Reading view

Ore Formation: A Surface Level Look

The past few months, we’ve been giving you a quick rundown of the various ways ores form underground; now the time has come to bring that surface-level understanding to surface-level processes.

Strictly speaking, we’ve already seen one: sulfide melt deposits are associated with flood basalts and meteorite impacts, which absolutely are happening on-surface. They’re totally an igneous process, though, and so were presented in the article on magmatic ore processes.

For the most part, you can think of the various hydrothermal ore formation processes as being metamorphic in nature. That is, the fluids are causing alteration to existing rock formations; this is especially true of skarns.

There’s a third leg to that rock tripod, though: igneous, metamorphic, and sedimentary. Are there sedimentary rocks that happen to be ores? You betcha! In fact, one sedimentary process holds the most valuable ores on Earth– and as usual, it’s not likely to be restricted to this planet alone.

Placer? I hardly know ‘er!

We’re talking about placer deposits, which means we’re talking about gold. In dollar value, gold’s great expense means that these deposits are amongst the most valuable on Earth– and nearly half of the world’s gold has come out of just one of them. Gold isn’t the only mineral that can be concentrated in placer deposits, to be clear; it’s just the one everyone cares about these days, because, well, have you seen the spot price lately?

Since we’re talking about sediments, as you might guess, this is a secondary process: the gold has to already be emplaced by one of the hydrothermal ore processes. Then the usual erosion happens: wind and water breaks down the rock, and gold gets swept downhill along with all the other little bits of rock on their way to becoming sediments. Gold, however, is much denser than silicate rocks. That’s the key here: any denser material is naturally going to be sorted out in a flow of grains. To be specific, empirical data shows that anything denser than 2.87 g/cm3 can be concentrated in a placer deposit. That would qualify a lot of the sulfide minerals the hydrothermal processes like to throw up, but unfortunately sulfides tend to be both too soft and too chemically unstable to hold up to the weathering to form placer deposits, at least on Earth since cyanobacteria polluted the atmosphere with O2.

Image: “MSL Sunset Dunes Mosaic“, NASA/JPL and Olivier de Goursac

One form of erosion is from wind, which tends to be important in dry regions – particularly the deserts of Australia and the Western USA. Wind erosion can also create placer deposits, which get called “aeolian placers”. The mechanism is fairly straightforward: lighter grains of sand are going to blow further, concentrating the heavy stuff on one side of a dune or closer to the original source rock. Given the annual global dust storms, aeolian placers may come up quite often on Mars, but the thin atmosphere might make this process less likely than you’d think.

We’ve also seen rockslides on Mars, and material moving in this matter is subject to the same physics. In a flow of grains, you’re going to have buoyancy and the heavy stuff is going to fall to the bottom and stop sooner. If the lighter material is further carried away by wind or water, we call the resulting pile of useful, heavy rock an effluvial placer deposit.

Still, on this planet at least it’s usually water doing the moving of sediments, and it’s water that’s doing the sortition. Heavy grains fall out of suspension in water more easily. This tends to happen wherever flow is disrupted: at the base of a waterfall, at a river bend, or where a river empties into a lake or the ocean. Any old Klondike or California prospector would know that that’s where you’re going to go panning for gold, but you probably wouldn’t catch a 49er calling it an “Alluvial placer deposit”. Panning itself is using the exact same physics– that’s why it, along with the fancy modern sluices people use with powered pumps, are called “placer mining”. Mars’s dry river beds may be replete with alluvial placers; so might the deltas on Titan, though on a world where water is part of the bedrock, the cryo-mineralogy would be very unfamiliar to Earthly geologists.

Back here on earth, wave action, with the repeated reversal of flow, is great at sorting grains. There aren’t any gold deposits on beaches these days because wherever they’ve been found, they were mined out very quickly. But there are many beaches where black magnetite sand has been concentrated due to its higher density to quartz. If your beach does not have magnetite, look at the grain size: even quartz grains can often get sorted by size on wavy beaches. Apparently this idea came after scientists lost their fascination with latin, as this type of deposit is referred to simply as a “beach placer” rather than a “littoral placer”.

While we in North America might think of the Klondike or California gold rushes– both of which were sparked by placer deposits– the largest gold field in the world was actually in South Africa: the Witwatersrand Basin. Said basin is actually an ancient lake bed, Archean in origin– about three billion years old. For 260 million years or thereabouts, sediments accumulated in this lake, slowly filling it up. Those sediments were being washed out from nearby mountains that housed orogenic gold deposits. The lake bed has served to concentrate that ancient gold even further, and it’s produced a substantial fraction of the gold metal ever extracted– depending on the source, you’ll see numbers from as high as 50% to as low as 22%. Either way, that’s a lot of gold.

Witwatersrand is a bit of an anomaly; most placer deposits are much smaller than that. Indeed, that’s in part why you’ll find placer deposits only mined for truly valuable minerals like gold and gems, particularly diamonds. Sure, the process can concentrate magnetite, but it’s not usually worth the effort of stripping a beach for iron-rich sand.

The most common non-precious exception is uraninite, UO2, a uranium ore found in Archean-age placer deposits. As you might imagine, the high proportion of heavy uranium makes it a dense enough mineral to form placer deposits. I must specify Archean-age, however, because an oxygen atmosphere tends to further oxidize the uraninite into more water-soluble forms, and it gets washed to sea instead of forming deposits. On Earth, it seems there are no uraninite placers dated to after the Great Oxygenation; you wouldn’t have that problem on Mars, and the dry river beds of the red planet may well have pitchblende reserves enough for a Martian rendition of “Uranium Fever”.

Image: Nandes Valles valley system, ESA/DLR/FU Berlin

While uranium is produced at Witwatersrand as a byproduct of the gold mines, uranium ore can be deposited exclusively of gold. You can see that with the alluvial deposits in Canada, around Elliot Lake in Ontario, which produced millions of pounds of the uranium without a single fleck of gold, thanks to a bend in a three-billion-year-old riverbed. From a dollar-value perspective, a gold mine might be worth more, but the uranium probably did more for civilization.

Lateritization, or Why Martians Can’t Have Pop Cans

Speaking of useful for civilization, there’s another type of process acting on the surface to give us ores of less noble metals than gold. It is not mechanical, but chemical, and given that it requires hot, humid conditions with lots of water, it’s almost certainly restricted to Sol 3. As the subtitle gives it away, this process is called “lateritization” and is responsible for the only economical aluminum deposits out there, along with a significant amount of the world’s nickel reserves.

