Water leak in Louvre damages hundreds of books

Investors holding 1,000, 5,000, and 10,000 XRP tokens could see massive profit if the XRP price rallies in a scenario where XRP powers the global payroll industry. XRP trades at $2.18 today with a market value of about $131.8 billion.

Market participants have continued to anticipate a scenario where an XRP price spike pushes their holdings to $1 million. XRP has struggled over the past few months.

Binance has secured three new licences in Abu Dhabi, tightening its grip on one of the most ambitious digital asset hubs in the Middle East and giving the exchange a powerful regulatory base as it pushes to keep institutional money on side.

The Financial Services Regulatory Authority of Abu Dhabi Global Market has approved Binance.com to operate through a trio of regulated entities that together cover exchange, clearing and broker dealer activities.

The authorizations were granted during Abu Dhabi Finance Week and apply to Binance’s global platform, not just a regional offshoot, which is a key point for professional traders watching where the exchange can legally serve them.

Major milestone

— Binance (@binance) December 8, 2025#Binance is the first-ever digital assets trading platform to secure a full suite of licenses from FSRA under @ADGlobalMarket.

This marks a breakthrough moment that raises global standards for regulation, security, and trust.

It reflects our commitment to… pic.twitter.com/ItRofJoAOC

Under the new structure, Nest Services Limited, which will be renamed Nest Exchange Limited, has been approved as a recognized investment exchange with permission to run a multilateral trading facility. It will host Binance’s on exchange business, including spot and derivatives markets.

Nest Clearing and Custody Limited has been approved as a recognized clearing house with added custody and securities depository permissions, putting it in charge of clearing, settlement and safekeeping of digital assets.

A third entity, BCI Limited, set to become Nest Trading Limited, holds a broker dealer licence that covers dealing and arranging in investments, asset management, custody arrangements and money services, including over the counter trading and conversion.

Binance has described the package as a comprehensive regulatory framework for Binance.com and a global first for the platform. The company says the approvals give it a cleaner path into multiple markets beyond the UAE and help it present itself as a more predictable counterparty to institutions that have grown wary of loosely regulated venues after a series of blow ups.

Richard Teng, Binance’s co-chief executive and a former senior executive at Abu Dhabi Global Market, said in a statement that working under the authority’s regime reflects a commitment to compliance, transparency and user protection.

He argued that the licence brings regulatory clarity and legitimacy and allows Binance to support its global operations from Abu Dhabi while keeping a distributed operating model that taps talent around the world.

For Abu Dhabi, the deal fits neatly into a broader push to turn its oil wealth and sovereign funds into long term exposure to digital assets and financial technology. The emirate, which sits on roughly $2 trillion in sovereign wealth, has been steadily increasing its footprint in crypto.

The Abu Dhabi Investment Council, an independently run arm of Mubadala Investment, more than tripled its holding in BlackRock’s iShares Bitcoin Trust during the third quarter, taking the position to almost 8m shares as of Sept. 30, worth about $518m at the time.

Binance also has direct financial ties to the city. In March, the exchange secured a $2b investment from AI-focused investor MGX, chaired by Sheikh Tahnoon bin Zayed Al Nahyan, one of the most influential figures in the emirate’s financial and security establishment.

That backing and the new licences deepen the sense that Abu Dhabi sees Binance as a core piece of its digital finance strategy.

The exchange has not yet named a global headquarters, but Teng has previously called the UAE an attractive option. With Abu Dhabi Global Market now authorised to host Binance.com’s regulated activities from January 5, 2026, the city will remain high on the list of possible long term bases, especially as more institutional clients demand clear regulatory anchors.

The approvals come after a difficult period for Binance on the enforcement front. Founder Changpeng Zhao stepped down as chief executive in 2023 after pleading guilty to breaking US anti money laundering laws.

The company agreed to pay more than $4.3b to settle a years long US investigation. Zhao was pardoned by President Donald Trump in October this year, removing a major legal cloud for the former CEO, but regulators and counterparties still expect Binance to prove that it can operate with tighter controls.

Binance says it now has more than 300m registered users and over $125 trillion in cumulative trading volume. It argues that operating under Abu Dhabi’s rules will give both retail and institutional users stronger comfort on oversight and consumer protection as it pushes toward its long stated goal of serving 1b people.

The leadership team is shifting as the regulatory architecture firms up. Last week, Teng named Binance co founder Yi He as the company’s new co-chief executive.

