Shiba Inu’s Shibarium Is In Trouble As Leading DeFi Platform Threatens Exit

Shiba Inu’s Layer-2 network, Shibarium, is facing a serious challenge after a prominent decentralized finance platform within its ecosystem publicly warned that it may abandon the chain entirely. K9 Finance DAO, a liquid staking protocol built on Shibarium, announced it has set a firm deadline to resolve outstanding issues linked to September’s bridge exploit.

The announcement, which was shared on the social media platform X, points to a breakdown in communication between ecosystem builders and the Shibarium development team. According to K9 Finance, private discussions that had been ongoing for months following the hack have now stalled, and this is why the DAO is addressing the matter publicly.

K9 Finance Brings Dispute Into the Open

In its statement, K9 Finance DAO said it had complied with every request made by the Shibarium team in the aftermath of the bridge exploit and had acted in good faith throughout the process. The DAO noted that it maintained several private communication channels with the Shib team in an effort to reach closure and ensure affected users were compensated.

That process has now reached a standstill. K9 Finance disclosed that it has received no further communication or guidance from the Shibarium team, leading it to move the discussion into the public timeline. However, this step was taken by the K9 Finance DAO to provide clarity to its holders and uphold responsible governance, not to provoke drama or controversy.

As part of its announcement, K9 Finance set January 6, 2026 as the final deadline for users impacted by the Shibarium bridge incident to be fully and verifiably made whole. If restitution is not completed by that date, the DAO says it will convene and vote on its future relationship with Shibarium, including whether continuing to operate on the chain makes sense for the long-term health of the K9 ecosystem.

K9 Finance is a decentralized finance protocol built on Shibarium that focuses on liquid staking within the Shiba Inu ecosystem. The platform operates as a decentralized autonomous organization, with governance decisions made by token holders through the K9 Finance DAO.

K9 Finance is one of the most visible DeFi platforms on the Shibarium chain, and its stance could influence sentiment among other builders.

The Main Issue: September’s Bridge Hack

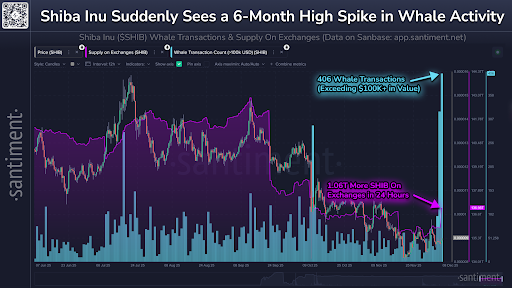

The dispute traces back to the Shibarium bridge exploit in September 2025, when attackers used a flash-loan-based strategy to drain assets from the bridge. The incident forced emergency pauses across parts of the network and security updates by the Shiba Inu team.

During that incident, roughly $4.1 million in assets, including ETH, SHIB, and other tokens, were taken, and around $717,000 worth of KNINE tokens were affected. However, the stolen KNINE tokens could not be sold from the attacker’s wallet because they were frozen by K9 Finance.

Although the Shibarium team later restored network functionality and introduced additional security measures, the recent announcement shows that compensation discussions have continued behind the scenes without a final resolution.