The process is fairly simple: in the hot tropics, ample rainfall will slowly leech any mobile ions out of clay soils. Ions like sodium and potassium are first to go, followed by calcium and magnesium but if the material is left on the surface long enough, and the climate stays hot and wet, chemical weathering will eventually strip away even the silica. The resulting “Laterite” rock (or clay) is rich in iron, aluminum, and sometimes nickel and/or copper. Nickel laterites are particularly prevalent in New Caledonia, where they form the basis of that island’s mining industry. Aluminum-rich laterites are called bauxite, and are the source of all Earth’s aluminum, found worldwide. More ancient laterites are likely to be found in solid form, compressed over time into sedimentary rock, but recent deposits may still have the consistency of dirt. For obvious reasons, those recent deposits tend to be preferred as cheaper to mine.

When we talk about a “warm and wet” period in Martian history, we’re talking about the existence of liquid water on the surface of the planet– we are notably not talking about tropical conditions. Mars was likely never the kind of place you’d see lateritization, so it’s highly unlikely we will ever find bauxite on the surface of Mars. Thus future Martians will have to make due without Aluminum pop cans. Of course, iron is available in abundance there and weighs about the same as the equivalent volume of aluminum does here on Earth, so they’ll probably do just fine without it.

Most nickel has historically come from sulfide melt deposits rather than lateralization, even on Earth, so the Martians should be able to make their steel stainless. Given the ambitions some have for a certain stainless-steel rocket, that’s perhaps comforting to hear.

It’s important to emphasize, as this series comes to a close, that I’m only providing a very surface-level understanding of these surface level processes– and, indeed, of all the ore formation processes we’ve discussed in these posts. Entire monographs could be, and indeed have been written about each one. That shouldn’t be surprising, considering the depths of knowledge modern science generates. You could do an entire doctorate studying just one aspect of one of the processes we’ve talked about in this series; people have in the past, and will continue to do so for the foreseeable future. So if you’ve found these articles interesting, and are sad to see the series end– don’t worry! There’s a lot left to learn; you just have to go after it yourself.

Plus, I’m not going anywhere. At some point there are going to be more rock-related words published on this site. If you haven’t seen it before, check out Hackaday’s long-running Mining and Refining series. It’s not focused on the ores– more on what we humans do with them–but if you’ve read this far, it’s likely to appeal to you as well.

Binance Bitcoin Stockpile Shrinks Amid Market Turmoil

Bitcoin showed some muscle today, breaching the $93,000 mark, as buying saw a good amount of activity across the digital currency market. Even with prices heading north, Bitcoin stored on Binance has been retreating, according to on-chain data.

That shrinking supply on a major exchange is one of several forces traders point to as tightening available coins for sale.

Binance Reserves Shrink

Based on an analysis by CryptoQuant, Binance’s Bitcoin reserves have declined as more coins move off the exchange. Some of that shift comes from holders moving funds into private cold wallets for safekeeping.

Reports show that large buyers in the US — including spot ETF managers — are also taking coins off the market and placing them with custodians.

Those moves reduce the float available to traders and can add upward pressure on prices when demand rises.

Why Binance’s Bitcoin Reserves Are Declining

“Historically, such conditions have supported medium- to long-term price appreciation. The current trend suggests that Binance’s reserve decline is a normal re-accumulation phase.” – By @xwinfinance pic.twitter.com/g3TCG4o6GD

— CryptoQuant.com (@cryptoquant_com) December 3, 2025

ETF Buying And Self-Custody

According to analysts, US spot ETFs have been buying meaningful amounts of Bitcoin for their products. Funds from big issuers are held by trusted custodians rather than on trading platforms.

At the same time, ordinary holders and whales frequently shift holdings to self-custody during rallies, signaling they do not plan to sell soon.

Together, these trends remove supply from exchanges and help explain why reserves on Binance are shrinking.

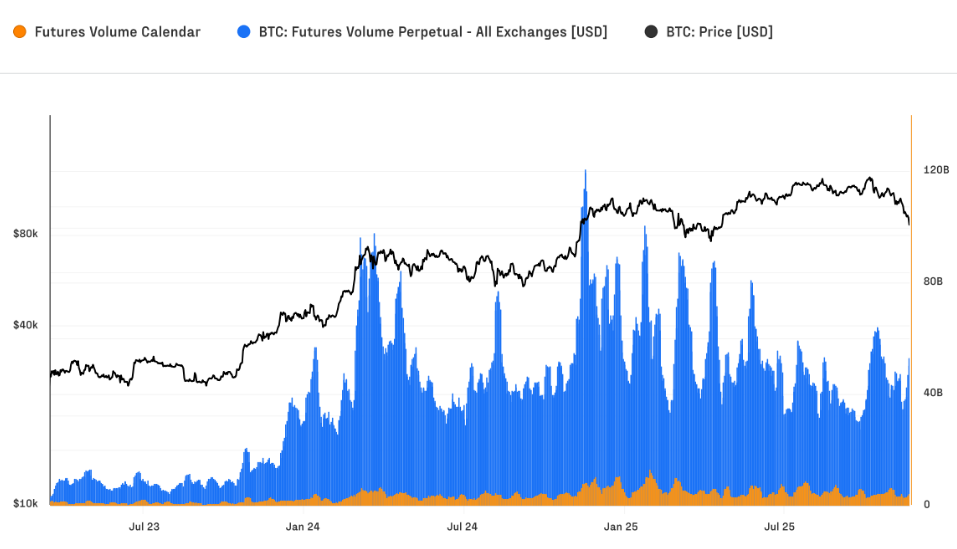

Derivatives activity also played a role in recent exchange balances. Daily futures wipeouts have climbed from averages of about $28 million long and $15 million short in the prior cycle to near $68 million long and $45 million short in the current run.

That uptick in forced exits peaked on Oct. 10, when over $640 million per hour in long positions were liquidated as Bitcoin slid from $121,000 to $102,000.

Open interest dropped roughly 22% in under 12 hours, falling from close to $50 billion to $38 billion at the time.

While those liquidations were dramatic, the futures market has grown overall. Open interest is at a record $67 billion and daily futures turnover reached $68 billion.

More than 90% of that activity is in perpetual contracts, which tend to amplify short-term moves. That combination raises both trading volume and the potential for sharp moves when sentiment flips.

Price Levels To WatchBased on trader calls, the market is watching the $92,000–$94,000 zone as a key resistance area. A clean daily close above that band could speed momentum toward $100K.

Nearer-term support sits around $88,000–$89,000, where buyers are expected to step in if prices pull back. Trading volume on a busy day climbed close to $86 billion, showing renewed interest from both retail and institutional participants.

