Bitcoin’s November Red Candle Signals Bearish MACD Cross, Eyes $75,000 Test

Bitcoin Magazine

Bitcoin’s November Red Candle Signals Bearish MACD Cross, Eyes $75,000 Test

Bitcoin Price Weekly Outlook

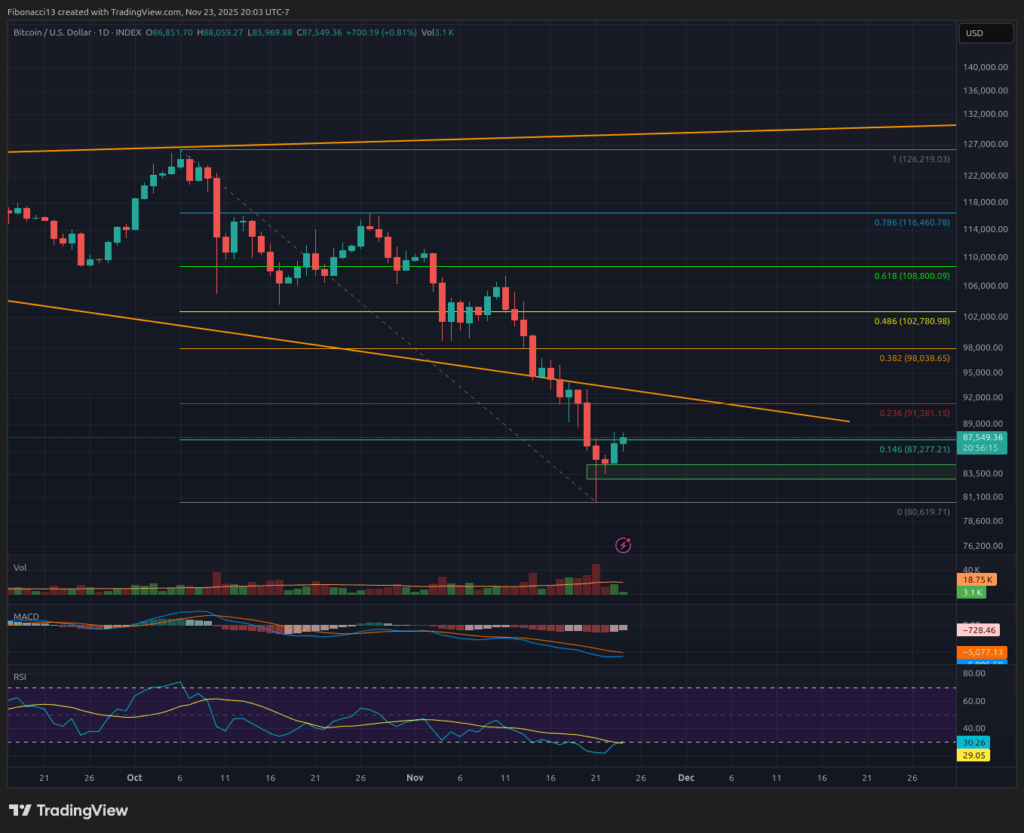

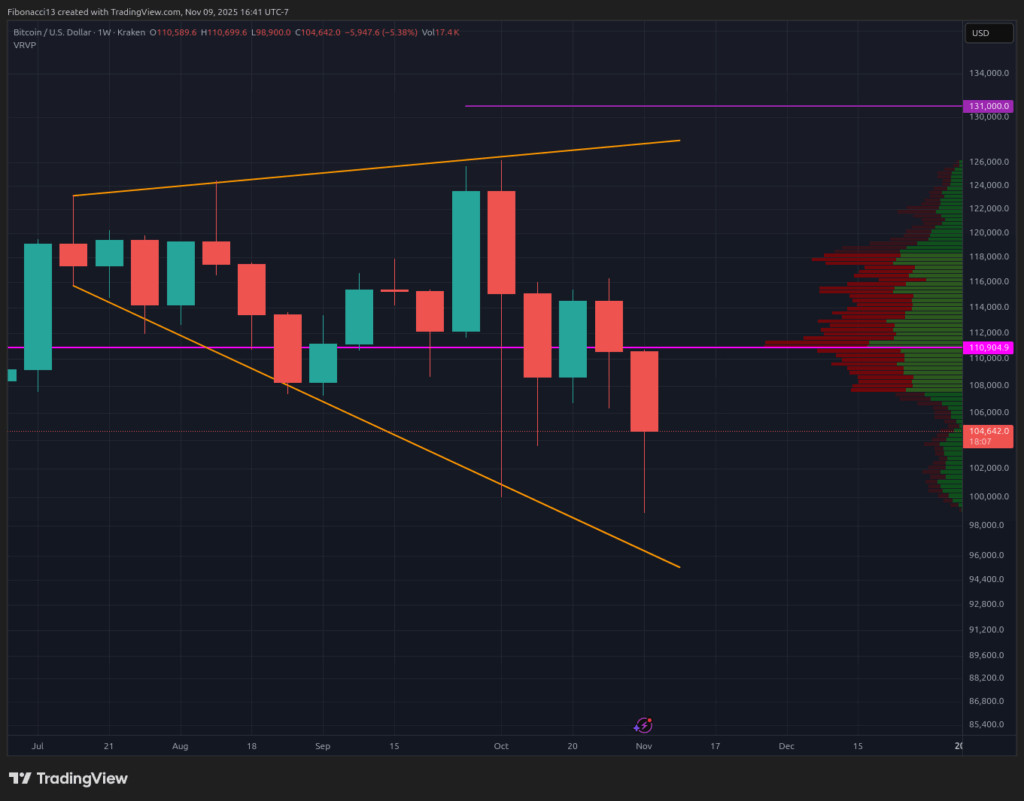

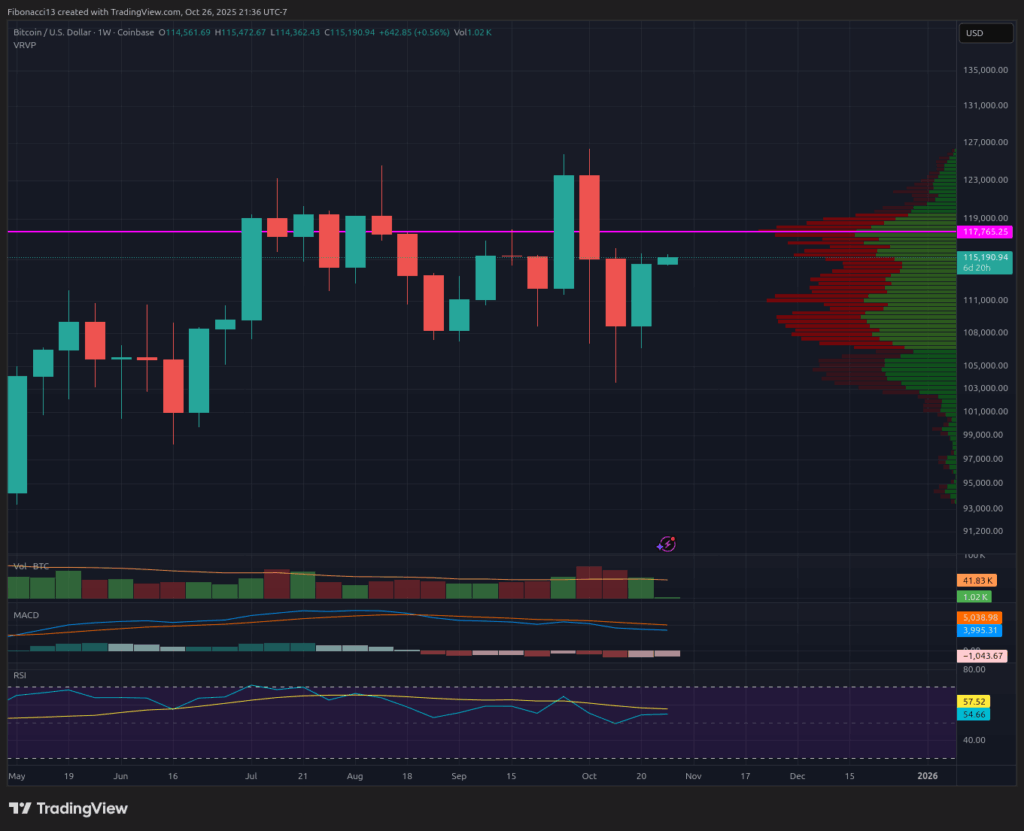

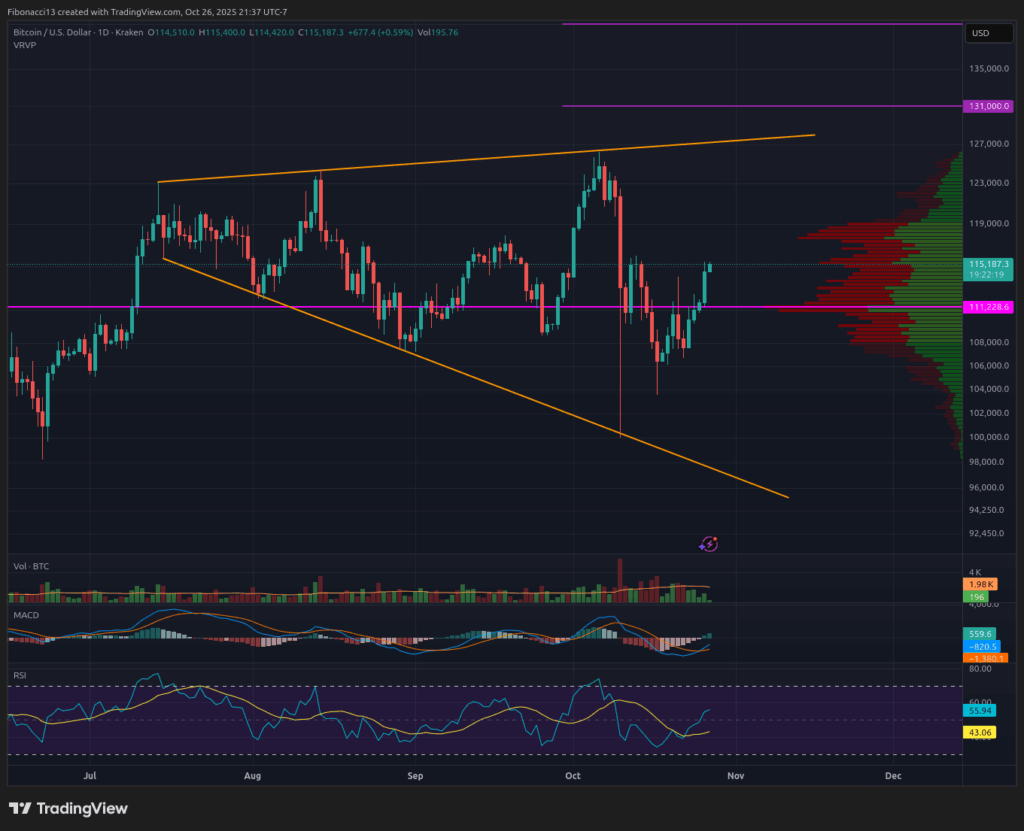

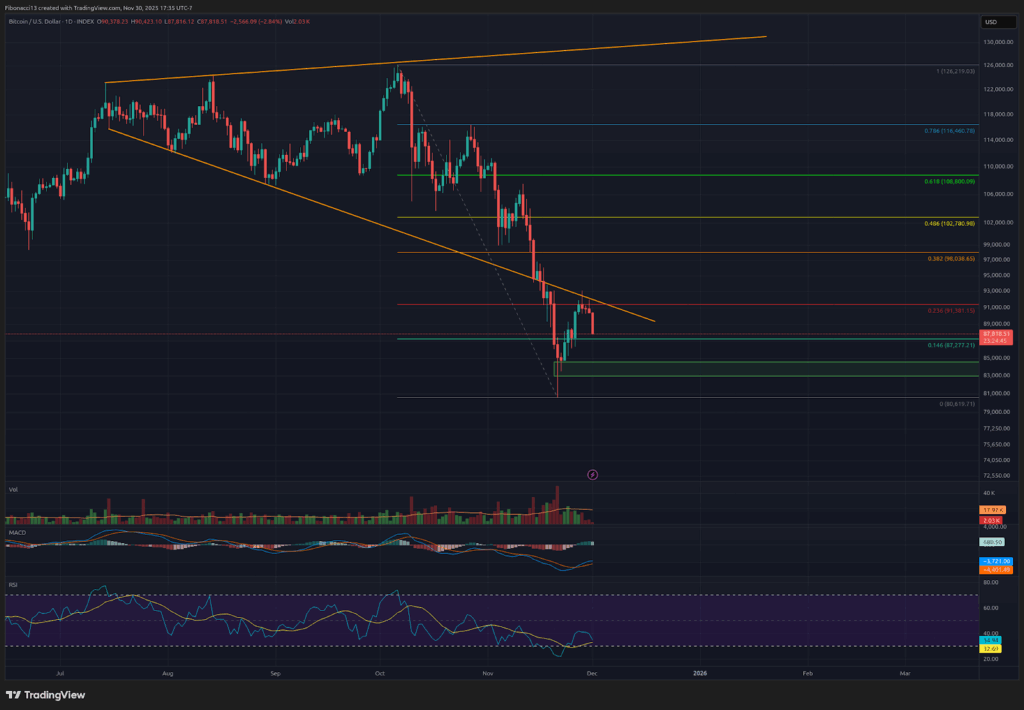

Bitcoin price managed to put in a green candle on the weekly close, finally, but it wasn’t enough to hold off the bears as the price dropped sharply right after the weekly and monthly close on Sunday night. The week and month closed at $90,385, still well below the closest resistance level at $91,400. Bears will likely look to take advantage of this weak close heading into this week, and potentially push the price down below the $84,000 support level.

