Senate Confirms Pro-Crypto Mike Selig as CFTC Chair — What To Expect

The U.S. Senate has confirmed crypto-friendly lawyer Mike Selig as the next chair of the Commodity Futures Trading Commission (CFTC), ending a prolonged period of leadership uncertainty at one of the country’s most important financial regulators.

The confirmation passed Thursday as part of a mass approval of federal nominees, with senators voting 53–43 under the provisions of Senate Resolution 532.

Confirmed, 53-43: Confirmation of the en bloc nominations provided for under the provisions of S.Res.532.

— Senate Cloakroom (@SenateCloakroom) December 19, 2025

Selig’s confirmation comes as President Donald Trump’s second administration moves to fill some of the most consequential regulatory vacancies affecting the digital asset sector.

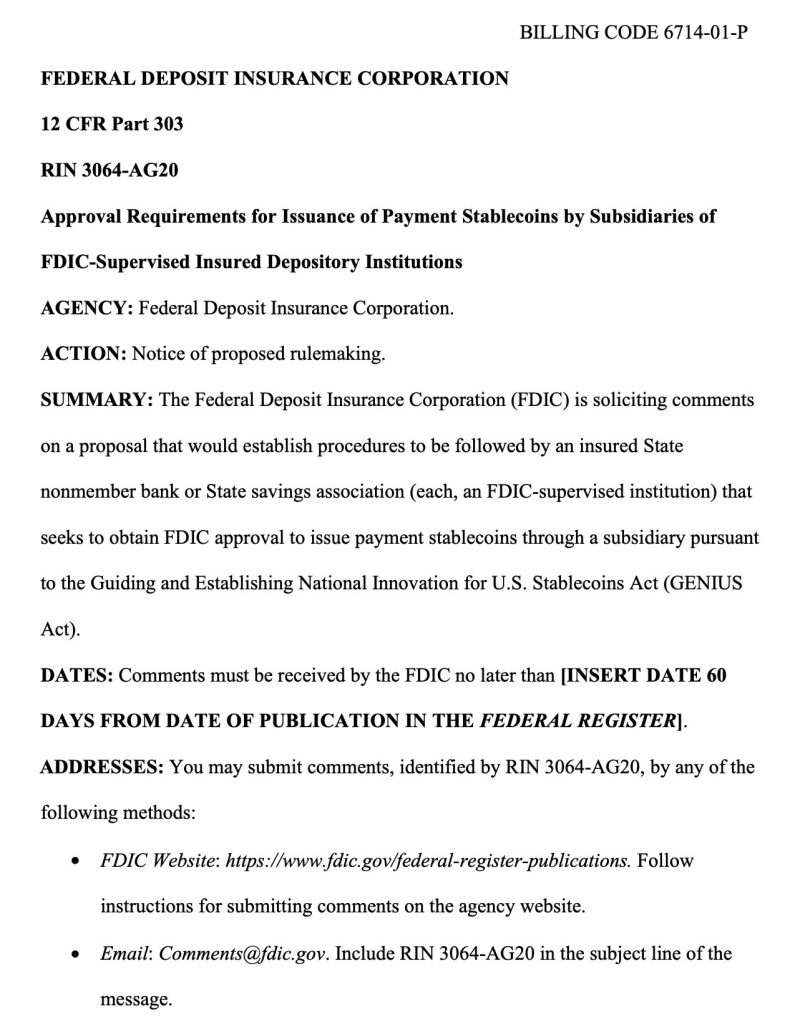

Alongside Selig, the Senate also elevated Travis Hill to chair the Federal Deposit Insurance Corporation (FDIC), placing permanent leadership at two agencies that play central roles in how crypto markets operate and how crypto companies interact with the banking system.

Power Without a Mandate: The CFTC’s Quiet Struggle Over Crypto Oversight

At the CFTC, the absence of a Senate-confirmed chair had become a growing operational problem. The agency, which is structured as a five-member independent commission, has been operating for months with just a single commissioner.

Acting Chair Caroline Pham remained the only seated member after a wave of resignations earlier in the year, a situation that concentrated authority while also limiting deliberation and long-term planning.

