Bitcoin Moves Within a ‘Structurally Fragile Range’, Weak But Solid

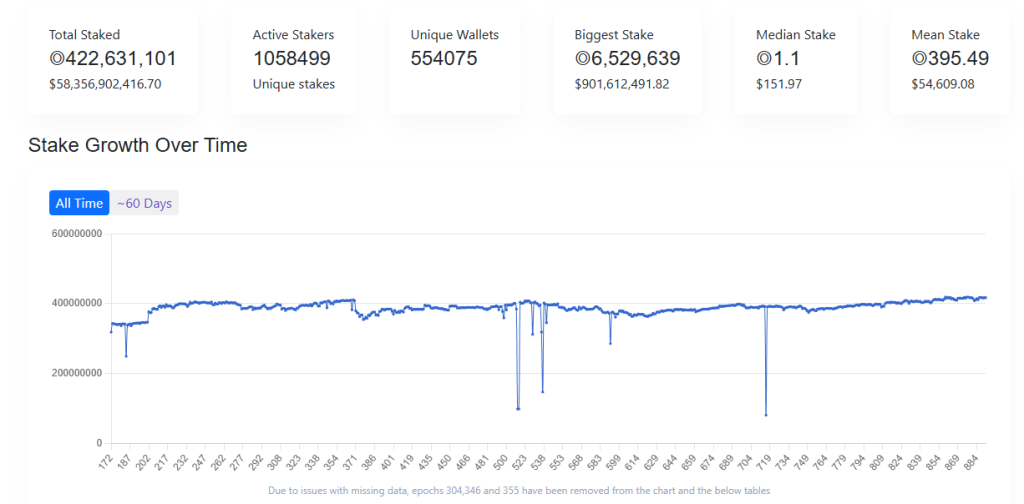

Bitcoin (BTC) sits in what can be described as a fragile range, experiencing pressure from high unrealized losses and realized loss realization, as well as heavy profit-taking by long-term holders. “The market is holding steady for now, but conviction remains absent,” according to the latest report by the blockchain data provider Glassnode.

The analysts found that the world’s number one coin trades within “a structurally fragile” zone. The three factors noted above are collectively anchoring price action at the moment.

It is noteworthy, however, that demand remains resilient enough to keep price above the True Market Mean (the cost basis of all non-dormant coins), despite this persistent sell pressure. This suggests that buyers are still absorbing distribution.

Overall, the market structure “suggests a weak but stable range, held up by patient demand yet constrained by persistent sell pressure,” the analysts say.

Moreover, the short-term trajectory depends on whether liquidity improves and sellers relent. Long term, the market depends on its ability to reclaim key cost-basis thresholds and exit “this time-driven, psychologically taxing phase.”

Anchored, But Under Strain#Bitcoin is stuck in a fragile range as losses climb, LTH selling grows, and demand stays weak. ETFs, liquidity, and futures remain muted while options price short-term volatility ahead of FOMC.

— glassnode (@glassnode) December 10, 2025

Read the full Week On-Chainhttps://t.co/S4BV3NwNqf pic.twitter.com/lRHc6X66QY

Moreover, looking at the onchain indicators, the analysts found that, as the market sits in this weak but bounded range, “time becomes a negative force.” They explain that investors find it more difficult to endure unrealized losses. Simultaneously, the possibility of loss realization increases.

Subsequently, as realized losses rise, recovery anchors further. A surge in realized profit from veteran investors boost this effect.

That said, the price did slightly recover above the True Market Mean. In the short term, if seller exhaustion arises, this underlying buy pressure could result in a retest of the $95,000 level and potentially the STH-Cost Basis at $102,700.

“Until then, the True Market Mean remains the most probable bottom-formation zone, barring a new macro shock,” the analysts write.

Transition Into Low-Liquidity, Mean-Reverting Environment

Onchain factors show a cautious tone, and off-chain conditions echo it, Glassnode says.

