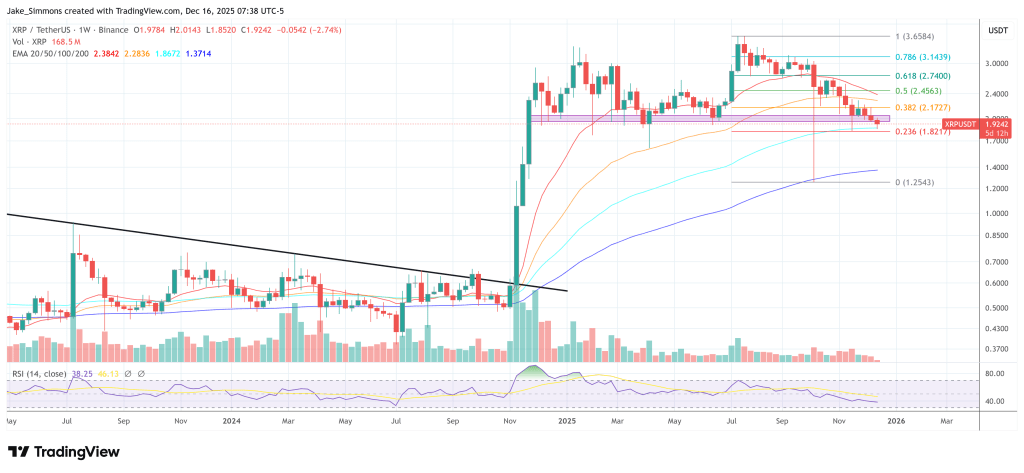

”. The chart highlights that, in the past five cases, similarly low readings in XRP’s weekly RSI have tended to occur around market bottoming zones.

”. The chart highlights that, in the past five cases, similarly low readings in XRP’s weekly RSI have tended to occur around market bottoming zones.