“Our Staffs Are Exhausted”: Senator Lummis Pushes for Crypto Market Structure Markup Next Week

Senator Cynthia Lummis said she wants the Senate Banking Committee to move ahead with a markup of the long-delayed crypto market structure bill as early as next week, showing that negotiations in Washington have reached another pressure point.

Speaking at the Blockchain Association Policy Summit on Tuesday, Lummis said she hoped the Responsible Financial Innovation Act, the committee’s version of market structure legislation, would be ready for a formal markup before Congress leaves for the holidays.

Lummis said the industry had begun to worry about the pace of progress, noting that bipartisan drafts had been rewritten repeatedly in recent weeks.

She described a process that has strained both Republican and Democratic staff members, adding that the constant revisions were no longer sustainable.

“Our staffs are exhausted,” she said, explaining that she and Senator Kirsten Gillibrand wanted to present a draft by the end of this week, circulate it to industry and lawmakers, and then bring the bill to a markup next week.

A markup hearing would allow senators to amend the legislation before sending it to the full Senate. Also, Lummis said in September that she expected the bill to be signed into law by 2026.

Crypto Bill Stalls in Senate as Lawmakers Restart Negotiations

Her push comes after the House passed its own bill, the Digital Asset Market Clarity Act of 2025, in July. Since then, it has been waiting in the Senate for the next round of action.

— Cryptonews.com (@cryptonews) July 16, 2025

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.#GeniusAct #Trumphttps://t.co/Lm2tCBbimp

The House legislation, formally introduced in May by Chairman French Hill, gives the Commodity Futures Trading Commission primary oversight of digital commodities while preserving the Securities and Exchange Commission’s authority over fundraising and token issuance.

The Senate Banking Committee has been developing its own version of a market structure framework, but progress stalled after the record-setting government shutdown and disagreements over how decentralized finance should be regulated.

— Cryptonews.com (@cryptonews) November 11, 2025

Senate introduces new Crypto Market Structure Bill draft to expand @CFTC authority over digital commodities like $BTC and $ETH.

#ClarityAct #CFTChttps://t.co/qKO9rR7aYs

Although senators released a discussion draft in July, the shutdown and the backlog that followed pushed talks deeper into the fall.

A report from Politico on Monday indicated that bipartisan negotiations had picked up again, with plans to hold a markup in December. That aligns with Senator Cynthia Lummis’ push to keep the timeline on track.

However, not everyone is pleased with how slow things have been moving. At the same policy event on Monday, Senator Bernie Moreno said the process had become “decently frustrating,” adding that he would rather see no bill at all than one that leaves major regulatory gaps untouched.

— Cryptonews.com (@cryptonews) December 9, 2025

Sen. Moreno warns U.S. lawmakers: “No deal is better than a bad deal.” U.S. crypto legislation may be delayed

#Regulation #CLARITYActhttps://t.co/Z9QlO4yiD4

He plans to meet with Democratic lawmakers this week in an effort to break the stalemate.

Lawmakers Race Clock as Crypto Bill Risks Election-Year Freeze

Earlier this year, Congress managed to push a stablecoin bill through with support from both parties, but the broader market structure package has been a far tougher lift.

One point of tension lies in how the House and Senate drafts define which tokens should not be regulated as securities.

The Senate version uses the term “ancillary assets,” while the Agriculture Committee’s proposal expands the CFTC’s authority instead. Both drafts still need markups, revisions, and formal votes before they can move forward.

There was a brief moment of optimism last week when Banking Committee Chair Tim Scott said a markup could take place on December 17 or 18.

But Senator Mark Warner suggested that wrapping everything up before the holiday recess would be difficult, noting that the White House still hadn’t provided final language on quorum and ethics rules.

The pressure to move faster is rising. Senator Thom Tillis warned that if negotiations drift into February, the bill could get stuck for the rest of the year once the election cycle takes over.

— Cryptonews.com (@cryptonews) October 28, 2025

@SenThomTillis has said Congress has until February to move the US Crypto Bill forward before election politics slow progress. #ClarityAct #USCongress #MarketStructurehttps://t.co/LwL7ZwiOje

That sense of urgency has only increased since the 43-day shutdown ended on November 13, leaving several crypto-focused bills, including the CLARITY Act, waiting for attention.