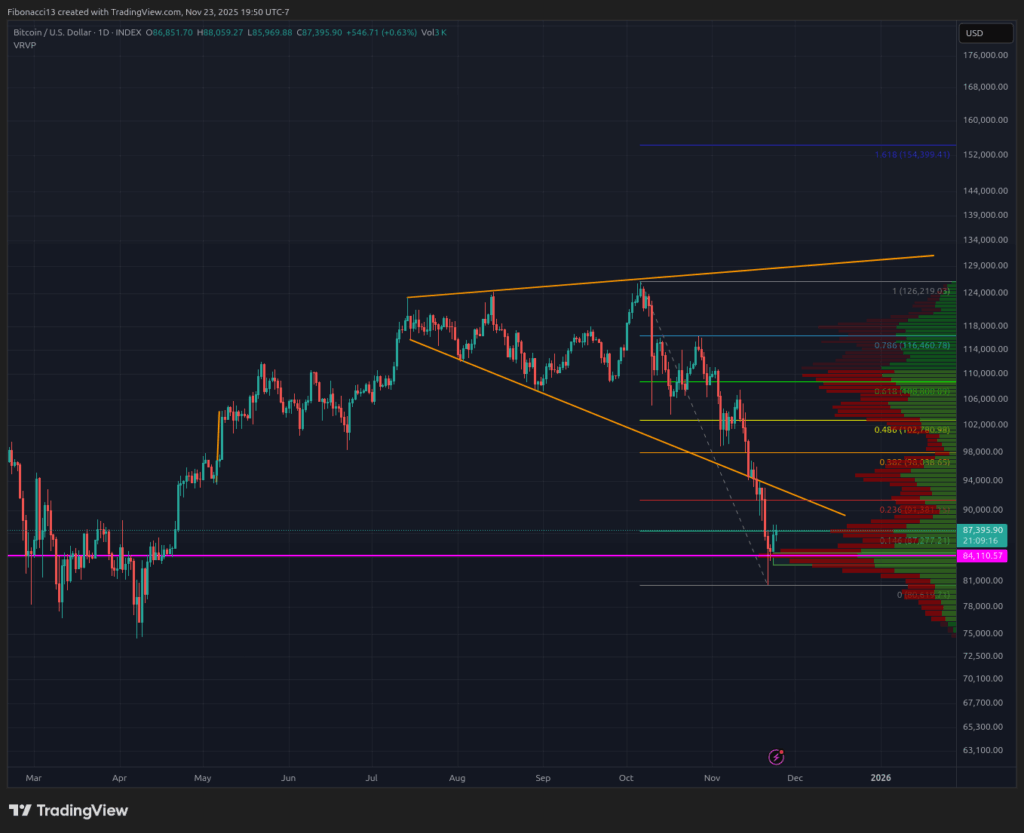

Key Support and Resistance Levels Now

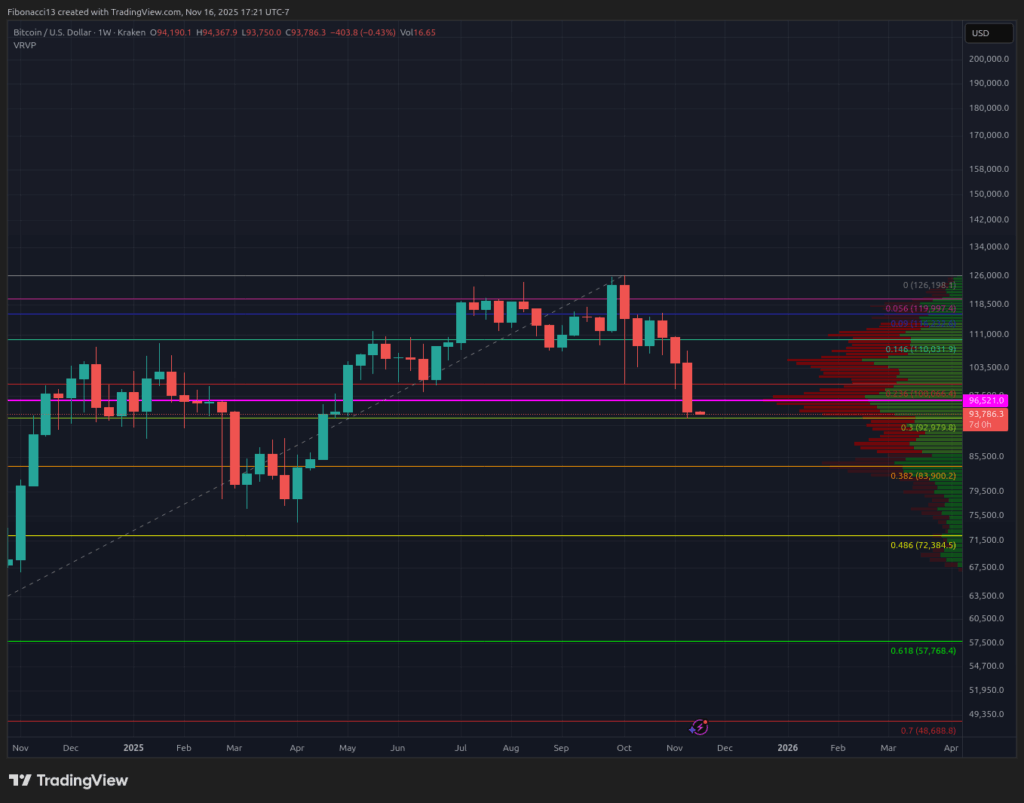

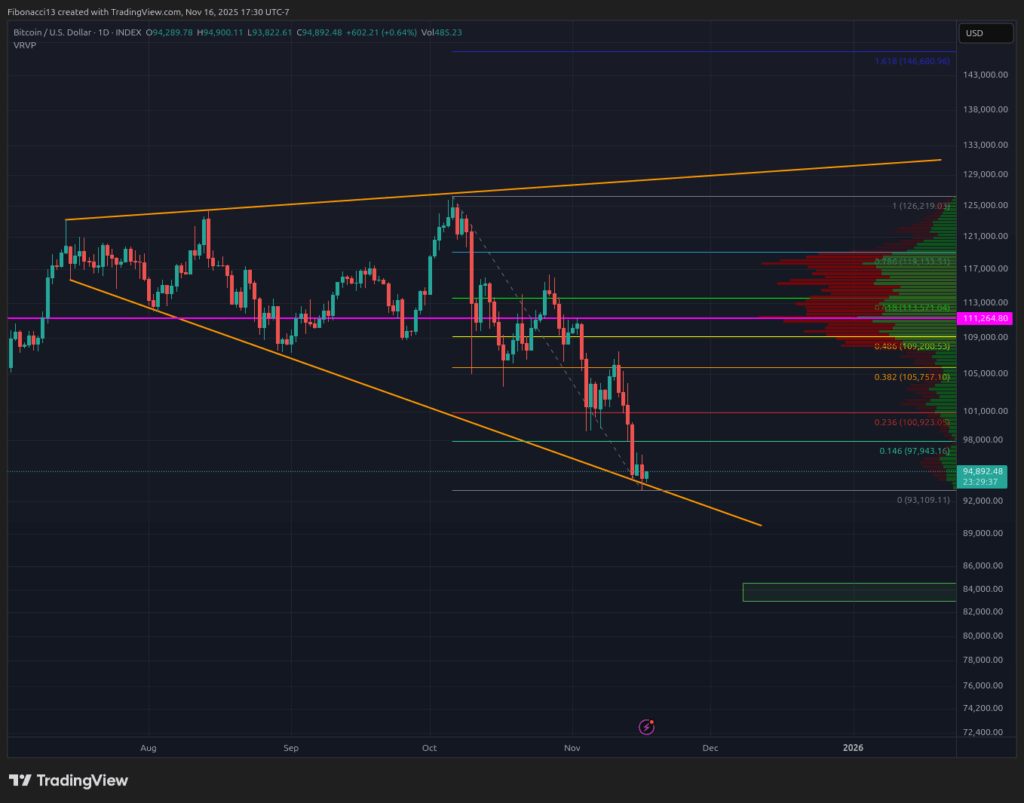

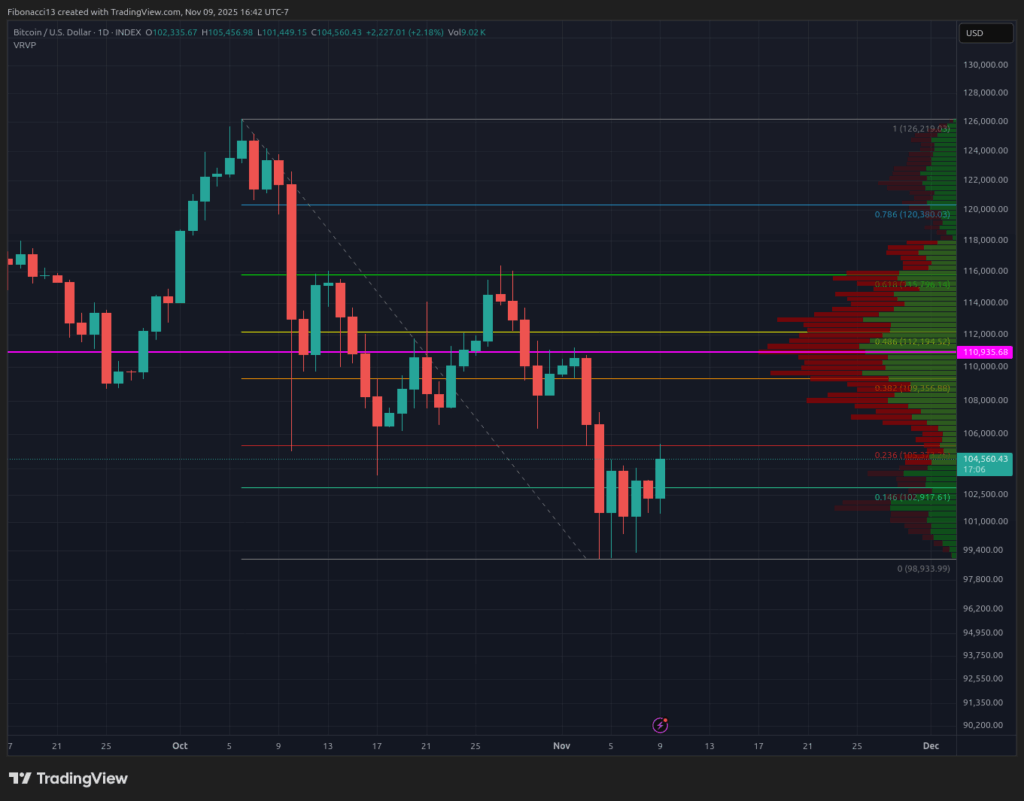

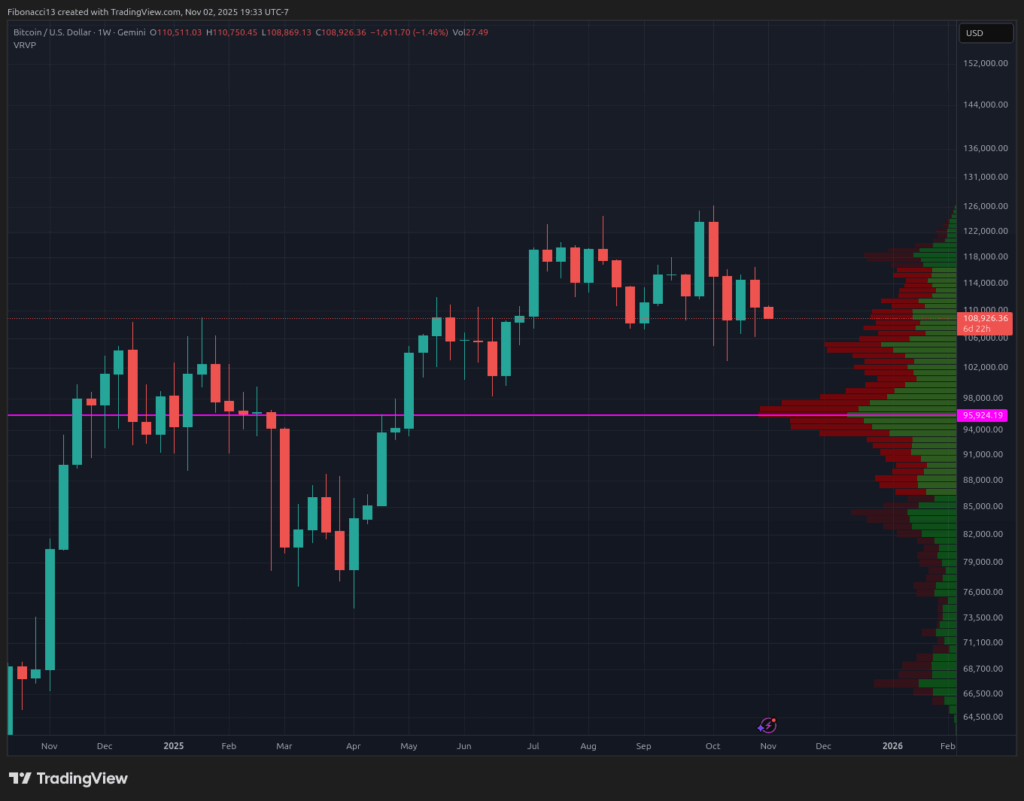

