Whistleblower Drops 5,000+ Secret Chats in Pump.fun MEV Scandal — Lawsuit Intensifies

A U.S. federal judge has allowed new evidence to be added to a sprawling class-action lawsuit tied to Solana-based memecoin platform Pump.fun.

This happened after a whistleblower resurfaced with nearly 5,000 internal chat messages that plaintiffs say shed new light on alleged insider trading and transaction manipulation.

Pumpdotfun & Solana lawsuit update:

— Burwick Law (@BurwickLaw) December 15, 2025

Leave to amend (file new complaint) GRANTED

“What appeared to be a fair, automated marketplace was, Plaintiffs say, structurally tilted to extract value from ordinary users while rewarding those with privileged access to Solana's… pic.twitter.com/mctvXdWScM

In a December 9, 2025 order filed in the U.S. District Court for the Southern District of New York, Judge Colleen McMahon granted plaintiffs permission to amend and refile their complaint against Pump.fun, MEV infrastructure firm Jito Labs, the Solana Foundation, Solana Labs, and related executives.

Retail Losses, Insider Priority Alleged in Pump.fun MEV Lawsuit

The decision clears the way for the case to proceed with expanded factual allegations centered on maximal extractable value, or MEV.

This controversial practice allows validators or sophisticated traders to profit by reordering transactions within a blockchain block.

The lawsuit was brought by Diego Aguilar, Kendall Carnahan, and lead plaintiff Michael Okafor on behalf of investors who purchased tokens launched on Pump.fun between March 1, 2024 and July 23, 2025 and later incurred losses.

— Cryptonews.com (@cryptonews) July 24, 2025

Pumpfun (@pumpdotfun) faces $5.5 billion class action lawsuit alleging unlicensed casino operations while generating $722 million revenue from retail trader losses.#Pumpfun #Lawsuithttps://t.co/yiKwU8HSEE

Plaintiffs allege the defendants operated what they describe as a coordinated “Pump Enterprise” that secretly gave insiders priority access to newly launched tokens while marketing those launches to the public as fair and resistant to rug pulls.

According to the complaint, Solana Labs’ validator infrastructure allegedly enabled transaction ordering control, while tools developed by Jito Labs allowed certain participants to pay for priority execution.

Pump.fun is accused of acting as the public-facing venue that launched the tokens, collected fees on every trade, and promoted a fair-launch narrative despite allegedly knowing insiders had structural advantages.

Plaintiffs say insiders bought tokens at low prices before public trading, triggering rapid price increases through automated bonding curves and leaving retail buyers to absorb losses once insiders exited.

Judge McMahon said the new evidence, supplied by a confidential informant who reappeared in September 2025, was not previously available and that plaintiffs acted diligently in seeking to amend their filing.

She rejected, however, a request to submit additional material under seal and outside the defendants’ view, citing fairness and transparency concerns.

Under the court’s schedule, plaintiffs must file their second amended complaint by December 19, with motions to dismiss due by January 23, 2026.

After Ethereum, Now Solana: MEV Faces Growing Legal Reckoning

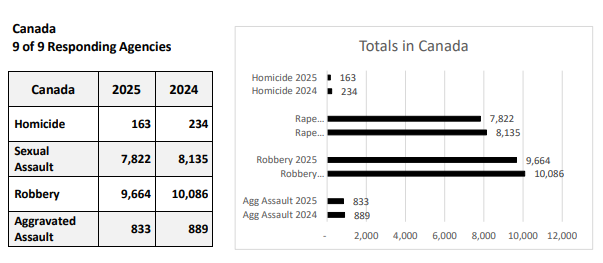

The case builds on earlier litigation filed in July accusing Pump.fun of operating an illegal “meme coin casino” that allegedly generated more than $722 million in revenue while inflicting between $4 billion and $5.5 billion in losses on retail traders.