The post “Our Staffs Are Exhausted”: Senator Lummis Pushes for Crypto Market Structure Markup Next Week appeared first on Cryptonews.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026. Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

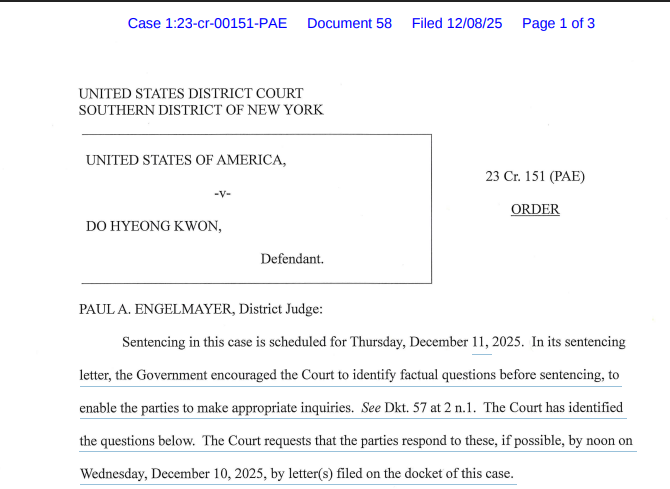

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

Strike CEO

Strike CEO

,

,  ) (@jp_mullin888)

) (@jp_mullin888)  Mantra lost 90% of its value in just one hour — $6B gone. No hack, no clear reason. Just “liquidations,” team silence, and big wallet moves. What really happened, and which red flags did investors ignore?

Mantra lost 90% of its value in just one hour — $6B gone. No hack, no clear reason. Just “liquidations,” team silence, and big wallet moves. What really happened, and which red flags did investors ignore?

Metaplanet approves the issuance of new Class B shares via a third-party allotment.

Metaplanet approves the issuance of new Class B shares via a third-party allotment.

The

The  Ondo opens tokenized U.S. stocks and ETFs to global users via Ethereum, with real-time pricing and DeFi compatibility built in.

Ondo opens tokenized U.S. stocks and ETFs to global users via Ethereum, with real-time pricing and DeFi compatibility built in. The SEC is weighing an “innovation exemption” to boost tokenization, just as the House passes a landmark stablecoin bill reshaping US crypto policy.

The SEC is weighing an “innovation exemption” to boost tokenization, just as the House passes a landmark stablecoin bill reshaping US crypto policy.

Canada’s financial intelligence agency

Canada’s financial intelligence agency

Arizona’s push to integrate digital assets into state financial infrastructure is nearing a critical milestone.

Arizona’s push to integrate digital assets into state financial infrastructure is nearing a critical milestone.  Bitcoin NYC Mayor Adams established the “nation’s first-ever” municipal office for crypto and blockchain to position the city as the global crypto hub.

Bitcoin NYC Mayor Adams established the “nation’s first-ever” municipal office for crypto and blockchain to position the city as the global crypto hub.

Russia is using cryptocurrencies to pay saboteurs carrying out hybrid attacks across the European Union, according to a Polish security official.

Russia is using cryptocurrencies to pay saboteurs carrying out hybrid attacks across the European Union, according to a Polish security official.  Poland has elected Karol Nawrocki, a conservative who says crypto should be “born in freedom, not buried in red tape.”

Poland has elected Karol Nawrocki, a conservative who says crypto should be “born in freedom, not buried in red tape.”

↓

↓

(@Gautamguptagg)

(@Gautamguptagg)  ,

,  ) (@JupiterExchange)

) (@JupiterExchange)

Thai police arrest alleged FINTOCH mastermind behind $31 million crypto Ponzi scheme that defrauded investors across multiple Asian countries.

Thai police arrest alleged FINTOCH mastermind behind $31 million crypto Ponzi scheme that defrauded investors across multiple Asian countries.

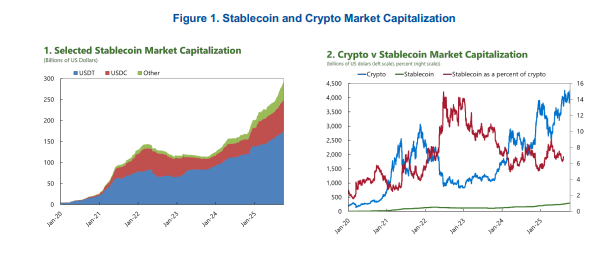

The ECB warns that stablecoins are growing fast, now topping $280B, with rising spillover risks as USDT and USDC dominate 90% of the market.

The ECB warns that stablecoins are growing fast, now topping $280B, with rising spillover risks as USDT and USDC dominate 90% of the market.

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products.

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products.

Families of the Hamas 2023 attack victims have sued Binance and CZ for facilitating $1 billion in crypto to the accounts of terror groups.

Families of the Hamas 2023 attack victims have sued Binance and CZ for facilitating $1 billion in crypto to the accounts of terror groups.