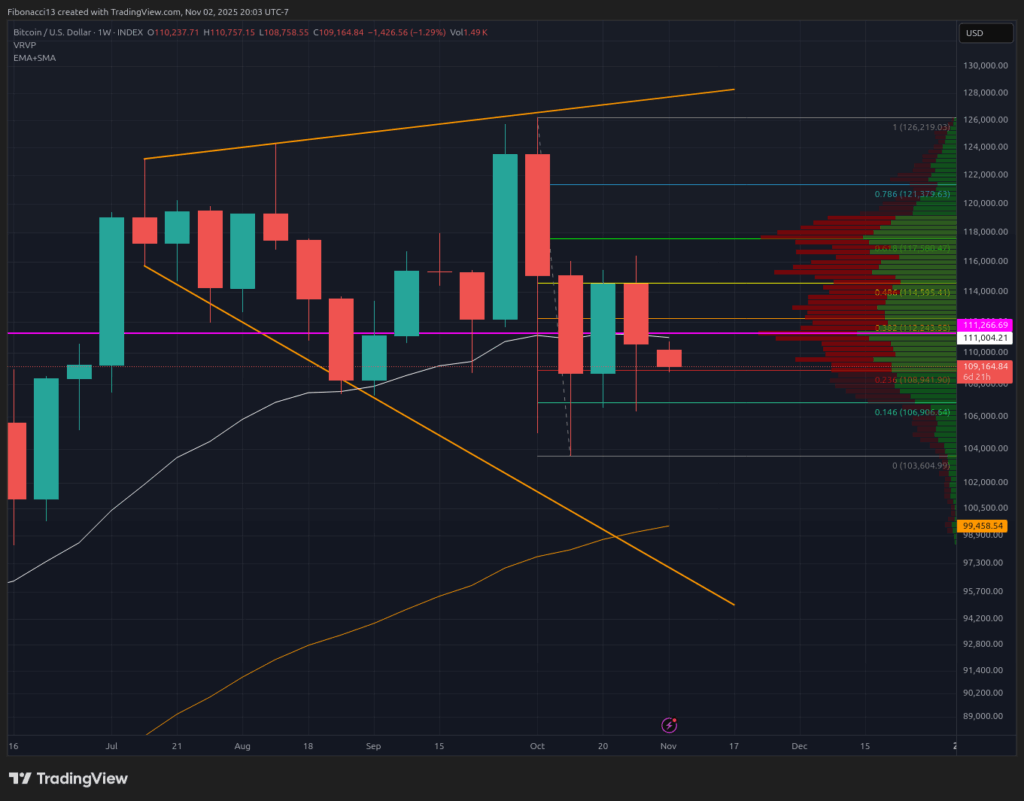

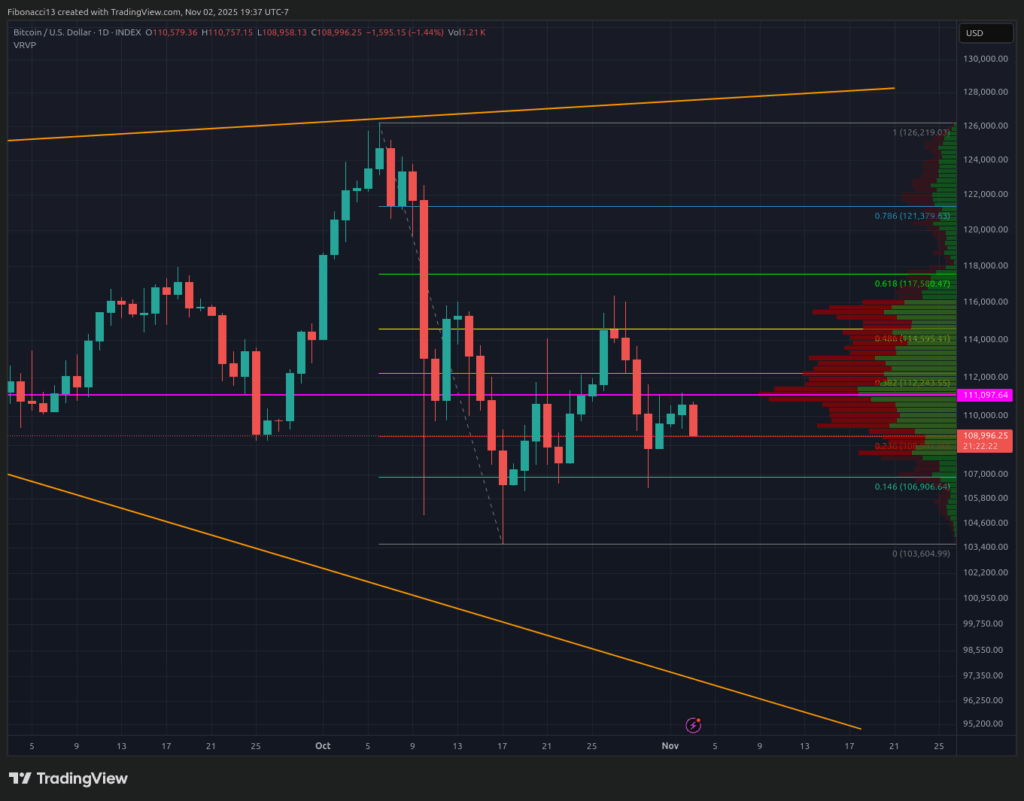

Bulls managed to test initial resistance last week at $91,400, but sold off heavily after hitting $93,000, short of the next resistance at $94,000. Above here, we should see strong resistance at $98,000 all the way up to $103,000. Higher resistance levels were covered in last week’s analysis, so we’ll reopen that topic if bulls can manage to get close to $100,000 after the end of this week.

