Strategy Formally Urges MSCI to Keep Digital Asset Treasury Companies on Global Indexes

Bitcoin Magazine

Strategy Formally Urges MSCI to Keep Digital Asset Treasury Companies on Global Indexes

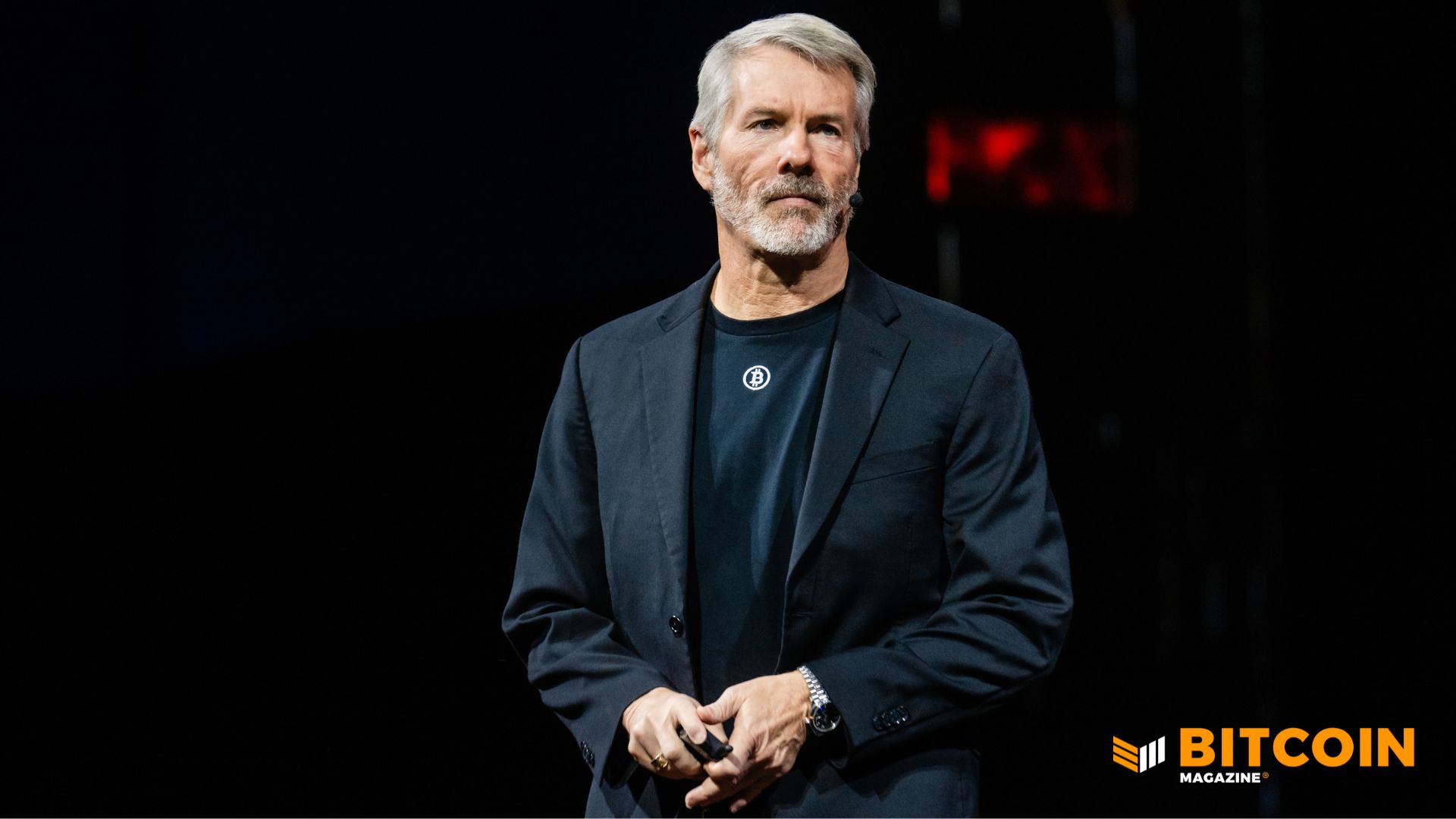

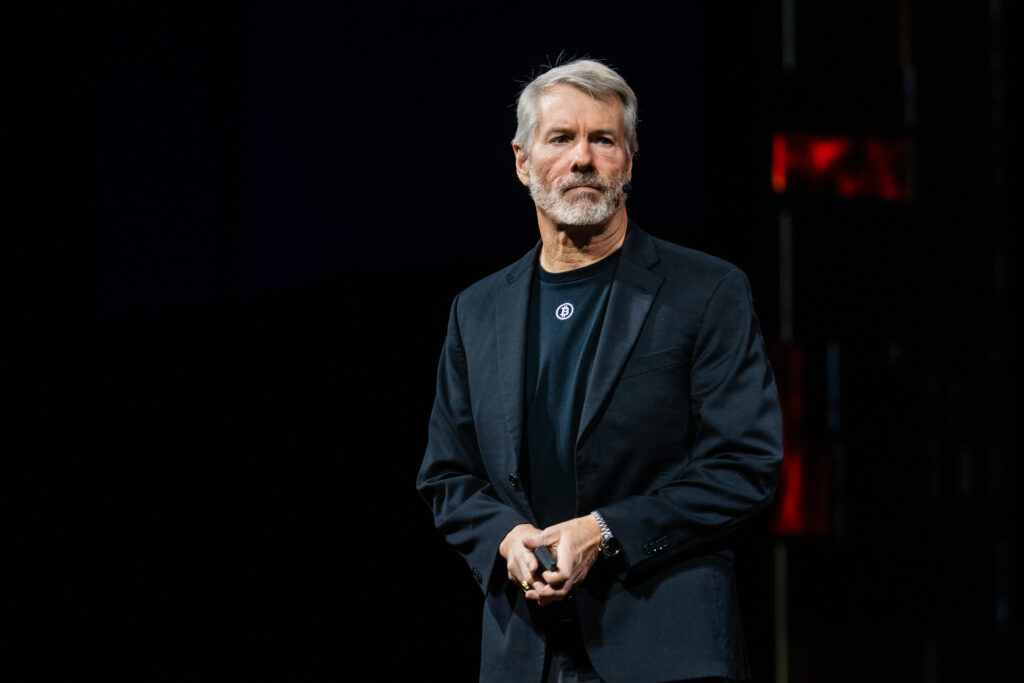

Strategy, the world’s largest Bitcoin treasury company, has submitted a formal response to MSCI’s consultation on digital asset treasury companies (DATs), urging the index provider not to exclude companies whose digital asset holdings exceed 50% of total assets.

In its detailed letter to the MSCI Equity Index Committee, Strategy argued that the proposed threshold is “misguided” and would have “profoundly harmful consequences” for both investors and the broader digital asset industry.

Founded in 1989, the company operates as a corporate treasury and capital markets business with significant Bitcoin holdings, offering investors a range of equity and fixed-income securities backed by its digital assets.

According to the company, its model is fundamentally different from a passive investment fund. Strategy actively uses its Bitcoin reserves to generate returns for shareholders, providing novel financial instruments akin to traditional bank and insurance products.

The company emphasized that “DATs are operating companies, not investment funds,” noting that its operational flexibility allows it to adapt its business model as the technology evolves.

Strategy calls MSCI’s logic “arbitrary, and unworkable.”

Strategy criticized MSCI’s proposal for introducing a digital-asset-specific 50% threshold, calling it “discriminatory, arbitrary, and unworkable.”

The company highlighted that many traditional businesses — including oil companies, timber operators, REITs, and media firms — also maintain concentrated holdings in single asset types but are not treated as investment funds.

