Vivek Ramaswamy’s Strive Urges MSCI to Rethink Bitcoin Index Exclusion

Bitcoin Magazine

Vivek Ramaswamy’s Strive Urges MSCI to Rethink Bitcoin Index Exclusion

Strive Asset Management is pushing back against MSCI’s latest proposal. The index provider suggested removing companies with bitcoin holdings over 50% of total assets from major equity benchmarks.

In a letter to MSCI CEO Henry Fernandez, Strive warned the plan could create uneven results worldwide. Companies report bitcoin differently under U.S. GAAP and IFRS accounting standards. Strive said this could lead to inconsistent outcomes for firms with similar exposure.

The Nasdaq-listed firm urged MSCI to rely on optional “ex-digital-asset treasury” index variants instead of redefining eligibility for broad benchmarks. These custom indexes already exist for sectors like energy and tobacco.

Strive is the 14th-largest public corporate bitcoin holder, with more than 7,500 BTC on its balance sheet. Its executives argued that the proposal would “depart from index neutrality” and asked MSCI to “let the market decide” how bitcoin-heavy firms are treated.

Co-founded by Vivek Ramaswamy and Anson Frericks in 2022, Strive has a mission to “depoliticize corporate America.”

MSCI’s ruling affect on companies like Strive and Strategy

The rule change could affect major players like Strategy, which holds 650,000 BTC. JPMorgan estimates MSCI’s exclusion could trigger $2.8 billion in passive outflows from Strategy alone. If other index providers follow suit, the total could rise to $8.8 billion.

Strive’s letter criticized the 50% threshold as “unjustified, overbroad and unworkable.” Many bitcoin treasury companies operate real businesses.

These include AI data centers, structured finance, and cloud infrastructure. Miners such as MARA, Riot, Hut 8, and CleanSpark are pivoting into renting excess power and compute capacity.

The firm drew comparisons to other industries. Indexes do not exclude energy companies with large oil reserves or gold miners whose value depends on metals. Applying a bitcoin-specific rule, Strive argued, imposes an investment judgment on benchmarks meant to remain neutral.