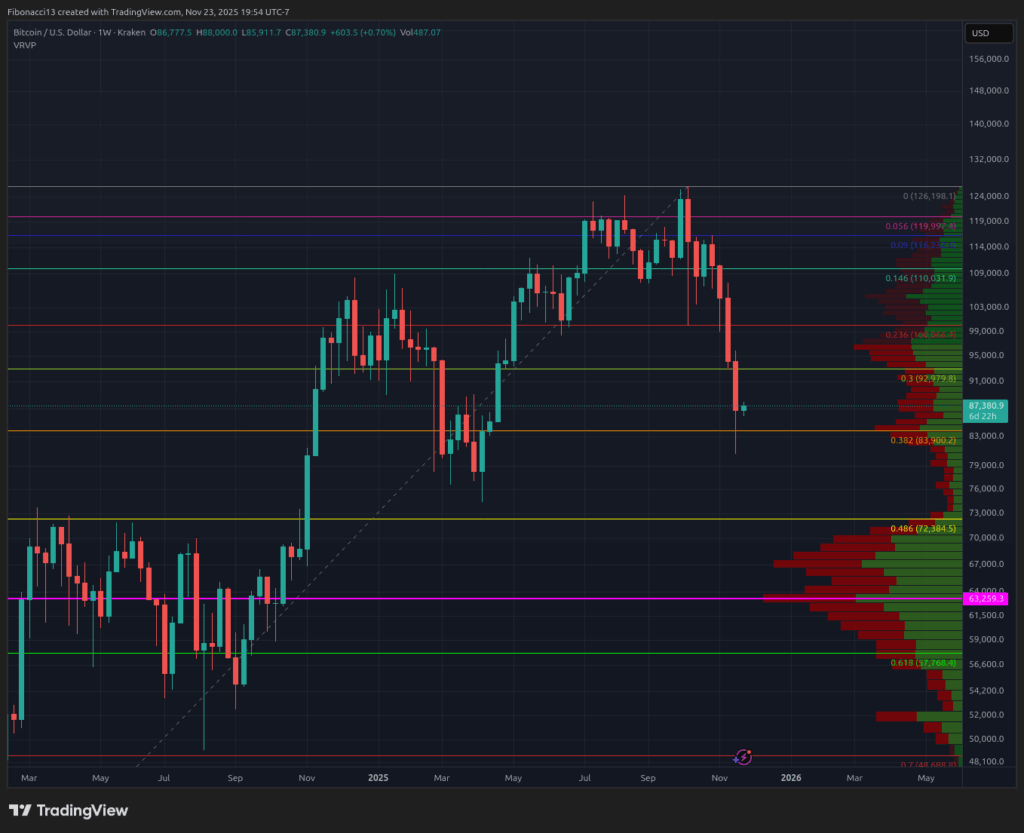

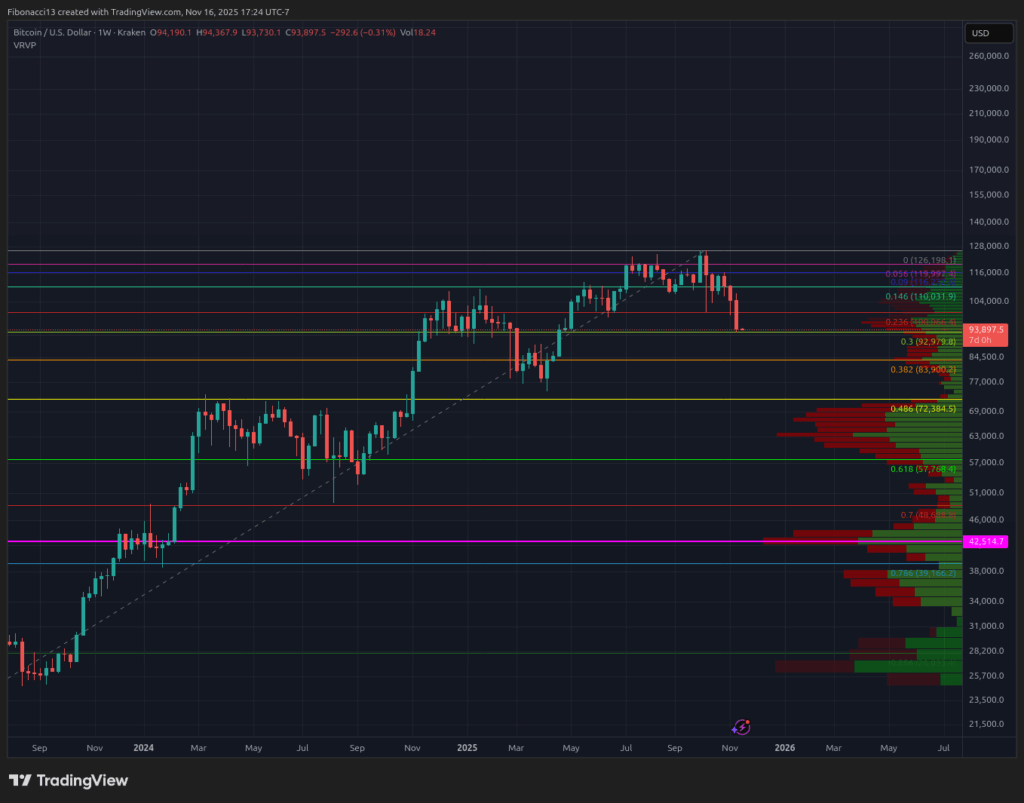

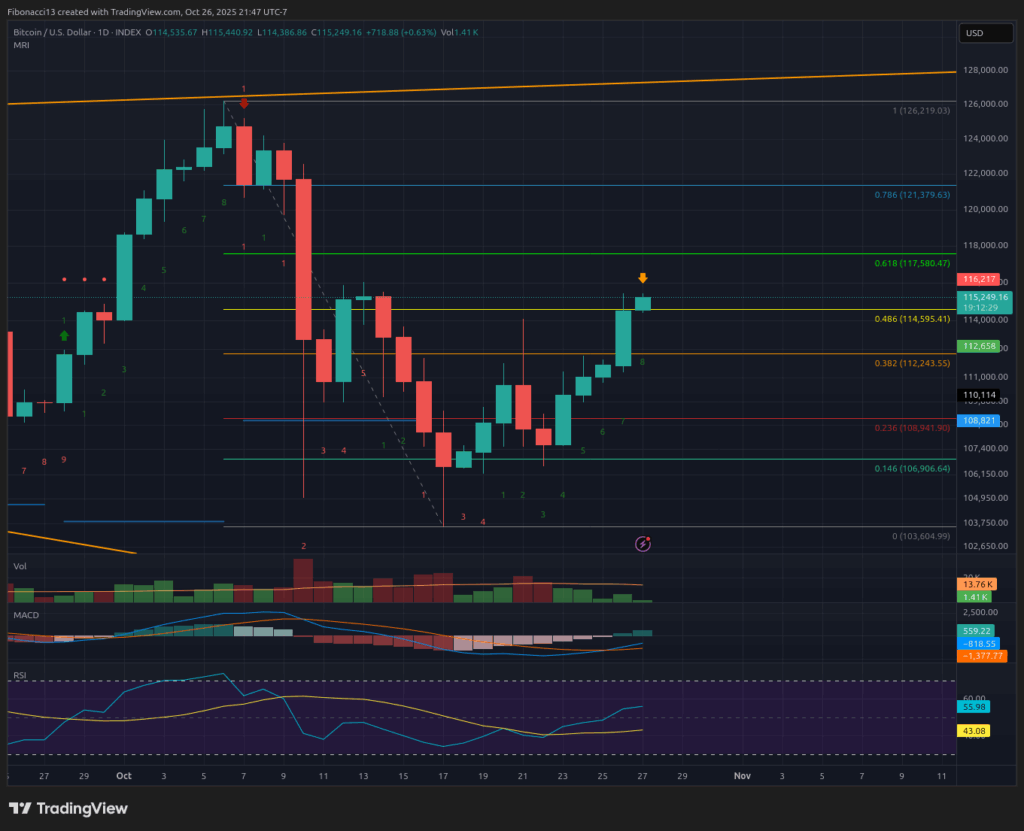

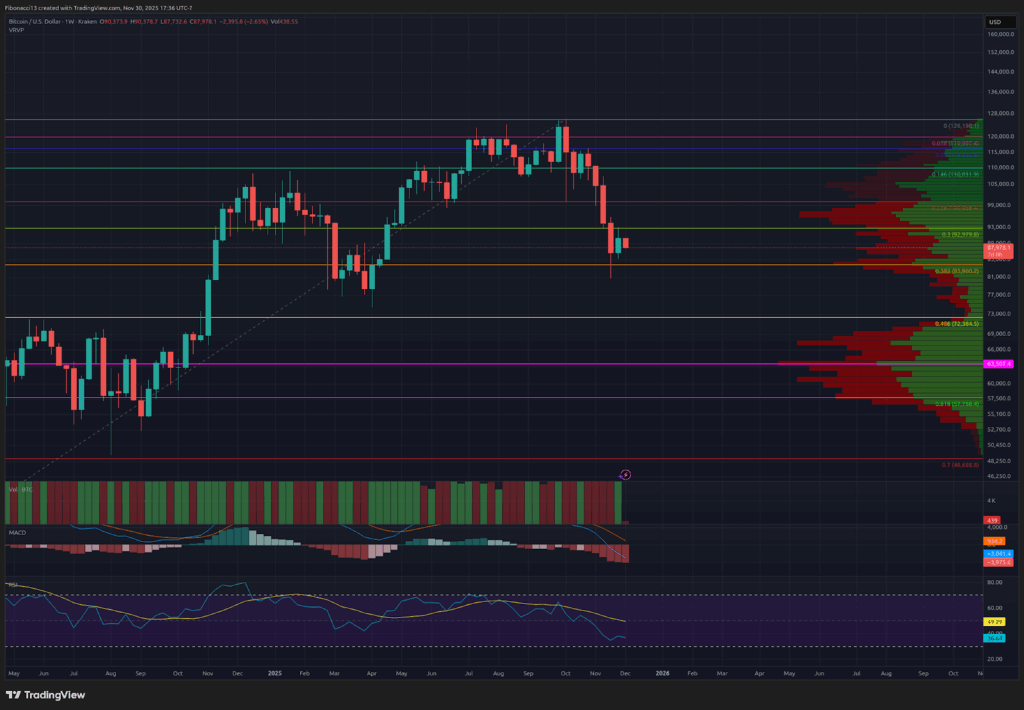

$84,000 Support held firm this past week, but bulls did not muster much of a bounce. This support level will be under pressure heading into this week. Initially, bulls will look to hold the 0.146 Fibonacci retracement at $87,000, however. Below $84,000, bulls may look to defend $75,000. Below here, the $72,000 to $69,000 area should provide strong support and at least a bounce or two from this zone. If this area sees heavy selling pressure, though, it may eventually crack and usher in a test of the 0.618 Fibonacci retracement at $57,700.

Outlook For This Week

With the price closing below resistance on Sunday, the bears jumped on this weakness and pushed the price down to $87,000 support. Look for bulls to defend this level early, but if it is lost, bulls know they must hold the line at $84,000 to avoid dropping to