Cardano Price Prediction: Top Analyst Spots Buy Signal – Here’s What to Watch

Analysts have reason to believe the ADA downtrend has run its course, with a TD Sequential buy signal opening the door for bullish Cardano price predictions.

Key opinion leader Ali Martinez has drawn attention to the setup, noting that the altcoin has printed a 9 on the TD Sequential at $0.37.

TD flashed a buy signal on Cardano $ADA.

— Ali Charts (@alicharts) December 14, 2025

Now $0.37 must hold to open the path to $0.54. pic.twitter.com/xLThWFUprW

The way the indicator works is that, using a systematic counting methodology 1 to 9, it identifies the points at which a trend becomes exhausted by tracking price movements against historical closing.

The count has now been completed, and $0.37 is now being tried as the proving ground for a potential launchpad.

If realised, Martinez argues the signal opens the path toward $0.54, a demand zone that has held firm throughout ADA’s year-long decline.

Cardano Price Prediction: Here’s What it Means for the Bull Run

The TD Sequential becomes far more reliable when it appears at historically significant support or resistance, and a strong confluence of support strengthens Cardano’s case.

The signal has formed at a base that aligns not only with a demand zone that has capped downside over the past three weeks, but also with the lower boundary of a year-long descending triangle.

The setup leans bullish, and momentum indicators support the view.

The RSI continues to print higher lows as it trends toward the 50 neutral line, signalling growing buy pressure beneath the surface.

At the same time, the MACD is holding just above a potential death cross with the signal line, a sign that current levels are pivotal for the prevailing trend.

If Martinez’s $0.54 target is reclaimed as higher and firmer support, a breakout attempt could be in play. Fully realised, the pattern targets a potential 380% move to $180.

SUBBD: These Fundamentals Could Eye a Spot in the 1%

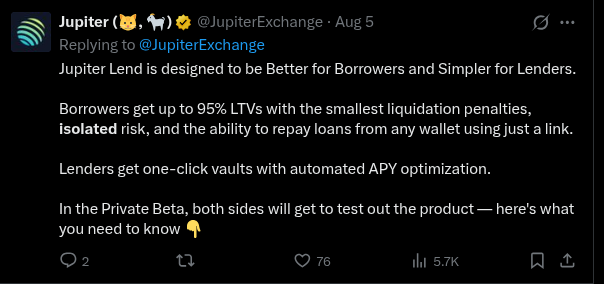

With market conditions shaping up for a 2026 bull run, capital is rotating into the next high-upside contender, and increasingly, SUBBD ($SUBBD).

Positioned as an AI-powered content platform, SUBBD is redefining the $85 billion subscriber economy by giving creators true ownership and fans genuine access.

Never miss a sale again.

— SUBBD (@SUBBDofficial) March 26, 2025

As a top creator, your audience is global. It's just not possible to cater to everyone – you can't be online 24/7

That's where your personal AI Assistant comes in, to handle requests and secure payments. Sleep peacefully knowing you're making money… pic.twitter.com/ju9VjLBmea

By cutting out the middlemen, $SUBDD puts control back in the hands of those who create real value.

Creators can monetize directly, while fans gain access to exclusive content, early releases, and meaningful interactions through token-gated perks.

The project has already raised almost $1.4 million in presale, and even a small share of the industry could push its valuation significantly higher post-launch.

With SUBBD, both sides of the community win — creators earn more, and fans get closer while embracing the decentralization use cases crypto was built for.

Visit the Official SUBBD Website HereThe post Cardano Price Prediction: Top Analyst Spots Buy Signal – Here’s What to Watch appeared first on Cryptonews.

TODAY: Do Kwon faces sentencing in the US over the Terra/LUNA collapse.

TODAY: Do Kwon faces sentencing in the US over the Terra/LUNA collapse.

LUNC is taking another big step forward!

LUNC is taking another big step forward!  99.39% YES votes

99.39% YES votes Zero votes against

Zero votes against Only 0.61% veto

Only 0.61% veto