— Cryptonews.com (@cryptonews) January 7, 2025

The chair of the U.S. Commodity Futures Trading Commission (CFTC), Rostin Behnam, has announced his resignation, effective January 20, according to a Financial Times report.#CFTC #CryptoRegulations https://t.co/1AY9hfcCKv

Although an acting chair can legally carry out agency functions, the lack of a permanent leader and full commission constrained the CFTC’s ability to build staff, coordinate with other regulators, and advance major new rulemakings.

That leadership gap mattered most for crypto policy. While Congress continues to debate legislation that would expand the agency’s mandate, the absence of a confirmed chair made it harder for the CFTC to set a clear regulatory direction or prepare for an expanded role.

— Cryptonews.com (@cryptonews) November 11, 2025

Senate introduces new Crypto Market Structure Bill draft to expand @CFTC authority over digital commodities like $BTC and $ETH.

#ClarityAct #CFTChttps://t.co/qKO9rR7aYs

Previous nominees, including Brian Quintenz, were withdrawn amid political friction, extending the period of uncertainty.

During this interim phase, Pham focused on internal reforms rather than sweeping regulatory changes.

Her tenure emphasized clearing compliance backlogs, streamlining enforcement processes, and launching limited pilot initiatives tied to digital assets.

Pham led a “back-to-basics” approach, resolving internal backlogs and launching early digital asset initiatives, but the lack of a permanent, Senate-confirmed chair made it harder to advance complex rulemakings or coordinate closely with other regulators such as the Securities and Exchange Commission.

The agency also began what it called a “crypto sprint,” a set of targeted efforts that included updating regulatory language to reflect blockchain-based markets and formally approved spot crypto trading.

Selig’s Term Begins as CFTC Prepares for a Larger Role in Crypto Markets

Selig now takes on the role with a full and permanent mandate. He is a former CFTC official and most recently served as chief counsel to the SEC’s Crypto Task Force. He was nominated in October, replacing the administration’s earlier choice for the position.

— Cryptonews.com (@cryptonews) October 25, 2025

US President @realDonaldTrump is preparing to nominate @MikeSeligEsq as the next chair of the @CFTC#Trump #Cryptohttps://t.co/UUjnN7ENyC

His term as chair will run through April 2029. During his confirmation process, Selig said crypto would be a priority and also pointed to ongoing challenges at the agency, including limited staffing, tight resources, and governance concerns.

The CFTC currently employs about 543 full-time staff, far fewer than the SEC’s roughly 4,200 employees, even as lawmakers in both chambers consider bills that would give the CFTC primary oversight of crypto spot markets.

Once sworn in, Selig, the current acting chair, Pham, will depart to join crypto payments firm MoonPay as chief legal and administrative officer.

— Cryptonews.com (@cryptonews) December 18, 2025

The US CFTC Chair Caroline Pham will join crypto payments firm MoonPay, following the Senate's confirmation of her successor, Mike Selig.#CFTC #CarolinePham #MoonPayhttps://t.co/Bu3z0uGLvI

While operating with a single commissioner may allow faster internal decision-making, it also raises questions about legal durability and bipartisan balance.

Several senators have already stated that confirming additional commissioners will be a key issue in 2026.

The post Senate Confirms Pro-Crypto Mike Selig as CFTC Chair — What To Expect appeared first on Cryptonews.

U.S. lawmakers target August 2026 for a comprehensive crypto tax bill to clarify reporting, staking, and small-transaction rules.

U.S. lawmakers target August 2026 for a comprehensive crypto tax bill to clarify reporting, staking, and small-transaction rules.

Pumpfun (@pumpdotfun) faces $5.5 billion class action lawsuit alleging unlicensed casino operations while generating $722 million revenue from retail trader losses.

Pumpfun (@pumpdotfun) faces $5.5 billion class action lawsuit alleging unlicensed casino operations while generating $722 million revenue from retail trader losses. MEV bot spam is now the main barrier to blockchain scalability, consuming most new throughput on Ethereum rollups and Solana.

MEV bot spam is now the main barrier to blockchain scalability, consuming most new throughput on Ethereum rollups and Solana.

BREAKING: Trump pardons Binance founder CZ following lobbying efforts, according to WSJ sources familiar with the matter.

BREAKING: Trump pardons Binance founder CZ following lobbying efforts, according to WSJ sources familiar with the matter.