Featured image from Safelincs, chart from TradingView

Arianne’s Urban Garden in Minnesota, Part 1

Risk Runs Hot: Massive Crypto Liquidation Wave Slams Traders Overnight

A sharp rise in crypto liquidations is sending a louder message of how some traders are using more leverage in recent months.

Average daily wipeouts have jumped from roughly $28 million in long bets and $15 million in shorts during the last cycle to about $68 million long and $45 million short in the current cycle, according to a new Glassnode and Fasanara report. That shift has made single sell-offs much more violent.

Early Black Friday Shock

Reports have disclosed that Oct. 10 was the clearest sign of the change. On that day, more than $640 million per hour in long positions were liquidated as Bitcoin plunged from $121,000 to $102,000.

Open interest fell about 22% in less than 12 hours, sliding from close to $50 billion to $39 billion. Traders felt the move fast. Positions were closed out on a scale Glassnode called one of the sharpest deleveraging events in Bitcoin’s history.

Futures Activity Hits Records

Futures markets have swelled. Open interest climbed to a record $68 billion and daily futures turnover topped $69 billion in mid-October.

Perpetual contracts now account for more than 90% of that activity, which concentrates risk in instruments that reset continuously.

Average daily futures wipeouts rising to $68 million long and $45 million short shows the costs when big swings occur.

Spot Trading DoublesBased on reports, spot trading has also become more active. Bitcoin’s spot volume has climbed into an $8 billion to $22 billion daily range, roughly double what was seen in the prior cycle.

During the Oct. 10 crash, hourly spot volume spiked to $7.3 billion, with many traders stepping in to buy the dip rather than run for the exits. That flow has helped shift where price discovery happens.

Capital Flows And Market ShareMonthly inflows into Bitcoin have varied from $40 billion to $190 billion, pushing realized market capitalization to a record $1.1 trillion.

Roughly $730 billion has flowed into the network since the November 2022 low — more than all previous cycles combined.

As a result, Bitcoin’s share of overall crypto market cap rose from 38% in late 2022 to 58% today, based on the report’s figures.

Bitcoin As Settlement RailMeanwhile, there’s another striking stat: over the past 90 days the Bitcoin network processed nearly $7 trillion in transfers. That throughput exceeded what major card networks handled in the same window.

This has been cited as a reason some participants view Bitcoin not just as a store of value, but as an increasingly important settlement rail.

Bitcoin Price ActionAt the time of writing, Bitcoin was trading at $93,165, up 6.5% and nearly 7% in the daily and weekly timeframes.

Featured image from Unsplash, chart from TradingView

In Which I Vibe-Code a Personal Library System

When I was a kid, I was interested in a number of professions that are now either outdated, or have changed completely. One of those dreams involved checking out books and things to patrons, and it was focused primarily on pulling out the little card and adding a date-due stamp.

Of course, if you’ve been to a library in the last 20 years, you know that most of them don’t work that way anymore. Either the librarian scans special barcodes, or you check materials out yourself simply by placing them just so, one at a time. Either way, you end up with a printed receipt with all the materials listed, or an email. I ask you, what’s the fun in that? At least with the old way, you’d usually get a bookmark for each book by way of the due date card.

As I got older and spent the better part of two decades in a job that I didn’t exactly vibe with, I seriously considered becoming a programmer. I took Java, Android, and UNIX classes at the local junior college, met my now-husband, and eventually decided I didn’t have the guts to actually solve problems with computers. And, unlike my husband, I have very little imagination when it comes to making them do things.

Fast forward to last weekend, the one before Thanksgiving here in the US. I had tossed around the idea of making a personal library system just for funsies a day or so before, and I brought it up again. My husband was like, do you want to make it tonight using ChatGPT? And I was like, sure — not knowing what I was getting into except for the driver’s seat, excited for the destination.

Vibing On a Saturday Night

I want to make a book storage system. Can you please write a Python script that uses SQL Alchemy to make a book model that stores these fields: title, author, year of publication, genre, and barcode number?

So basically, I envisioned scanning a book’s barcode, pulling it up in the system, and then clicking a button to check it out or check it back in. I knew going in that some of my books don’t have barcodes at all, and some are obliterated or covered up with college bookstore stickers and what have you. More on that later.

First, I was told to pip install sqlalchemy, which I did not have. I was given a python script called books_db.py to get started. Then I asked for code that looks up all the books and prints them, which I was told to add to the script.

Then things were getting serious. I asked it to write a Flask server and a basic HTML front end for managing the books in the system. I was given the Flask server as app.py, and then some templates: base.html to be used by all pages, and index.html to view all the books, and add_book.html to, you know, add a new book. At that point, I got to see what it had created for the first time, and I thought it was lovely for a black and white table. But it needed color.

Check It Out

I asked the chat-thing for features and implemented them piecemeal, as you do if you’re not a masochist. First up was a cute little trash-can delete-button for every entry. Then it was time to set up the CheckoutEvent. Each of these events records which book it belongs to, whether it’s a check-out or check-in event, and the timestamp of said event. Of course, then it was time to get the checkout history wired to the front-end and accessible by clicking a book’s title.

All I really had to do was add a history route to app.py, update index.html to make the titles clickable, and create the book_history.html it spat out. Then I had it add the buttons for checking in and out on the new checkout history page, which involved adding routes to app.py as well as a helper to compute the current status.

Then it had me modify the history route and update book_history.html with the actual buttons. And they’re super cute, too — there’s a little red book on the checkout button, and a green book on the check-in.

Barcode Blues

On the index.html page, can you add a barcode number-based search box? And when the user searches, redirect them to the book page for that barcode?

Now it was time to get the barcode scanning situation up and running. I was sure at some point that ChatGPT would time me out for the night since I use the free model, but it just kept helping me do whatever I wanted, and even suggesting new features.

I wanted the barcode handling to be twofold: one, it should definitely pull the checkout page if the book exists in the system, and it should also definitely go to the book-entering page if not.

Yes — that’s a great workflow feature.We’ll add a barcode search box to your index page, and when someone submits a barcode, the app will:

-

Look up the book by barcode -

Redirect straight to that book’s checkout history page -

Show a nice error if the barcode doesn’t exist

I did what it told me, adding a barcode search route in app.py and updating the index() route to use it. I then added its barcode search form to index.html. It was at this point that I had to figure out a way to generate barcodes so I could make little stickers for the books that lack them entirely, or have otherwise obliterated ones.

