South Korea Misses Stablecoin Bill Deadline — Banks vs. Innovation Battle Heats Up

South Korea’s effort to legalize won-pegged stablecoins has hit another setback after the country’s top financial regulator missed a government-imposed deadline, exposing a deepening power struggle between financial authorities over who should control the next phase of digital finance.

Earlier this month, the ruling Democratic Party asked the Financial Services Commission to submit a draft stablecoin bill by December 10, fulfilling President Lee’s campaign pledge to create a legal framework for digital assets.

— Cryptonews.com (@cryptonews) December 1, 2025

South Korea pushes for draft stablecoin bill by Dec. 10 deadline as lawmakers threaten independent action if FSC misses target. #SouthKorea #Stablecoinhttps://t.co/dLzvS4qax1

That deadline passed without a submission.

Stablecoin Disagreement Holds Up South Korea’s Crypto Bill

The South Korean media outlet Newsis reported that FSC later confirmed it was unable to deliver the proposal on time, saying it needed additional coordination with other agencies.

A spokesperson said the regulator would instead release the government’s position publicly alongside its formal submission to the National Assembly, citing the public’s right to understand the framework being proposed.

The FSC said it is preparing a draft tentatively titled the Basic Digital Asset Act, also described as Phase Two of South Korea’s virtual asset legislation.

Officials expect the proposal to be released later this month or early next month, ahead of a consolidated bill the ruling party has pledged to introduce in January 2026 under President Lee Jae-myung’s election commitments.

Behind the delay is an unresolved dispute between the FSC and the Bank of Korea over who should lead stablecoin issuance.

The central bank has argued that stablecoins function similarly to currency and deposit-like instruments and should therefore remain under bank control.

It has pushed for a rule requiring domestic banks to hold at least a 51% stake in any stablecoin-issuing entity, along with inspection powers and veto authority over approvals.

The FSC has resisted that approach, pointing to overseas models, noting that most issuers under the European Union’s MiCA framework are non-bank digital asset firms and that Japan’s first yen-linked stablecoin was issued by a fintech company.

FSC officials have said bank-led issuance lacks global precedent and could limit participation by technology firms that already operate digital payment infrastructure.

Negotiations between the FSC and the BOK remain ongoing. Officials familiar with the talks say a compromise may involve flexible ownership thresholds based on business scope, though no agreement has been confirmed.

The disagreement has stalled coordination long enough for lawmakers to begin reviewing multiple competing drafts at the National Assembly’s Political Affairs Committee.

