Texas Goes Full Crypto Mode as Bitcoin ATM Operator Eyes 200 New Machines

Texas’ role as a center of U.S. crypto activity is set to expand further after Bitcoin Bancorp said it plans to deploy up to 200 licensed Bitcoin ATMs across the state beginning in the first quarter of 2026.

The state is adding to an already dense network of crypto kiosks operating under one of the country’s clearest regulatory frameworks.

Bitcoin Bancorp Enters Texas, Citing Clear Rules and Strong ATM Demand

Bitcoin Bancorp, which trades over the counter under the ticker BCBC, said the planned rollout would mark its entry into what it described as a strategically important market.

BIG NEWS!

— BitcoinBancorp (@BCBC_stock) December 15, 2025Bitcoin Bancorp (OTC: $BCBC) is set to deploy up to 200 licensed Bitcoin ATMs across Texas starting Q1 2026!

Expansion Targets One of the Most Crypto-Friendly U.S. States as Part of a Broader National Growth Strategy

Excited to bring easier Bitcoin access to the…

The company is one of only three publicly traded Bitcoin ATM network owners in the United States and says it holds foundational patents tied to Bitcoin ATM technology.

Eric Noveshen, a director at the firm, said agreements are already in place that could support faster revenue growth as the company moves from planning into execution.

Following the announcement, Bitcoin Bancorp shares rose 7.83% on the day and are up 29.53% over the past five days, reflecting increased investor confidence in the expansion strategy.

The expansion comes at a time when Texas already hosts more than 4,000 live crypto ATMs, the highest number of any U.S. state.

Large national operators, including Athena Bitcoin, Bitcoin Depot, Coinhub, Cryptobase, and Byte Federal, have established broad coverage across major cities such as Houston, Dallas, Austin, and San Antonio.

The presence of this existing infrastructure has lowered barriers for new deployments and signaled sustained consumer demand for in-person crypto access.

Why Bitcoin ATM Operators Keep Flocking to Texas

Texas’ appeal to ATM operators largely stems from its regulatory structure. State law treats virtual currency as a form of money under the Texas Money Services Act, placing Bitcoin ATM operators within a familiar licensing regime overseen by the Texas Department of Banking.

Companies must obtain a money transmitter license, meet minimum net worth requirements of at least $500,000, post a surety bond of no less than $150,000, and submit to regular examinations.

Consumer protection has also become a growing focus. In Texas, state rules require Bitcoin ATM operators to clearly disclose fees, exchange rates, and complaint procedures.

Federal Scrutiny Intensifies Around Bitcoin ATMs

Oversight of Bitcoin ATMs in the United States is tightening at the federal level as regulators respond to rising fraud concerns and increased consumer use.

Currently at the federal level, Bitcoin ATM operators are classified as money services businesses under the Bank Secrecy Act, placing them under the supervision of the Financial Crimes Enforcement Network (FinCEN).

This requires operators to maintain formal anti-money laundering programs, conduct customer identity verification, and monitor transactions for suspicious activity.

Identity checks typically scale with transaction size, ranging from basic phone verification for smaller amounts to government-issued identification and enhanced due diligence for larger transfers.

Operators are also required to file currency transaction reports for cash transactions exceeding $10,000, submit suspicious activity reports when necessary, and retain records for a minimum of five years.

At the same time, federal lawmakers are moving to further regulate the sector. Proposed legislation such as the Crypto ATM Fraud Prevention Act of 2025 shows a more focused concern over the role of crypto kiosks in scam-related losses nationwide.

What the Crypto ATM Fraud Prevention Act Proposes

Introduced in the U.S. Senate as Bill S. 710, the Crypto ATM Fraud Prevention Act of 2025, which has been read twice and referred to the Senate Committee on Banking, Housing, and Urban Affairs, is designed to reduce fraud risks while increasing transparency for consumers.

Key provisions of the bill include mandatory registration of virtual currency kiosks with the U.S. Treasury; also, operators are required to provide clear pre-transaction disclosures outlining terms, fees, and a warning that transactions are final and non-refundable.

The bill mandates prominent fraud warnings on kiosks, the issuance of physical receipts containing transaction details and fraud-reporting information, and the implementation of written anti-fraud policies submitted to FinCEN.

The post Texas Goes Full Crypto Mode as Bitcoin ATM Operator Eyes 200 New Machines appeared first on Cryptonews.

South Korea pushes for draft stablecoin bill by Dec. 10 deadline as lawmakers threaten independent action if FSC misses target.

South Korea pushes for draft stablecoin bill by Dec. 10 deadline as lawmakers threaten independent action if FSC misses target.

