Dogecoin ETFs Flat At Launch, But TA Points To $1 If This Support Holds

The launch of spot exchange-traded funds (ETFs) tracking Dogecoin in the United States was met with muted enthusiasm. Inflows into Grayscale and Bitwise’s ETFs were limited in their first week of trading, despite the hype around the first-ever Dogecoin ETFs. But even as ETF inflows sputter, some technical analysts argue that DOGE might still undergo a strong price rally, possibly all the way to $1, if important support levels hold.

Spot DOGE ETFs Off To A Slow Start

When Grayscale rolled out its Spot DOGE fund (GDOG) on November 24, inflow volume clocked in at just about $1.8 million on the first day, far below the estimates some market participants had forecasted. For example, Eric Balchunas, senior ETF analyst at Bloomberg, predicted that the ETF will witness a $12 million volume on the first day of trading.

According to data from SoSoValue, net inflows across the DOGE ETFs by Grayscale and Bitwise added up to just over $2.16 million over the course of the initial trading week. This shows that institutional and retail investors are somewhat cautious when it comes to investing in the meme cryptocurrency.

This is in contrast to the strong opening inflows seen by other altcoin ETFs, such as those for Solana (SOL) and XRP which were launched in the past few weeks. Furthermore, the lackluster uptake has raised doubts about whether the ETFs will ignite the kind of renewed interest in DOGE that some backers hoped for.

Technical Outlook Suggests Bullish Potential To $1

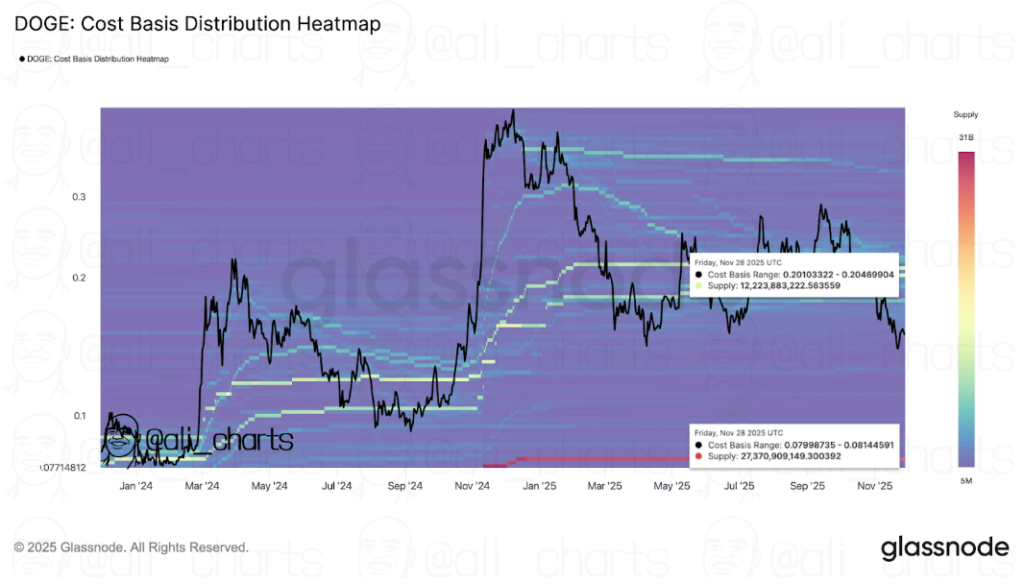

Even though ETF demand is currently tepid, multiple technical outlooks point to a potentially more optimistic outcome for Dogecoin. One technical outlook from crypto analyst Ali Martinez identifies key support at roughly $0.08, with resistance around $0.20. This support level harkens back to a time when DOGE dipped below $0.10, before launching into a multi-month rally to $0.50 after the US elections.

Dogecoin Key Price Levels. Source: @ali_charts On X

More bullishly, a multi-week technical breakdown done by crypto analyst XForceGlobal suggests that DOGE might be wrapping up a long-term corrective phase and positioning for a fifth wave, which is a powerful upward impulse according to the Elliott Wave Theory. That wave could push prices well beyond current levels, with intermediate targets potentially between $0.33 and $0.50, and a longer-term stretch to $1.

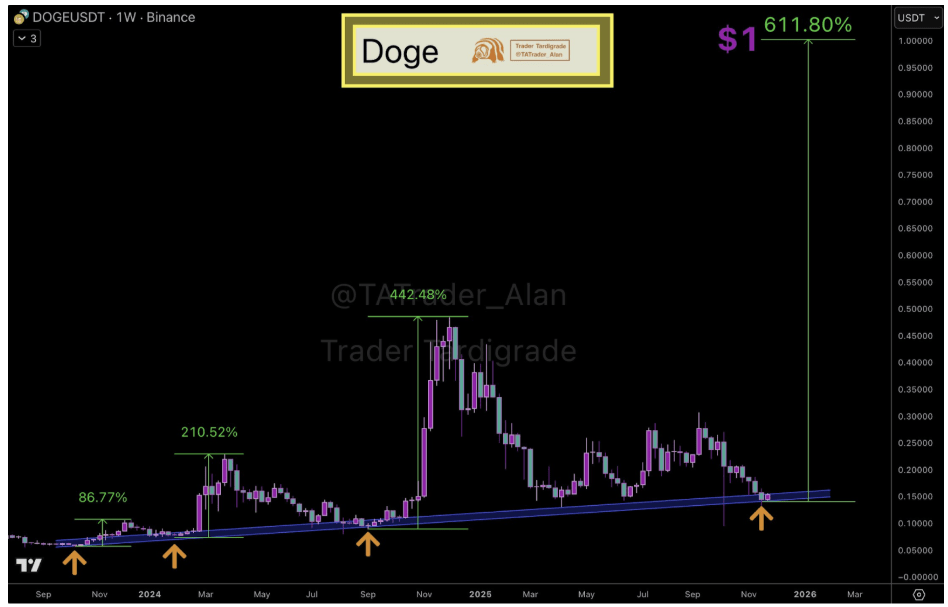

Similarly, crypto analyst Trader Tardigrade believes Dogecoin has dropped back onto the same long-term support zone that previously led to major rallies, calling it the launch pad for the next big move. His weekly chart highlights how Dogecoin’s price action has repeatedly bounced from this ascending trendline, producing gains of more than 80%, 210%, and even over 440% since October 2023.

Dogecoin Technical Analysis. Source: @TATrader_Alan On X

The analyst says the pattern is intact once again, and if the support at $0.15 holds, Dogecoin could follow the same structure into a larger expansion phase. Based on his projection, that continuation would give Dogecoin enough momentum to make a gradual 610% climb to $1 by 2026.

At the time of writing, Dogecoin is trading at $0.15 and is close to either rebounding or breaking below the support.

Featured image from Unsplash, chart from TradingView