I have a pretty basic 1D barcode scanning gun, and it won’t scan everything. As I soon found out, it prefers fake EAN barcodes to UPCs altogether. I finally found an online barcode generator and got to work, starting with a list of randomly-generated numbers I made with Excel. I decided I wanted all the fake barcodes to start with 988, which is close enough to the ISBN 978 lead-in, and happens to use my favorite number twice.

We took a brief detour as I asked the chat-thing to make the table to have ascending/descending sorting by clicking the headers. The approach it chose was to keep things server-side, and use little arrows to indicate direction. I added sorting logic to app.py and updated index.html to produce the clickable headers, and also decided that the entries should be color-coded based on genre, and implemented that part without help from GPT. Then I got tired and went to bed.

The Long, Dark Night of the Solo Programmer

I’m of a certain age and now sleep in two parts pretty much every night. In fact, I’m writing this part now at 1:22 AM, blasting Rush (2112) and generally having a good time. But I can tell you that I was not having a good time when I got out of bed to continue working on this library system a couple of hours later.

There I was, entering books (BEEP!), when I decided I’d had enough of that and needed to try adding more features. I cracked my knuckles and asked the chat-thing if it could make it so the search works across all fields — title, author, year, genre, or barcode. It said, cool, we can do that with a simple SQLAlchemy or_ query. I was like, whatever, boss; let’s get crazy.

Can you make it so the search works across all fields?

It had me import or_ and update the search route in app.py to replace the existing barcode search route with a generalized search using POST. Then I was to update index.html to rename the input to a general query. Cool.

But no. I messed it up some how and got an error about a missing {% endblock %}. In my GPT history it says, I’m confused about step 2. Where do I add it? And maybe I was just tired. I swear I just threw the code up there at the top like it told me to. But it said:

Ah! I see exactly why it’s confusing — your current index.html starts with the <h1> and then goes straight into the table. The search form should go right under the <h1> and before the table.

Then I was really confused. Didn’t I already have a search box that only handled barcodes? I sure did, over in base.html. So the new search code ended up there. Maybe that’s wrong. I don’t remember the details, but I searched the broader internet about my two-layer error and got the thing back to a working state many agonizing minutes later. Boy, was I proud, and relieved that I didn’t have to ask my husband to fix my mistake(s) in the morning. I threw my arms in the air and looked around for the cats to tell them the good news, but of course, I was the only one awake.

Moar Features!

I wasn’t satisfied. I wanted more. I asked it to add a current count of books in the database and display it toward the top. After that, it offered to add a count of currently-checked-out vs. available books, to which I said yes please. Then I wanted an author page that accepts an author’s name and shows all books by that author. I asked for a new page that shows all the books that are checked out. Most recently, I made it so the search box and the column headers persist on scroll.

I’m still trying to think of features, but for now I’m busy entering books, typing up check-out cards on my IBM Wheelwriter 5, and applying library pockets to the inside back covers of all my books. If you want to make your own personal library system, I put everything on GitHub.

On the Shoulders of Giants (and Robots)

I couldn’t have done any of this without my husband’s prompts and guidance, his ability to call shenanigans on GPT’s code whenever warranted, and ChatGPT itself. Although I have programmed in the past, it’s been a good long time since I even printed “Hello, World” in any language, though I did find myself recalling a good deal about this and that syntax.

If you want to make a similar type of niche system for your eyes only, I’d say this could be one way to do it. Wait, that’s pretty non-committal. I’d say just go for it. You have yourself and the broader Internet to check mistakes along the way, and you just might like some of the choices it makes on your behalf.

Angela’s Summer Flowers in North Carolina

Ethereum Open Interest Cut In Half As $6.4B In Positions Vanish: Market Reset Accelerates

Ethereum has fallen below the $2,800 mark after a sharp and sudden decline, deepening panic across the market and reinforcing the sense that bulls have lost control. The recent drop has pushed investors into defensive mode, with some analysts now openly discussing the possibility of a broader bear market emerging. Selling pressure has intensified across spot and derivatives markets, and volatility continues to rise as traders struggle to identify a reliable support zone.

A new CryptoQuant report by Darkfost highlights one of the most alarming developments: Ethereum’s open interest on Binance has been steadily collapsing for more than three months. After reaching an all-time high of $12.6 billion on August 22, open interest has now been cut in half. Nearly $6.4 billion in derivative positions have evaporated, bringing ETH’s open interest down to $6.2 billion, a steep 51% decline.

While this appears to be an extraordinary contraction, Darkfost notes that open interest has only just slipped below the previous all-time high of $7.7 billion. This underscores how speculative and overstretched the 2025 derivatives market had become — and suggests that Ethereum may be undergoing a much deeper structural reset than most expected.

Speculation Unwinds Across Exchanges as Ethereum Enters Deep Reset Phase

Darkfost emphasizes that 2025 has been the most speculative phase in Ethereum’s history, fueled by aggressive leverage, rapid inflows, and a market structure that proved far less solid — and far less sustainable — than it appeared during the rally. The collapse in open interest on Binance is only part of the story.

The same pattern is unfolding across major derivatives platforms, revealing a broader structural unwind rather than an exchange-specific phenomenon.

On Gate.io, ETH open interest has fallen from $5.2 billion to $3.5 billion. On Bybit, the drop is even more severe, plunging from $6.1 billion to $2.3 billion. This synchronized contraction shows how aggressively speculative positions have been flushed out. Meanwhile, the ongoing correction has dragged Ethereum’s price from $4,830 to $2,800, marking a steep 43% decline from the highs.

This widespread reduction in leverage suggests the market is undergoing a deeper reset than typical corrections. Investors are not rushing to re-enter positions, especially as liquidations continue to stack up across exchanges.

While shrinking open interest weighs on short-term momentum and sentiment, Darkfost notes that such aggressive deleveraging may ultimately help rebuild a healthier market foundation — one capable of supporting a durable bottom for ETH.

ETH Loses Key Trend Support as 3-Day Structure Turns Fully Bearish

Ethereum’s 3-day chart shows a decisive breakdown in structure, with price now firmly below the 50 SMA, 100 SMA, and 200 SMA for the first time since late 2024. The rejection from the $3,600–$3,800 region triggered a strong impulse to the downside, sending ETH directly through all major moving averages and confirming a shift toward a higher-timeframe downtrend. The current trading zone around $2,800 reflects a critical test of former support, but momentum remains weak.

The 50 SMA has now crossed below the 100 SMA, while both are beginning to converge downward toward the 200 SMA — a configuration that typically precedes sustained corrections. Volume has increased on red candles, showing that sellers remain dominant, and there is little evidence of aggressive dip-buying. The most recent candle wick toward $2,700 highlights vulnerability rather than strength, suggesting buyers are hesitant to defend this level with conviction.

