Coinbase Expands Native Solana Support With In‑App DEX Trading After Bridge Backlash

Coinbase has expanded its Solana integration by activating native decentralized exchange trading inside its mobile application, giving users the ability to swap Solana-based tokens directly on-chain for the first time through the platform.

The update, confirmed by Coinbase protocol specialist Andrew, allows trades to be settled in USDC alongside standard payment options such as cash, bank accounts, and debit cards.

BREAKING: @coinbase to allow users to trade all Solana tokens through a DEX , without listings

— Solana (@solana) December 11, 2025pic.twitter.com/IyQ5IXHGgR

It follows the company’s August rollout of DEX support for Base-network assets and fulfills its earlier promise to bring Solana into the lineup before the end of the year.

Solana Becomes Core to Coinbase’s Vision as On-Chain Trading Surges

The move arrives at a time when Coinbase is pushing to evolve into what it calls the “everything exchange,” a long-term plan to combine custodial and on-chain trading under one roof.

Earlier this month, the company revealed that it would acquire Vector, an on-chain trading platform built natively on Solana.

Coinbase said the deal, expected to close by year-end, will plug Vector’s infrastructure into its DEX architecture.

Vector’s tools specialize in identifying new Solana assets the moment they deploy on-chain or emerge from launchpads, a capability Coinbase believes will improve speed, liquidity, and asset discovery for retail traders.

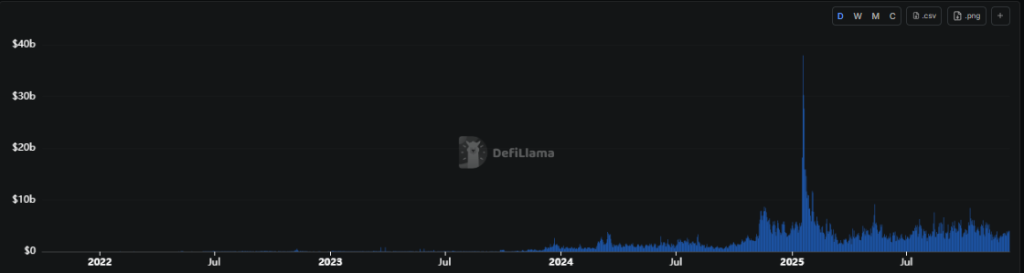

Solana’s trading environment has become one of Coinbase’s strategic focal points. Data shows that Solana DEX volume has already surpassed $1 trillion in 2025, underlining the chain’s acceleration.

A recent snapshot of the ecosystem shows more than $4 billion in 24-hour volume and nearly $94 billion over the past month

Platforms such as HumidiFi, Pump, Meteora, Raydium, Orca, and Tessera V now dominate activity, collectively accounting for more than 88 percent of daily trades.

The dataset shows that newer entrants have carved out significant market share, reshaping a space once led by Orca and Serum.

Notably, in October, Coinbase quietly expanded its on-chain features by adding DEX trading to its mobile app for U.S. users. The update lets people swap tokens directly on-chain, including assets that haven’t yet made it onto Coinbase’s main listings.

— Cryptonews.com (@cryptonews) October 9, 2025

@Coinbase has rolled out DEX trading directly within its mobile app for U.S. users, expanding the platform’s on-chain capabilities.#Coinbase #DEXhttps://t.co/rhNl9TEAuz

New York users are still blocked due to local rules. The company had been testing the feature with a smaller group of users since August before rolling it out more widely.

Solana Community Voices Friction as Coinbase Rolls Out Base–Solana Bridge

Coinbase’s decision to deepen its Solana integration comes just days after the company faced criticism within the Solana community for launching a new cross-chain bridge between Base and Solana.

The bridge, secured by Chainlink’s Cross-Chain Interoperability Protocol, went live on December 5 and is designed to let users move SPL assets into Base environments and use them inside Base-native applications.

Base lead Jesse Pollak described the product as a two-way channel intended to unlock shared liquidity.

However, Solana co-founder Anatoly Yakovenko dismissed the framing and argued that bridges act as value-capture mechanisms rather than neutral infrastructure.

The problem is that alignment is bs. @ilblackdragon is working on near intents for near, and isn’t trying to sell me alignment bs. It’s a great competitive product that pushes the industry forward. It has solana tokens on it, but the value capture is on near. Good for him.…

— toly(@aeyakovenko) December 5, 2025

He urged Base developers to move computation to Solana if they expected economic alignment.

The tension escalated as Solana Foundation members criticized the bridge’s rollout, saying it bypassed their technical and marketing teams and lacked a single Solana-based launch partner.

Jesse — we’d be happy to engage you in a genuine commercial conversation… just not a performative one with platitudes that don’t mean much.

— Akshay BD (@akshaybd) December 5, 2025

i’m sure you’ll appreciate that your past DMs (now made public), the comments from the recent panel about flipping solana, and base being…

Pollak responded by pointing to nine months of development work and said demand from builders on both sides justified the connection.

Market observers noted that Coinbase and Base had followed a similar pattern during earlier outreach to Ethereum developers.

Coinbase Doubles Down on International Expansion

The DEX expansion also arrives as Coinbase attempts to recover from declining trading volumes and mounting competition from U.S. rivals like Robinhood and Kraken.

By allowing users to hold their own assets and execute trades on-chain, the company is trying to capture demand for self-custody and reduce reliance on traditional exchange infrastructure.

Coinbase’s broader international lineup has also expanded recently. In November, the company launched Coinbase Business in Singapore, and on December 8, the exchange reopened registration in India after a two-year hiatus, with plans to restore fiat support by 2026.

The post Coinbase Expands Native Solana Support With In‑App DEX Trading After Bridge Backlash appeared first on Cryptonews.

8 Dec | 1:35pm

8 Dec | 1:35pm Mainstage, ADQ Arena

Mainstage, ADQ Arena

,

,  ) (@jp_mullin888)

) (@jp_mullin888)  Mantra lost 90% of its value in just one hour — $6B gone. No hack, no clear reason. Just “liquidations,” team silence, and big wallet moves. What really happened, and which red flags did investors ignore?

Mantra lost 90% of its value in just one hour — $6B gone. No hack, no clear reason. Just “liquidations,” team silence, and big wallet moves. What really happened, and which red flags did investors ignore?

Canada’s financial intelligence agency

Canada’s financial intelligence agency