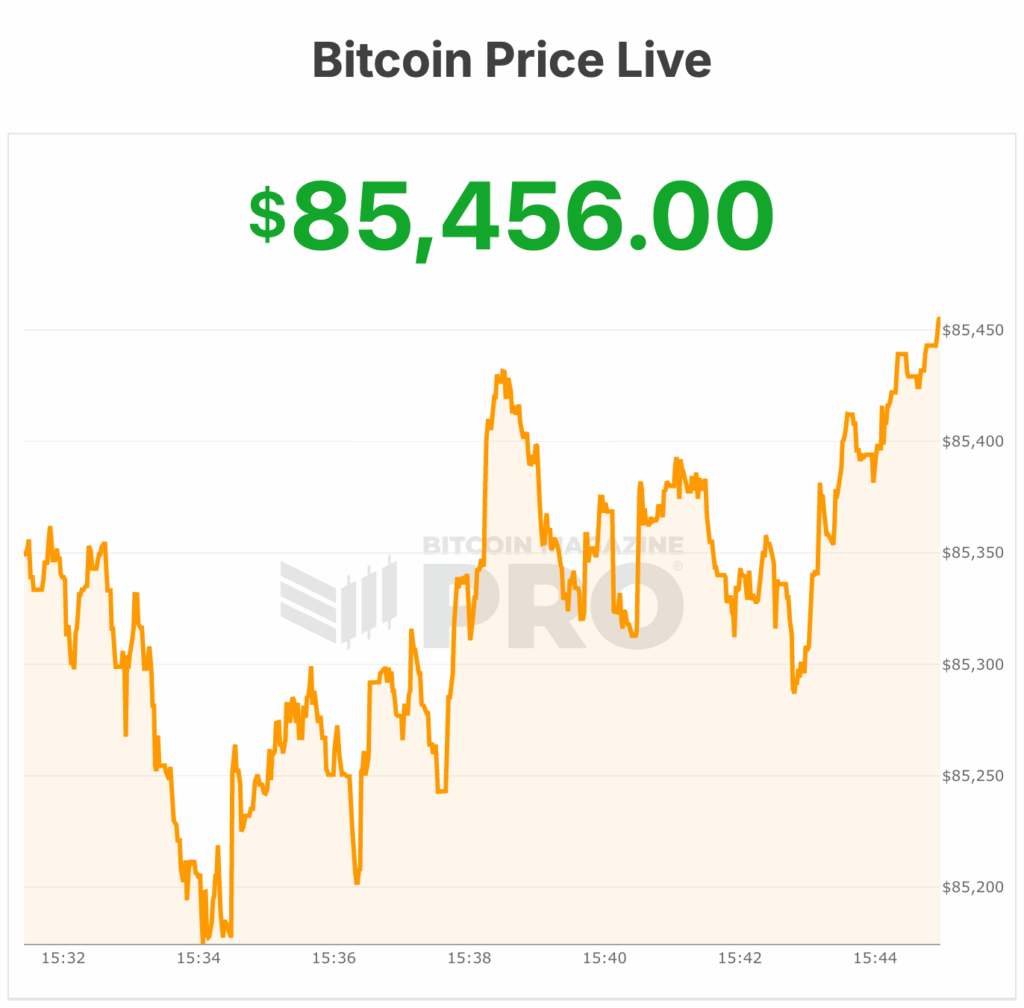

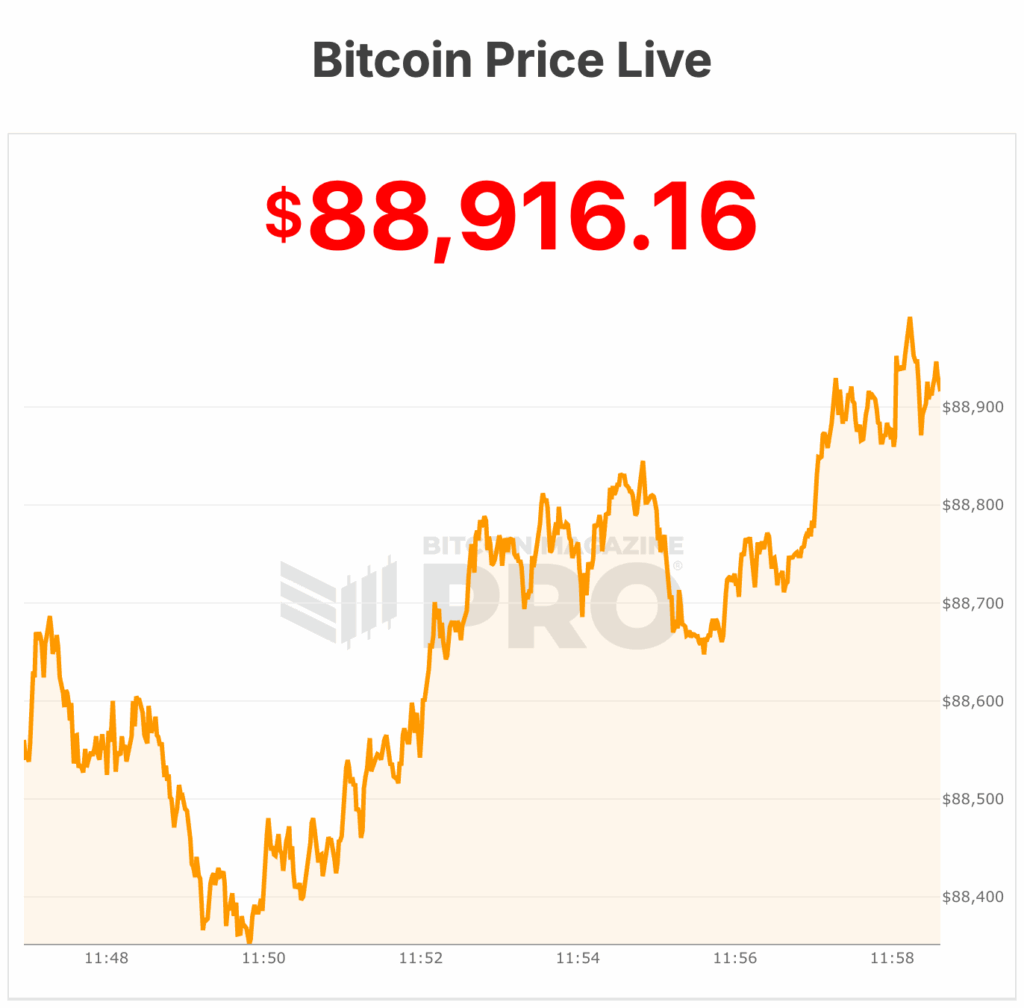

Executives also highlighted market volatility and accounting differences. Bitcoin’s price swings could push companies in and out of eligibility from quarter to quarter. Derivatives or structured products further complicate exposure calculations.

Strive warned that strict rules could push innovation abroad. U.S. markets may face penalties, while international companies benefit from IFRS treatment. The firm believes the proposal may stifle new bitcoin-backed financial products.

MSCI plans to announce its decision on January 15, 2026, before the February index review. Strive is among several firms lobbying against the proposal. Its argument centers on fairness, neutrality, and market choice rather than restricting investor access.

Last week, Strategy’s Michael Saylor disputed MSCI index disputes and clarified that Strategy is a publicly traded operating company with a $500 million software business and a treasury strategy using Bitcoin, not a fund, trust, or holding company.

This post Vivek Ramaswamy’s Strive Urges MSCI to Rethink Bitcoin Index Exclusion first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

CFTC announces spot Bitcoin and crypto can now trade on CFTC-registered exchanges

CFTC announces spot Bitcoin and crypto can now trade on CFTC-registered exchanges

Russia's second-largest bank, VTB, set to launch

Russia's second-largest bank, VTB, set to launch

UK passes law officially recognising crypto as property.

UK passes law officially recognising crypto as property.