Strive Lines Up $500 Million Stock Offering to Buy More Bitcoin

Bitcoin Magazine

Strive Lines Up $500 Million Stock Offering to Buy More Bitcoin

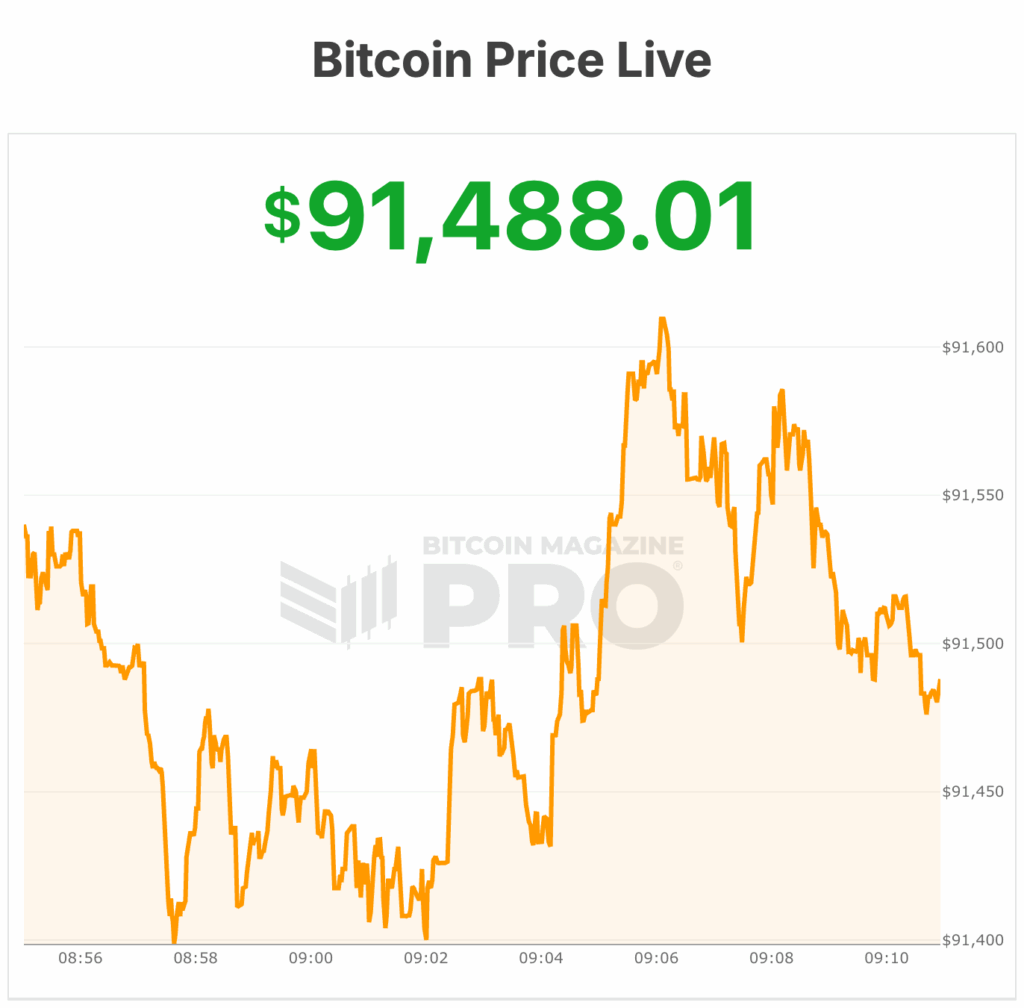

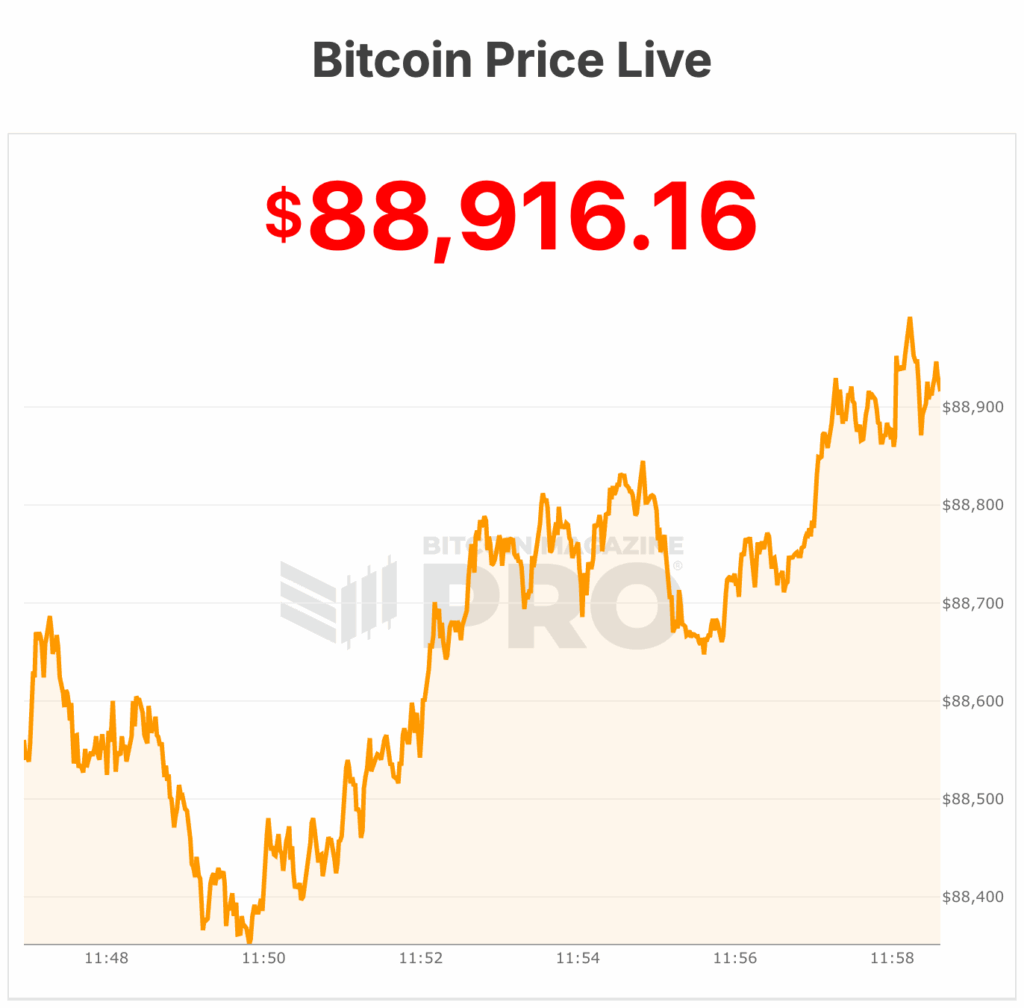

Strive, a publicly traded bitcoin treasury and asset-management firm, said it has arranged a $500 million at-the-market offering to help fund more bitcoin purchases.

The company plans to sell Variable Rate Series A Perpetual Preferred Stock, known as SATA. The offering allows Strive to issue shares into the market at prevailing prices rather than through a single sale. The structure gives the firm flexibility to raise capital as demand allows.

SATA carries a 12% dividend and an effective yield near 13%. The preferred stock is modeled on Strategy’s STRC perpetual preferred equity, which has been used as a funding tool for bitcoin accumulation.

