Why is XRP price crashing as the Ripple ETF inflows soar?

MetaMask, the most widely used Ethereum wallet, is moving directly into the prediction market arena through a new integration with Polymarket, giving users the ability to trade event outcomes from inside their wallets.

Key Takeaways:

“You can now trade on the future outcome of real world events inside your wallet,” Consensys’ Gabriela Helfet wrote, adding that users will also earn MetaMask Rewards points for every prediction placed.

The integration creates a new on-ramp for Polymarket and introduces “one tap funding,” allowing users to deposit with any token from any EVM-compatible chain.

The move further tightens the link between everyday crypto wallets and decentralized betting platforms, positioning MetaMask as a gateway not only to Web3 apps but also to real-world event speculation.

Polymarket has surged in popularity over the past year, fueled in part by heightened attention during the 2024 US election cycle.

Former President Donald Trump’s embrace of crypto and a more relaxed regulatory climate helped push the platform back into the US market.

The company is now reportedly exploring a valuation of up to $15 billion, following a $2 billion strategic investment from Intercontinental Exchange, the parent of the NYSE.

Predicting on MetaMask only takes a few seconds.

— MetaMask.eth

We've enabled 1-click funding with any EVM token, or you can get started instantly if you have an existing @polymarket account! pic.twitter.com/zZtrQPDu3m(@MetaMask) December 5, 2025

For MetaMask, the move comes as the wallet expands beyond its Ethereum-focused roots. In October, it launched multichain accounts that support both EVM and non-EVM networks, including Solana.

The wallet is also preparing for the rollout of a native MASK token, as parent company Consensys gears up for a potential IPO.

The move comes as Polymarket is recruiting staff for an internal market-making team that would trade against its own customers, mirroring a controversial feature already used by rival Kalshi that has drawn criticism and legal challenges.

As reported, the New York-based prediction market startup has approached traders, including sports bettors, to join the new unit, people familiar with the matter said, requesting anonymity because the plans remain private.

Prediction markets have crossed $13 billion in cumulative trading volume, marking a record high even as broader crypto markets cool.

The surge has drawn in major players across tech and finance, including Fanatics, Coinbase, and MetaMask, all of which have recently launched or expanded event-trading platforms.

Against this backdrop, YZi Labs, the venture firm founded by Binance co-founder Changpeng “CZ” Zhao, has been intensifying its involvement in the sector.

YZi-backed Opinion has emerged as one of the most surprising breakout platforms. Launched on BNB Chain in October, it recorded nearly $1.5 billion in weekly trading volume within its first month, briefly overtaking established names such as Kalshi and Polymarket.

Meanwhile, prediction markets platform Kalshi has secured a major media breakthrough after signing a partnership with CNN, making the company the network’s official prediction markets partner while closing a $1 billion funding round at an $11 billion valuation.

The post MetaMask Enters Prediction Markets With Polymarket Integration appeared first on Cryptonews.

Polymarket is recruiting staff for an internal market-making team that would trade against its own customers, mirroring a controversial feature already used by rival Kalshi that has drawn criticism and legal challenges.

According to Bloomberg, the New York-based prediction market startup has approached traders, including sports bettors, to join the new unit, people familiar with the matter said, requesting anonymity because the plans remain private.

Polymarket declined to comment on the recruitment effort.

The move comes as the platform prepares its full U.S. relaunch after securing regulatory clearance from the Commodity Futures Trading Commission, having paid a $1.4 million penalty in 2022 for operating an unregistered derivatives exchange.

Kalshi already operates an in-house trading arm, Kalshi Trading, which places bids on the exchange and effectively takes opposing positions to customers’ bets.

Company executives have defended the unit as necessary to create liquidity and improve the user experience.

Still, critics argue it creates inherent conflicts of interest and makes Kalshi resemble a traditional sportsbook rather than a neutral peer-to-peer platform.

Some are now claiming that the company is a gambling company and not a prediction company.

“Let’s just call a spade a spade, it’s gambling, lots of things are gambling,” a X user said.

— Martin Shkreli (@MartinShkreli) December 5, 2025

it has been decided by the courtshttps://t.co/lU0S6XWrkA

A proposed class action lawsuit filed last month alleges that Kalshi Trading sets betting lines that disadvantage customers, claiming “consumers place bets on Kalshi, they face off against money provided by a sophisticated market maker on the other side of the ledger.“

Kalshi co-founder Luana Lopes Lara dismissed the lawsuit as a “pure smear campaign” on social media.