Delays in Stablecoin Rules Raise Fears South Korea Is Falling Behind

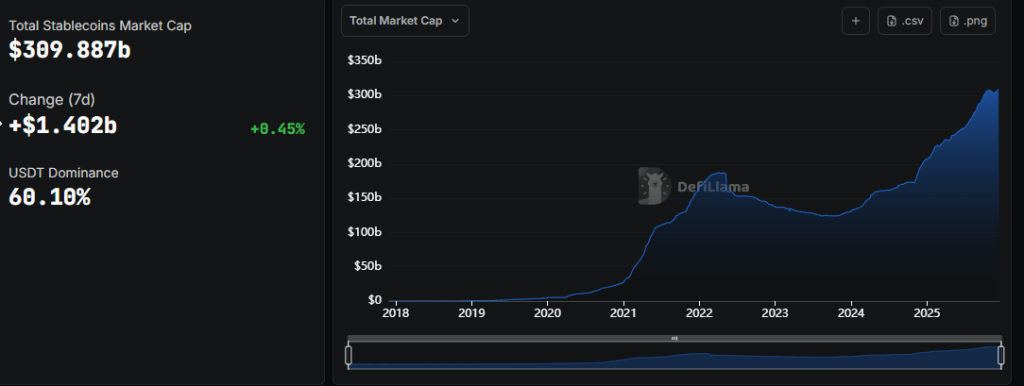

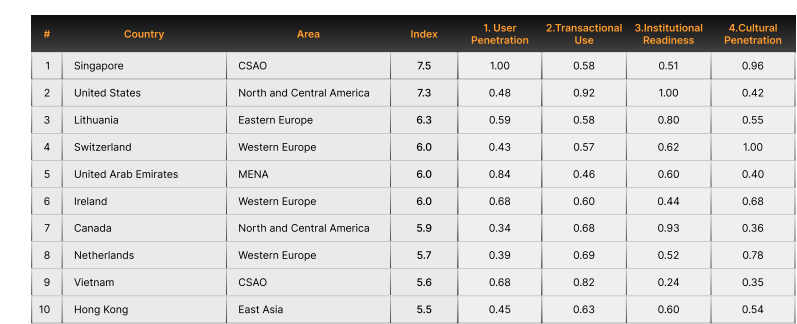

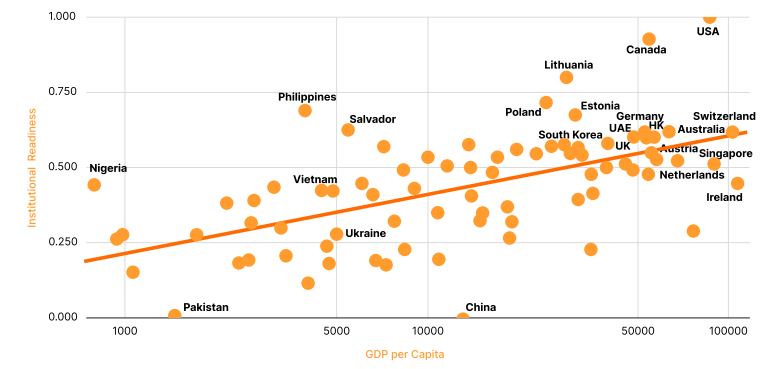

Industry groups have warned that continued delays risk leaving South Korea behind jurisdictions such as the United States, the European Union, and Japan, all of which have already established stablecoin rules.

Domestic stablecoin issuance remain illegal in South Korea, even as companies prepare infrastructure behind the scenes.

Naver Financial has developed a blockchain wallet for Busan’s local currency program, while KakaoBank has begun work on a KRW-denominated digital token. Major banks have also explored a joint stablecoin project targeting late 2025 or early 2026.

— Cryptonews.com (@cryptonews) November 25, 2025

Naver Financial, the fintech arm of South Korean internet giant Naver, is preparing to roll out a stablecoin wallet in Busan.#SouthKorea #Cryptohttps://t.co/40QBNaXJ9C

Regulatory urgency has been heightened by recent enforcement challenges. In December, Korean authorities disclosed that Binance froze only a small portion of funds stolen during last month’s Upbit hack, despite urgent requests from police and the exchange.

— Cryptonews.com (@cryptonews) December 12, 2025

Korean authorities say @Binance froze only a small portion of the crypto stolen during last month’s @Official_Upbit hack.#SouthKorea #Binancehttps://t.co/o5VVQN9tYp

Investigators said hackers rapidly laundered assets across chains and wallets, highlighting the difficulty of coordinating responses without clearer oversight frameworks.

Experts said the incident shows the need for faster, more structured controls as digital-asset activity expands.

South Korea’s stablecoin debate is also unfolding against a backdrop of delayed crypto policy more broadly. The country’s virtual asset tax regime, approved in 2020, has been postponed several times and is now scheduled for 2027.

The post South Korea Misses Stablecoin Bill Deadline — Banks vs. Innovation Battle Heats Up appeared first on Cryptonews.

Credit card giant

Credit card giant

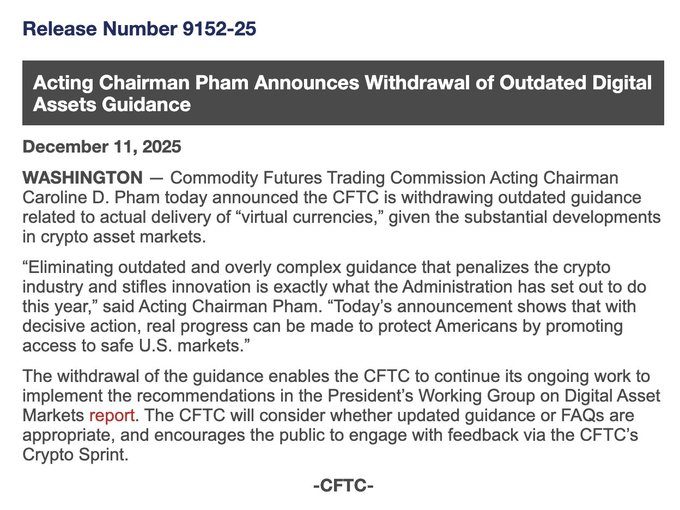

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products.

