Bitcoin Down, MSTR Sliding — Why Did a $284B NY Pension Fund Buy Despite a 7% Drop?

Bitcoin prices extended their decline this week, dragging closely correlated equities lower and pushing shares of Strategy (MSTR) down sharply during regular trading hours.

Yet even as the stock slid more than 7% in a single session, one of the largest public pension funds in the United States quietly increased its exposure.

The New York State Common Retirement Fund, which manages roughly $284 billion in assets reportedly raised its position in Strategy, a Nasdaq-listed company widely viewed as an equity proxy for Bitcoin exposure.

JUST IN: $284 billion U.S. New York State Retirement Fund increased its position in #Bitcoin treasury company Strategy $MSTR to $50 million. pic.twitter.com/XnHfpvUZPL

— BitcoinTreasuries.NET (@BTCtreasuries) December 15, 2025

Strategy Drops 7% on $2.3B Volume as Bitcoin Sell-Off Deepens

The move came as Strategy shares fell to $163.55 by 13:56 EST on December 15, down 7.29% on the day. Trading activity was heavy, with $2.32 billion in value changing hands across nearly 14 million shares.

The stock moved between an intraday high of $176.50 and a low of $160.54, placing its market capitalization at $50.7 billion.

Strategy currently has 287.35 million shares outstanding, with 267.03 million in circulation, and trades at a basic mNAV of 0.88.

The decline mirrors renewed pressure in the broader crypto market. Bitcoin was trading around $86,214, down 3.5% over the past 24 hours, 4.4% over the past week, and more than 10% over the past month.

The pullback followed a steep correction from Bitcoin’s recent peak above $126,000, a move that has weighed heavily on companies with direct balance-sheet exposure to the asset.

Repeat Buyer Signal: New York State Pension Fund Continues Expanding Its Position

New York State fund raised its stake during the second quarter of 2025 and disclosed another increase in a November filing covering third-quarter positions.

At that point, the fund owned approximately 0.10% of Strategy, valued at about $113.8 million.

The New York State fund is one of the largest public retirement systems in the country, with a portfolio heavily weighted toward public equities, fixed income, private equity, real assets, and alternative investments, with public stocks accounting for just over 40% of total assets.

Its holdings include large positions in major U.S. technology, financial, consumer, and healthcare companies.

The Strategy investment remains a small allocation within that diversified portfolio, but its persistence has drawn attention given the volatility tied to Bitcoin-linked assets.

Strategy Pushes Bitcoin Holdings Past 671,000 BTC as Shares Fall

Strategy has become the most prominent example of that exposure. The company has spent the past several years converting operating cash flows, equity issuance proceeds, and debt financing into Bitcoin purchases.

That approach has caused its shares to trade as a leveraged reflection of Bitcoin’s price movements.

Since peaking above $450 in July, MSTR shares have fallen nearly 62%, according to Yahoo Finance data.

Over the past six months, the stock is down more than 55%, moving from roughly $369 in mid-June to the mid-$160 range.

Despite the volatility, Strategy has continued adding to its Bitcoin holdings. Last week, the company disclosed the purchase of 10,645 BTC for $980.3 million at an average price of $92,098 per coin.

The acquisition lifted its total holdings to 671,268 BTC, reinforcing its position as the world’s largest corporate holder of Bitcoin.

Those acquisitions came as Strategy moved to address investor concerns about liquidity and cash obligations.

The company recently established a $1.44 billion U.S. dollar reserve intended to cover dividend payments and interest expenses without requiring the sale of Bitcoin during periods of market stress.

Management said the reserve is sufficient to fund at least 12 months of dividend obligations, with plans to extend coverage to two years.

Other public pension systems, including New Jersey’s, have also disclosed increased MSTR holdings in recent months, showing a broader pattern of selective institutional exposure to Bitcoin-linked equities rather than direct cryptocurrency ownership.

The post Bitcoin Down, MSTR Sliding — Why Did a $284B NY Pension Fund Buy Despite a 7% Drop? appeared first on Cryptonews.

South Korea pushes for draft stablecoin bill by Dec. 10 deadline as lawmakers threaten independent action if FSC misses target.

South Korea pushes for draft stablecoin bill by Dec. 10 deadline as lawmakers threaten independent action if FSC misses target.  Naver Financial, the fintech arm of South Korean internet giant Naver, is preparing to roll out a stablecoin wallet in Busan.

Naver Financial, the fintech arm of South Korean internet giant Naver, is preparing to roll out a stablecoin wallet in Busan.

