NYSE Owner ICE in Talks to Invest in MoonPay at Nearly $5 Billion Valuation

Intercontinental Exchange (ICE), the company behind the New York Stock Exchange (NYSE), is negotiating an investment in crypto payments firm MoonPay as part of a funding round that could value the company at approximately $5 billion, according to a recent Bloomberg report.

The potential valuation marks a 47% increase from MoonPay’s previous $3.4 billion valuation, which comes just a month after the company secured approval from the New York Department of Financial Services to position it alongside Coinbase and PayPal.

Intercontinental Exchange, owner of the New York Stock Exchange, is in talks to invest in crypto payments firm MoonPay as part of a funding round, people familiar with the matter said https://t.co/vpWqgfO5bF

— Bloomberg (@business) December 18, 2025

ICE Expands Digital Asset Portfolio with Strategic Bets

ICE’s potential investment reflects an aggressive expansion into emerging financial technologies.

The exchange operator already manages Bakkt, its proprietary crypto platform, and recently deployed $2 billion into Polymarket, the prediction market platform that gained prominence during the 2024 election cycle.

Beyond direct investments, ICE forged a technical partnership with Chainlink in August to deliver foreign exchange and precious metals rates onchain through Chainlink Data Streams.

The integration leverages ICE’s Consolidated Feed, which aggregates real-time pricing data from over 300 exchanges and marketplaces worldwide, contributing to Chainlink’s derived FX and metals datasets used across decentralized finance protocols.

The latest NYSE-backed investment talks emerge as MoonPay transitions from a simple cryptocurrency on-ramp provider into a full-service digital asset custodian capable of holding client assets and executing institutional-level trades.

The Limited Purpose Trust Charter complements MoonPay’s existing BitLicense, allowing the company to expand custody and other crypto services throughout New York.

This regulatory milestone places MoonPay in direct competition with established players operating under New York’s strict digital asset licensing requirements, which include comprehensive anti-money laundering protocols and consumer protection standards.

Moonpay High-Profile Leadership Hire Signals Regulatory Focus

MoonPay announced Wednesday that Caroline Pham, the acting chairman of the Commodity Futures Trading Commission (CFTC), will join as chief legal officer following her departure from the agency.

Pham will depart once the Senate confirms Mike Selig, Trump’s choice to chair the CFTC permanently.

She showed her readiness for the handover on X, writing: “I’m looking forward to a successful confirmation of Mike Selig as the CFTC’s next chairman and a smooth transition once he is sworn in. The future is bright. Onward and upward.”

— Cryptonews.com (@cryptonews) December 18, 2025

The US CFTC Chair Caroline Pham will join crypto payments firm MoonPay, following the Senate's confirmation of her successor, Mike Selig.#CFTC #CarolinePham #MoonPayhttps://t.co/Bu3z0uGLvI

Her background spans both Wall Street and Washington.

She previously led market structure for strategic initiatives as a Managing Director at Citigroup. She used her CFTC role to push forward innovation policies that supported President Trump’s pro-crypto objectives.

The leadership addition arrives as MoonPay expands its product offerings.

The same day, digital asset platform Exodus partnered with MoonPay to launch a US dollar-backed stablecoin aimed at mainstream adoption.

According to JP Richardson, co-founder and CEO of Exodus, “Stablecoins are quickly becoming the simplest way for people to hold and move dollars onchain, but the experience still needs to meet the expectations set by today’s consumer apps.”

Building a Regulated Footprint

MoonPay has steadily expanded its regulatory credentials throughout the year.

The company secured a Money Transmitter License from Wisconsin’s Department of Financial Institutions in March, strengthening its nationwide compliance framework.

Ivan Soto-Wright, MoonPay’s co-founder and CEO, emphasized the strategic importance of regulatory credentials at the time.

gotta catch 'em all!

— MoonPay

the Wisconsin Department of Financial Institutions has granted MoonPay a Money Transmitter License

for Wisconsin residents, your experience buying crypto just got even better ~ especially when you use MoonPay Balance pic.twitter.com/40hAspQkwr(@moonpay) March 14, 2025

“Earning our Wisconsin MTL strengthens our position in the market as a fully-regulated platform, and further solidifies our commitment to iron-clad compliance,” he said.

The company has simultaneously pursued partnerships that extend its infrastructure beyond traditional crypto trading.

In late October, Rumble announced an exclusive collaboration with MoonPay to launch Rumble Wallet, enabling content creators to manage earnings outside conventional banking systems and execute trades in Bitcoin and other digital assets directly through the video platform.

The post NYSE Owner ICE in Talks to Invest in MoonPay at Nearly $5 Billion Valuation appeared first on Cryptonews.

US crypto exchange Coinbase is letting users to trade stocks on its platform and place bets on a wide range of events through a partnership with Kalshi.

US crypto exchange Coinbase is letting users to trade stocks on its platform and place bets on a wide range of events through a partnership with Kalshi.

NEW: Big news from the

NEW: Big news from the  Custodia Bank petitions full appeals court to review Federal Reserve's master account denial, citing constitutional concerns and federal law violations.