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products. The US

The US

More than 70% of traders who bought into Kanye West’s Solana-based memecoin YZY ended up in the red, according to

More than 70% of traders who bought into Kanye West’s Solana-based memecoin YZY ended up in the red, according to

(@aeyakovenko)

(@aeyakovenko)

OCC head Jonathan Gould said that crypto firms seeking federal bank charters should be evaluated on par with traditional financial firms.

OCC head Jonathan Gould said that crypto firms seeking federal bank charters should be evaluated on par with traditional financial firms. Strike CEO

Strike CEO

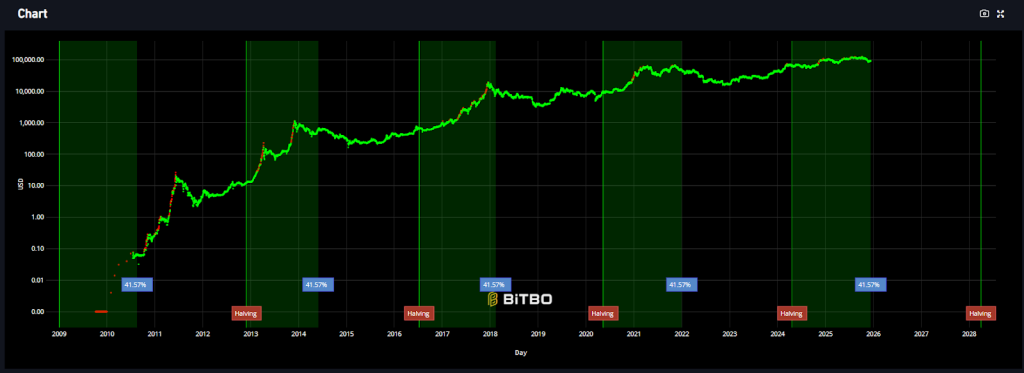

Once a reliable pattern, the four-year Bitcoin cycle may no longer hold. Here’s what changed, and why it matters now more than ever.

Once a reliable pattern, the four-year Bitcoin cycle may no longer hold. Here’s what changed, and why it matters now more than ever.

Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.

Glassnode analysis suggests Bitcoin's 4-year cycle remains intact despite institutional adoption challenging "cycle death" narrative.

金融審議会「暗号資産制度に関するワーキング・グループ」報告書を公表しました。

金融審議会「暗号資産制度に関するワーキング・グループ」報告書を公表しました。 Japan plans to classify crypto as financial products under insider rules, cut profit taxes and tighten disclosure on 105 listed assets.

Japan plans to classify crypto as financial products under insider rules, cut profit taxes and tighten disclosure on 105 listed assets. Japan intends to require crypto exchanges to hold reserves to cover customer losses, tightening safeguards against hacks and operational failures.

Japan intends to require crypto exchanges to hold reserves to cover customer losses, tightening safeguards against hacks and operational failures.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026. Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

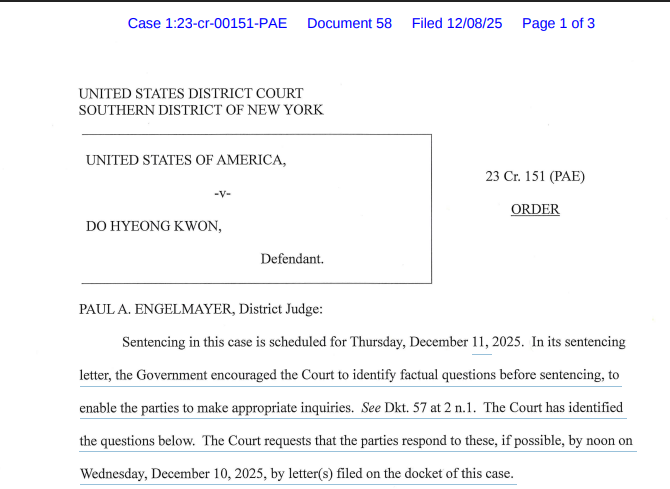

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

,

,  ) (@jp_mullin888)

) (@jp_mullin888)