Credit card giant

Credit card giant

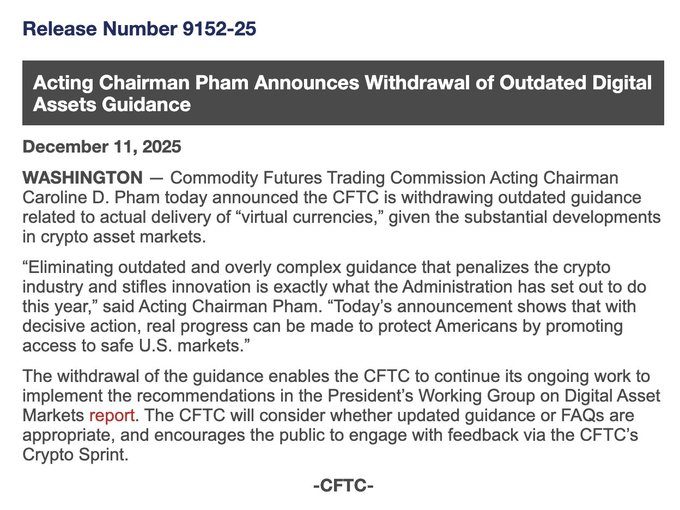

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products.

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products. The US

The US

More than 70% of traders who bought into Kanye West’s Solana-based memecoin YZY ended up in the red, according to

More than 70% of traders who bought into Kanye West’s Solana-based memecoin YZY ended up in the red, according to

(@aeyakovenko)

(@aeyakovenko)

OCC head Jonathan Gould said that crypto firms seeking federal bank charters should be evaluated on par with traditional financial firms.

OCC head Jonathan Gould said that crypto firms seeking federal bank charters should be evaluated on par with traditional financial firms. Strike CEO

Strike CEO

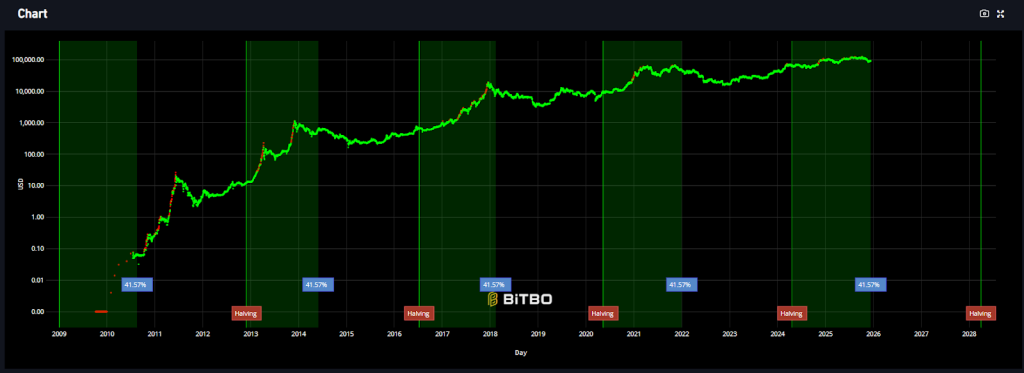

Once a reliable pattern, the four-year Bitcoin cycle may no longer hold. Here’s what changed, and why it matters now more than ever.

Once a reliable pattern, the four-year Bitcoin cycle may no longer hold. Here’s what changed, and why it matters now more than ever.

Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.

Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.

金融審議会「暗号資産制度に関するワーキング・グループ」報告書を公表しました。

金融審議会「暗号資産制度に関するワーキング・グループ」報告書を公表しました。 Japan plans to classify crypto as financial products under insider rules, cut profit taxes and tighten disclosure on 105 listed assets.

Japan plans to classify crypto as financial products under insider rules, cut profit taxes and tighten disclosure on 105 listed assets. Japan intends to require crypto exchanges to hold reserves to cover customer losses, tightening safeguards against hacks and operational failures.

Japan intends to require crypto exchanges to hold reserves to cover customer losses, tightening safeguards against hacks and operational failures.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026. Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

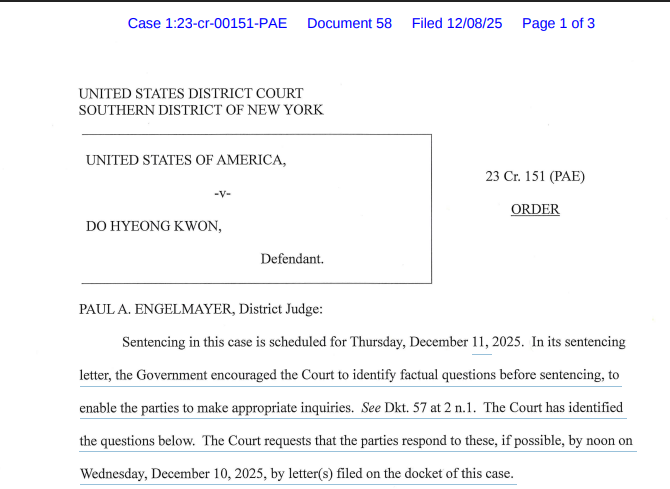

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

,

,  ) (@jp_mullin888)

) (@jp_mullin888)