Altcoin Season Shows Flickers As Bitcoin Tests Support Near $90,000

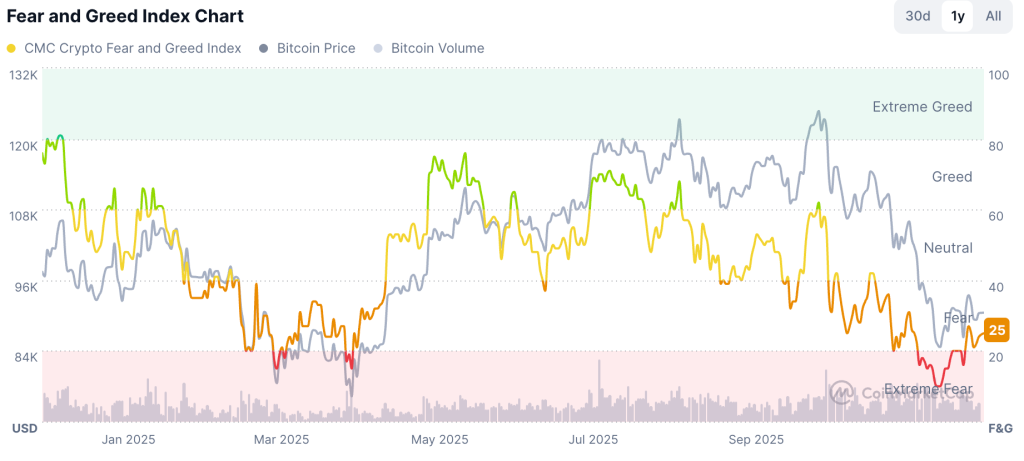

Market conditions appear steadier today, even though risk appetite has not recovered fully. The Fear and Greed Index sits at 29, down slightly from 30 yesterday but still clear of the extreme fear zone that dominated most of last week.

