Here Is XRP Price If 10 Fortune 500 Companies Add It to Their Balance Sheets

How could the XRP price react if the top 10 Fortune 500 companies decide to add XRP to their balance sheets? Notably, as U.S.

How could the XRP price react if the top 10 Fortune 500 companies decide to add XRP to their balance sheets? Notably, as U.S.

ExtraVod, a market commentator, recently suggested that an XRP flash crash may be imminent, but projects a possible recovery from the lows. Notably, XRP has continued to face downward pressure since hitting a peak of $2.21 on Dec.

How much would the XRP price grow if XRP's market cap appreciated by up to $1 trillion? XRP has been the subject of discussions and speculations over the past few days, especially following the launch of its first pure spot-based ETF, the Canary Capital XRP ETF (XRPC).

A widely followed early Bitcoin investor, known as NoLimit on X, has released long-term price targets for top crypto assets like XRP and Bitcoin through 2029. His projections come as Bitcoin trades at $92,370 and XRP sits at $2.09, offering a multi-year outlook amid growing expectations for the next major crypto cycle.

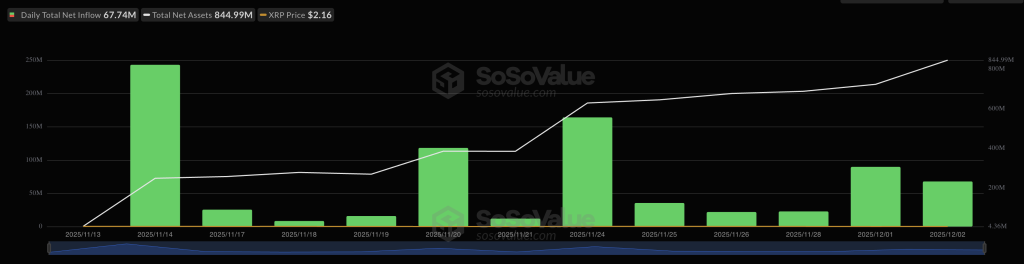

The debut of XRP ETFs has revived optimism in the market, especially as these products continue to attract large amounts of capital. For context, since their launch, the funds have pulled in roughly $666 million across 11 trading sessions.

XRP holders are increasingly eyeing the potential upside if Bitcoin were to hit the much-discussed $1 million milestone. Indeed, altcoins like XRP stand to benefit significantly from major rallies in the crypto market, thanks to institutional interest.

A well-known crypto analyst has suggested that several investors would only FOMO into XRP when the price starts surging to new highs. XRP Market Sentiment Turns Sour Dark Defender, who has always maintained a bullish stance on XRP's price, said this at a time when XRP has continued to face struggles alongside the broader crypto market.

A prominent market analyst has suggested that XRP is still not looking hot despite the recent recovery push. Notably, XRP continues to face pressure around the lower end of the $2 range, and broader market sentiment remains uneasy.

A crowd sentiment-based bullish indicator has resurfaced, with past price consequences sparking speculation of an XRP rally. Market intelligence platform Santiment brought this to the attention of XRP holders in a December 4 tweet, suggesting a similar price action would follow.

"All roads lead to Rome," analyst EGRAG says, as he suggests XRP could follow one of two paths to $27 after its triangle breakout. EGRAG presented this analysis while speaking on XRP's future prospects amid the recent market uncertainty.

An XRP community pundit stressed that XRP rarely makes small moves when its supply tightens, and current market data suggests that supply is tightening now. The Next XRP Move Market commentator XFinanceBull said this while speaking on disclosures surrounding XRP's available supply from Mullen, another community figure.

An XRP community commentator has presented what he believes could be the possible XRP price if Bitcoin hits the new target set by the Ripple CEO. Notably, the Ripple CEO Brad Garlinghouse maintained his bullish outlook for the crypto market, and specifically, for Bitcoin, when he spoke at the ongoing Binance Blockchain Week in Dubai.