She stated that Kalshi Trading operates unprofitably and receives “no preferential access or treatment.”

However, the legal challenge shows mounting concerns about whether prediction markets function as advertised, neutral platforms where users with differing opinions trade directly with each other.

1. Rebrand gambling as asset allocation

— Harry Crane (@HarryDCrane) December 5, 2025

2. Rebrand sportsbook as truth engine

3. Rebrand bets as predictions

4. Spin up in-house market maker to c̶o̶m̶p̶e̶t̶e̶ collaborate with c̶u̶s̶t̶o̶m̶e̶r̶s̶ fellow investors for the greater good

It's really noble if you think about it. https://t.co/UQx67fg3DI

Polymarket’s decision to build an internal trading desk arrives as the company executes its return to American markets following years offshore.

In December, the CFTC issued a no-action letter covering QCX LLC and QC Clearing LLC, two entities Polymarket acquired earlier in 2025 for $112 million to gain licensed designated contract market status and regulated clearing capabilities.

The agency granted temporary relief from certain swap data reporting requirements, allowing the platform to operate within the same framework governing federally supervised U.S. trading venues.

— Cryptonews.com (@cryptonews) November 25, 2025

Prediction market platform Polymarket says it has received an Amended Order of Designation from the CFTC.#Crypto #CFTChttps://t.co/H44tIIxPaz

Founder and CEO Shayne Coplan confirmed receiving “the green light to go live in the USA” and credited CFTC staff for completing the process in record time.

The regulatory clearance caps a lengthy journey that intensified in November 2024 when the FBI raided Coplan’s Manhattan residence and seized electronic devices as part of an investigation into whether Americans continued accessing the site through VPNs despite the 2022 ban.

Despite being barred from U.S. operations since 2022, Polymarket expanded aggressively overseas, recording roughly $6 billion in wagers during the first half of 2025 alone.

The platform gained global attention during the 2024 presidential election cycle, as its markets closely tracked Donald Trump’s odds of winning.

Prediction markets rely heavily on market makers willing to take less popular trades, as the platforms match buyers with sellers on binary yes-or-no contracts.

Both Polymarket and Kalshi have offered incentives rewarding heavy users who provide liquidity, while a small number of traditional financial trading firms, including Susquehanna International Group and Jump Trading, have begun serving as external market makers on Kalshi.

— Cryptonews.com (@cryptonews) November 25, 2025

@GalaxyDigital is in talks to provide liquidity on Polymarket and Kalshi, reflecting the growing momentum of prediction markets among retail traders and Wall Street.#PredictionMarkets #Galaxy https://t.co/2wgytQSkZ4

Mike Novogratz’s Galaxy Digital is currently in talks with both platforms to become a liquidity provider, with Novogratz telling Bloomberg that the firm is “doing some small-scale experimenting with market-making on prediction markets.“

The broader debate centers on whether prediction markets genuinely differ from traditional gambling operations.

During a public appearance last month, Coplan called conventional sportsbooks a “scam” that “rip off the consumer,” positioning Polymarket as a transparent alternative where users trade against each other rather than facing house odds designed to extract profits.

The post Polymarket to Launch In-House Trading Desk That Bets Against Users: Report appeared first on Cryptonews.

Market sentiment shifts suggest skepticism about Bitcoin's near-term growth, potentially impacting investor confidence and strategic decisions.

The post Polymarket odds of Bitcoin dropping to $80K by year-end surge to 40% appeared first on Crypto Briefing.

Market volatility highlights the ongoing sensitivity of cryptocurrencies to economic indicators, impacting investor confidence and market stability.

The post Bitcoin drops below $89K, wiping over $100B from the crypto market appeared first on Crypto Briefing.

Glassnode's new metrics enhance crypto market analysis, enabling traders to better assess risk and identify strategic opportunities across assets.

The post Glassnode introduces interpolated implied volatility metrics for crypto options appeared first on Crypto Briefing.