He described her as a driving force since the exchange’s launch, and credited her with shaping its culture, vision and user focused approach. Her formal elevation signals that Binance wants to present a more structured leadership bench as it leans further into regulated markets.

The post Binance Gains Multiple Regulatory Approvals In Abu Dhabi, Deepening UAE Presence appeared first on Cryptonews.

10x Research says Bitcoin may look calm on the surface, but the derivatives market is flashing signs of brewing volatility. In its latest weekly report, the firm notes that options traders are buying volatility, downside skew has returned, funding rates have softened, and futures open interest is diverging, all while spot ETFs continue to see net outflows. Despite bullish macro hopes around U.S. liquidity, 10x warns that market structure remains unsupportive, suggesting traders should brace for unexpected moves in the coming 1–2 weeks. Currently, Bitcoin is trading above $91,200, 1.8% up in the last 24 hours.

But what else is happening in crypto news today? Follow our up-to-date live coverage below.

The post [LIVE] Crypto News Today: Latest Updates for Dec. 08, 2025 – Market on Edge: 10x Research Warns Bitcoin’s Range Is About to Snap appeared first on Cryptonews.

![]() Aaron Krolik / New York Times:

Aaron Krolik / New York Times:

How “cash to crypto” swaps allow users everywhere to convert national currencies to stablecoins and then debit cards, avoiding financial oversight and sanctions — Smugglers, money launderers and people facing sanctions once relied on diamonds, gold and artwork to store illicit fortunes.

MIDI controllers are easy to come by these days. Many modern keyboards have USB functionality in this regard, and there are all kinds of pads and gadgets that will spit out MIDI, too. But you might also like to build your own, like this touchscreen design from [Nick Culbertson].

The build takes advantage of a device colloquially called the Cheap Yellow Display. It consists of a 320 x 240 TFT touchscreen combined with a built-in ESP32-WROOM-32, available under the part number ESP32-2432S028R.

[Nick] took this all-in-one device and turned it into a versatile MIDI controller platform. It spits out MIDI data over Bluetooth and has lots of fun modes. There’s a straightforward keyboard, which works just like you’d expect, and a nifty beat sequencer too. There are more creative ideas, too, like the bouncing-ball Zen mode, a physics-based note generator, and an RNG mode. If you liked Electroplankton on the Nintendo DS, you’d probably dig some of these. Files are on GitHub if you want to replicate the build.

These days, off-the-shelf hardware is super capable, so you can whip up a simple MIDI controller really quickly. Video after the break.