Credit card giant

Credit card giant

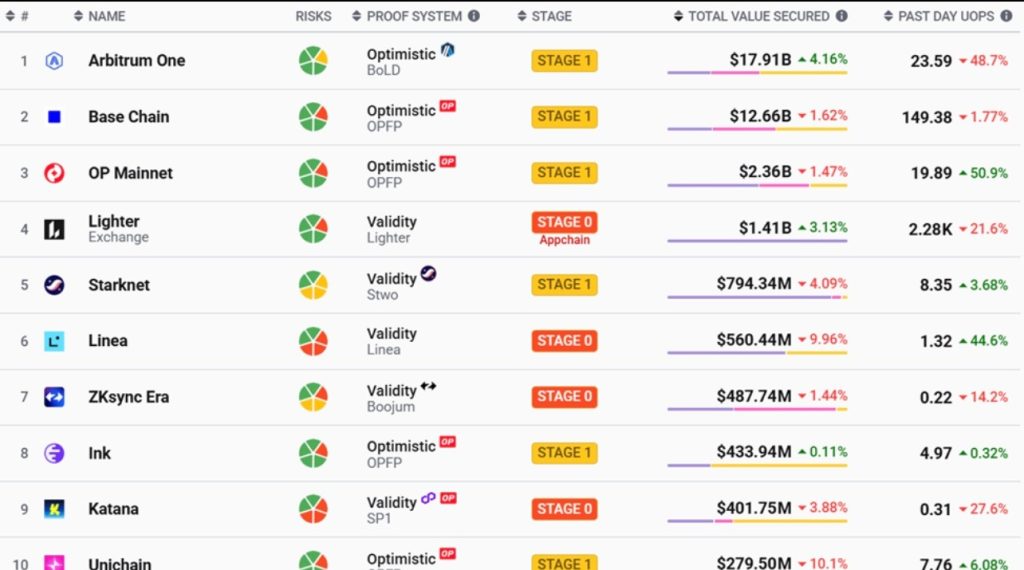

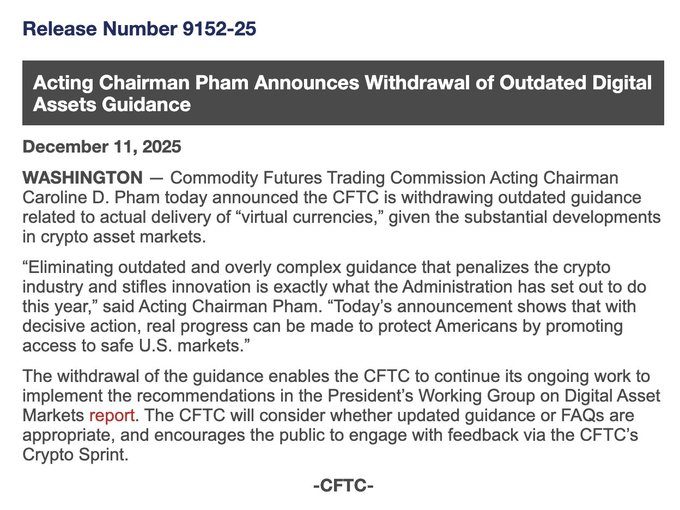

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products.