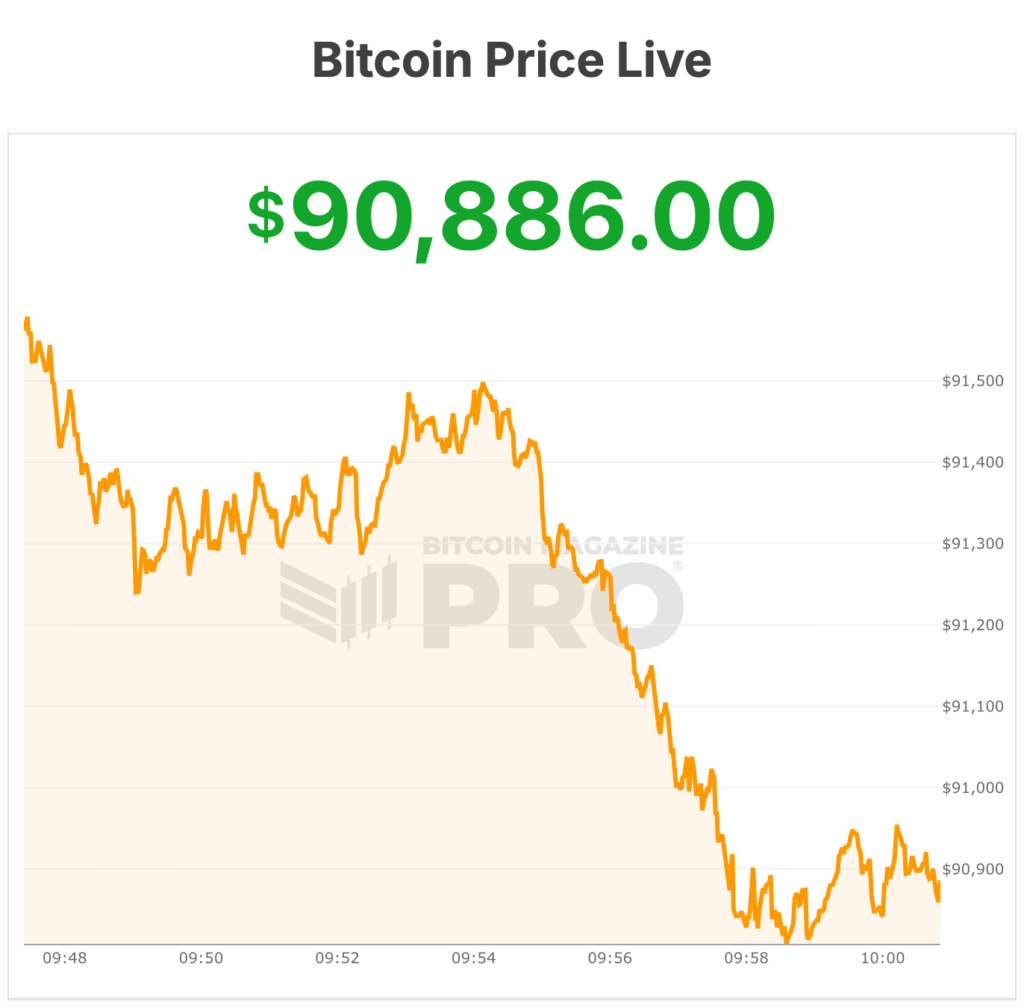

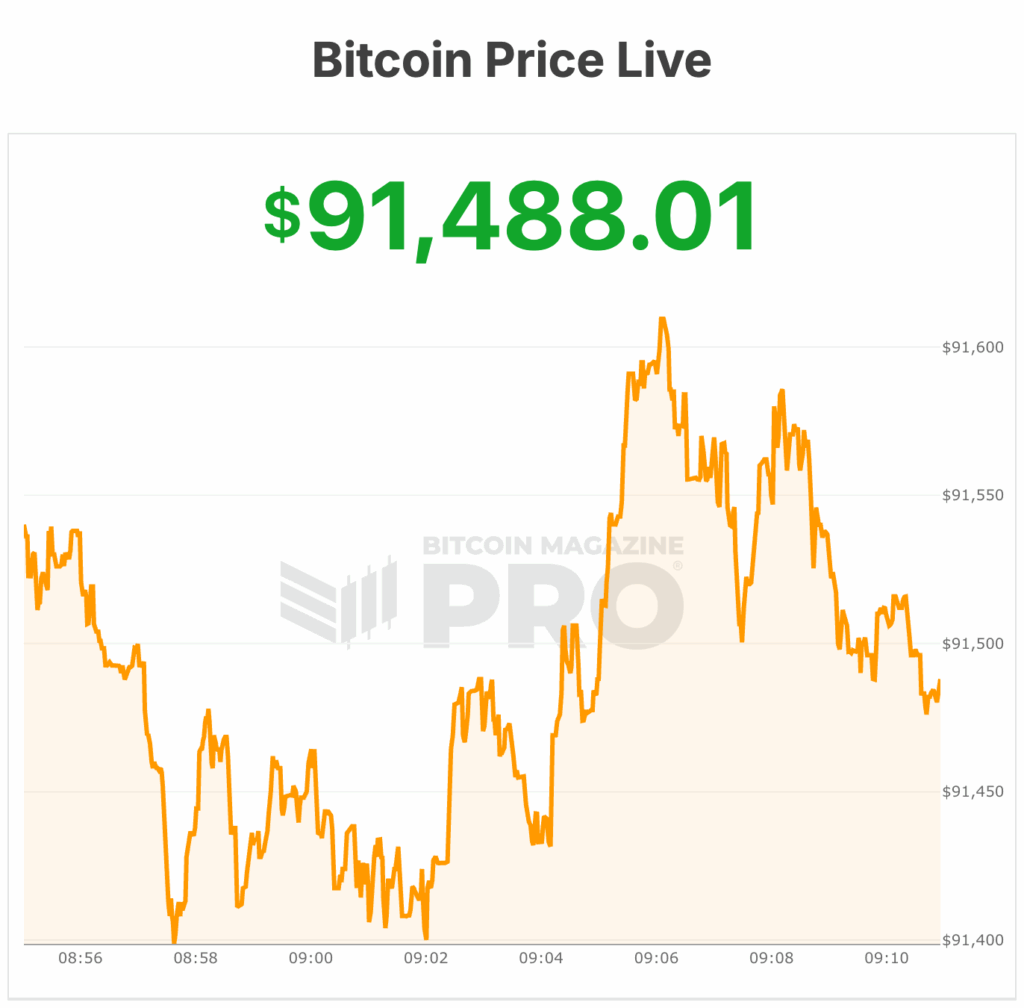

The company warned that price volatility, differing accounting standards, and asset valuation changes would create index instability, causing DATs to whipsaw in and out of MSCI’s indices.

The letter further argued that the proposal would inappropriately inject policy considerations into index construction.

“MSCI has consistently held itself out as providing indices that accurately and objectively measure market performance,” Strategy wrote.

JUST IN: Strategy officially asks MSCI to revoke its proposal to exclude #Bitcoin treasury companies like $MSTR from its indexes. pic.twitter.com/3k1RlJDZjX

— Bitcoin Magazine (@BitcoinMagazine) December 10, 2025

Excluding DATs based on the type of assets they hold, rather than the underlying business model, could compromise MSCI’s neutrality and mislead investors about how these companies operate.

Strategy noted that its investors buy exposure to the company’s management and innovation capabilities, not merely to Bitcoin itself, citing historical trading patterns in which the company’s stock often outperformed the underlying value of its digital holdings.

Strategy: Digital assets are popular in government policy

The company also framed the debate in the context of U.S. economic policy. Strategy noted that the federal government, under President Trump, has made digital assets central to national economic endeavors, including the establishment of a Strategic Bitcoin Reserve and promoting access to digital assets in retirement accounts.

Excluding DATs from MSCI indices would, the letter argued, conflict with these policies and chill innovation in a nascent sector.

Analysts cited in the letter estimate that Strategy alone could face up to $2.8 billion in stock outflows if MSCI implements the exclusion, with broader implications for the emerging digital asset economy.