Custodia Bank petitions full appeals court to review Federal Reserve's master account denial, citing constitutional concerns and federal law violations. The OCC has conditionally approved five crypto firms, including

The OCC has conditionally approved five crypto firms, including  Coinbase returns to India after two-year absence, with plans to introduce rupee deposits and fiat trading by 2026.

Coinbase returns to India after two-year absence, with plans to introduce rupee deposits and fiat trading by 2026.

PearPass — the password manager that keeps your data on your devices.

PearPass — the password manager that keeps your data on your devices. (@paoloardoino)

(@paoloardoino)  Dorsey's Bitchat explodes in Madagascar as protesters adopt censorship-resistant messaging during violent protests over infrastructure failures.

Dorsey's Bitchat explodes in Madagascar as protesters adopt censorship-resistant messaging during violent protests over infrastructure failures.

HashKey’s Hong Kong debut briefly jumped 6% before slipping below its IPO price, as a $206M listing met cautious sentiment in a volatile crypto market.

HashKey’s Hong Kong debut briefly jumped 6% before slipping below its IPO price, as a $206M listing met cautious sentiment in a volatile crypto market.

Bhutan has migrated its self-sovereign identity system to Ethereum, enabling 800K citizens to verify their identity on a public blockchain.

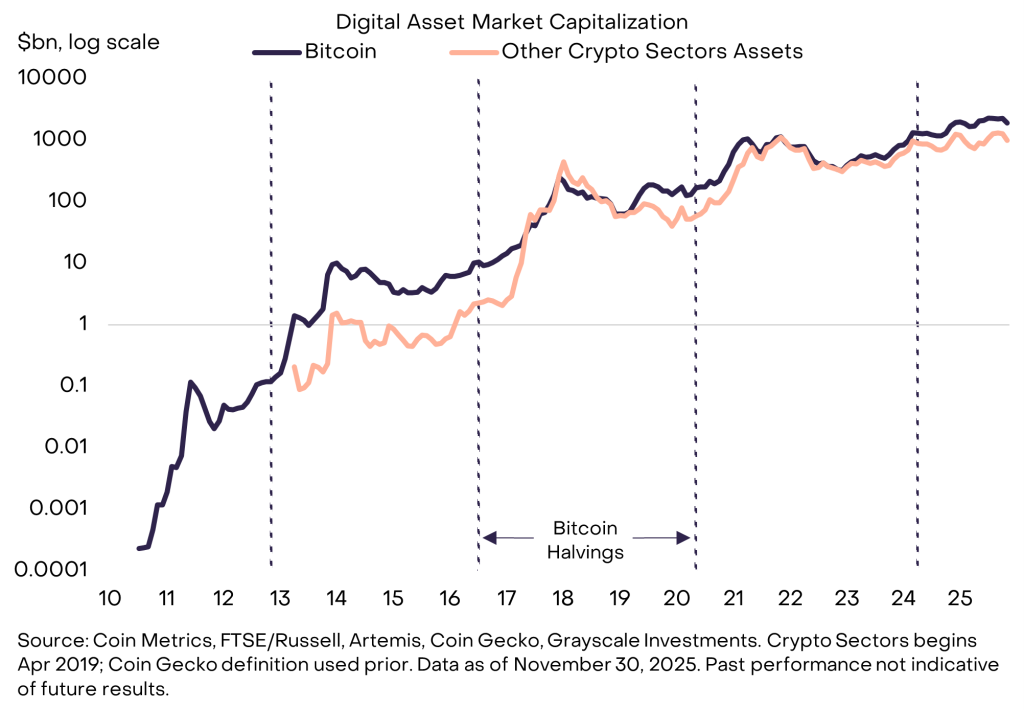

Bhutan has migrated its self-sovereign identity system to Ethereum, enabling 800K citizens to verify their identity on a public blockchain. Bitwise and Grayscale predict Bitcoin will break its four-year cycle and reach new all-time highs in 2026 driven by institutional capital and regulatory clarity.

Bitwise and Grayscale predict Bitcoin will break its four-year cycle and reach new all-time highs in 2026 driven by institutional capital and regulatory clarity.

Sam Bankman-Fried (SBF) is pushing for a new trial this week following his 2023 conviction tied to his time at FTX.

Sam Bankman-Fried (SBF) is pushing for a new trial this week following his 2023 conviction tied to his time at FTX.

The UK Treasury said that it will implement “firm and proportionate” rules for crypto regulation overseen by the UK FCA.

The UK Treasury said that it will implement “firm and proportionate” rules for crypto regulation overseen by the UK FCA. The UK has formally recognized cryptocurrencies and stablecoins as legal property through a new Act of Parliament.

The UK has formally recognized cryptocurrencies and stablecoins as legal property through a new Act of Parliament.

A federal appeals court in Denver has upheld the Federal Reserve’s right to deny crypto-focused bank

A federal appeals court in Denver has upheld the Federal Reserve’s right to deny crypto-focused bank

During the last 3 BOJ rate hikes, BTC drops 20%+…

During the last 3 BOJ rate hikes, BTC drops 20%+…