new lows and testing $75,000 this week. So, we may see some range-bound action this week as bears may still need a bit of a rest before taking out this support level. If bulls can hold them off, they will again attempt to conquer $91,400 and potentially $94,000 this week, but I wouldn’t expect any strong moves up this week.

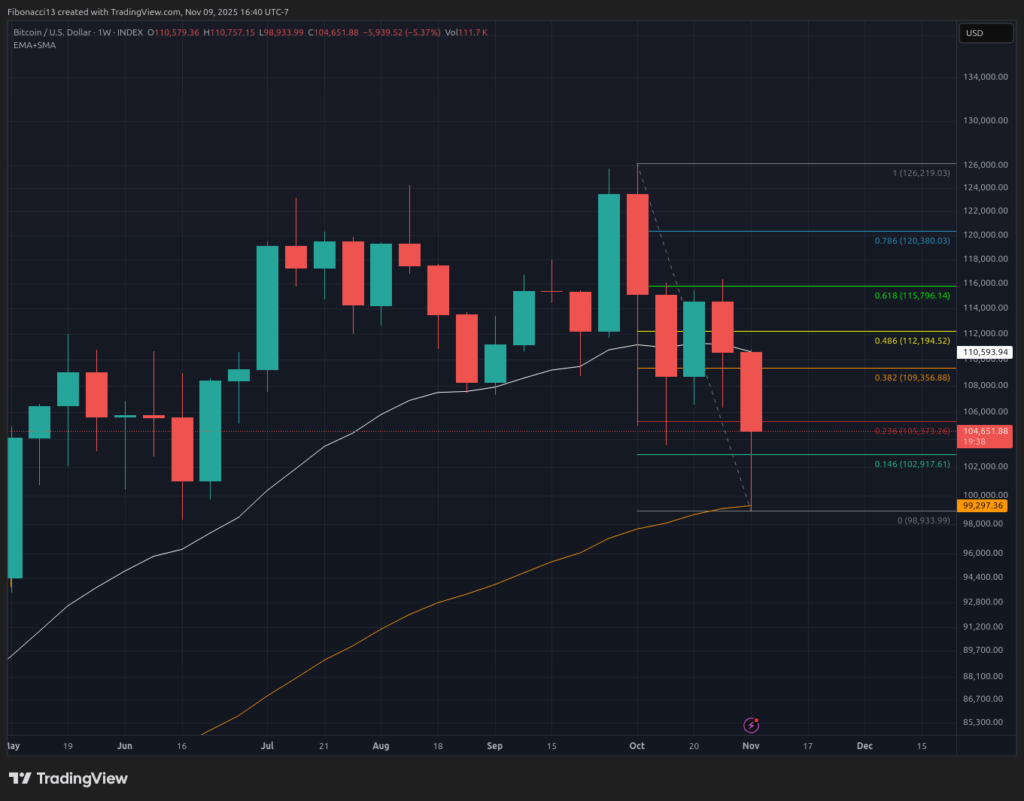

The next few weeks

Sunday night brought us the monthly candle close for November as well. November closed as a big red bearish candle, taking out the April, May and June green closes in one fell swoop. Price did rally to close above the monthly 21-EMA, which is a good sign, but December will have to try to put in some reversal candles to keep the bulls’ hopes alive. The most bearish aspect of November’s close is that it confirmed a bearish cross on the MACD oscillator. This is to be taken seriously on such a high time frame and should keep the price subdued for at least the coming two to three months. This signal is yet another sign that the Four-year cycle top is likely in.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

EMA: Exponential Moving Average. A moving average that applies more weight to recent prices than earlier prices, reducing the lag of the moving average.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

Oscillators: Technical indicators that vary over time, but typically remain within a band between set levels. Thus, they oscillate between a low level (typically representing oversold conditions) and a high level (typically representing overbought conditions). E.G., Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD).

MACD Oscillator: Moving Average Convergence-Divergence is a momentum oscillator that subtracts the difference between 2 moving averages to indicate trend as well as momentum.

This post Bitcoin’s November Red Candle Signals Bearish MACD Cross, Eyes $75,000 Test first appeared on Bitcoin Magazine and is written by Ethan Greene - Feral Analysis and Juan Galt.