Bitcoin Price Prediction: Can the BTC Price Push Above $90,000 With the Latest BoJ Rate Hikes?

Bitcoin remains under pressure as global markets digest a further shift away from ultra-loose monetary policy in Japan. At its December meeting, the Bank of Japan raised its short-term policy rate to around 0.75% from 0.5%, citing growing confidence that inflation will remain near its 2% target, according to official statements.

The decision reflects stronger wage growth and persistent price pressures. Japan’s headline inflation stays around 2.9% in November, whereas, core inflation held above target for a 44th straight month, based on reported government data. Policymakers emphasised that real rates remain deeply negative, signaling any further tightening will be gradual and data-dependent.

Markets Absorb the Move With Little Shock

In response to the news, Japanese government bond yields surged higher, with long-dated yields hovering near recent highs. Whereas, the Japanese yen weakened modestly, suggesting the interest rate hike was largely priced in. Broader risk assets remained cautious rather than reactive.

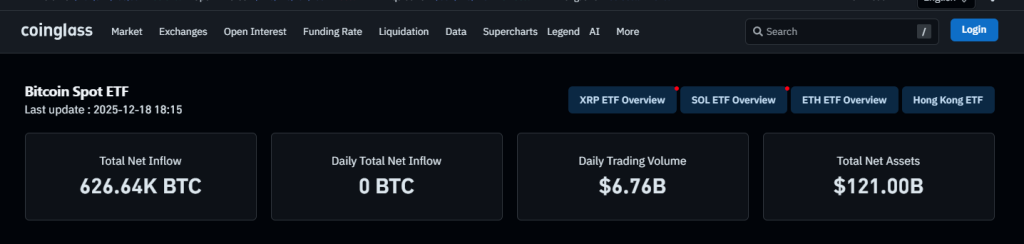

Crypto markets, however, stayed under pressure. Bitcoin has slipped around 7% in the last seven days, while Ethereum has fallen by more than 10%, according to market data, reflecting weak risk appetite rather than Japan-specific flows.

Why Japan Still Matters for Bitcoin

For Bitcoin, the relevance lies less in the immediate response and more in the global liquidity backdrop. Japan has long functioned as a key funding market, and higher yields could gradually tighten global financial conditions. Investors are now watching whether continued BoJ normalization feeds into risk assets over time.

Against this backdrop, Bitcoin’s ability to reclaim higher levels will depend on technical confirmation, as traders balance tightening signals against longer-term adoption and structural demand trends.

Bitcoin Technical Analysis: Signs of a Developing Base

Recent candles show selling pressure fading. Long lower wicks followed by small bodies suggest dip buying rather than forced liquidation. Momentum supports that view, with RSI recovering toward 52 after leaving oversold territory, pointing to stabilization rather than continuation lower.

Price action now resembles base formation, not a reversal. On TradingView’s path projection, the preferred scenario is a slow push back toward the channel midline if Bitcoin reclaims the $88,200–$89,200 pivot zone.

Key Levels That Define the Next Move

A sustained move above the pivot would open upside toward $92,000, then $94,200, the prior range high. Failure to hold $84,500 shifts focus to $80,600, where the ascending channel base sits.

From a trading perspective, structure favors patience. Acceptance above $89,200 offers upside setups toward the low-$90,000s, while risk remains defined below recent lows. For now, the correction looks like consolidation, not breakdown.

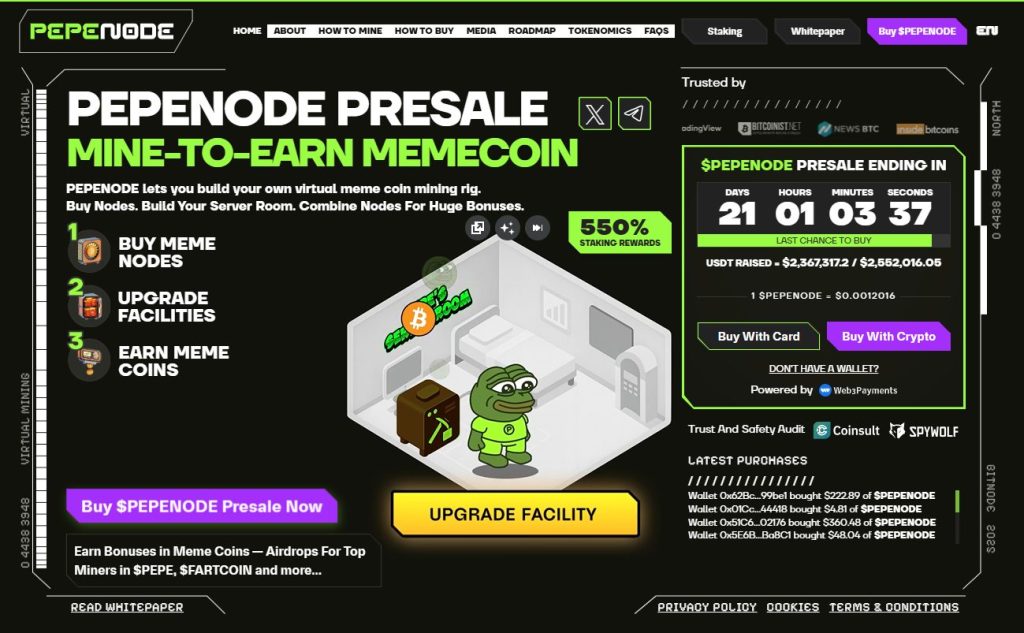

PEPENODE: A Mine-to-Earn Meme Coin Nearing Presale Close

PEPENODE is gaining momentum as a next-generation meme coin that blends viral culture with interactive gameplay. With over $2.36 mn raised and the presale approaching its cap, interest is building fast as the countdown enters its final stretch.

What makes PEPENODE stand out is its mine-to-earn virtual ecosystem. Instead of passive holding, users can build digital server rooms using Miner Nodes and facilities, earning simulated rewards through a visual dashboard. The concept brings gamification and competition into the meme coin space, giving holders something to do before launch.

The project also offers presale staking, allowing early participants to earn boosted rewards ahead of the token generation event. Leaderboards and bonus incentives are planned post-launch to keep engagement high.

With 1 $PEPENODE priced at $0.0012016 and limited allocation remaining, the presale is entering its final opportunity window for early buyers.

Click Here to Participate in the PresaleThe post Bitcoin Price Prediction: Can the BTC Price Push Above $90,000 With the Latest BoJ Rate Hikes? appeared first on Cryptonews.

Sky 501, Virgin 602, Freeview 233 and YouTube

Sky 501, Virgin 602, Freeview 233 and YouTube