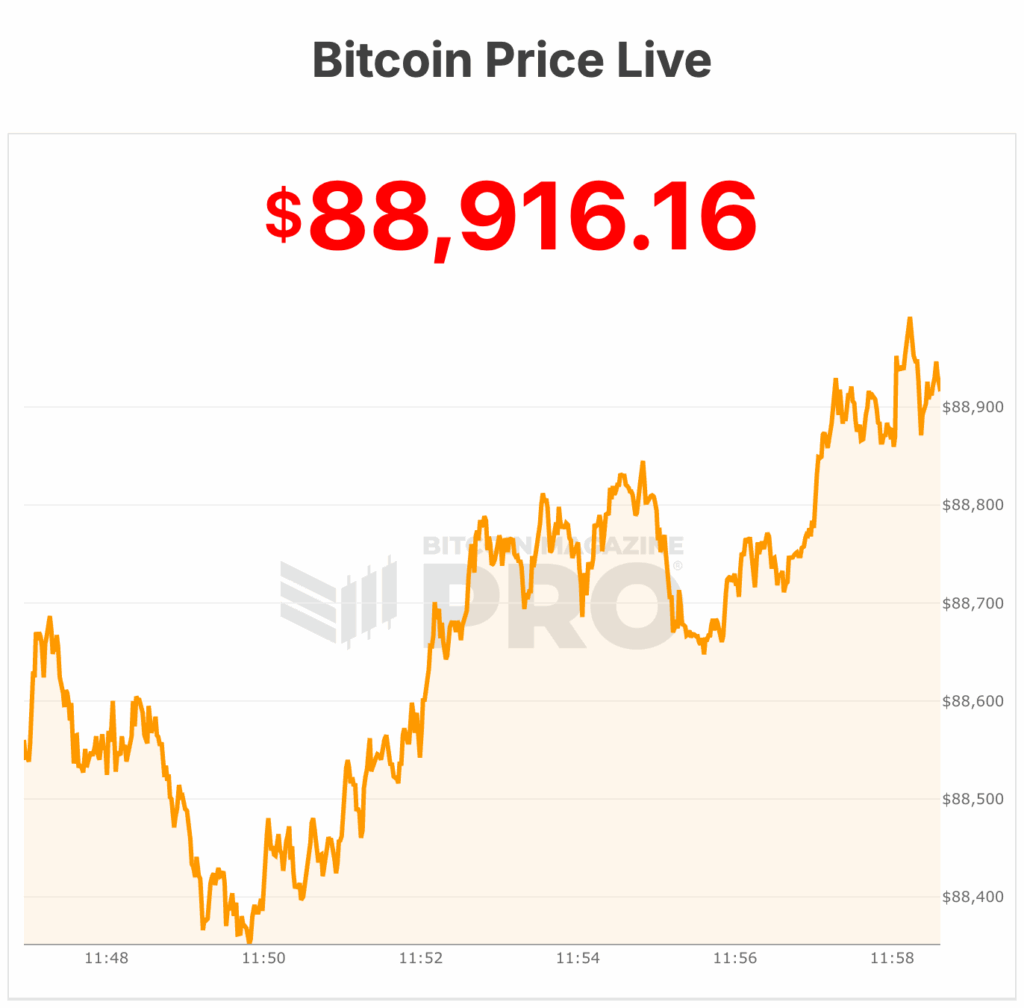

Bitcoin Magazine

Bitcoin Price Craters to $88,000, But JPMorgan Maintains $170,000 Target

Bitcoin price plunged to $88,000s on Friday, down over 4% in the past 24 hours. The cryptocurrency is trading near its seven-day low of $88,091, and about 4% below its seven-day high of $92,805.

The global market capitalization for Bitcoin now stands at $1.77 trillion, with a 24-hour trading volume of $48 billion.

Despite the recent drop, Wall Street bank JPMorgan remains bullish on the Bitcoin price over the long term. The bank continues to maintain its gold-linked volatility-adjusted BTC target of $170,000 over the next six to twelve months.

Analysts say the model accounts for fluctuations in price and mining costs.

One key factor in the market is Strategy (MSTR), the largest corporate Bitcoin holder. The company owns 650,000 BTC. Its enterprise-value-to-Bitcoin-holdings ratio, known as mNAV, currently stands at 1.13.

JPMorgan analysts describe this as “encouraging.” A ratio above 1.0 indicates Strategy is unlikely to face forced sales of its Bitcoin.