— Cryptonews.com (@cryptonews) June 17, 2025

https://t.co/BB5leCKHRh faces criticism after extracting $741 million in fees while being accused of facilitating harmful livestream content as X suspends platform accounts amid $1 billion fundraising plans.https://t.co/pDiCRn80Wz

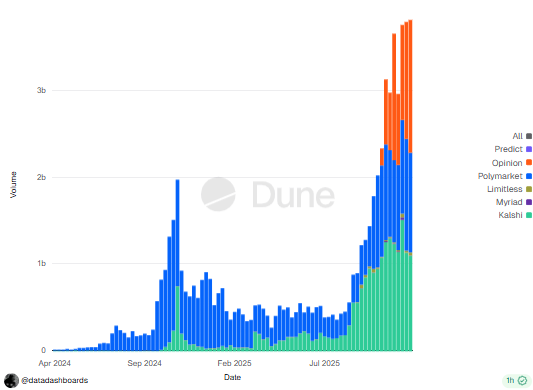

Court filings claim the platform processes tens of billions of dollars in cumulative trading volume and launches tens of thousands of tokens daily, while the vast majority of user addresses fail to realize meaningful profits.

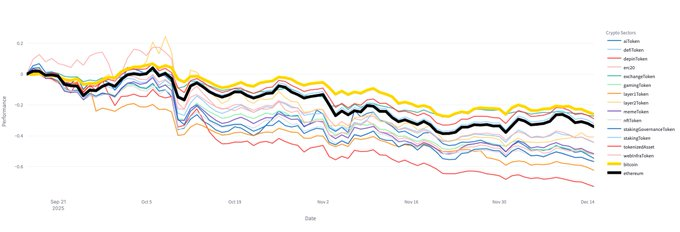

At the center of the dispute is MEV, a practice that has become increasingly prevalent across major blockchains.

MEV involves extracting profit by influencing the order in which transactions are processed, often through front-running or sandwich attacks.

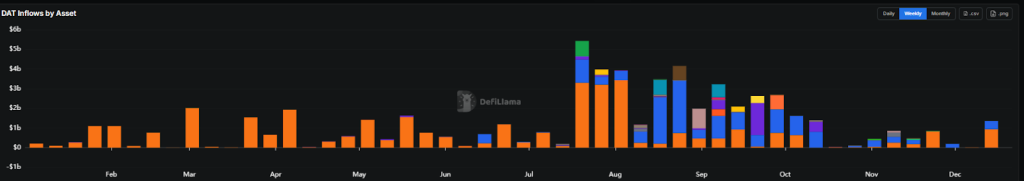

Research cited in recent court filings and industry reports shows MEV bots now consume a substantial share of blockspace on Solana and Ethereum-based networks, contributing to higher fees and uneven execution outcomes for ordinary users.

— Cryptonews.com (@cryptonews) June 17, 2025

MEV bot spam is now the main barrier to blockchain scalability, consuming most new throughput on Ethereum rollups and Solana.#MEV #BlockchainScalabilityhttps://t.co/kNRiwwORsU

The legal scrutiny around MEV has intensified following criminal cases tied to similar tactics.

In one closely watched matter, two MIT-educated brothers, Anton and James Peraire-Bueno, were charged with wire fraud and money laundering after allegedly exploiting Ethereum’s validator layer to extract $25 million in seconds.

Although a jury later failed to reach a verdict, prompting a mistrial, the case marked the first criminal prosecution centered on MEV manipulation and shows the difficulty courts face when applying traditional fraud statutes to blockchain mechanics.

The post Whistleblower Drops 5,000+ Secret Chats in Pump.fun MEV Scandal — Lawsuit Intensifies appeared first on Cryptonews.

BREAKING: Trump pardons Binance founder CZ following lobbying efforts, according to WSJ sources familiar with the matter.

BREAKING: Trump pardons Binance founder CZ following lobbying efforts, according to WSJ sources familiar with the matter. Sen. Moreno warns U.S. lawmakers: “No deal is better than a bad deal.” U.S. crypto legislation may be delayed

Sen. Moreno warns U.S. lawmakers: “No deal is better than a bad deal.” U.S. crypto legislation may be delayed