ETH is also forming a series of lower highs and lower lows, further confirming bearish market structure. If $2,750 breaks cleanly, the next significant liquidity zones sit near $2,550 and $2,300, where prior consolidations developed earlier in the cycle.

Featured image from ChatGPT, chart from TradingView.com

XRP Ledger Explodes As Activity Experiences One of Its Strongest Growth Waves Yet

XRP may be holding above the $2 price mark for a brief period, but the leading altcoin is still facing heightened bearish pressures at that level due to a broader market pullback on Monday. Even with the ongoing downward trend in price, XRP is still experiencing robust engagement as evidenced by the massive surge in activity on the XRP Ledger.

An Explosive uptick In XRP Ledger’s Activity

Prices are constantly dwindling along with the entire crypto market, but the XRP Ledger is seeing sharp engagement within the bearish period. After months of quiet and reduced adoption, the Ledger has roared back to life, recording one of its strongest growth waves yet.

Arthur, a community member and official partner of the BingX cryptocurrency exchange, shared this surge in activity on the social media platform X. This isn’t a mild rise; it’s a growth wave with significant weight behind it, the kind that indicates an expanding utility rather than fleeting speculation.

Furthermore, the sharp growth in activity suggests that more investors are choosing to conduct their day-to-day XRP operations on the Ledger, reflecting a renewed conviction in the network. The Ledger’s current activity spike is centered around the rise in Account Set transactions to a point not seen in years.

After navigating through XRPL metrics, the expert revealed that more than 40,000 Account Set transactions were carried out on the Ledger, marking its highest level in years. Such a massive wave of transactions to a new peak suggests that the Ledger may be speeding into its next phase in a market where many chains find it difficult to sustain momentum.

At the same time, there was also a surge in Automated Market Maker (AMM) bids just after November 23 concluded, indicating that preparations are taking place on the network. With Ripple’s stablecoin RLUSD approvals, AMM rollout, and the onboarding of institutional investors at an accelerated rate, it simply implies that the Ledger is picking up pace.

Open Interest Suffers A Steep Decline

While the price of XRP has pulled back, the decline appears to be heavily impacting investors’ sentiment toward the altcoin. Its derivatives market has significantly lost its weight in a single and steep decline as Open Interest (OI) experiences a sharp drop.

In a report from Glassnode, a leading on-chain data analytics platform, the token’s futures open interest fell from 1.7 billion XRP in early October to 0.7 billion XRP by the end of November. This figure represents a more than 59% flush out from October to November alone.

The funding rates have also followed suit, recording a drop from 0.001% to 0.001% in the 7-day Simple Moving Average (SMA). A combination of the drop in open interest and funding rates marks a structural pause in the altcoin’s speculators’ appetite to bet heavily on an upward direction. At the time of writing, the altcoin was trading at $2.02 after falling by over 1% in the last 24 hours.

Give Us One Manual For Normies, Another For Hackers

We’ve all been there. You’ve found a beautiful piece of older hardware at the thrift store, and bought it for a song. You rush it home, eager to tinker, but you soon find it’s just not working. You open it up to attempt a repair, but you could really use some information on what you’re looking at and how to enter service mode. Only… a Google search turns up nothing but dodgy websites offering blurry PDFs for entirely the wrong model, and you’re out of luck.

These days, when you buy an appliance, the best documentation you can expect is a Quick Start guide and a warranty card you’ll never use. Manufacturers simply don’t want to give you real information, because they think the average consumer will get scared and confused. I think they can do better. I’m demanding a new two-tier documentation system—the basics for the normies, and real manuals for the tech heads out there.

Give Us The Goods

Once upon a time, appliances came with real manuals and real documentation. You could buy a radio that came with a full list of valves that were used inside, while telephones used to come with printed circuit diagrams right inside the case. But then the world changed, and a new phrase became a common sight on consumer goods—”NO USER SERVICABLE PARTS INSIDE.” No more was the end user considered qualified or able to peek within the case of the hardware they’d bought. They were fools who could barely be trusted to turn the thing on and work it properly, let alone intervene in the event something needed attention.

This attitude has only grown over the years. As our devices have become ever more complex, the documentation delivered with them has shrunk to almost non-existent proportions. Where a Sony television manual from the 1980s contained a complete schematic of the whole set, a modern smartphone might only include a QR code linking to basic setup instructions on a website online. It’s all part of an effort by companies to protect the consumer from themselves, because they surely can’t be trusted with the arcane knowledge of what goes on inside a modern device.

This Sony tv manual from 1985 contained the complete electrical schematics for the set.

byu/a_seventh_knot inmildlyinteresting

This sort of intensely technical documentation was the norm just a few decades ago.

It’s understandable, to a degree. When a non-technical person buys a television, they really just need to know how to plug it in and hook it up to an aerial. With the ongoing decline in literacy rates, it’s perhaps a smart move by companies to not include any further information than that. Long words and technical information would just make it harder for these customers to figure out how to use the TV in the first place, and they might instead choose a brand that offers simpler documentation.

This doesn’t feel fair for the power user set. There are many of us who want to know how to change our television’s color mode, how to tinker with the motion smoothing settings, and how to enter deeper service modes when something seems awry. And yet, that information is kept from us quite intentionally. Often, it’s only accessible in service manuals that are only made available through obscure channels to selected people authorised by OEMs.

Two Tiers, Please

I don’t think it has to be this way. I think it’s perfectly fine for manufacturers to include simple, easy-to-follow instructions with consumer goods. However, I don’t think that should preclude them from also offering detailed technical manuals for those users that want and need them. I think, in fact, that these should be readily available as a matter of course.

Call it a “superuser manual,” and have it only available via a QR code in the back of the basic, regular documentation. Call it an “Advanced Technical Supplement” or a “Calibration And Maintenance Appendix.” Whatever jargon scares off the normies so they don’t accidentally come across it and then complain to tech support that they don’t know why their user interface is now only displaying garbled arcane runes. It can be a little hard to find, but at the end of the day, it should be a simple PDF that can be downloaded without a lot of hurdles or paywalls.

I’m not expecting manufacturers to go back to giving us full schematics for everything. It would be nice, but realistically it’s probably overkill. You can just imagine what that would like for a modern smartphone or even just a garden variety automobile in 2025. However, I think it’s pretty reasonable to expect something better than the bare basics of how to interact with the software and such. The techier manuals should, at a minimum, indicate how to do things like execute a full reset, enter any service modes, and indicate how the device is to be safely assembled and disassembled should one wish to execute repairs.

