CFTC Scraps ‘Outdated’ Bitcoin Guidance – What This Means for Future Regulation

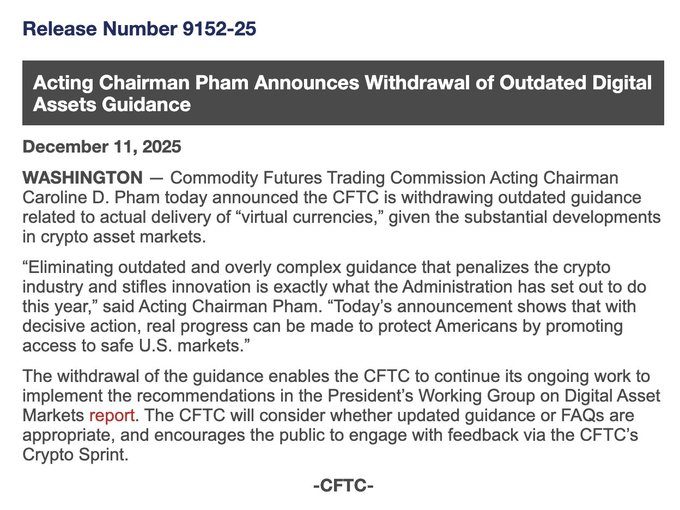

The U.S. Commodity Futures Trading Commission has formally scrapped its 2020 “actual delivery” guidance for Bitcoin and other virtual currencies and set the stage for a broader shift in how the agency oversees crypto markets.

Acting Chair Caroline Pham announced the withdrawal on December 11, calling the old framework outdated and inconsistent with the market’s level of maturity.

Source: CTFC

She said the move reflects the administration’s push this year to remove rules that had become overly complex and deterred crypto firms from operating within the U.S., adding that eliminating such barriers shows “real progress can be made to protect Americans by promoting access to safe U.S. markets.”

CFTC Withdraws 28-Day Crypto Delivery Standard, Easing Path for New Products

The guidance that has now been withdrawn defined the conditions under which a leveraged or margined crypto purchase could be considered “actual delivery,” a standard built around a 28-day window that required the buyer to have full possession and control of the asset.

It was introduced at a time when regulators were still unsure how virtual currency markets would develop, and it placed crypto in a category separate from other commodities.

Pham said the agency’s experience with virtual currency derivatives listings, along with years of market growth and the development of stronger custody practices, made the old rules incompatible with how the industry now operates.

The withdrawal allows digital assets to be regulated under the CFTC’s general, technology-neutral framework, a shift that reduces compliance burdens for exchanges seeking to list new products.

It also marks a step toward normalizing Bitcoin and Ethereum alongside traditional commodities.

The update lands at a time when U.S. regulators are moving quickly on crypto policy. Only days before scrapping the old guidance, the CFTC cleared the way for spot crypto trading to occur directly on federally regulated futures exchanges, a first for the industry.

@ CFTC approves spot crypto trading on U.S. futures exchanges, giving investors safe, regulated access to digital assets. #SpotTrading #CFTC https://t.co/S30HuwWjGX

— Cryptonews.com (@cryptonews) December 4, 2025

Acting Chair Caroline Pham called the move a major shift, saying it brings spot trading onto platforms that have operated under federal rules for decades.

It also forces leveraged retail crypto trades, previously stuck in a gray zone, onto exchanges that already follow strict market protections.

The move comes after months of coordination with other agencies, including the SEC. Earlier this year, both regulators confirmed that registered exchanges under either agency could support certain spot crypto products.

— Cryptonews.com (@cryptonews) September 3, 2025

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products.#SpotCrypto #SEC #CFTChttps://t.co/5C5uy800Ju

CFTC Advances Crypto Sprint With New Tokenized Collateral Pilot

These moves are part of a wider effort tied to the CFTC’s “Crypto Sprint,” a program examining tokenized collateral, stablecoin use in derivatives markets, and ways to modernize clearing and settlement rules through blockchain systems.

The agency has already begun testing some of these ideas in practice. On December 8, it launched a pilot program that allows Bitcoin, Ether, and USDC to be used as collateral in derivatives markets, giving the agency real-time insight into how tokenized assets behave under regulated conditions.

— Cryptonews.com (@cryptonews) December 9, 2025

The US @CFTC has launched a pilot allowing Bitcoin, Ether and USDC to serve as collateral in derivatives markets, marking a major step toward regulated crypto integration.#CFTC #Tokenization https://t.co/XrmdLTamP7

For the first three months of the pilot, futures commission merchants can only accept those three digital assets and must submit weekly reports on their holdings, a structure the agency says will help it monitor risk while still expanding access to new tools.

The CFTC’s divisions have also issued guidance confirming that tokenized real-world assets, such as U.S. Treasuries and money market funds, can be evaluated within the existing regulatory framework.

To ease the transition, the agency granted no-action relief to firms that want to accept certain non-securities digital assets as customer margin.

Pham has emphasized that the goal is to give U.S. traders safer alternatives to offshore platforms after years of high-profile failures and losses.

The shift is unfolding as the agency undergoes its own leadership transition. Pham has been serving as acting chair since January and is expected to step down once the Senate confirms President Donald Trump’s nominee, Michael Selig.

The post CFTC Scraps ‘Outdated’ Bitcoin Guidance – What This Means for Future Regulation appeared first on Cryptonews.

More than 70% of traders who bought into Kanye West’s Solana-based memecoin YZY ended up in the red, according to

More than 70% of traders who bought into Kanye West’s Solana-based memecoin YZY ended up in the red, according to

(@aeyakovenko)

(@aeyakovenko)

OCC head Jonathan Gould said that crypto firms seeking federal bank charters should be evaluated on par with traditional financial firms.