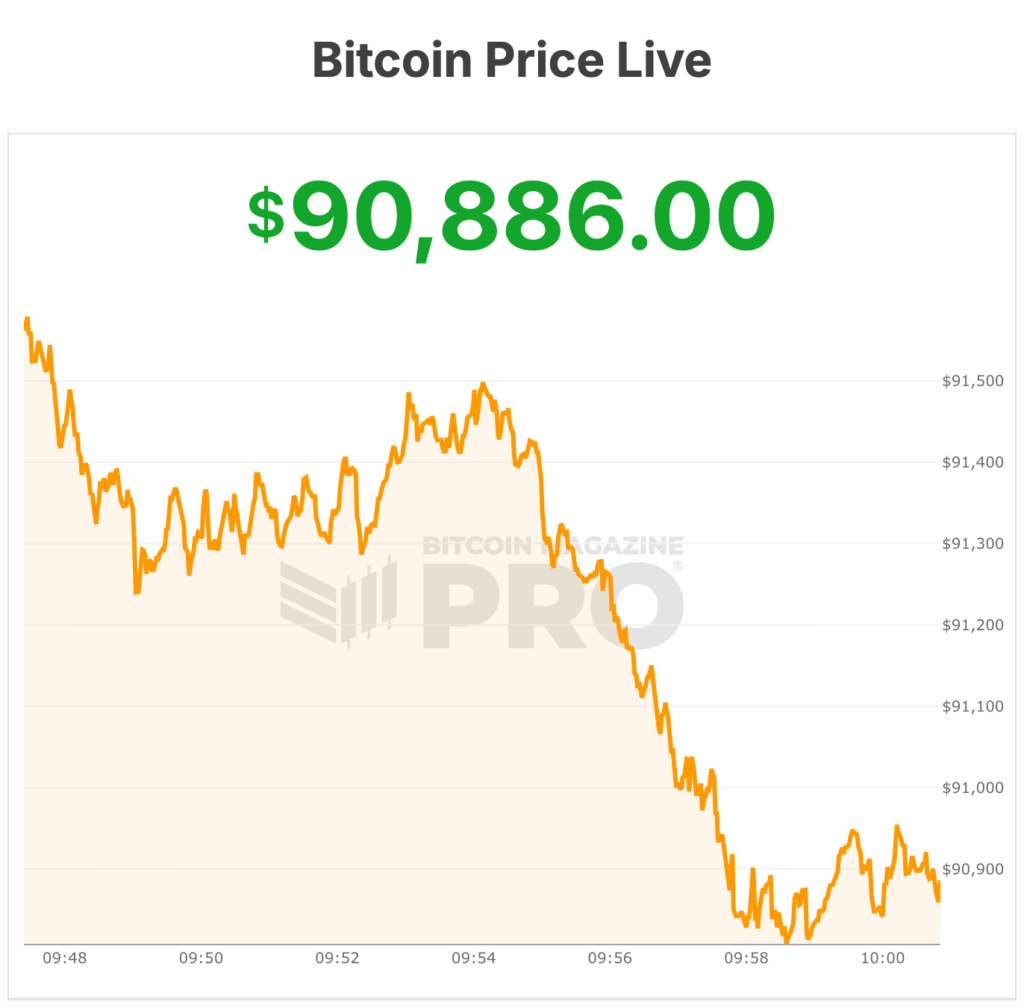

SATA currently trades around $91, below its $100 par value.

Strive said proceeds may be used for a range of purposes. These include buying bitcoin, purchasing income-generating assets, supporting working capital, repurchasing common shares, or pursuing acquisitions.

JUST IN:

— Bitcoin Magazine (@BitcoinMagazine) December 10, 2025Vivek Ramaswamy's Strive to raise $500 million to buy more #Bitcoin

Nothing stops this trainpic.twitter.com/I2ZStdFYBX

The company did not specify how much of the raise would be allocated to bitcoin purchases.

The 14th-largest corporate bitcoin holder

Strive currently holds about 7,525 bitcoin, valued at roughly $695 million at recent market prices. That positions the firm as the 14th-largest publicly traded corporate holder of bitcoin.

The company has leaned into a bitcoin-focused treasury strategy following a public reverse merger earlier this year.

The company was co-founded in 2022 by entrepreneur and political figure Vivek Ramaswamy. Since launching its first exchange-traded fund in August 2022, Strive Asset Management has grown to oversee more than $2 billion in assets, according to company disclosures.

The firm markets itself as an alternative asset manager with a focus on aligning capital with long-term investment themes.