JUST IN: JPMorgan says it is sticking to its Bitcoin vs gold model target, which would see BTC hit $170,000 over the next year

— Bitcoin Magazine (@BitcoinMagazine) December 5, 2025pic.twitter.com/PNt9ojpBRv

Strategy has also built a $1.44 billion U.S. dollar reserve. The reserve is designed to cover dividend payments and interest obligations for at least 12 months. The company aims to extend coverage to 24 months.

Mining pressures continue to weigh on Bitcoin. The network’s hashrate and mining difficulty have fallen. High-cost miners outside China are retreating due to rising electricity costs and declining prices. Some miners have sold Bitcoin to remain solvent.

JPMorgan now estimates Bitcoin’s production cost at $90,000, down from $94,000 last month. Falling hashrates can push production costs lower, but the short-term effect is sustained selling pressure from miners.

Institutional investors also show caution. BlackRock’s iShares Bitcoin Trust, or IBIT, has recorded six consecutive weeks of net outflows. Investors pulled more than $2.8 billion from the ETF over this period, according to Bloomberg.

The withdrawals highlight subdued appetite among traditional investors, even as Bitcoin prices stabilize. Analysts note that the trend marks a reversal from the persistent inflows seen earlier in the year.

The broader market is still recovering from the October 10 liquidation event. That crash wiped out over $1 trillion in crypto market value and pushed Bitcoin into a bear market.

Although the Bitcoin price has recovered some ground this week, momentum remains fragile.

JPMorgan analysts now say Bitcoin’s next major move depends less on miner behavior. Instead, it depends on Strategy’s ability to hold its Bitcoin without selling. The mNAV ratio and reserve fund provide confidence that the company can weather market volatility.

Other potential catalysts remain. The MSCI index decision on January 15 could impact Strategy’s stock and, indirectly, Bitcoin. Analysts say a positive outcome could trigger a strong rally.

Last week, Strategy’s Michael Saylor disputed MSCI index disputes and clarified that Strategy is a publicly traded operating company with a $500 million software business and a treasury strategy using Bitcoin, not a fund, trust, or holding company.

He emphasized the firm’s recent activity, including five digital credit security offerings totaling over $7.7 billion in notional value.

Bitcoin Magazine analysts believe that the bitcoin price correlation with Gold has recently strengthened mainly during market downturns, offering a clearer view of its purchasing power when analyzed against Gold instead of USD.

Breaking below the 350-day moving average (~$100,000) and the $100K psychological level signaled Bitcoin’s entry into a bear market, dropping roughly 20% immediately.

While USD charts show a 2025 peak, Bitcoin measured in Gold peaked in December 2024 and has fallen over 50%, suggesting a longer bear phase.

Historical Gold-based bear cycles indicate potential support zones approaching, with current declines at 51% over 350 days reflecting institutional adoption and constrained supply rather than cycle shifts.

For now, bitcoin price hovers near $88,000.

This post Bitcoin Price Craters to $88,000, But JPMorgan Maintains $170,000 Target first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Losses for Internet Computer come amid a 29% decrease in trading volume, suggesting bulls could benefit from reduced selling pressure.

However, with ICP briefly rallying on hype around AI integrations like the Caffeine platform, only to reverse course, it may yet allow bears to strengthen the upper hand.

The ICP project, launched by the DFINITY Foundation, is one of the top artificial intelligence-related coins.

DFINITY aims to revolutionize the internet by enabling fully on-chain applications, from decentralized finance to AI-driven services, without reliance on traditional cloud providers.

In early November, the DFINITY Foundation unveiled an update for its AI platform Caffeine DeAI.

The news saw the price of ICP surge sharply, with bulls eventually hitting highs of $9.62 on Nov. 8, 2025.

The uptick aligned with market cheer for an update that pushed the narrative of the Internet Computer as a key AI cloud engine.

As well as allowing users to create and deploy apps easily, Caffeine features an App Market and supports monetization.

DFINITY said Caffeine will help drive network usage and transition ICP to a deflationary asset, among other features.

However, the token’s price has tumbled since that November peak and hit $3.50 on December 5, 2025. That’s a 64% dump in the past month and reflects broader market pressure.

Market analysts have attributed the sell-off pressure across crypto to a confluence of factors.

