Bank Of America Opens Up To Bitcoin, Recommends Up To 4% Crypto Allocation

Bank of America is the latest traditional institution to warm up to Bitcoin, with its investment strategists set to cover four ETFs starting in January.

Bank of America To Begin Endorsing Crypto Exposure

As reported by Yahoo Finance, Bank of America will start recommending its clients a 1% to 4% portfolio allocation to digital assets. Until now, the bank’s wealth advisors couldn’t endorse crypto exposure and clients had to request access to digital asset products if they wanted them in their portfolio.

With this move, Bank of America advisors can begin recommending digital asset exposure to clients across the bank’s Merrill, Bank of America Private Bank, and Merrill Edge Platforms. “Our guidance emphasizes regulated vehicles, thoughtful allocation, and a clear understanding of both the opportunities and risks,” said Chris Hyzy, chief investment officer at Bank of America Private Bank.

Investment strategists will initially cover four Bitcoin exchange-traded funds (ETFs) starting January 5. ETFs are investment vehicles that allow traders to invest into an underlying asset without having to directly own it. Since they trade on traditional platforms and are regulated, institutional entities prefer to invest through them.

The four spot Bitcoin ETFs Bank of America will be focusing on include Bitwise’s BITB, BlackRock’s IBIT, Fidelity’s FBTC, and Grayscale’s BTC.

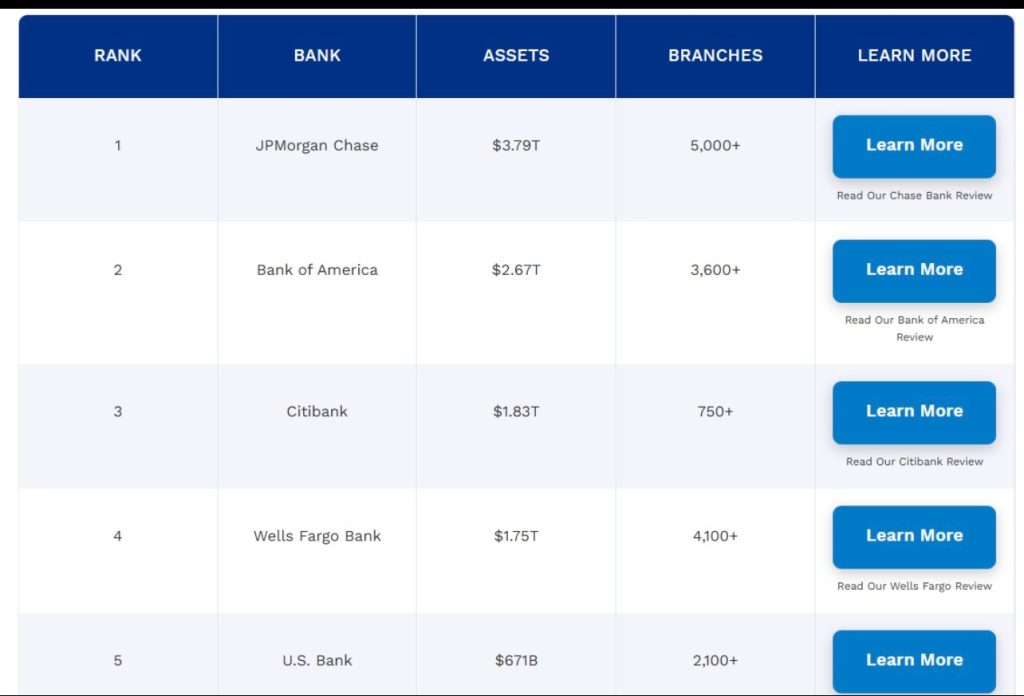

Bank of America is one of the largest financial institutions in the world, ranking only second behind JPMorgan Chase in market cap and placing sixth largest in terms of total assets. It’s designated as a global systemically important bank (G-SIB) by the Financial Stability Board (FSB), meaning it’s so entrenched in world economy that instability related to it could have widespread consequences.

Even an institution of its size no longer being able to ignore Bitcoin showcases just how far digital asset adoption in traditional finance has come. “This update reflects growing client demand for access to digital assets,” noted Nancy Fahmy, head of Bank of America’s investment solutions group.

The news arrives just a day after Vanguard Group, one of the largest asset managers in the world, opened its doors to crypto ETFs and mutual funds.

Morgan Stanley, another G-SIB, broadened access to crypto exposure for its clients back in October. The financial services institution’s global investment committee suggested 2% to 4% allocation in digital assets.

Bank of America’s recommendation of 1% to 4% is quite similar. “The lower end of this range may be more appropriate for those with a conservative risk profile, while the higher end may suit investors with greater tolerance for overall portfolio risk,” added Hyzy.

Bitcoin Price

Bitcoin has already recovered from its Monday blow as its price has returned to $92,100.

Morgan Stanley’s Global Investment Committee advises investors to keep a cautious 2%–4% of portfolios in crypto, tied to risk appetite.

Morgan Stanley’s Global Investment Committee advises investors to keep a cautious 2%–4% of portfolios in crypto, tied to risk appetite. Vanguard will allow trading of crypto-focused ETFs and mutual funds starting Tuesday, opening access to Bitcoin, Ether and other tokens for millions of investors.

Vanguard will allow trading of crypto-focused ETFs and mutual funds starting Tuesday, opening access to Bitcoin, Ether and other tokens for millions of investors. U.S. banks officially cleared to hold crypto following the

U.S. banks officially cleared to hold crypto following the