Gensler calls out crypto hype—again: Bitcoin aside, ‘it’s a risk asset’

Former SEC Chairman Gary Gensler told Bloomberg that cryptocurrencies, excluding Bitcoin, represent highly speculative assets with minimal fundamental backing.

His remarks came as Bitcoin rebounded toward $92,000 following a volatile week marked by bond market turbulence and institutional shifts.

Gensler drew a sharp distinction between Bitcoin and thousands of alternative tokens, arguing investors face heightened risk beyond the flagship cryptocurrency.

“Putting aside Bitcoin for a minute, all the thousands of other tokens, not the stablecoins that are backed by U.S. dollars, but all the thousands of their tokens. You have to ask yourself, what’s the fundamentals? What’s underlying it?” he said, noting these assets generate no dividends or tangible returns.

Despite Gensler’s caution, institutional adoption accelerated dramatically on Wednesday when Vanguard reversed years of opposition and enabled its 50 million clients to trade Bitcoin, Ethereum, XRP, and Solana ETFs.

The $11 trillion asset manager’s policy shift, driven by new CEO Salim Ramji, previously BlackRock’s Bitcoin ETF architect, triggered immediate market response with $1 billion in IBIT volume within 30 minutes of trading.

Eric Balchunas, a Bloomberg ETF analyst, captured the significance, stating Bitcoin jumped 6% around the U.S. market open on the first day after Vanguard lifted its ban.

THE VANGUARD EFFECT: Bitcoin jumps 6% right around US open on first day after bitcoin ETF ban lifted. Coincidence? I think not. Also $1b in IBIT volume in first 30min of trading. I knew those Vanguardians had a little degen in them, even some of the most conservative investors… pic.twitter.com/OKyihvEqqD

— Eric Balchunas (@EricBalchunas) December 2, 2025

The reversal marks a complete departure from Vanguard’s 2024 stance, which declared that crypto had no place in long-term portfolios. It now offers regulated spot ETFs from BlackRock, Fidelity, Grayscale, VanEck, and Bitwise.

Even conservative allocation scenarios suggest massive potential inflows, with 0.5% of Vanguard’s assets representing $55 billion, exceeding total first-year 2024 ETF cycle flows.

Markets responded positively across digital assets, with Ethereum rising 8.3% to $3,040, XRP gaining 7.6% to $2.18, and total crypto market capitalization climbing 6.5% to $3.22 trillion.

Bitcoin just ripped higher after getting absolutely crushed yesterday because Vanguard finally cracked and opened its platform to crypto ETFs starting today.

— StockMarket.News (@_Investinq) December 3, 2025

That's genuinely massive since they manage trillions and suddenly 50 million retail customers who couldn't touch Bitcoin… https://t.co/r8NISLyx4p

Bitcoin’s V-shaped recovery followed Federal Reserve action that ended quantitative tightening and injected $13.5 billion through overnight funding facilities.

Akshat Siddant, lead quant analyst at Mudrex, noted in an earlier Cryptonews report that Bitcoin exchange reserves fell to multi-year lows of 2.19 million BTC, strengthening buying pressure. The next major resistance sits around $96,000, with support near $87,800.

— Cryptonews.com (@cryptonews) December 3, 2025

Bitcoin climbed toward $92,000 at the Asia open as regional stocks steadied and futures signaled a calmer session after recent global volatility.#AsiaMarketOpen #bitcoin https://t.co/1nSEUv98wM

The improvement followed Monday’s turmoil, when Japanese rate-hike expectations triggered global bond selloffs and amplified cryptocurrency declines.

Japanese government bond moves remained subdued on Wednesday, though yields stayed pressured as markets priced Bank of Japan tightening later this month.

Notably, Gensler also addressed broader market infrastructure during the interview, downplaying concerns about Thanksgiving’s 10-hour outage at the Chicago Mercantile Exchange, caused by a data center cooling system failure.

