Coinbase Wins India Approval for $2.45B CoinDCX Stake

Coinbase has received regulatory approval from India’s Competition Commission to acquire a minority stake in CoinDCX valued at $2.45 billion, marking a crucial milestone in the US exchange’s expansion into one of Asia’s fastest-growing crypto markets.

The clearance follows months of regulatory review and deepens Coinbase’s partnership with India’s largest digital asset platform.

Chief Legal Officer Paul Grewal called the approval an “important regulatory milestone” that strengthens Coinbase’s long-term commitment to CoinDCX, which now serves over 20.4 million users across India and the UAE with more than $1.2 billion in assets under custody.

The investment builds on Coinbase’s initial backing of CoinDCX in 2020 and comes after the Indian exchange faced significant security challenges earlier this year.

We appreciate the Competition Commission of India approval of our proposal to acquire a minority stake in @CoinDCX, marking an important regulatory milestone and deepening Coinbase’s long-term partnership with one of India’s most established and trusted digital asset platforms. pic.twitter.com/IzTmJkyO7u

— paulgrewal.eth (@iampaulgrewal) December 17, 2025

Recovery Following $44 Million Security Breach

The approval arrives seven months after CoinDCX suffered a major hack that compromised $44 million from an internal liquidity account.

Cybersecurity firm Cyvers linked the July incident to North Korea’s Lazarus Group, noting the attack followed the same pattern as the $234 million WazirX breach that occurred exactly one year earlier.

Hackers executed the theft in just five minutes across seven rapid transactions, siphoning funds after conducting test transactions days earlier.

Indian police later arrested a CoinDCX software engineer whose compromised credentials allegedly enabled the breach.

However, the employee claimed that hackers exploited his system while he worked as a freelancer using company equipment.

CoinDCX CEO Sumit Gupta confirmed customer funds remained secure throughout the incident and launched a recovery bounty program offering up to 25% of retrieved assets, potentially worth $11 million.

Coinbase explicitly referenced the breach in its investment statement, writing that CoinDCX’s response to challenges “only strengthened our conviction in their team and platform.“

Strategic Positioning in Key Growth Markets

The investment reinforces Coinbase’s presence in India and the Middle East, following CoinDCX’s acquisition of Dubai-based BitOasis last year.

Coinbase described both regions as “top regions for crypto growth” driven by high adoption rates, supportive regulation, and substantial economic potential.

Gupta said the fresh capital would accelerate new product launches across the Web3 ecosystem while enabling market expansion and enhanced security infrastructure.

He called the investment “more than just capital,” adding that “it’s a deep vote of confidence in our mission, approach, and team.“

The funding comes as Coinbase simultaneously reopened direct operations in India following a two-year hiatus, now offering crypto-to-crypto trading with plans to integrate rupee deposits by 2026.

— Cryptonews.com (@cryptonews) December 8, 2025

Coinbase returns to India after two-year absence, with plans to introduce rupee deposits and fiat trading by 2026.#Coinbase #Indiahttps://t.co/xTgnD4Ux9I

The company’s return required full regulatory compliance after suspending services in 2023, when payment processors blocked its access to the Unified Payments Interface.

John O’Loghlen, Coinbase’s Asia-Pacific director, explained that forcing existing customers to close their accounts ran counter to typical business strategy but established a clean regulatory slate.

Coinbase subsequently secured Financial Intelligence Unit registration alongside competitors, including Binance, KuCoin, and Bybit, all of which faced similar regulatory obstacles before paying penalties and resuming operations.

Broader Strategic Expansion Beyond India

The CoinDCX deal strengthens Coinbase’s foothold in a market where citizens hold approximately $4.5 billion in digital assets, despite restrictive tax policies, including a 30% profit levy and a mandatory 1% transaction tax.

India consistently ranks among the top countries in global crypto adoption indices, though the Reserve Bank continues to oppose cryptocurrencies due to financial stability concerns.

Coinbase now employs over 500 people across India while continuing to hire for both domestic and international operations.

Grewal recently joined the US-India Business Council board to strengthen bilateral commercial relationships.

The CoinDCX investment aligns with Coinbase’s broader expansion into new product categories and markets.

— Cryptonews.com (@cryptonews) December 18, 2025

US crypto exchange Coinbase is letting users to trade stocks on its platform and place bets on a wide range of events through a partnership with Kalshi.#Coinbase #CoinbaseKalshi #PredictionMarkethttps://t.co/7X7UId3tKZ

The exchange recently launched prediction markets through a partnership with Kalshi, introduced stock trading capabilities, and announced Solana integration at its San Francisco product showcase, where CEO Brian Armstrong declared that “Coinbase is now the best place to trade every asset, not just crypto.“

The company also filed with US regulators for a National Trust Company Charter to offer payments and financial services without relying on third-party banks. It also recently relocated its corporate registration from Delaware to Texas to improve regulatory efficiency and flexibility.

The post Coinbase Wins India Approval for $2.45B CoinDCX Stake appeared first on Cryptonews.

PearPass — the password manager that keeps your data on your devices.

PearPass — the password manager that keeps your data on your devices. (@paoloardoino)

(@paoloardoino)  Dorsey's Bitchat explodes in Madagascar as protesters adopt censorship-resistant messaging during violent protests over infrastructure failures.

