Bhutan Says 10,000 Bitcoin Will Help Shape Its New Administrative City

Bhutan has pledged up to 10,000 bitcoin — roughly $1 billion — to back the development of Gelephu Mindfulness City, a new special economic zone the crown is promoting as a hub for sustainable industry and jobs.

Reports have disclosed the allocation was announced on national day and framed as a long-term commitment to fund the city’s growth rather than a quick selloff of reserves.

King Announces Bitcoin Allocation

According to King Jigme Khesar Namgyel Wangchuck, the pledge is meant “for our people, our youth, and our nation,” and aims to make every Bhutanese “a custodian, stakeholder, and beneficiary” of the project. The statement linked the Bitcoin allocation directly to the government’s plan to support economic opportunity inside Gelephu.

Bhutan and Cumberland DRW have signed a multi-year MoU to build a responsible digital asset ecosystem in Gelephu Mindfulness City, guided by the vision of His Majesty King Jigme Khesar Namgyel Wangchuck.

The partnership focuses on sustainable digital asset infrastructure,… pic.twitter.com/IJR7t3oHYl

— gmcbhutan (@gmcbhutan) December 15, 2025

Plan For Digital Reserves

Based on reports, officials say the 10,000 BTC will be held with an eye toward preserving value while generating returns through careful, risk-managed strategies — not by liquidating the holdings immediately.

The government has also signed a multi-year memorandum of understanding with market maker Cumberland DRW to help build digital-asset infrastructure and explore reserve management, stablecoins, and renewable energy-based mining inside the zone.

The Mindfulness City covers a very large area and has been pitched as an economic response to youth emigration, low birth rates, and lagging jobs.

Reports from earlier coverage describe the plan as a mix of green energy, tech, tourism, and regulated finance, with space set aside for vetted businesses and infrastructure projects such as an airport and dry port. the project’s promoters present it as a way to create higher-value work without abandoning Bhutan’s environmental and social aims.

Officials say the partnership with Cumberland will focus on building market access and institutional-grade operations for the city’s crypto activities, including experimenting with a national stablecoin and sustainable mining tied to renewable power. Local leaders have sought legal and investment partners to give investors a clearer route into the zone’s projects.

Global Implications And RisksAnalysts note this is one of the larger sovereign moves toward using bitcoin as a development tool, and the pledge raises clear questions about governance, transparency, and the possible exposure of state coffers to crypto price swings.

Reports flag both opportunity and risk: the funds could underwrite major projects, but they also require careful oversight to avoid losses that would hurt public services.

Featured image from Visit Bhutan, chart from TradingView

Market Impact And Buying Method

Market Impact And Buying Method

(@lightning)

(@lightning)

BREAKING: Visa launches Stablecoin Advisory Practice

BREAKING: Visa launches Stablecoin Advisory Practice

(@arrington)

(@arrington)

(@paulbrigner)

(@paulbrigner)

(@CoinbaseMarkets)

(@CoinbaseMarkets)

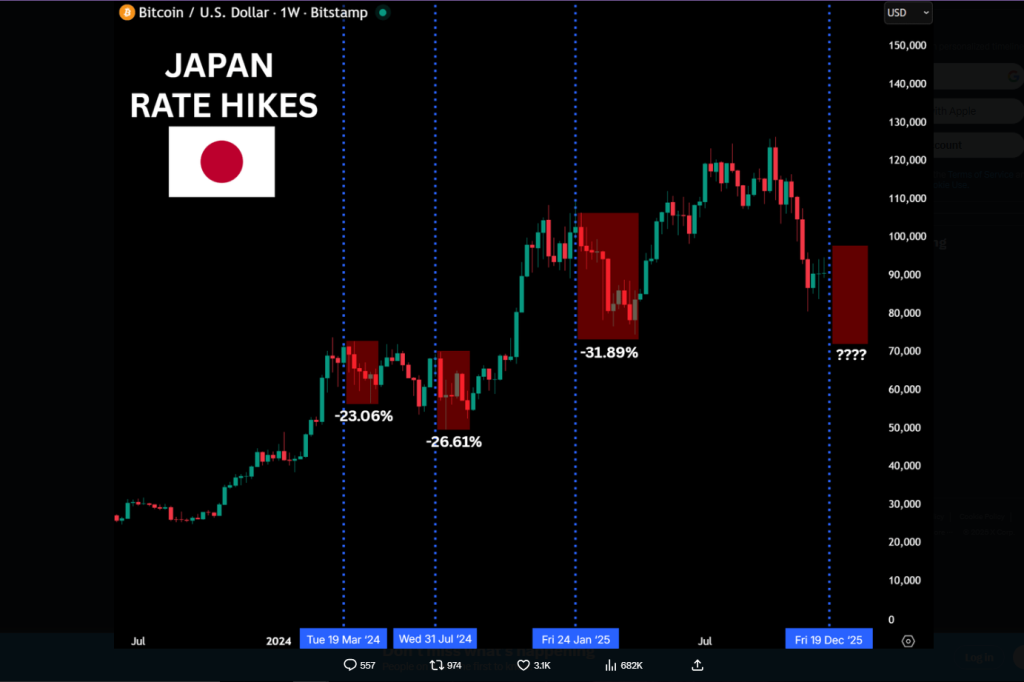

BREAKING: JAPAN WILL CRASH

BREAKING: JAPAN WILL CRASH

Look at the

Look at the

. Crypto.com is committed to accelerating the adoption of cryptocurrency through innovation and empowering the next generation of users to participate in a more accessible digital ecosystem.

. Crypto.com is committed to accelerating the adoption of cryptocurrency through innovation and empowering the next generation of users to participate in a more accessible digital ecosystem.