OCC head Jonathan Gould said that crypto firms seeking federal bank charters should be evaluated on par with traditional financial firms. Strike CEO

Strike CEO

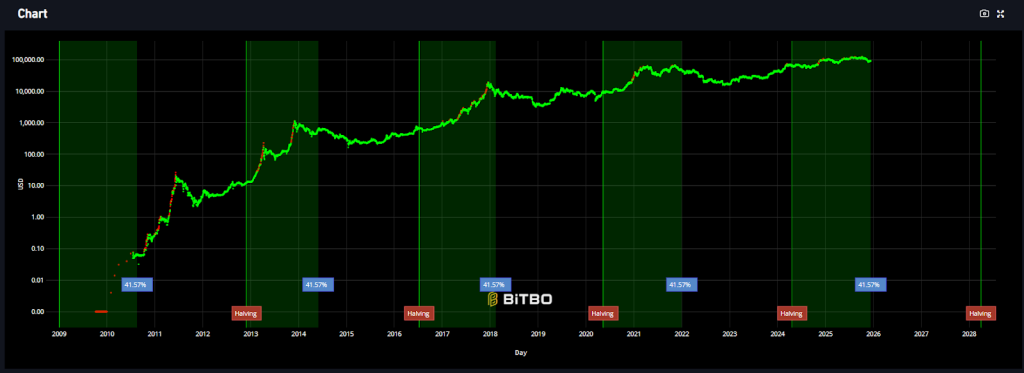

Once a reliable pattern, the four-year Bitcoin cycle may no longer hold. Here’s what changed, and why it matters now more than ever.

Once a reliable pattern, the four-year Bitcoin cycle may no longer hold. Here’s what changed, and why it matters now more than ever.

Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.

Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.

金融審議会「暗号資産制度に関するワーキング・グループ」報告書を公表しました。

金融審議会「暗号資産制度に関するワーキング・グループ」報告書を公表しました。 Japan plans to classify crypto as financial products under insider rules, cut profit taxes and tighten disclosure on 105 listed assets.

Japan plans to classify crypto as financial products under insider rules, cut profit taxes and tighten disclosure on 105 listed assets. Japan intends to require crypto exchanges to hold reserves to cover customer losses, tightening safeguards against hacks and operational failures.

Japan intends to require crypto exchanges to hold reserves to cover customer losses, tightening safeguards against hacks and operational failures.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026. Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

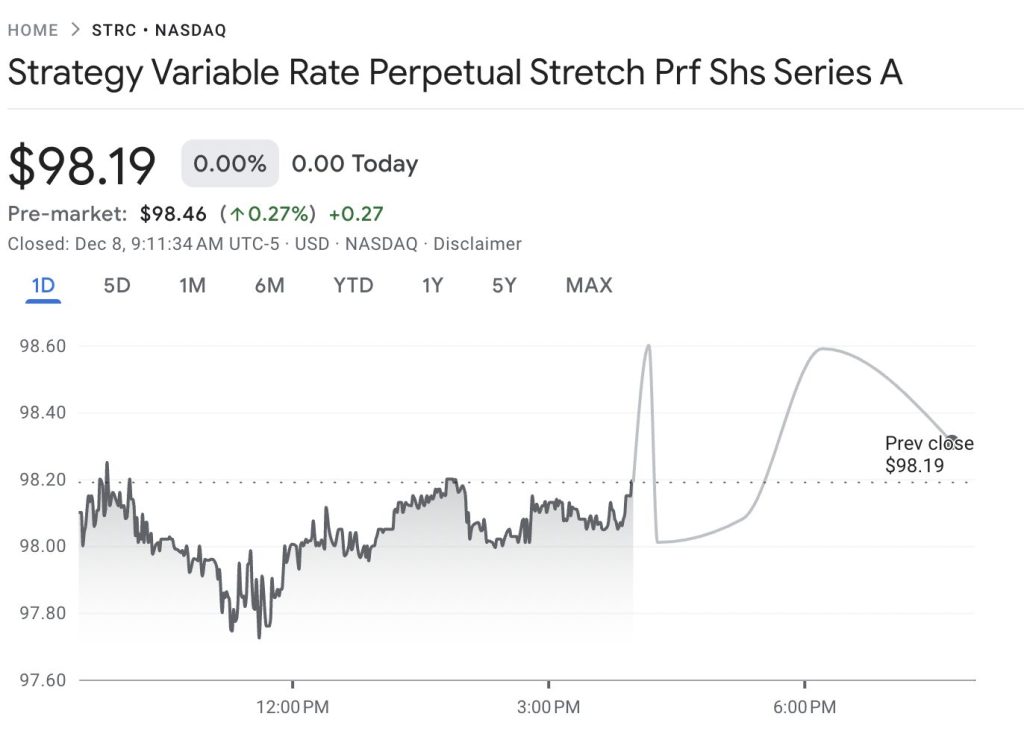

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

,

,  ) (@jp_mullin888)

) (@jp_mullin888)

The

The  Ondo opens tokenized U.S. stocks and ETFs to global users via Ethereum, with real-time pricing and DeFi compatibility built in.

Ondo opens tokenized U.S. stocks and ETFs to global users via Ethereum, with real-time pricing and DeFi compatibility built in.

Canada’s financial intelligence agency

Canada’s financial intelligence agency

Bitcoin NYC Mayor Adams established the “nation’s first-ever” municipal office for crypto and blockchain to position the city as the global crypto hub.

Bitcoin NYC Mayor Adams established the “nation’s first-ever” municipal office for crypto and blockchain to position the city as the global crypto hub.