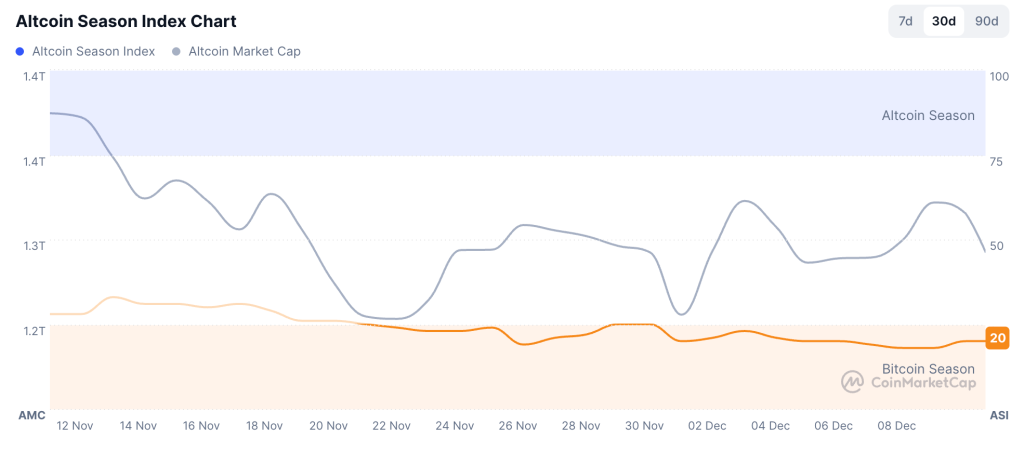

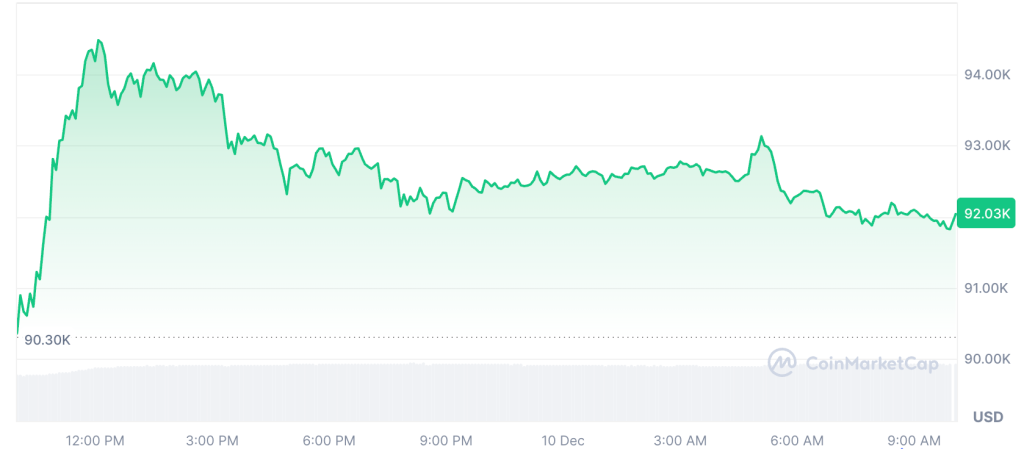

The Altcoin Season Index has climbed to 20 from 18, showing only a small improvement. Bitcoin is trading near $90,000 after slipping about 1.7% from yesterday’s levels, yet it continues to hold above the threshold that traders have treated as the main psychological line for the month.

Altcoin Season Index (Source: CoinMarketCap)

The absence of sharp losses across major tokens and the presence of steady gains in several mid-cap names suggest that traders remain cautious but active. It is not a pivot toward a wide rally, though it offers a clearer read on where liquidity concentrates when conditions ease slightly.

MYX Finance Edges Higher With Firm Turnover

MYX Finance (MYX) is trading around $3.10, up by about 6% in 24 hours. Volumes remain above its recent baseline, and order books still show tight ranges across venues. The project continues to benefit from interest in liquid restaking strategies and from consistent engagement within its own community.

Current flows look less driven by headlines and more by a pattern of rotation into assets that maintain liquidity even when conditions soften. That places MYX among the few tokens that can hold modest upward movement during quieter sessions.

Tezos Shows Small Lift On Development Steadiness

Tezos (XTZ) is now trading near $0.51, up by roughly 3.4%. The token has not produced any major announcements in recent days, but its long-running emphasis on regular upgrades and predictable development cycles has helped maintain a stable user base.

The Tezos ecosystem is built by the community.

— Tezos (@tezos) December 10, 2025

Builders, artists, bakers, collectors… All in one place. pic.twitter.com/XMl3w26VJO

Activity across staking and smart contract deployments has held steady through the recent pullback, which supports the view that XTZ tracks network involvement more closely than speculative surges. Today’s move fits that pattern of limited but reliable upside during calmer trading periods.

UNUS SED LEO Maintains Its Defensive Profile

UNUS SED LEO (LEO) is trading around $9.40, up by about 1.4%. The token is known for its defensive behavior during uncertain stretches since a large share of its trading occurs within venues that already interact heavily with it.

Volumes remain consistent rather than explosive, and the move today aligns with its historical tendency to rise modestly when broader volatility eases. Market screens show fewer abrupt swings in its pairs compared with many large caps, which shows its role as a lower velocity asset during consolidation phases.

What These Moves Say About Altcoin Season

The combination of MYX Finance, Tezos, and UNUS SED LEO inching higher while indices remain in the fear zone points to an environment defined by selectivity rather than momentum.

Bitcoin’s hold above $90,000 limits pressure on the rest of the market, yet the absence of strong inflows keeps the altcoin season distant. Even so, the persistence of small but steady gains suggests that capital has not retreated fully and continues to search for tokens that carry clear liquidity or stable network participation.

These conditions do not generate a broad rally, yet they show that the market can stabilize after deep fear. If sentiment holds near current levels and Bitcoin avoids large swings, pockets of altcoin activity may continue to form even without a decisive shift toward risk-taking.

The post Altcoin Season Shows Flickers As Bitcoin Tests Support Near $90,000 appeared first on Cryptonews.

Nansen launches

Nansen launches

8 Dec | 1:35pm

8 Dec | 1:35pm Mainstage, ADQ Arena

Mainstage, ADQ Arena