Of course, this won’t help those of us repairing older gear from the 90s and beyond. If you want to fix that old S-VHS camcorder from 1995, you’re still going to have to go to some weird website and risk your credit card details over a $30 charge for a service manual that might cover your problem. But it would be a great help for any new gear moving forward. Forums died years ago, so we can no longer Google for a post from some old retired tech who remembers the secret key combination to enter the service menu. We need that stuff hosted on manufacturer websites so we can get it in five minutes instead of five hours of strenuous research.

Will any manufacturers actually listen to this demand? Probably, no. This sort of change needs to happen at a higher level. Perhaps the right to repair movement and some boisterous EU legislation could make it happen. After all, there is an increasing clamour for users to have more rights over the hardware and appliances they pay for. If and when it happens, I will be cheering when the first manuals for techies become available. Heaven knows we deserve them!

Are Bitcoin Traders Pulling Back? Open Interest Plummets By 50% In A Sudden Market Reset

With the crypto market turning increasingly bearish, Bitcoin’s price has experienced another pullback, bringing it closer to the $80,000 mark once again. Along with the current drop in price, BTC’s derivatives market is showcasing bearish performance, suffering one of its steepest declines of the ongoing cycle.

Mass Derivative Unwind For Bitcoin

In a volatile landscape, Bitcoin’s Open Interest (OI) has contracted sharply as though the speculative framework supporting the market were suddenly removed. This steep drop in open interest comes after a sudden pullback in the price of BTC, causing it to lose the previously reclaimed $91,000 mark.

A report from Darkfost, a market expert and author at CryptoQuant, shows that the open interest has been sliced in half, indicating a drastic shift in investors’ sentiment and behavior. With a massive portion of leverage being evaporated, the market now stands unusually silent, while it prepares for its next decisive trigger.

Darkfost highlighted that Bitcoin leveraged positions continue to get liquidated or are being intentionally closed. Despite the recent drop in BTC’s price, this period of uncertainty is not bolstering traders’ enthusiasm to increase their exposure to risk.

Currently, the market is exhibiting a risk-off attitude, a trend that is understandable given the current state of the crypto environment. As a result, the open interest of BTC has cleared a whopping $20 billion. Data shared by the expert shows that the key metric fell from 47.5 billion BTC to 28.35 billion BTC between October 6 and December, indicating a drop of half during the period.

According to the expert, this is the worst flush in both the current cycle and the history of Bitcoin since the availability of the derivatives market. “I continue to say that the derivatives market has a major impact on Bitcoin and is the number one driver,” Darkfost stated.

BTC Percentage Loss Hits Historic Level

As the Bitcoin price continues to pull back, short-term BTC holders are feeling the weight of the waning action. These holders, also referred to as retail investors, have realized substantial losses from their positions.

Darkfost’s research is based solely on the spot market. His objective is to identify a very particular group of investors who speculate over the short term. With a realized price of $113,692, BTC holders between 1 month and 3 months are now experiencing the largest percentage loss in the ongoing market cycle.

For the past two weeks, this group of investors has been holding average unrealized losses between 20% and 25%. During his cycle, these phases have been linked with the creation of a bottom. This is because the cohort often has to decide between two behaviors: selling or holding.

In the event that a large portion of these traders are capitulating, this is typically the moment when the opportunity to accumulate BTC becomes more interesting, as observed in recent weeks. However, this setup becomes valid if the bullish trend remains intact in the long term, which Darkfost expresses trust in for the meantime.

Deborah’s Favorite Trees in New York

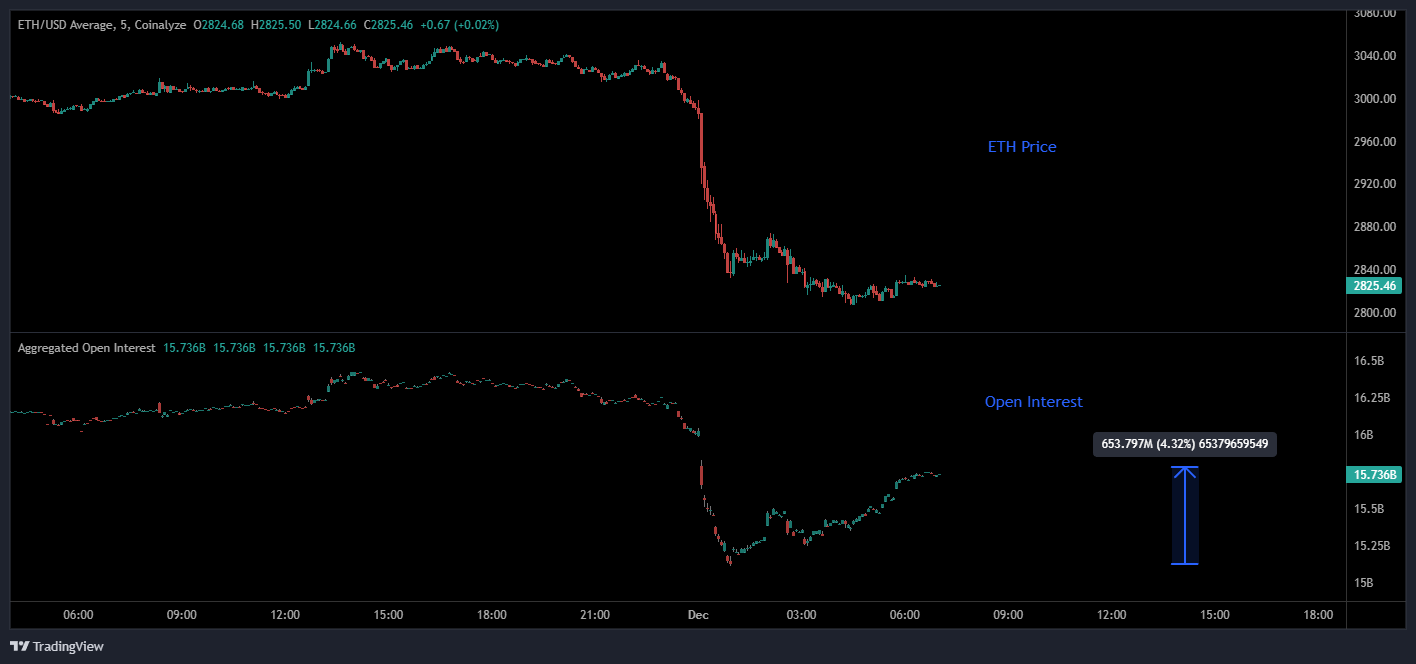

Ethereum Speculators Add $654M In Bets As Price Plunges To $2,800

Data shows the Ethereum Open Interest has shot up by more than 4% following the sharp move down in the cryptocurrency’s price.