The OCC has conditionally approved five crypto firms, including

The OCC has conditionally approved five crypto firms, including

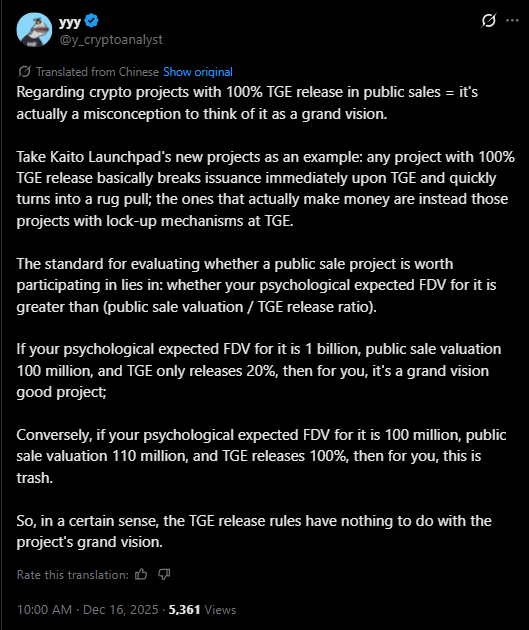

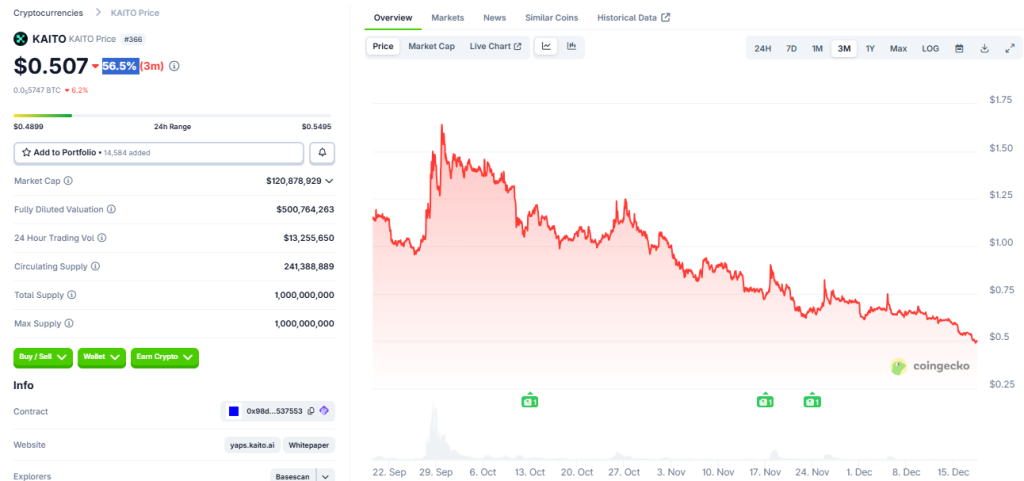

(@KaitoAI)

(@KaitoAI)

(@shaams)

(@shaams)

The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.  Dubai’s real estate market is witnessing a surge in new investors thanks to its new tokenization initiative.

Dubai’s real estate market is witnessing a surge in new investors thanks to its new tokenization initiative.

