Major Ethereum Whale Returns: Buys $119M In ETH Amid Market Drop

Ethereum is struggling to regain momentum after failing to reclaim the $3,200 level, keeping the market in a fragile equilibrium. Despite several recovery attempts, price action suggests that bulls are now focused less on pushing higher and more on defending current demand zones. This hesitation reflects broader uncertainty across the crypto market, where traders remain cautious amid tightening liquidity and elevated macro risk.

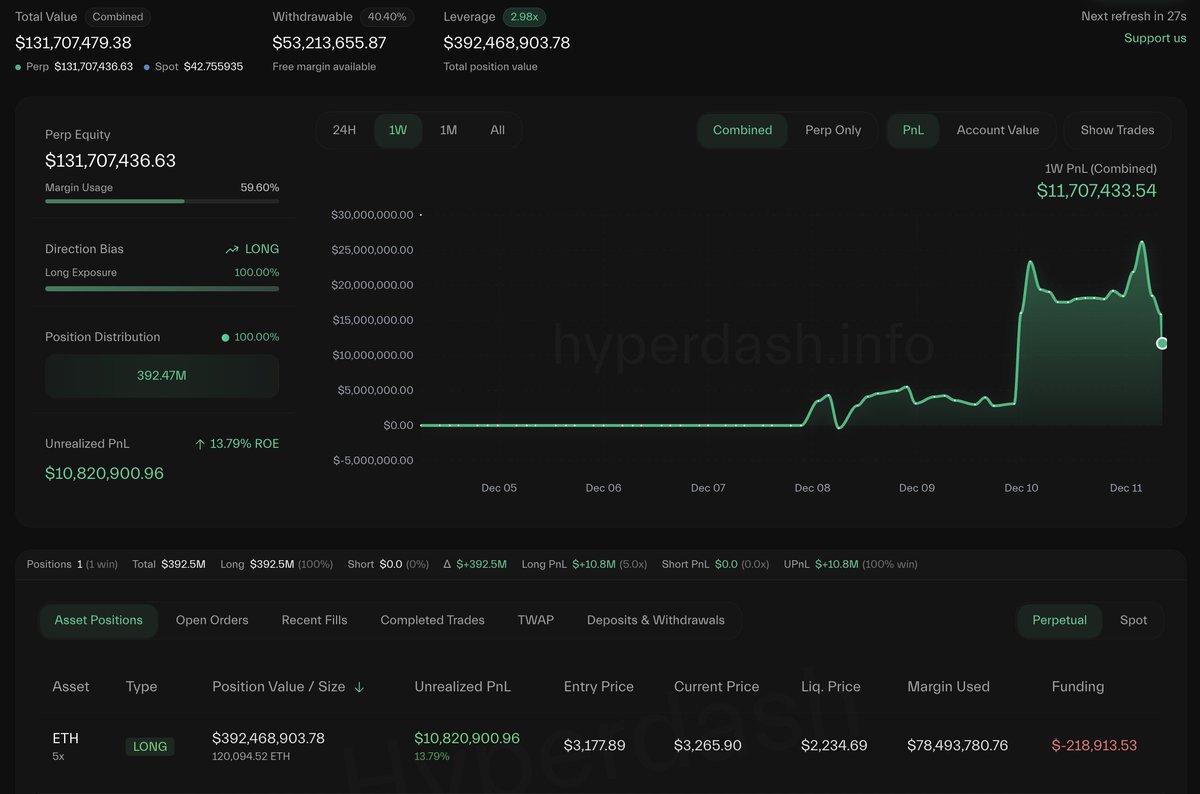

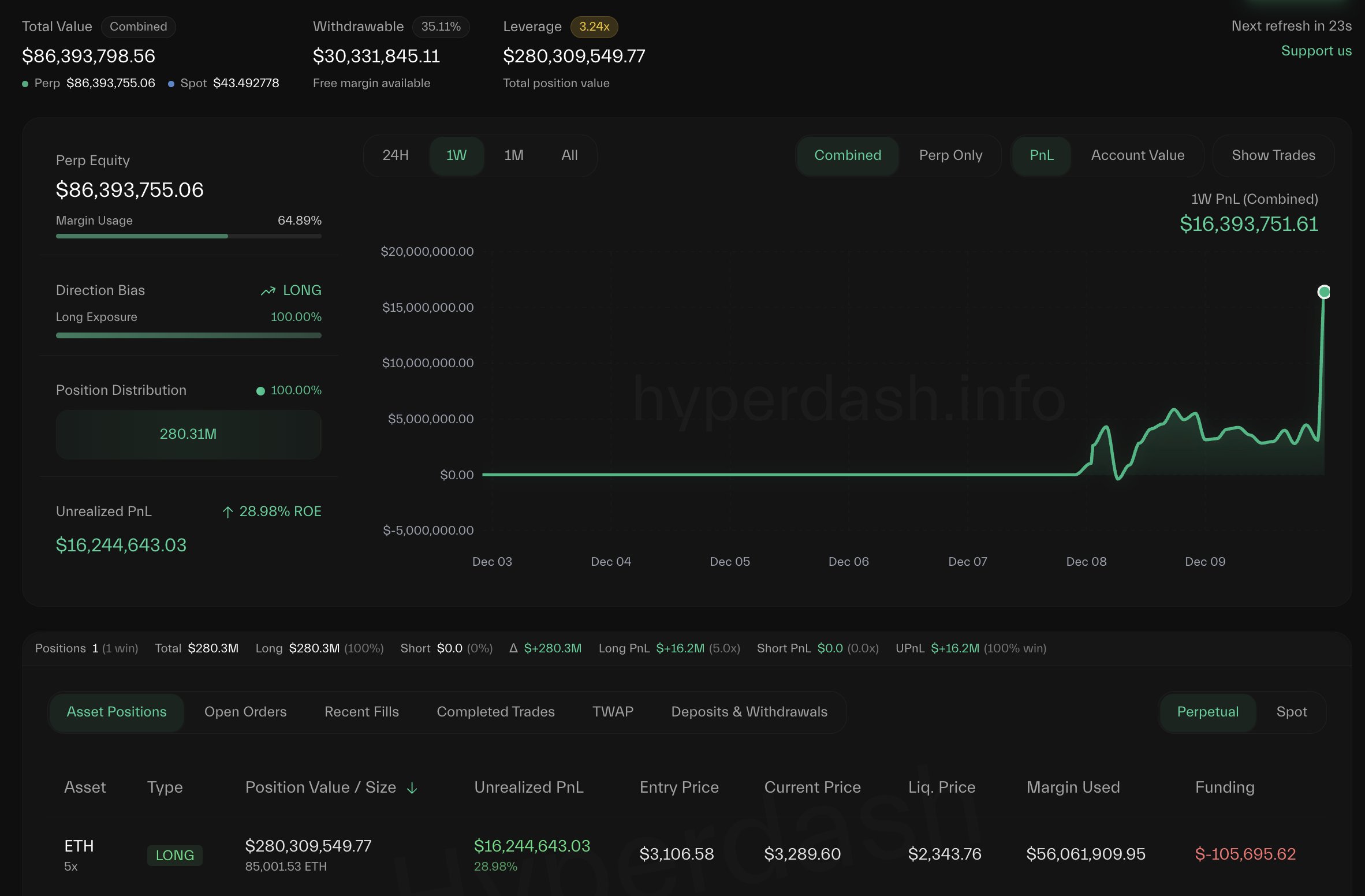

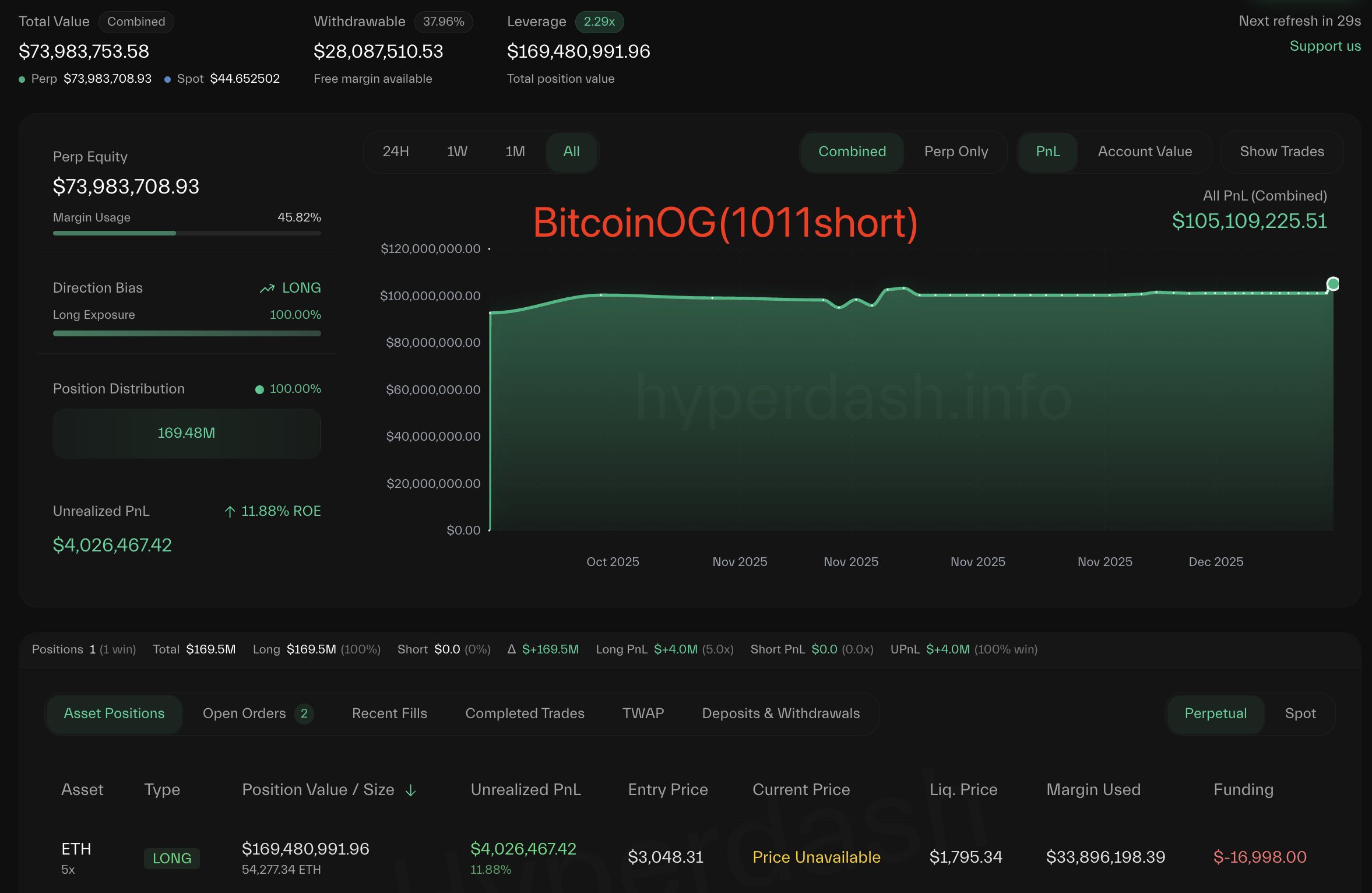

However, beneath the surface, on-chain activity is beginning to tell a more nuanced story. According to Lookonchain, data sourced from Arkham reveals that a major market participant has re-entered aggressively. The so-called 66kETHBorrow Whale, who previously accumulated 489,696 ETH worth roughly $1.5 billion, has started buying Ethereum again as prices declined.

This behavior stands out because it occurred during weakness rather than strength, a pattern typically associated with strategic accumulation rather than short-term speculation.

Whale activity during drawdowns often signals confidence in higher prices over a longer time horizon, even when sentiment remains fragile. While Ethereum still faces technical resistance overhead, the return of large buyers suggests that demand is weak but has not disappeared.