As well as macroeconomic headwinds, FUD around Tether and Strategy (MSTR) has dampened risk appetite for Bitcoin (BTC) and the speculative assets across altcoins.

These same aspects apply to ICP and the dip to $3.50, with intraday revisits of lower levels, strengthening the fragile outlook.

Adding to this is the overall sentiment around token dumps if BTC price tanks.

Recently, when Bitcoin dipped to near $80,000, the Internet Computer token plummeted from above $5 to below $4.2.

Price currently hovers around $3.51 as Bitcoin flirts with support near $90,500. If momentum escapes bulls further, sellers could eye the all-time lows of $1.98 reached in October 2025.

On the flipside, the altcoin could benefit from network upgrades and adoption trends.

This, amid a resurgence in AI tokens and tokenized Bitcoin demand, may help buyers. A shift in sentiment as the macro environment improves will be crucial to bulls.

The post Internet Computer (ICP) crashes to $3.50 as AI hype fades and market pressure mounts appeared first on CoinJournal.

Chainlink continues to play a key role in the blockchain interoperability and asset tokenisation space, and that shows in the two latest integrations.

As a pivotal oracle network bridging decentralised finance (DeFi) with traditional systems, Chainlink’s traction is forecast to be a major factor for the native token LINK.

On December 5, 2025, LINK traded around $14.

Bulls were under pressure but remained upbeat amid recent advancements. Among these is the collaboration with Coinbase on the Base-Solana bridge and the integration into a Solana-based RWA consortium.

Three major industry players here: Coinbase, Chainlink and Solana. Industry reaction to their latest collaboration highlights the potential impact.

Simply, the launch of the Base-Solana bridge marks a significant milestone in multi-chain connectivity. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) serves as the security backbone alongside Coinbase’s node operators.

As announced, this mainnet deployment enables seamless asset transfers between Base and Solana.

CCIP will help verify all messages, ensuring tamper-proof and reliable token movements on Solana. In this case, users can now deposit SOL into Base applications, import any Solana Program Library (SPL) token, and export Base assets back to Solana.

“The bridge is now live on mainnet and rolling out for anyone to use in apps including Zora, Aerodrome, Virtuals, Flaunch, and Relay,’ Base said in a blog post. “Users will be able to trade SOL, CHILLHOUSE, TRENCHER, and many more Solana assets on Base.”

The Base-Solana bridge is live

Secured by @Chainlink CCIP alongside Coinbase, the bridge unlocks new cross-chain experiences:

• Support Solana assets natively in Base apps

• Enable users to trade & use assets across chains

• Bridge assets and tap into both ecosystems🧵

— Base Build (@buildonbase) December 4, 2025

Another major development is news that Chainlink has joined the newly formed RWA Consortium on Solana. The initiative, led by Figure Technology Solutions in partnership with Kamino Finance, CASH, Raydium, Privy, and Gauntlet, was announced on December 4, 2025.

Experts say real-world assets onchain value will grow exponentially in the next five years.

Early adoption has virtually every RWA now onchain and Solana plays a key role in this space. Chainlink too.

The new alliance aims to democratize access to over $1 billion in monthly onchain loan originations. First to deploy is PRIME, a liquid staking token on the Hastra liquidity protocol.

“We’re democratizing access to institutional lending markets,” said Mike Cagney, founder and executive chairman of Figure. “For the first time, a DeFi user with $100 can participate in the same loan pools as major financial institutions, earning yields from real lending activity with full transparency and instant liquidity.”

Chainlink’s oracle infrastructure is central to this goal. Its technology will connect Solana’s developer-friendly environment with Figure’s $19 billion in tokenized loan originations.

These initiatives could further catalyse price appreciation for both LINK and SOL.

At the time of writing, LINK changed hands at $14 while Solana price hovered at $136. If prices rise further, the main short-term target will be highs above $26, last seen in August. SOL bulls will eye $200.

Other bullish catalysts will include crypto ETFs, regulatory clarity and a flip in global macroeconomic outlook.

The post Chainlink partners with Coinbase on Base–Solana bridge as LINK targets new breakout levels appeared first on CoinJournal.

The expiration of these options could lead to increased market volatility and influence trading strategies in the cryptocurrency sector.

The post $4B in Bitcoin and Ethereum options set to expire appeared first on Crypto Briefing.