“I think the management team would make a different decision and probably would switch over to the backup data center more quickly,” he said, had the incident occurred during regular trading hours.

December historically favors stocks, and prospects of easier U.S. monetary policy supported sentiment following Japan’s shock.

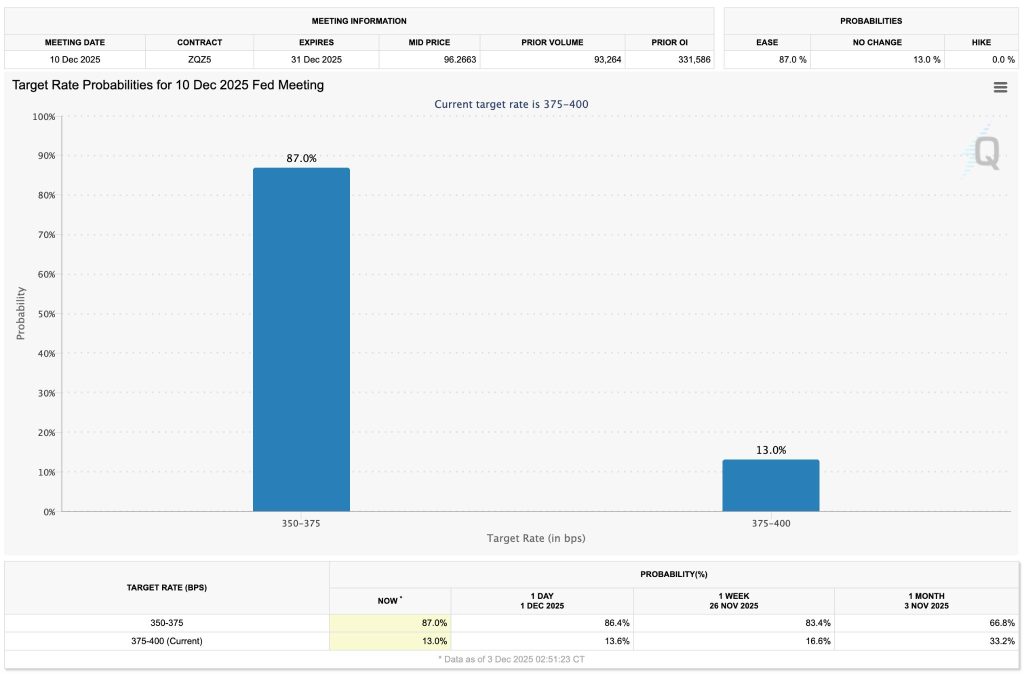

Traders now see over 80% probability of a 25-basis-point Federal Reserve cut at the December meeting, up from 63% a month earlier, according to CME’s FedWatch Tool, despite Fed officials warning against cutting too quickly amid inflation concerns.

Attention turned to Friday’s release of the Personal Consumption Expenditures Index, the Fed’s preferred inflation gauge, which could cement expectations ahead of next week’s policy decision.

Markets also monitored potential succession plans for Fed Chair Jerome Powell, with White House economic adviser Kevin Hassett emerging as a leading contender when Powell’s term ends next year.

On the technical level, Sykodelic, a macro specialist with over seven years in crypto, challenged bearish sentiment heading into 2026.

“So you’re telling me you’re bearish heading into 2026 when Vanguard aped $1bn in 30 mins, Blackrock ETF is highest earner for them, QT has ended and rates continuing to drop, overall macro tailwinds piling up,” he said, arguing new highs in 2026 remain likely despite four-year cycle theories predicting deeper corrections.

Just like Sykodelic, analyst Michael Van De Poppe also projected Bitcoin could test $100,000 and potentially $105,000 during December, though warned that losing $92,000 support could trigger a harsh correction toward $88,000-$90,000.

The post Former SEC Chair Gensler Warns All Cryptos Are Risky — Except Bitcoin appeared first on Cryptonews.