Ethereum Has Seen A Pullback Over The Past Day

The cryptocurrency sector as a whole has witnessed a plunge to kick off the new month, with Bitcoin and Ethereum both being down by more than 5% over the last 24 hours. ETH is back in the low $2,800 levels, having essentially retraced the recovery that it had made during the last week of November.

The sudden price decline has unleashed a wave of liquidations on the derivatives exchanges, leading to $158 million in Ethereum-related contracts being flushed. Of these, $140 million of the liquidations involved long positions alone.

Below is a heatmap from CoinGlass that breaks down the liquidation numbers related to the various digital asset symbols.

Interestingly, while notable liquidations have occurred, derivatives investors still haven’t become discouraged.

ETH Open Interest Has Gone Up Since The Dip

As pointed out by CryptoQuant community analyst Maartunn in an X post, the Ethereum Open Interest has witnessed a sharp jump following the price decline. The “Open Interest” here refers to an indicator that measures the total amount of positions related to ETH that are currently open on all centralized derivatives platforms.

Here is the chart shared by Maartunn that shows the trend in this metric over the past couple of days:

As displayed in the above graph, the Ethereum Open Interest initially collapsed alongside the price drop as long positions suffered forceful closures. As ETH’s bearish momentum tapered off and the price settled into a sideways rhythm, however, the metric saw a gradual reversal in direction, indicating that speculators have started opening up fresh positions.

Since the dip, the ETH Open Interest has gone up by almost $654 million, equivalent to an increase of 4.3%. “Looks like the gamblers are back for another round,” noted the analyst.

Historically, a high value on the metric has generally been something that has led to volatility for the cryptocurrency. This is because an extreme amount of positions implies the presence of a high amount of leverage in the sector. In these conditions, any sharp swing in the asset can induce a large number of liquidations in the market. These liquidations only feed back into the price move that caused them, making it more intense.

An example of this pattern was already seen during the past day. With the Ethereum Open Interest now rising again, it remains to be seen whether more volatility will follow.

3D Printing and the Dream of Affordable Prosthetics

As amazing as the human body is, it’s unfortunately not as amazing as e.g. axolotl bodies are, in the sense that they can regrow entire limbs and more. This has left us humans with the necessity to craft artificial replacement limbs to restore some semblance of the original functionality, at least until regenerative medicine reaches maturity.

Despite this limitation, humans have become very adept at crafting prosthetic limbs, starting with fairly basic prosthetics to fully articulated and beautifully sculpted ones, all the way to modern-day functional prosthetics. Yet as was the case a hundred years ago, today’s prosthetics are anything but cheap. This is mostly due to the customization required as no person’s injury is the same.

When the era of 3D printing arrived earlier this century, it was regularly claimed that this would make cheap, fully custom prosthetics a reality. Unfortunately this hasn’t happened, for a variety of reasons. This raises the question of whether 3D printing can at all play a significant role in making prosthetics more affordable, comfortable or functional.

What’s In A Prosthetic

The requirements for a prosthetic depend on the body part that’s affected, and how much of it has been lost. In the archaeological record we can find examples of prosthetics dating back to around 3000 BCE in Ancient Egypt, in the form of prosthetic toes that likely were mostly cosmetic. When it came to leg prosthetics, these would usually be fashioned out of wood, which makes the archaeological record here understandably somewhat spotty.

While Pliny the Elder made mention of prosthetics like an iron hand for a general, the first physical evidence of a prosthetic for a lost limb are found in the form of items such as the Roman Capua Leg, made out of metal, and a wooden leg found with a skeleton at the Iron Age-era Shengjindian cemetery that was dated to around 300 BCE. These prosthetics were all effectively static, providing the ability to stand, walk and grip items, but truly functional prosthetics didn’t begin to be developed until the 16th century.

These days we have access to significantly more advanced manufacturing methods and materials, 3D scanners, and the ability to measure the electric currents produced by muscles to drive motors in a prosthetic limb, called myoelectric control. This latter control method can be a big improvement over the older method whereby the healthy opposing limb partially controls the body-powered prosthetic via some kind of mechanical system.

All of this means that modern-day prosthetics are significantly more complex than a limb-shaped piece of wood or metal, giving some hint as to why 3D printing may not produce quite the expected savings. Even historically, the design of functional prosthetic limbs involved complex, fragile mechanisms, and regardless of whether a prosthetic leg was just static or not, it would have to include some kind of cushioning that matched the function of the foot and ankle to prevent the impact of each step to be transferred straight into the stump. After all, a biological limb is much more than just some bones that happen to have muscles stuck to them.

Making It Fit

Perhaps the most important part of a prosthetic is the interface with the body. This one element determines the comfort level, especially with leg prostheses, and thus for how long a user can wear it without discomfort or negative health impacts. The big change here has been largely in terms of available materials, with plastics and similar synthetics replacing the wood and leather of yesteryear.

Generally, the first part of fitting a prosthetic limb involves putting on the silicone liner, much like one would put on a sock before putting on a shoe. This liner provides cushioning and creates an interface with the prosthesis. For instance, here is an instruction manual for just such a liner by Össur.

These liners are sized and trimmed to fit the limb, like a custom comfortable sock. After putting on the liner and adding an optional distal end pad, the next step is to put on the socket to which the actual prosthetic limb is attached. The fit between the socket and liner can be done with a locking pin, as pictured on the right, or in the case of a cushion liner by having a tight seal between the liner and socket. Either way, the liner and socket should not be able to move independently from each other when pulled on — this movement is called “pistoning”.

For a below-knee leg prosthesis the remainder of the device below the socket include the pylon and foot, all of which are fairly standard. The parts that are most appealing for 3D printing are this liner and the socket, as they need to be the most customized for an individual patient.

Companies like the US-based Quorum Prosthetics do in fact 3D print these sockets, and they claim that it does reduce labor cost compared to traditional methods, but their use of an expensive commercial 3D printer solution means that the final cost per socket is about the same as using traditional methods, even if the fit may be somewhat better.

This highlights perhaps the most crucial point about using 3D printing for prosthetics: to make it truly cheaper you also have to lean into lower-tech solutions that are accessible to even hobbyists around the world. This is what for example Operation Namaste does, with 3D printed molds for medical grade silicone to create liners, and their self-contained Limbkit system for scanning and printing a socket on the spot in PETG. This socket can be then reinforced with fiberglass and completed with the pylon and foot, creating a custom prosthetic leg in a fraction of the time that it would typically take.