(@KaitoAI)

(@KaitoAI)

(@shaams)

(@shaams)

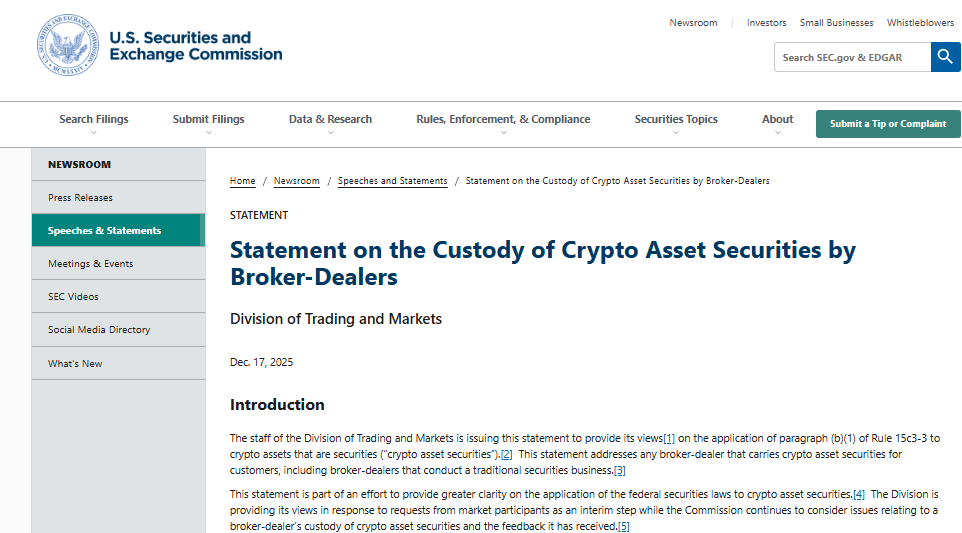

The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.  Dubai’s real estate market is witnessing a surge in new investors thanks to its new tokenization initiative.

Dubai’s real estate market is witnessing a surge in new investors thanks to its new tokenization initiative.

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

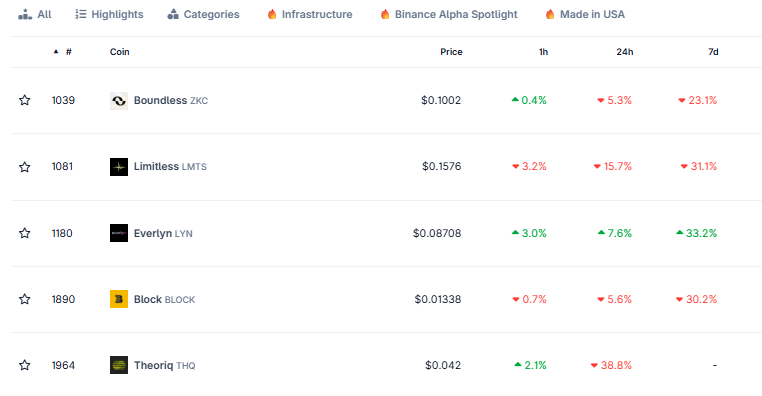

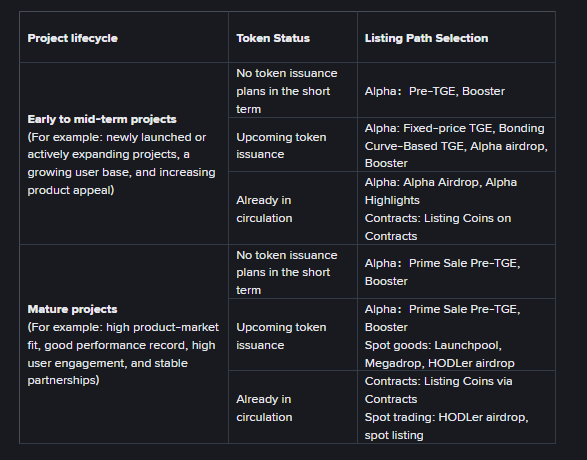

CZ criticized Binance’s listing process, calling it a “bit broken.”

CZ criticized Binance’s listing process, calling it a “bit broken.” CZ doesn't deserve a presidential pardon — and anger from Binance users following last week's crash proves it

CZ doesn't deserve a presidential pardon — and anger from Binance users following last week's crash proves it

The

The

Strategy’s spot

Strategy’s spot