Whale Accumulation Raises Questions Amid Ethereum Weakness

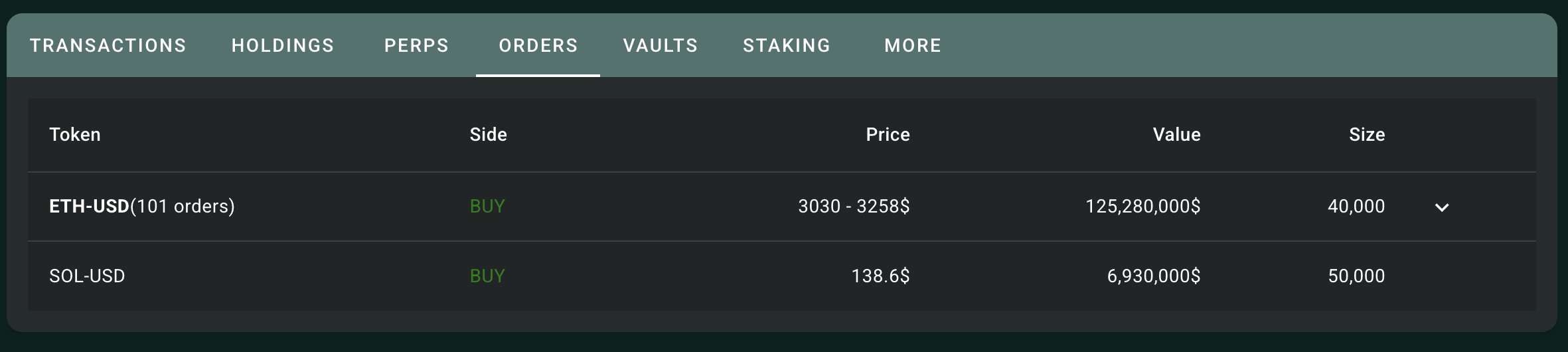

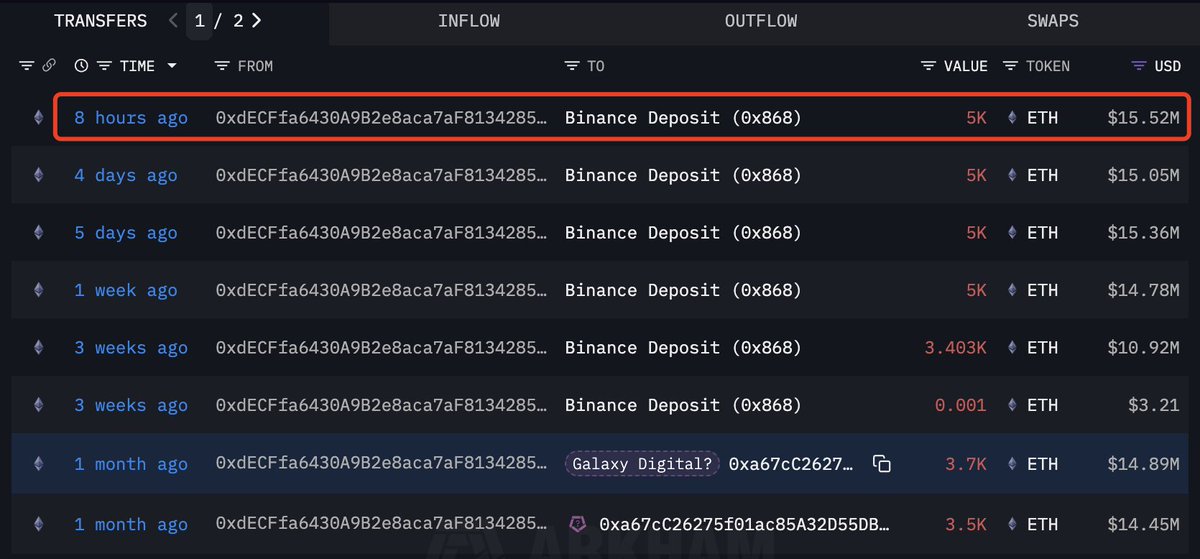

Lookonchain data provides further insight into the recent actions of the 66kETHBorrow whale, highlighting a sequence that has drawn significant attention from the market. Over the past eight hours, the whale borrowed approximately $85 million in USDT from Aave and transferred the funds to Binance.

Shortly after, he withdrew 38,576 ETH, valued at roughly $119.3 million, from the exchange. This rapid movement of capital during a market pullback has raised questions among smaller investors, many of whom are wondering whether this whale is acting on information or conviction that is not yet reflected in price.

Such behavior is often interpreted as deliberate accumulation, particularly when ETH is withdrawn from exchanges rather than left on trading platforms. Exchange outflows generally reduce immediate sell-side liquidity, reinforcing the perception of long-term positioning. However, it is critical to acknowledge the limits of on-chain visibility. These transactions represent only the wallets that have been publicly identified and tracked.

There is no certainty that this whale’s exposure is fully transparent. He could be holding hedges, short positions, or additional long exposure through other wallets, centralized exchanges, or derivatives markets that are not visible on-chain. As a result, while the activity suggests confidence, it should not be interpreted as definitive directional confirmation.

ETH Price Struggles Below Key Moving Averages

Ethereum is currently trading near the $3,150–$3,200 zone after a modest rebound, but the broader technical structure remains fragile. On the daily chart, ETH continues to trade below its 50-day and 100-day moving averages, both of which are now acting as dynamic resistance. The recent bounce stalled near the declining 50-day MA, highlighting the lack of strong follow-through from buyers.

The 200-day moving average, positioned closer to the $3,500 area, remains well above current price levels. This reinforces that Ethereum is still in a corrective phase within a larger macro uptrend. As long as price remains below this long-term trend indicator, upside attempts are likely to face selling pressure from both swing traders and systematic strategies.

Price action over the past weeks shows a series of lower highs following the rejection near $4,000 in October, confirming a short-term bearish market structure. However, ETH has so far defended the $2,800–$2,900 support region, suggesting that buyers are still active at lower levels.

For Ethereum to shift momentum decisively, bulls must reclaim and hold above the $3,300–$3,400 range. Failure to do so keeps downside risks open, with a potential retest of prior demand zones if broader market sentiment deteriorates.

Featured image from ChatGPT, chart from TradingView.com

(@leshka_eth)

(@leshka_eth)