Crypto Regulation: European Commission Proposes Single Oversight Regime

The European Commission has moved to allocate the supervision of crypto companies and their activities under the sole jurisdiction of the European Securities and Markets Authority (ESMA). This move will end the application of different regulatory styles in several member states operating under the EU’s Markets in Crypto-Assets regulation (MiCA).

ESMA’s Single Crypto Authority To Boost Competitiveness, Innovation – EC

In a Thursday announcement, the European Commission, the executive arm of the European Union (EU), rolled out a series of regulatory measures aimed at creating a singular financial service market. This initiative centers around creating a competitive, innovative, and efficient financial system that offers EU citizens better options for wealth growth and business financing.

A statement from the announcement read:

Deeper integration of financial markets is not an end, but a means to create a single market for financial services greater than the sum of its national parts. Simplified access to capital markets reduces costs and makes the markets more appealing for investors and companies across all Member States, irrespective of size.

In particular, the EC’s new regulatory package will move the oversight of Crypto-Asset Service Providers (CASPs), among other groups of businesses to under the sole authority of the ESMA. Interestingly, the EC’s recent move comes just three months after the French, Austrian, and Italian market authorities pushed for a stronger European framework for cryptocurrencies, citing major differences in each national implementation of the MiCA regulations.

Presently, crypto regulation across the 27 EU member states operates under MiCA, resulting in a patchwork of national approaches which the EC claims is hindering competition and effective cross-border operations. The ESMA’s singular regime aims to eliminate these discrepancies in order to provide a better integrated EU financial market.

The EC said:

Improvements to the supervisory framework are closely linked to the removal of regulatory barriers. The package aims to address inconsistencies and complexities from fragmented national supervisory approaches, making supervision more effective and conducive to cross-border activities, while being responsive to emerging risks.

Alongside the new singular regime, the European Commission has also expressed plans to create a friendly environment for the adoption of distributed ledger technology, e.g, blockchains, to spur innovations in the financial sector. However, all these regulatory changes still remain subject to negotiation and approval by the European Parliament and European Council.

Crypto Market Overview

At the time of writing, the total crypto market cap is valued at $3.04 trillion, following a slight 0.25% loss in the past day. Meanwhile, total trading volume is valued at $135.47 billion.

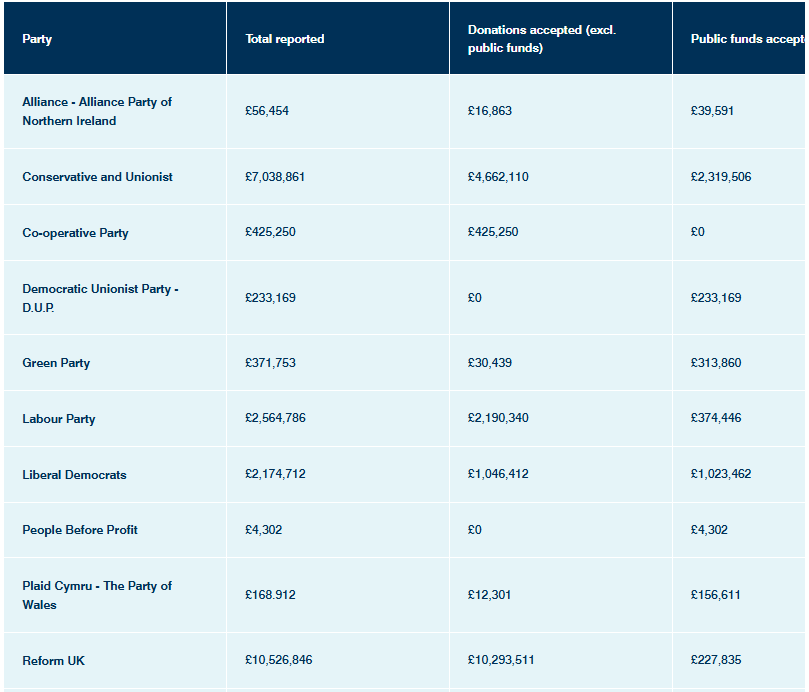

UK considers crypto political donation ban, threatening @Nifel_Farage Reform UK’s campaign and fundraising amid foreign interference and money-laundering concerns.

UK considers crypto political donation ban, threatening @Nifel_Farage Reform UK’s campaign and fundraising amid foreign interference and money-laundering concerns.

The Federal Deposit Insurance Corporation will publish its first US stablecoin rule framework later this month.

The Federal Deposit Insurance Corporation will publish its first US stablecoin rule framework later this month. The U.S. Treasury is calling on the public for feedback on how financial institutions can prevent crypto risks as part of the GENIUS Act.

The U.S. Treasury is calling on the public for feedback on how financial institutions can prevent crypto risks as part of the GENIUS Act.  GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.

Zdaniem Prezydenta, zawetowane przepisy realnie zagrażają wolnościom Polaków, ich majątkowi i stabilności państwa.

Zdaniem Prezydenta, zawetowane przepisy realnie zagrażają wolnościom Polaków, ich majątkowi i stabilności państwa.

The SEC granted

The SEC granted  Kevin Hassett, director of the National Economic Council, has emerged as Trump’s top Fed chair contender, putting a crypto-linked ally within reach of leading the central bank.

Kevin Hassett, director of the National Economic Council, has emerged as Trump’s top Fed chair contender, putting a crypto-linked ally within reach of leading the central bank.