US Senate Confirms Crypto-Friendly Lawyer Mike Selig As New CFTC Chair

The US Senate voted to confirm Mike Selig as chairman of the Commodity Futures Trading Commission in a package of nominations that passed 53–43.

Based on reports, the vote took place on December 18, 2025, and the crypto-friendly lawyer Selig is set to take over leadership of the agency as it prepares to play a larger role in digital asset oversight.

Official Choice And What It Means

According to coverage from legal and industry outlets, Selig’s new term will run through April 2029, giving him multi-year authority to shape policy at the CFTC.

Selig arrives at the agency after serving as chief counsel to the SEC’s crypto task force and following earlier experience at the CFTC, which sources say includes time as a law clerk.

Congratulations to @MichaelSelig and Travis Hill. The @CFTC and @FDICgov are in great hands. America’s future just got a little brighter. https://t.co/oUGpr40Rnw

— Kyle Hauptman (@kylehauptman) December 19, 2025

A Shift In Regulatory Tone

Reports have disclosed that the confirmation was part of a broader set of approvals that also elevated Travis Hill to lead the FDIC.

The nominations were advanced under US President Donald Trump administration’s picks and were bundled with many other candidates in the same roll call.

Industry groups responded quickly, with crypto firms noting the move could bring clearer rules for markets that many say need more regulatory certainty.

Mike Selig will initially be the sole commissioner at the normally five-member commission after a string of departures left the agency short-staffed, a fact that lawmakers flagged during hearings as a risk for any new rulemaking push.

Some analysts say the staffing gap could slow action, while others expect expedited hiring and appointments to follow.

Based on reports from major outlets, Acting Chair Caroline Pham plans to leave the CFTC to join crypto payments firm MoonPay once Selig is sworn in.

That transition marks another sign of closer ties forming between regulators and private crypto firms, a trend that has drawn attention on Capitol Hill.

Meanwhile, Travis Hill has been confirmed as chairman of the Federal Deposit Insurance Corporation. He has been serving as the agency’s acting chair and has signaled a supportive approach toward crypto.

Lawmakers and industry watchers will pay attention to how Selig and Hill handle rulemaking for tokenized products and spot market oversight — areas where Congress has discussed granting clearer authority to the CFTC.

Selig will also face questions about enforcement priorities and the agency’s capacity to supervise a market that some estimates place in the trillions of dollars of tradable value.

Featured image from Unsplash, chart from TradingView

Among top cap assets, here are the amount of non-empty wallets on each network currently:

Among top cap assets, here are the amount of non-empty wallets on each network currently: Ethereum

Ethereum

The Ministry of Justice has just revealed that Taiwan now holds 210.45 Bitcoin in seized assets.

The Ministry of Justice has just revealed that Taiwan now holds 210.45 Bitcoin in seized assets.

: Silver soars to $66 for the first time in history

: Silver soars to $66 for the first time in history

Bitcoin maturing fast!

Bitcoin maturing fast!

The Fed broke the law by citing this very guidance in the Custodia denial, even tho…

The Fed broke the law by citing this very guidance in the Custodia denial, even tho…

(@CaitlinLong_)

(@CaitlinLong_)

Reaction And Next Steps

Reaction And Next Steps

Regulators Move To Tighten Rules

Regulators Move To Tighten Rules

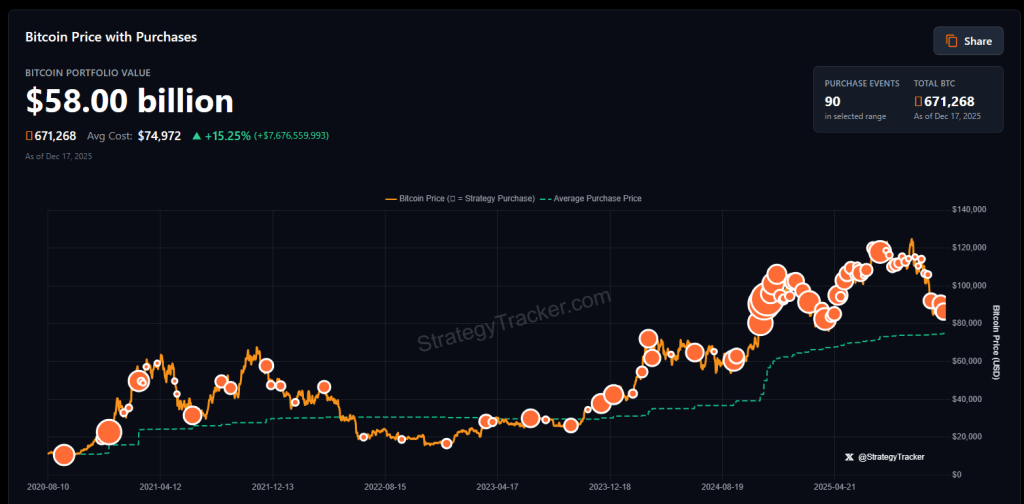

Market Impact And Buying Method

Market Impact And Buying Method

(@lightning)

(@lightning)