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products. The US

The US

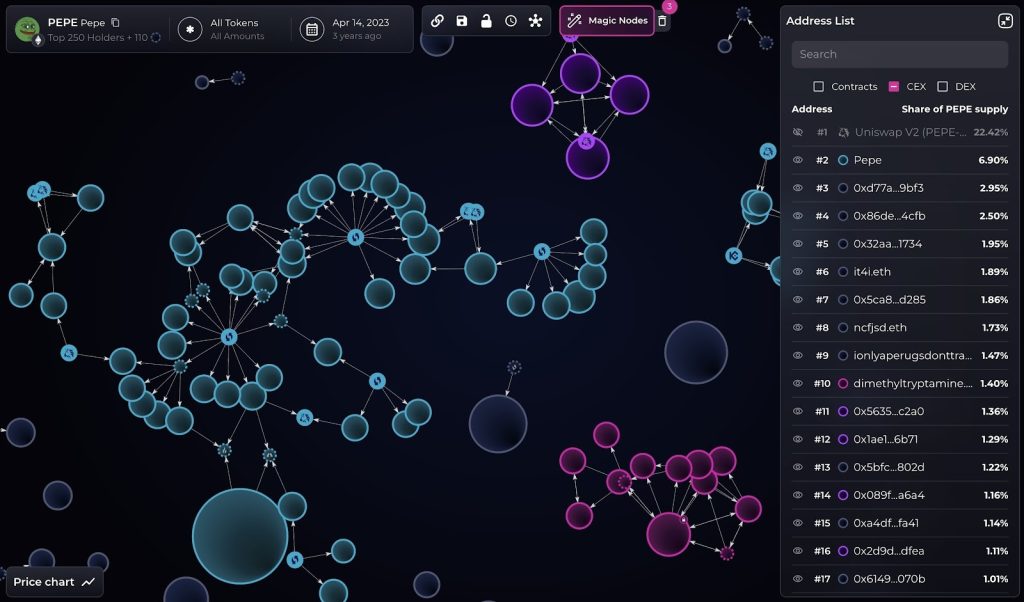

More than 70% of traders who bought into Kanye West’s Solana-based memecoin YZY ended up in the red, according to

More than 70% of traders who bought into Kanye West’s Solana-based memecoin YZY ended up in the red, according to

(@aeyakovenko)

(@aeyakovenko)

OCC head Jonathan Gould said that crypto firms seeking federal bank charters should be evaluated on par with traditional financial firms.

OCC head Jonathan Gould said that crypto firms seeking federal bank charters should be evaluated on par with traditional financial firms. Strike CEO

Strike CEO

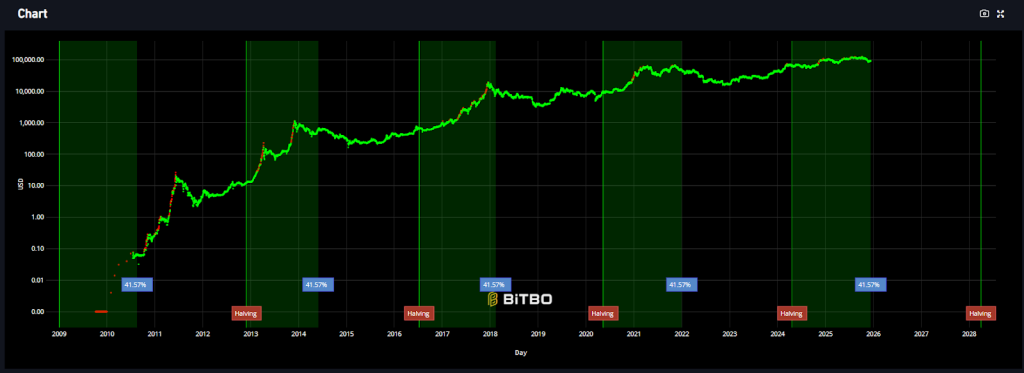

Once a reliable pattern, the four-year Bitcoin cycle may no longer hold. Here’s what changed, and why it matters now more than ever.

Once a reliable pattern, the four-year Bitcoin cycle may no longer hold. Here’s what changed, and why it matters now more than ever.

Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.

Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.

金融審議会「暗号資産制度に関するワーキング・グループ」報告書を公表しました。

金融審議会「暗号資産制度に関するワーキング・グループ」報告書を公表しました。 Japan plans to classify crypto as financial products under insider rules, cut profit taxes and tighten disclosure on 105 listed assets.

Japan plans to classify crypto as financial products under insider rules, cut profit taxes and tighten disclosure on 105 listed assets. Japan intends to require crypto exchanges to hold reserves to cover customer losses, tightening safeguards against hacks and operational failures.

Japan intends to require crypto exchanges to hold reserves to cover customer losses, tightening safeguards against hacks and operational failures.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026. Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

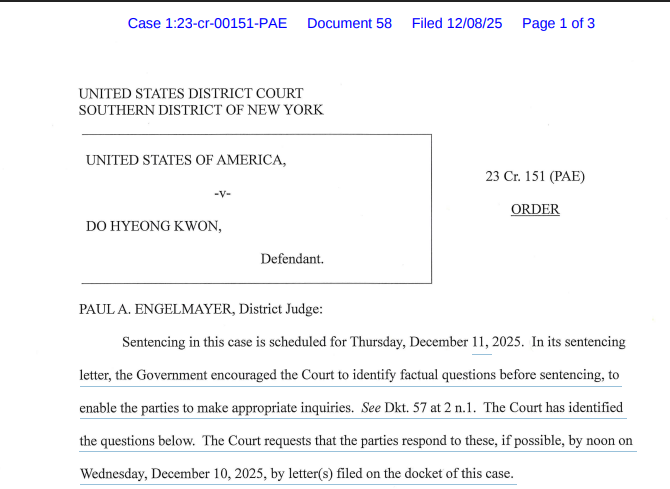

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.