XRP community figure KING VALEX has shared a bold new forecast that places XRP’s future value between $10,000 and $50,000. According to him, once XRP achieves full global institutional adoption, its price will need to rise exponentially to support global liquidity flows across major financial systems.

Net inflows to XRP exchange-traded funds (ETFs) have been positive for 11 days in a row at a point when cryptos are bouncing back strongly. This favors a bullish XRP price prediction as institutional appetite seems to be rising.

According to SoSo Value, the assets under management (AUM) held in these funds have surged to $844 million in just a couple of weeks, following the launch of multiple ETFs by Bitwise, Canary Capital, and Grayscale.

On December 1, these vehicles attracted $89 million even though the market was experiencing a strong decline.

In the past 24 hours, XRP has surged by 7% to $2.17 as the crypto market seems ready to make a comeback. Trading volumes have increased by 20% to nearly $5 billion, currently accounting for 4% of the token’s circulating market cap.

The daily chart shows that XRP is about to hit the upper bound of a descending price channel that has been forming since early October.

If the price breaks out of this setup and climbs above its 200-day exponential moving average (EMA), this would justify a bullish XRP price prediction.

The first target if that happens would be the $3.1 level, meaning a 48% upside potential based on where the price is trading today.

The Relative Strength Index (RSI) has been forming a bullish divergence, as momentum has not made a lower low, even though the price has kept dropping.

If positive ETF inflows continue, or accelerate, over the next few days, that should create a strong floor for XRP, and could result in an explosive move if bears are squeezed out of their positions.

Meanwhile, as the market recovers, the best crypto presales of this year, like Bitcoin Hyper ($HYPER), could outperform well-established tokens like XRP.

BTC holders and developers have been restrained by the network’s slow speed and high transaction costs for years.

Bitcoin Hyper ($HYPER) is here to change that by introducing the first real layer-2 chain for the top crypto using Solana’s technology.

Through the Hyper Bridge, investors will be able to maintain their assets in a designated Bitcoin wallet and receive the corresponding amount on the Hyper L2 to access a suite of DeFi applications, payment platforms, and even launchpads for meme coins.

Through these solutions, they will get the chance to stake their assets, earn yield, and more to generate passive income safely for the first time, all without leaving the Bitcoin OG blockchain.

Analysts believe that as wallets and exchanges adopt Bitcoin Hyper, the demand for its native asset, $HYPER, is expected to increase rapidly.

To buy $HYPER while it is still available at its presale price, simply head to the official Bitcoin Hyper website and link up a compatible wallet like Best Wallet.

You can either swap USDT or SOL for this token or use a bank card to

Visit the Official Bitcoin Hyper Website HereThe post XRP Price Prediction: Institutions Are Pouring In Cash Through ETFs – A Violent Move Up is Next appeared first on Cryptonews.

Maelius, an experienced market analyst, has predicted a possible XRP surge to a two-digit price, but insists this target remains conservative. Maelius' forecast comes when XRP has begun recovering from a recent downtrend that had persisted since October.

XRP has shown strength with its recent price trend, and an analyst believes this present price rebound feels different from past recoveries. Specifically, Henry expatriated on the difference in the current XRP rebound in his recent X post, following the asset’s explosive move yesterday.

XRP shows bullish momentum, but it must break key resistance on the daily chart to unlock its next upside target. Notably, XRP is trading around $2.20, extending its latest advance with a strong 24-hour performance.

A market analyst recently compared XRP to Nvidia Corporation, calling attention to the latter's impressive returns over the past 25 years. This recent comparison came from EGRAG Crypto, a well-known market technician who has remained bullish on XRP.

In a passionate message to the XRP community, prominent analyst Egrag has reaffirmed his long-term bullish forecast for XRP. He insists that double-digit price targets up to $33 remain realistic expectations, despite growing dull sentiment amid previously unrealized forecasts.

Grok, xAI's LLM chatbot, predicts XRP price if Bitcoin ever reaches the audacious $1 billion projection from a Fidelity executive. Notably, three years ago, Fidelity's Director of Global Macro, Jurrien Timmer, made one of the boldest Bitcoin price forecasts ever.