Dorsey's Bitchat explodes in Madagascar as protesters adopt censorship-resistant messaging during violent protests over infrastructure failures.

HashKey’s Hong Kong debut briefly jumped 6% before slipping below its IPO price, as a $206M listing met cautious sentiment in a volatile crypto market.

HashKey’s Hong Kong debut briefly jumped 6% before slipping below its IPO price, as a $206M listing met cautious sentiment in a volatile crypto market.

Bhutan has migrated its self-sovereign identity system to Ethereum, enabling 800K citizens to verify their identity on a public blockchain.

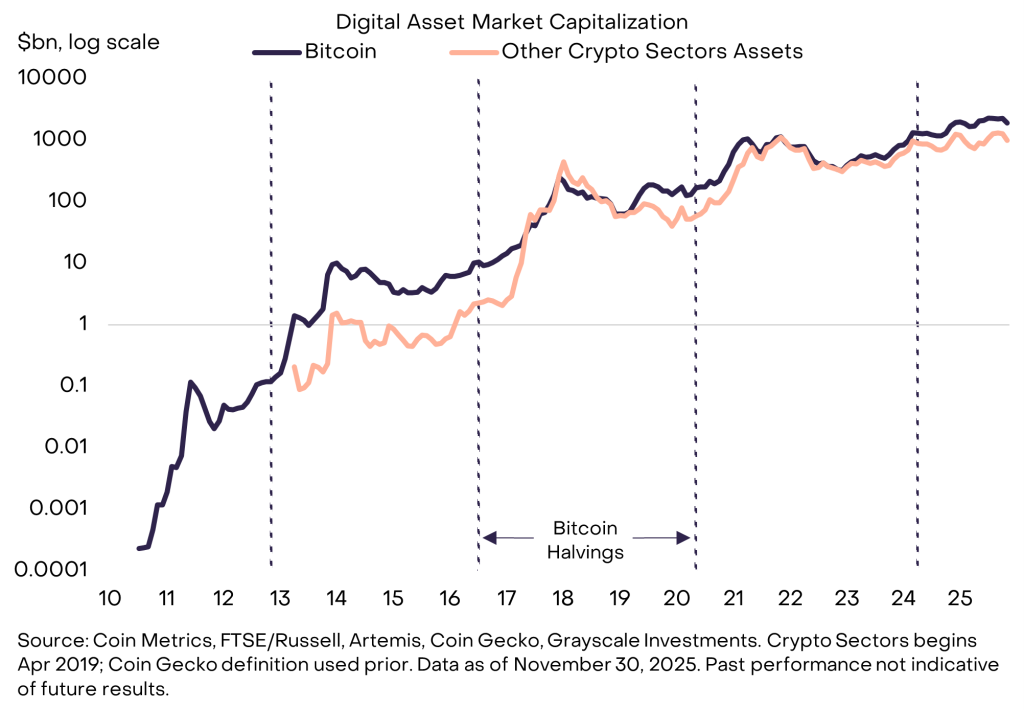

Bhutan has migrated its self-sovereign identity system to Ethereum, enabling 800K citizens to verify their identity on a public blockchain. Bitwise and Grayscale predict Bitcoin will break its four-year cycle and reach new all-time highs in 2026 driven by institutional capital and regulatory clarity.

Bitwise and Grayscale predict Bitcoin will break its four-year cycle and reach new all-time highs in 2026 driven by institutional capital and regulatory clarity.

Sam Bankman-Fried (SBF) is pushing for a new trial this week following his 2023 conviction tied to his time at FTX.

Sam Bankman-Fried (SBF) is pushing for a new trial this week following his 2023 conviction tied to his time at FTX.

CATHIE WOOD SAYS THE BITCOIN

CATHIE WOOD SAYS THE BITCOIN

The UK Treasury said that it will implement “firm and proportionate” rules for crypto regulation overseen by the UK FCA.

The UK Treasury said that it will implement “firm and proportionate” rules for crypto regulation overseen by the UK FCA. The UK has formally recognized cryptocurrencies and stablecoins as legal property through a new Act of Parliament.

The UK has formally recognized cryptocurrencies and stablecoins as legal property through a new Act of Parliament.

A federal appeals court in Denver has upheld the Federal Reserve’s right to deny crypto-focused bank

A federal appeals court in Denver has upheld the Federal Reserve’s right to deny crypto-focused bank

JPMorgan is launching its first tokenized money-market fund on Ethereum, reports the WSJ.

JPMorgan is launching its first tokenized money-market fund on Ethereum, reports the WSJ.

During the last 3 BOJ rate hikes, BTC drops 20%+…

During the last 3 BOJ rate hikes, BTC drops 20%+…

FC Barcelona draws backlash over sponsorship with obscure crypto firm ZKP amid concerns about transparency and financial desperation.

FC Barcelona draws backlash over sponsorship with obscure crypto firm ZKP amid concerns about transparency and financial desperation.

US prosecutors demand 12-year sentence for Do Kwon after Terra's $40B collapse that destabilized crypto markets and aided FTX implosion.

US prosecutors demand 12-year sentence for Do Kwon after Terra's $40B collapse that destabilized crypto markets and aided FTX implosion.