Strategy’s Bitcoin Appetite Dries Up In 2025 — What Happened?

Strategy, the Michael Saylor-led corporate Bitcoin buyer long watched by investors, has sharply cut back purchases this year, according to CryptoQuant. Once a steady force of demand, its monthly buys have fallen dramatically, changing the way market watchers view institutional support for Bitcoin.

Sharp Drop In Monthly Purchases

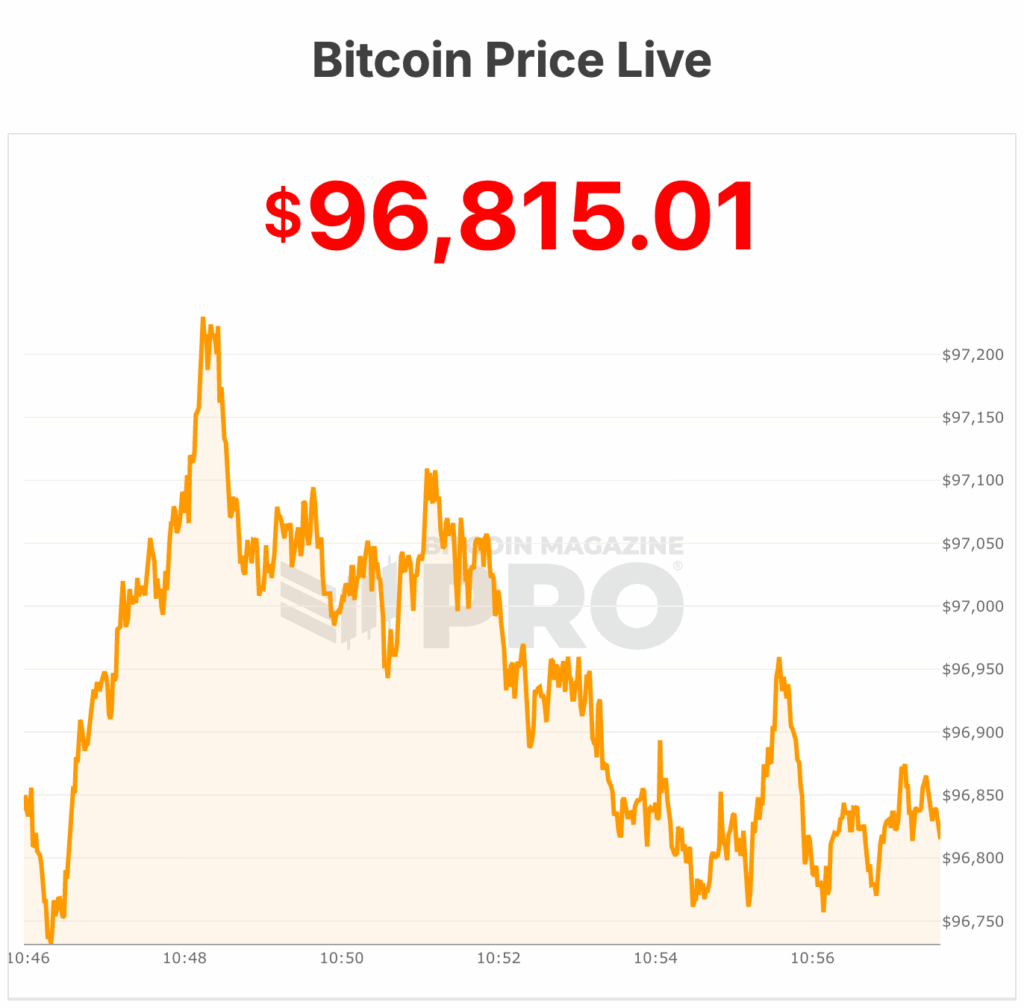

Based on reports, Strategy’s monthly accumulation peaked around 134,000 BTC in late 2024. By November 2025 that figure had dropped to roughly 9,100 BTC. That move amounts to about a 93% decline from the high-water mark. Buying this month was almost nil, with only 135 BTC recorded early in December. Those numbers show how quickly a major buyer can thin out.

Strategy’s Bitcoin buying has collapsed through 2025.

Monthly purchases fell from 134K BTC at the 2024 peak to just 9.1K BTC in November 2025, only 135 BTC so far this month.

A 24-month buffer makes one thing clear: they’re bracing for the bear market. pic.twitter.com/qEwXR3JQ82

— CryptoQuant.com (@cryptoquant_com) December 3, 2025

A Big Buy Amid The Pullback

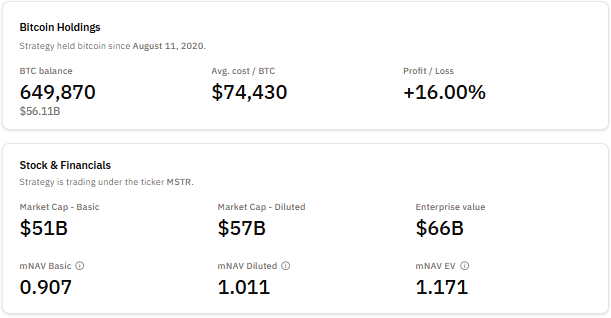

Reports have disclosed that on November 17, 2025, Strategy made a sizeable purchase of roughly 8,178 BTC, a buy worth near $835 million at the time. The purchase was the largest for the firm since July and pushed its total holdings to about 649,870 BTC. But while that single entry was large, it did not reverse the broader trend: overall monthly activity is far lower than it was a year earlier.

Big Holdings But More Cash On Hand?According to CryptoQuant, Strategy has also piled up cash — about $1.4 billion has been set aside. That reserve is being held to cover dividend payments, debt servicing and other company needs. Observers say this signals a shift toward preserving liquidity rather than steady accumulation of Bitcoin. In other words, the company appears to be prioritizing cash stability over more buys for now.

Market analysts are taking the slowdown as a warning sign that corporate appetite for Bitcoin treasuries may be cooling. If other big holders act the same, the structural demand that helped support prices could weaken.

Some traders will read the figures as a move to brace for a possible bear market. Others point out that Strategy’s enormous stash — nearly 650,000 BTC — still gives it room to ride out a downturn without having to sell immediately.

Key signals to monitor include the monthly purchase totals going forward and any change in Strategy’s cash holdings. Observers will be watching to see if the company returns to regular Bitcoin purchases or if the reduced buying becomes the standard.

It’s also important to monitor other corporate treasuries, because if several slowdowns occur together, the market for newly issued and available Bitcoin could tighten significantly.

Featured image from JRU, chart from TradingView

STRATEGY BUYS ANOTHER 8,178

STRATEGY BUYS ANOTHER 8,178