Kalshi, Robinhood, Crypto.com Hit With Connecticut Stop Order for Gambling Violations

Connecticut’s Department of Consumer Protection on Wednesday ordered Kalshi, Robinhood and Crypto.com to halt what it calls unlicensed online gambling in the state, targeting sports-style “prediction” products that regulators say are really illegal wagers.

The agency’s Gaming Division issued cease-and-desist letters to KalshiEX LLC, Robinhood Derivatives LLC and Crypto.com, accusing all three of offering sports wagers in Connecticut without a license and in violation of state gaming law.

The order covers so-called “sports event contracts” and any other form of online gambling the platforms make available to residents.

Officials Argue Prediction Markets Are Being Marketed As Investments

“Only licensed entities may offer sports wagering in the state of Connecticut,” Consumer Protection Commissioner Bryan T. Cafferelli said.

None of the three firms hold such a license in the state, he added, and even if they did, the contracts they offer would still run afoul of rules that ban wagers for anyone under 21.

— Connecticut Department of Consumer Protection (@CTDCP) December 3, 2025

Today, DCP's Gaming Division issued Cease and Desist orders to three platforms conducting unlicensed sports wagering.

Learn why Prediction Market Platforms offering "Sports Events" Contracts are illegal:https://t.co/LXLK1tRR0w

Gaming Director Kris Gilman said the firms are “deceptively advertising that their services are legal,” arguing that they operate outside the state’s regulatory perimeter and pose “a serious risk to consumers” who may not realise they have no formal protections.

“A prediction market wager is not an investment,” she said, drawing a line between trading and betting.

State Warns That Unvetted House Rules Can Lead To Unfair Payout Practices

Regulators say the products raise a series of integrity and consumer protection issues. Because the platforms are not licensed, they are not required to meet Connecticut’s technical standards for wagering systems, leaving financial and personal data more exposed in the event of failures or abuse.

The state also says there are no mandated integrity controls, such as systems to block insiders from betting on events where they have advance knowledge or influence over outcomes. By contrast, licensed operators must use controls to bar known insiders and monitor and report suspicious betting patterns.

Any regulator does not vet house rules that govern how wagers pay out, the department warned, which means customers may have little recourse if bets are settled in unexpected ways or winnings are withheld. If disputes arise, the agency says it has no clear path to recover funds for users of these unlicensed platforms.

State Says Platforms Listed Events Vulnerable To Insider Knowledge

Connecticut officials also object to the types of events the platforms list. They say some wagers cover outcomes known to or heavily influenced by a relatively small group of insiders, such as award shows, professional team trades and similar events. State law prohibits betting on events where the outcome is known in advance because it is inherently unfair to ordinary bettors.

The department alleges the firms advertised and offered wagers to people on the state’s Voluntary Self-Exclusion List and to individuals under 21, and even promoted services on college campuses, all of which it says are illegal under Connecticut law.

Under the cease-and-desist orders, Kalshi, Robinhood and Crypto.com must immediately stop advertising, offering, promoting or otherwise making sports event contracts or any other unlicensed online gambling products to Connecticut residents. They must also allow residents to withdraw any funds currently held on their platforms.

Failure to comply could trigger civil penalties under the Connecticut Unfair Trade Practices Act and potential criminal action for breaches of the state’s gaming statutes.

For now, the state reminded residents that only three operators are authorised to take sports bets, namely DraftKings through Foxwoods, FanDuel through Mohegan Sun and Fanatics through the Connecticut Lottery, with a minimum age of 21 for sports wagering and 18 for fantasy contests.

The post Kalshi, Robinhood, Crypto.com Hit With Connecticut Stop Order for Gambling Violations appeared first on Cryptonews.

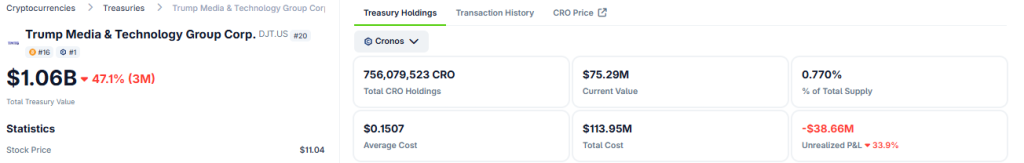

Trump Media +

Trump Media +  Trump’s Truth Social has replaced its planned token with

Trump’s Truth Social has replaced its planned token with