The

The

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

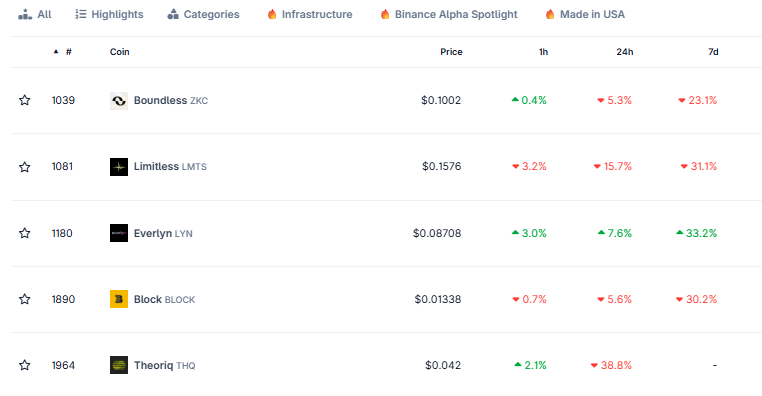

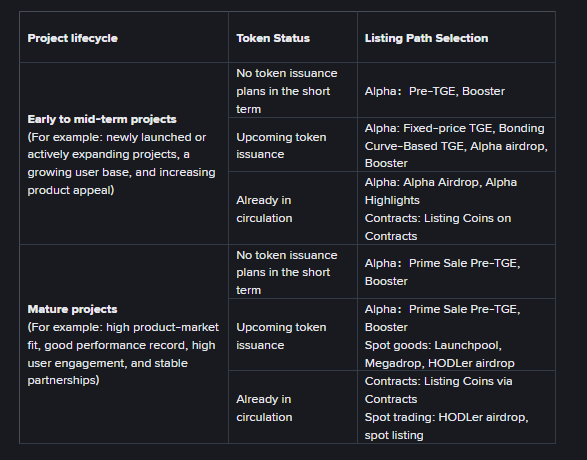

CZ criticized Binance’s listing process, calling it a “bit broken.”

CZ criticized Binance’s listing process, calling it a “bit broken.” CZ doesn't deserve a presidential pardon — and anger from Binance users following last week's crash proves it

CZ doesn't deserve a presidential pardon — and anger from Binance users following last week's crash proves it

The

The

Strategy’s spot

Strategy’s spot

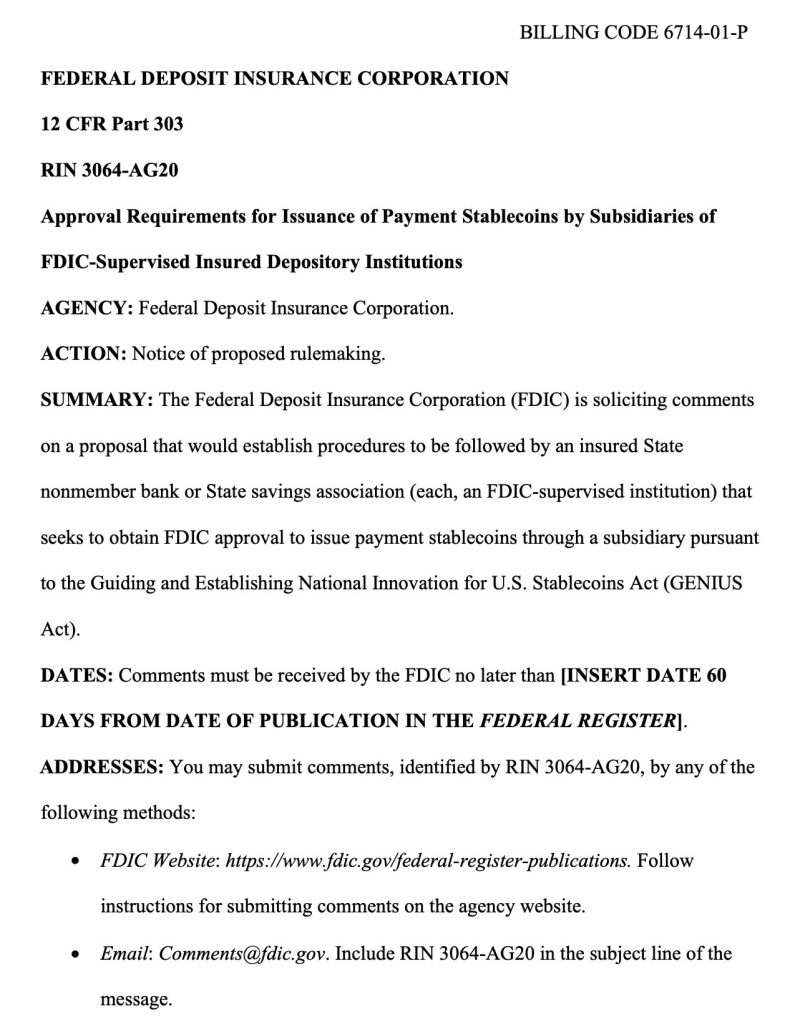

South Korea pushes for draft stablecoin bill by Dec. 10 deadline as lawmakers threaten independent action if FSC misses target.

South Korea pushes for draft stablecoin bill by Dec. 10 deadline as lawmakers threaten independent action if FSC misses target.

Credit card giant

Credit card giant