Strategy positioned itself within a historical context, comparing the rise of digital asset treasuries to earlier industrial leaders.

The letter highlighted examples like Standard Oil, AT&T, Intel, and NVIDIA, noting that these companies made concentrated investments in emerging technologies that were initially viewed as risky but ultimately became foundational to economic growth.

Similarly, the letter argued, digital asset treasuries are building critical infrastructure for a new financial system.

Don’t succumb to ‘short-sightedness’

The letter concluded by urging MSCI to reject the 50% threshold, citing the risk of stifling innovation, damaging index integrity, and undermining federal strategy. Strategy recommended that MSCI allow the market to continue evolving and conduct more thorough consultation before considering any policy that would differentiate DATs from other operating companies.

The company invoked MSCI’s precedent in reorganizing the Communication Services sector after nearly two decades of industry evolution, suggesting a measured, deliberative approach.

“History shows that when foundational technologies have emerged, institutions that prospered allowed markets to test them rather than throttling them in advance,” Strategy wrote. “MSCI can either succumb to short-sightedness or allow its indices to reflect, neutrally and faithfully, the next era of financial technology.”

Elsewhere, companies like Strive and Bitcoin For Corporations also challenged MSCI’s decision.

This post Strategy Formally Urges MSCI to Keep Digital Asset Treasury Companies on Global Indexes first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Eric Trump and Donald Trump Jr. backed American Bitcoin, acquires an additional 416 BTC.

Eric Trump and Donald Trump Jr. backed American Bitcoin, acquires an additional 416 BTC.

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

Minister of State Bilal Bin Saqib says, “

Minister of State Bilal Bin Saqib says, “