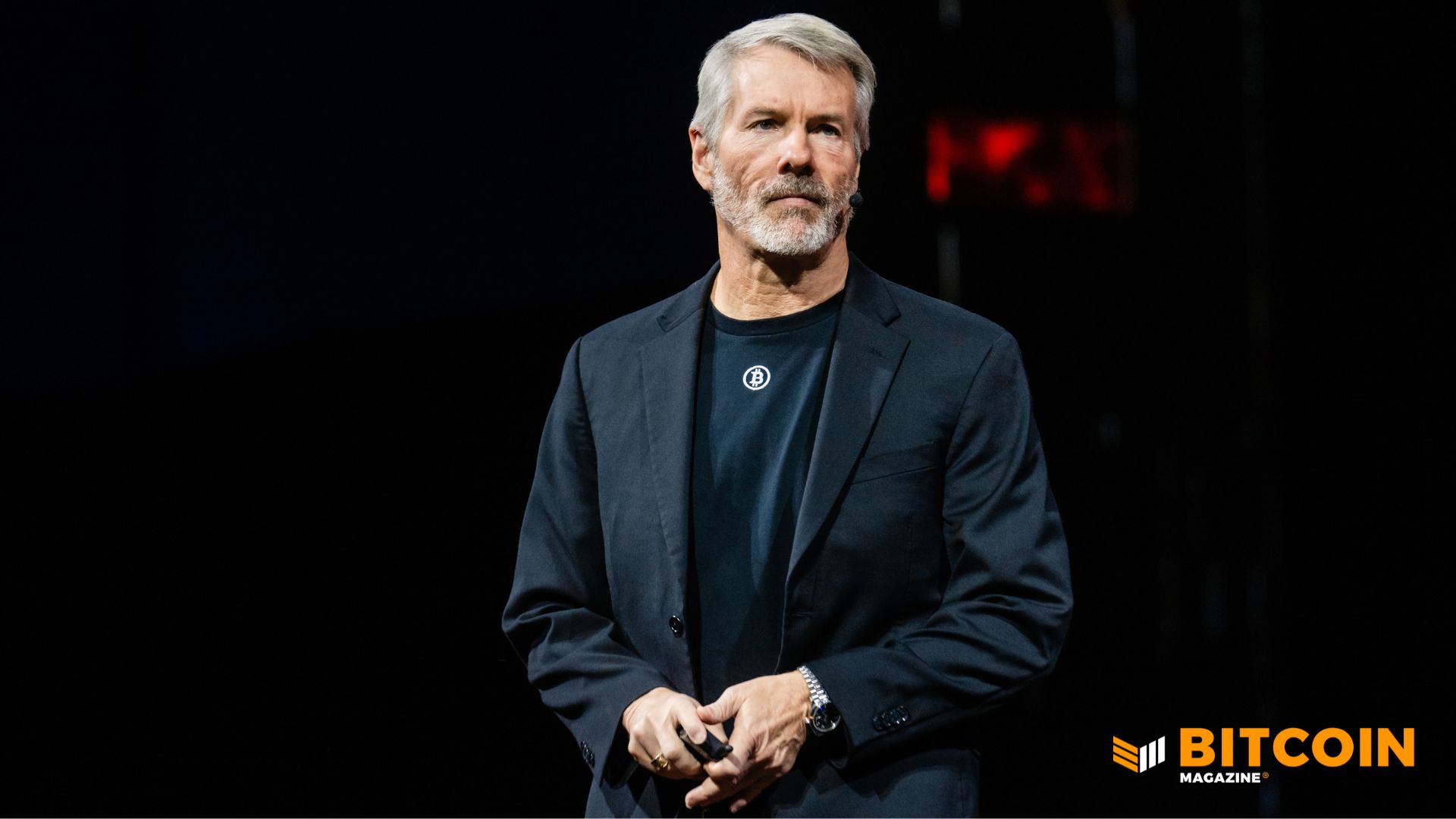

In September, Strive agreed to acquire Semler Scientific, a transaction that increased the combined entity’s bitcoin exposure. The move placed the company among a growing group of public companies that use equity markets to build large bitcoin positions, a strategy popularized by Michael Saylor’s Strategy.

Shares of its common stock, ASST, trade near $1 today.

Strive calls out MSCI on bitcoin beliefs

The company has also taken an active role in market structure debates tied to bitcoin treasury firms. Earlier this month, Strive called on index provider MSCI to avoid excluding companies with large digital asset holdings from major equity benchmarks.

MSCI is reportedly consulting investors on whether firms with balance sheets dominated by crypto assets should remain eligible for inclusion.

The company argued that such exclusions would limit investor choice and reshape capital flows across passive funds. The review could have broad implications for companies that hold bitcoin as a core treasury asset.

This post Strive Lines Up $500 Million Stock Offering to Buy More Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

Minister of State Bilal Bin Saqib says, “

Minister of State Bilal Bin Saqib says, “