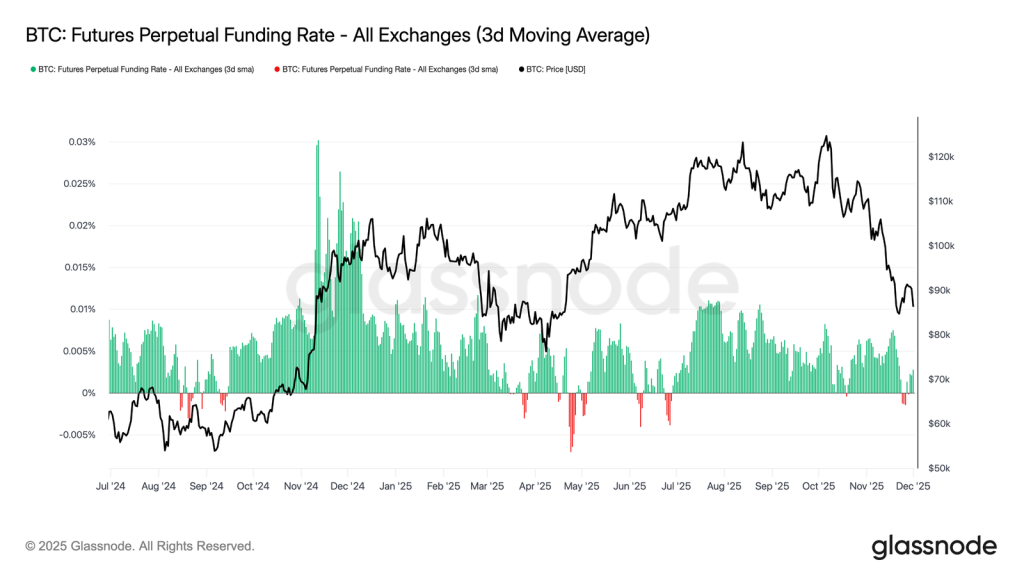

In short, exchange-traded funds (ETF) flows are negative, spot liquidity is subdued, and futures markets lack speculative engagement.

The spot market is seeing a thinner demand buffer. This lowers immediate buy-side support, with the price standing in a place “more vulnerable to macro catalysts and volatility shocks.”

Moreover, Bitcoin’s spot relative volume sits near the lower bound of its 30-day range. It suggests “a more defensive positioning across the board.” Fewer liquidity-driven flows are available to absorb volatility or sustain directional moves.

Additionally, “across perpetual markets, funding hovered around zero to slightly negative during the week, underscoring the continued retreat in speculative long positioning,” the report says.

Meanwhile, the options market recorded “muted” action, in contrast with a jump in short-dated implied volatility. This comes as traders position for a larger move.

“Options markets reinforce a defensive posture, with traders accumulating volatility, bidding short-dated downside protection, and positioning for a near-term volatility event,” the analysts says.

Additionally, they found that traders are buying and not selling volatility. Also, traders buying both wings suggest hedging and convexity-seeking behaviour instead sentiment-driven speculation.

“Combined with rising implied volatility and a downside-leaning skew, the flow profile suggests that market participants are preparing for a volatility event with a bias toward the downside,” Glassnode says.

Notably, the US Federal Reserve meeting on 10 December was the last meaningful catalyst, so the market is preparing for a transition into a low-liquidity, mean-reverting environment.

After the rate cut announcement, gamma sellers typically re-enter, accelerating IV decay into year-end. “Absent a hawkish surprise or a notable shift in guidance, the path of least resistance points toward lower implied volatility and a flatter surface through late December,” the report concludes.

The post Bitcoin Moves Within a ‘Structurally Fragile Range’, Weak But Solid appeared first on Cryptonews.

Coinbase returns to India after two-year absence, with plans to introduce rupee deposits and fiat trading by 2026.

Coinbase returns to India after two-year absence, with plans to introduce rupee deposits and fiat trading by 2026.

SOUTH KOREAN BANKING GIANT WOORI BANK JUST STARTED DISPLAYING

SOUTH KOREAN BANKING GIANT WOORI BANK JUST STARTED DISPLAYING