SEC Chair Touts Crypto-Led Shift To On-Chain Finance

SEC Chair Paul Atkins is leaning into a message that would’ve sounded borderline heretical in Washington not that long ago: the rails are changing, and crypto-native infrastructure is going to be part of it.

“As I told @MariaBartiromo last week, US financial markets are poised to move on-chain,” Atkins wrote on X late Thursday, adding that the SEC is “prioritizing innovation and embracing new technologies to enable this on-chain future, while continuing to protect investors.”

Crypto Will Put The Future Of Finance On-Chain

Atkins didn’t leave it at vibes. Earlier in the day, Atkins pointed to a staff no-action letter out of the SEC’s Division of Trading and Markets tied to the Depository Trust Company’s (DTC) voluntary tokenization effort — a pilot that effectively gives the plumbing of US securities settlement a carve-out to experiment without immediately tripping over parts of the Exchange Act rulebook.

“Today, the Division of Trading and Markets issued a no-action letter to the Depository Trust Company (DTC) regarding DTC’s voluntary securities tokenization pilot program. DTC’s initiative marks an important step towards on-chain capital markets,” Atkins shared via X.

The letter dated Dec. 11 describes a “pilot version” of what it calls DTCC Tokenization Services — a preliminary, time-limited program that lets DTC participants elect to have certain security entitlements recorded using distributed ledger tech instead of relying solely on DTC’s centralized ledger.

In plain English: eligible participants can tokenize positions, hold them in registered wallets on approved blockchains, and transfer those tokenized entitlements directly to another participant’s registered wallet — with DTC’s official records still serving as the system of record for what’s real.

Atkins added: “On-chain markets will bring greater predictability, transparency, and efficiency for investors. DTC’s participants will now be allowed to transfer tokenized securities directly to the registered wallets of other participants, which will be tracked by DTC’s official records.I’m excited to see the benefits of this program to our financial markets and will continue to encourage market participants to innovate as we move towards on-chain settlement.”

Notably, the no-action relief itself is narrowly scoped: it’s centered on how the pilot interacts with Reg SCI, Section 19(b)/Rule 19b-4, and certain clearing-agency standards — and it’s structured to sunset three years after launch of the preliminary version, with DTC required to notify staff when that launch happens. So this isn’t “tokenized stocks for everyone next week.” It’s closer to a supervised sandbox with reporting hooks.

Notably, Atkins is already pitching what comes next. “But this is just the beginning,” he wrote, saying he wants the SEC to consider an “innovation exemption” that would let market participants begin transitioning on-chain “without being burdened by cumbersome regulatory requirements.”

That line is doing a lot of work, and it’s also where the fight (or at least the lobbying) is likely to concentrate. What qualifies as “innovation”? Who gets exempted, and from which obligations? And what’s the gating factor — investor protection, market integrity, operational resilience, or just politics?

Crypto watchers noticed the tone shift immediately. CryptoQuant CEO Ki Young Ju summed it up in one sentence: “SEC Chairman: The future of finance is on-chain.”

For now, the tangible takeaway is the DTC pilot: a regulated core market utility experimenting with tokenized representations under staff comfort. The rest — the “on-chain future” language, and the exemption talk — is the part that could either become a framework or just another ambitious headline that runs into the realities of US market structure.

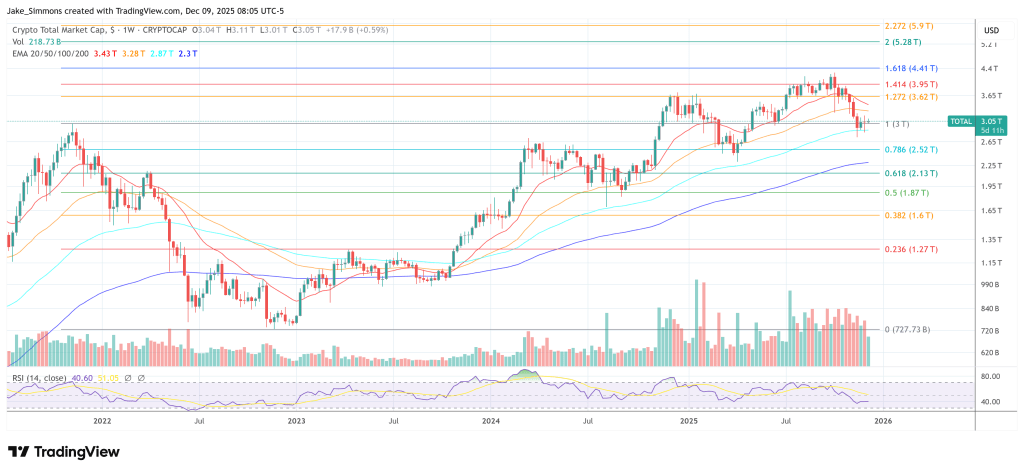

At press time, the total crypto market cap stood at $3.1 trillion.

(@JasonYanowitz)

(@JasonYanowitz)