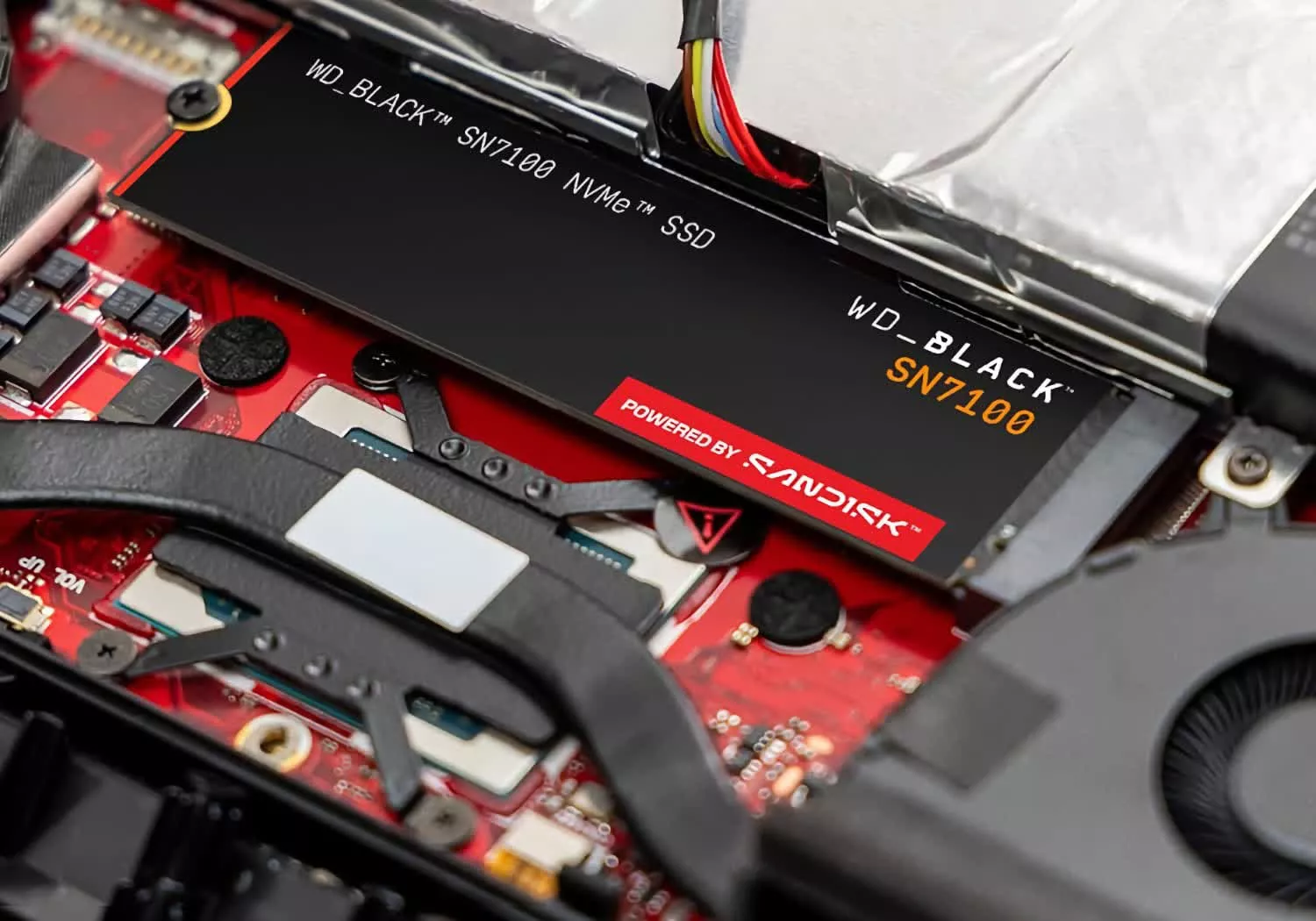

The storage market is in flux: PCIe 4.0 prices are climbing, PCIe 5.0 and USB4 are getting cheaper, and Crucial is gone. Here are the best picks for speed, capacity, and value.

After eight months in orbit, NASA astronaut Jonny Kim is about to depart the International Space Station (ISS) for the journey back to Earth. Kim will be traveling home alongside Roscosmos cosmonauts Sergey Ryzhikov and Alexey Zubritsky aboard the Soyuz MS-27 spacecraft. The undocking will take place on Monday evening ET, with the final descent happening […]

The post A NASA astronaut is about enjoy a 17,500 mph ride home. How to watch appeared first on Digital Trends.

I just finished a long trip that saw me trekking, sleeping by river beds, camping in the Himalayan foothills, living in tribal lands, and staying as far away from city landscapes as possible. It was a necessary change of pace. It was also my first extended spell where the Apple Watch wasn’t my on-wrist companion. […]

The post I used the Galaxy Watch 8 Classic for a long vacation, and it’s better than the Apple Watch appeared first on Digital Trends.

Solana started a recovery wave above the $132 zone. SOL price is now consolidating and faces hurdles near the $138 zone.

Solana price remained stable and started a decent recovery wave from $128, like Bitcoin and Ethereum. SOL was able to climb above the $130 level.

There was a move above the 23.6% Fib retracement level of the downward move from the $147 swing high to the $128 low. Besides, there was a break above a key bearish trend line with resistance at $132 on the hourly chart of the SOL/USD pair.

Solana is now trading below $138 and the 100-hourly simple moving average. On the upside, immediate resistance is near the $137 level, the 100-hourly simple moving average, and the 50% Fib retracement level of the downward move from the $147 swing high to the $128 low.

The next major resistance is near the $140 level. The main resistance could be $142. A successful close above the $142 resistance zone could set the pace for another steady increase. The next key resistance is $150. Any more gains might send the price toward the $155 level.

If SOL fails to rise above the $140 resistance, it could continue to move down. Initial support on the downside is near the $132 zone. The first major support is near the $130 level.

A break below the $130 level might send the price toward the $128 support zone. If there is a close below the $128 support, the price could decline toward the $120 zone in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $132 and $130.

Major Resistance Levels – $138 and $140.

Decentralized messengers shift security beyond encryption by reducing metadata, limiting data requests and preparing for post-quantum threats.

ZKsync says the first Ethereum zero-knowledge rollup blockchain will have an “orderly sunset” next year, as it has served its purpose.

Bitcoin is holding a critical Fibonacci support level, but analysts warned that a break could trigger losses down to April lows of $76,000.