Founder of Operation Namaste, Jeff Erenstone, wrote a 2023 article on the hype and reality with 3D printed prosthetics, as well as how he got started with the topic. Of note is that the low-cost methods that his Operation Namaste brings to low-resource countries in particular are not quite on the same level as a prosthetic you’d get fitted elsewhere, but they bring a solution where previously none existed, at a price point that is bearable.

Merging this world with that of of Western medical systems and insurance companies is definitely a long while off. Additive manufacturing is still being tested and only gradually integrated into Western medical systems. At some level this is quite understandable, as it comes with many asterisks that do not exist in traditional manufacturing methods.

It probably doesn’t bear reminding that having an FDM printed prosthetic snap or fracture is a far cry from having a 3D printed widget do the same. You don’t want your bones to suddenly go and break on you, either, and faulty prosthetics are a welcome source of expensive lawsuits in the West for lawyers.

Making It Work

Beyond liners and sockets there is much more to prosthetic limbs, as alluded to earlier. Myoelectric control in particular is a fairly recent innovation that detects the electrical signals from the activation of skeletal muscles, which are then used to activate specific motor functions of a prosthetic limb, as well as a prosthetic hand.

The use of muscle and nerve activity is the subject of a lot of current research pertaining to prosthetics, not just for motion, but also for feedback. Ideally the same nerves that once controlled the lost limb, hand or finger can be reused again, along with the nerves that used to provide a sense of touch, of temperature and more. Whether this would involve surgical interfacing with said nerves, or some kind of brain-computer interface is still up in the air.

How this research will affect future prosthetics remains to be seen, but it’s quite possible that as artificial limbs become more advanced, so too will the application of additive manufacturing in this field, as the next phase following the introduction of plastics and other synthetic materials.

A Fabulous Fall in Carla’s Garden, Part 2

Ethereum Leverage Reset Complete – Time For Market Re-Accumulation?

Ethereum presently trades around $3,000 following a broader crypto market rebound in the last week. During this time, the market’s largest altcoin gained by 7.22%, providing a much-needed relief after an extended correction that dominated the majority of the last two months. As price stabilizes, crypto analytics platform XWIN Research Japan shares a forward-looking assessment of Ethereum’s outlook, especially considering developments in the futures market.

Ethereum Bulls Buy The Dip After Weak Position Exits

Amid the widespread correction of the crypto market in Q4 2025, Ethereum’s prices crashed from $4,700 to as low as $2,900, representing a 38% price decline. XWIN Research Japan reports this price fall coincided with certain relevant developments in the futures market.

In particular, Ethereum’s open interest across all exchanges dropped from $21 billion to around $17 billion in late November, as overleveraged long positions were closed down, forcing traders to open new positions with moderate leverage size. Meanwhile, funding rates stayed positive but declined to around 0.002, meaning that the dominant bullish sentiment from mid-2025 greatly reduced.

Looking at on-chain data, the Market Value to Realized Value (MVRV) is at 1.27, while Binance data shows it to be around 1.0, both values indicating Ethereum is in a neutral to fair value zone, suggesting a period of stability before the next major trend emerges. Meanwhile, the recent market recovery kick-started after ETH retested the realized price of whale addresses, indicating that large market players are bolstering their holdings.

XWIN Research Japan supports this theory, noting that Ethereum Treasury BitMine has boosted its market holdings to 3.63 million ETH. Additionally, a BlackRock client recently acquired tens of millions of dollars’ worth of ETH, further reinforcing the strength of current market demand. However, despite this robust market demand, ETH Spot ETF net outflows for November hit $1.42 billion, indicating there is significant selling pressure in the market.

Ethereum Market Outlook

At the time of writing, Ethereum trades at $3,003, reflecting a 0.22% loss in the past day. Despite its gains in the last week, the altcoin is still down by 22.34% over the last month, suggesting the majority of short-term holders are in losses.

XWIN Research Japan explains that although the overleveraged position has been cleared out with market whales now ramping up their holding, Ethereum remains in a “bottom-building phase”. Therefore, investors should still anticipate a “choppy, sell-on-rally” price action in the short term. The analysts predict a major trend reversal with time as the current price area becomes increasingly attractive to investors for massive accumulation opportunities.

Bitcoin Options Activity Surges As BTC-Denominated OI Breaks Record

Data shows the Bitcoin-denominated Options Open Interest has witnessed a sharp surge recently and set a new all-time high (ATH).

Bitcoin Options Trend Suggests Investors Repositioning Amid Downtrend

According to the latest weekly report from Glassnode, the recent market volatility has brought with it fresh activity on the options market. Options are one of the ways derivatives traders bet on future Bitcoin price action. An options contract grants the investor the right (but not the obligation) to buy or sell the cryptocurrency at a set price on or before a pre-set date. Bullish options bets are known as “calls,” while bearish ones as “puts.”

In the past, futures trading dominated the BTC derivatives market, but in recent times, options have gained popularity and now rival futures in terms of the Open Interest.

The Open Interest here refers to an indicator that measures the total amount of positions related to a given market that are open on all centralized exchanges. Below is the chart for this metric shared by Glassnode in the report that shows the trend in its BTC-denominated value for the options market over the past year.

As is visible in the graph, the Bitcoin Options Open Interest has shot up recently, indicating that options traders have been opening new positions. This surge in activity has come as BTC’s spot price has gone through some sharp volatility. The rise in the indicator has been so strong that it has pushed its value to a new ATH. Glassnode noted that this is a result of “a combination of volatility-arbitrage strategies and renewed demand for risk management.”

While the Options Open Interest denominated in BTC has spiked, the same hasn’t been true for the USD version, which remains well below the peak witnessed in late-October.

That said, the rise in the BTC-denominated metric is still a sign that investors have been repositioning, even if the overall USD capital involved is lower. “This sets the stage for the upcoming key expiry, which is shaping up to be one of the most significant in the near term,” explained the analytics firm.

Like the USD-denominated Options Open Interest, the indicator for the perpetual futures market has also seen a decline recently.

As displayed in the above chart, the Bitcoin Futures Open Interest has been following a slow and steady decline since the massive deleveraging event in October. The pace of the decline indicates investors themselves have been pulling back on risk, rather than facing forceful liquidations.

The report concluded:

The market now rests on a leaner leverage base, which lowers the odds of sharp, liquidation-driven volatility and reflects a more cautious, defensive positioning across futures markets.

BTC Price

Bitcoin has returned to $91,300 following its sharp 5% surge over the past day.