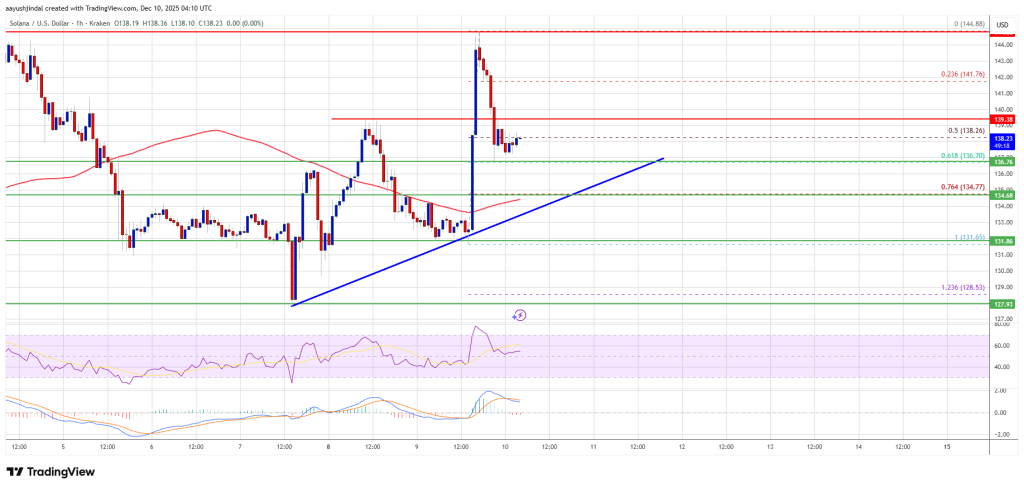

Solana (SOL) Turns Lower From Key Zone—Is Support About to Be Tested?

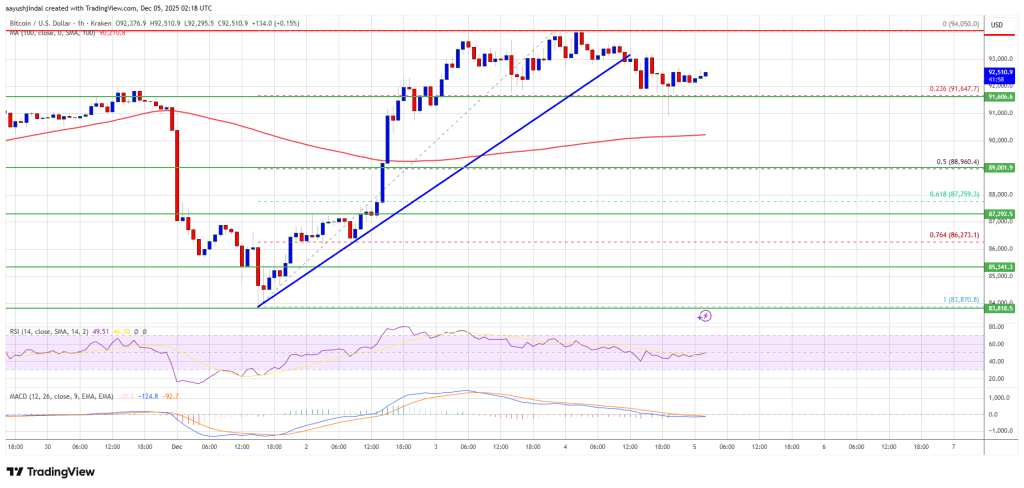

Solana failed to stay above $142 and corrected gains. SOL price is now trading below $140 and might find bids near the $135 zone.

- SOL price started a downside correction below $142 against the US Dollar.

- The price is now trading above $135 and the 100-hourly simple moving average.

- There is a bullish trend line forming with support at $135 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could extend losses if it dips below the $135 zone.

Solana Price Starts Downside Correction

Solana price failed to surpass $145 and started a downside correction, like Bitcoin and Ethereum. SOL dipped below $142 and $140 to enter a short-term bearish zone.

There was a move below the 50% Fib retracement level of the upward wave from the $131 swing low to the $145 high. However, the bulls are active near $136. There is also a bullish trend line forming with support at $135 on the hourly chart of the SOL/USD pair.

Solana is now trading above $135 and the 100-hourly simple moving average. On the upside, the price is facing resistance near the $140 level. The next major resistance is near the $145 level. The main resistance could be $148. A successful close above the $148 resistance zone could set the pace for another steady increase. The next key resistance is $155. Any more gains might send the price toward the $165 level.

More Losses In SOL?

If SOL fails to rise above the $142 resistance, it could start another decline. Initial support on the downside is near the $136 zone and the 61.8% Fib retracement level of the upward wave from the $131 swing low to the $145 high. The first major support is near the $135 level and the trend line.

A break below the $135 level might send the price toward the $132 support zone. If there is a close below the $132 support, the price could decline toward the $125 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $135 and $132.

Major Resistance Levels – $142 and $145.