US Fed Has Ended Quantitative Tightening, But Why Is The Bitcoin Price Still Below $100,000?

The Federal Reserve has officially brought its multi-year quantitative tightening program to a close, freezing its balance sheet at about $6.57 trillion after draining more than $2.3 trillion from the system since 2022.

The Federal Reserve’s decision to formally end quantitative tightening has created a sense of anticipation across the crypto market. Liquidity inflows have shaped every major crypto cycle, and removing the multi-year drain on liquidity is expected to set the stage for healthier crypto market conditions and see the Bitcoin price push above $100,000 in the coming days.

Policy Shift Meets A Market Still Searching For Direction

The Fed has frozen its balance sheet at roughly $6.57 trillion after three years of balance-sheet reduction. Treasury runoff has stopped on December 1, though mortgage-backed securities will continue declining slowly.

Ending QT means that the Fed is stepping away from the rapid balance-sheet reduction that tightened financial conditions throughout 2023 and 2024. The move comes after bank reserves fell to levels that threatened short-term funding stability, and the Fed made the move to halt any further liquidity drain.

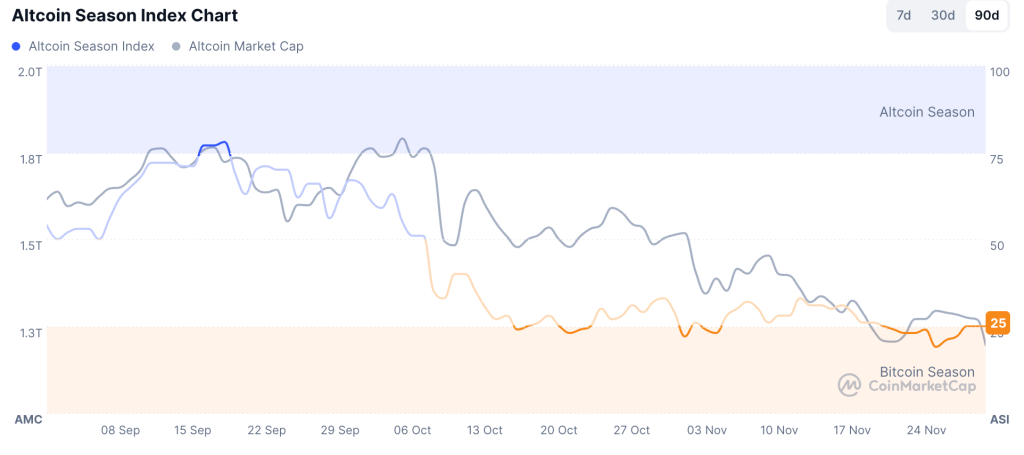

Crypto investors are expecting the end of QT to relieve some of the selling pressure that has contributed to the crypto industry in recent months. This is due to historical comparisons of how the industry played out in previous ends to QT.

In 2019, when the Fed last ended QT, digital assets bottomed within weeks and then entered a strong recovery phase. That period represented a decisive low for altcoins and preceded Bitcoin’s rise from roughly $3,800 to $29,000 over the next year and a half.

Interestingly, the entire crypto market’s short-term behavior is starting to show signs of bullishness. Particularly, the entire market is up by 7.2% in the past 24 hours, with Bitcoin leading the charge. However, cryptocurrencies are facing a different macro environment today, and the outlook is whether Bitcoin and other cryptocurrencies can go on another extended bullish rally in the coming months.

Why Is Bitcoin’s Reaction Delayed?

Ending QT is a meaningful turning point, but it does not automatically flood the system with fresh liquidity. Benjamin Cowen, founder of IntoTheCryptoverse, offers one of the clearest explanations for what to expect.

He noted that in 2019, the Fed announced QT would end on August 1, but the balance sheet continued falling through mid-August because previously scheduled Treasury maturities had not yet settled. It wasn’t until early 2020 that Bitcoin started to experience explosive gains. According to Cowen, the same dynamic applies now.

Therefore, the Federal Reserve’s balance sheet could continue edging lower for a few more weeks, meaning the first meaningful uptick in liquidity may not show up until early 2026. This delay suggests that traders hoping for an immediate boost or a quick return of Bitcoin above $100,000 are simply ahead of the cycle. The tightening phase has ended, but the actual recovery in liquidity has yet to begin.

The SEC granted

The SEC granted  Kevin Hassett, director of the National Economic Council, has emerged as Trump’s top Fed chair contender, putting a crypto-linked ally within reach of leading the central bank.

Kevin Hassett, director of the National Economic Council, has emerged as Trump’s top Fed chair contender, putting a crypto-linked ally within reach of leading the central bank. U.S. lawmakers propose the AI Fraud Deterrence Act against rising AI‑powered fraud and deepfake scams.

U.S. lawmakers propose the AI Fraud Deterrence Act against rising AI‑powered fraud and deepfake scams.