MetaMask Enters Prediction Markets With Polymarket Integration

MetaMask, the most widely used Ethereum wallet, is moving directly into the prediction market arena through a new integration with Polymarket, giving users the ability to trade event outcomes from inside their wallets.

Key Takeaways:

- MetaMask has integrated Polymarket, allowing users to trade real-world event outcomes.

- The integration adds one-tap funding from any EVM chain.

- Polymarket’s rapid growth continues amid a potential $15 billion valuation.

“You can now trade on the future outcome of real world events inside your wallet,” Consensys’ Gabriela Helfet wrote, adding that users will also earn MetaMask Rewards points for every prediction placed.

MetaMask Becomes New Gateway to Polymarket With One-Tap Funding

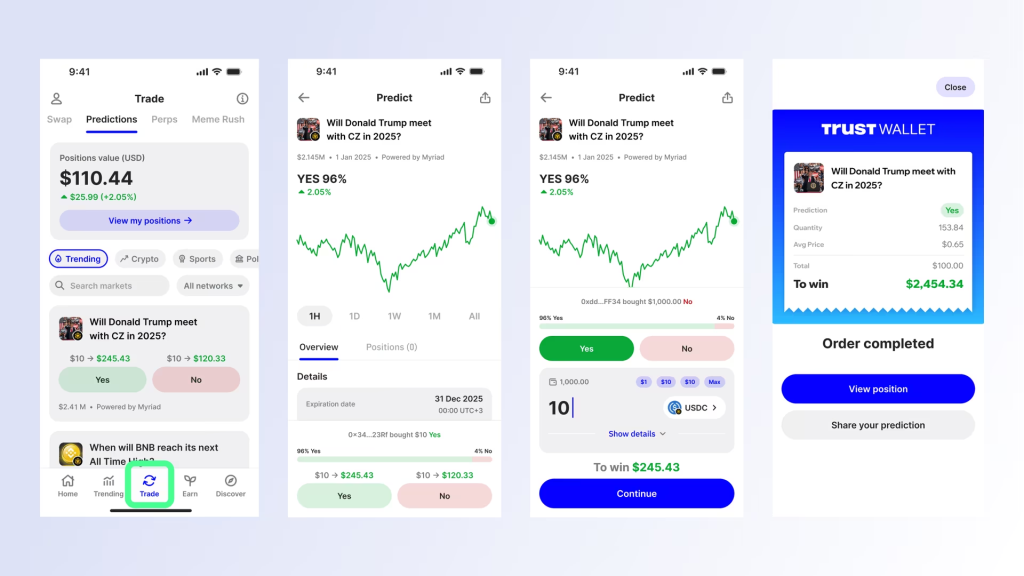

The integration creates a new on-ramp for Polymarket and introduces “one tap funding,” allowing users to deposit with any token from any EVM-compatible chain.

The move further tightens the link between everyday crypto wallets and decentralized betting platforms, positioning MetaMask as a gateway not only to Web3 apps but also to real-world event speculation.

Polymarket has surged in popularity over the past year, fueled in part by heightened attention during the 2024 US election cycle.

Former President Donald Trump’s embrace of crypto and a more relaxed regulatory climate helped push the platform back into the US market.

The company is now reportedly exploring a valuation of up to $15 billion, following a $2 billion strategic investment from Intercontinental Exchange, the parent of the NYSE.

Predicting on MetaMask only takes a few seconds.

— MetaMask.eth

We've enabled 1-click funding with any EVM token, or you can get started instantly if you have an existing @polymarket account! pic.twitter.com/zZtrQPDu3m(@MetaMask) December 5, 2025

For MetaMask, the move comes as the wallet expands beyond its Ethereum-focused roots. In October, it launched multichain accounts that support both EVM and non-EVM networks, including Solana.

The wallet is also preparing for the rollout of a native MASK token, as parent company Consensys gears up for a potential IPO.

The move comes as Polymarket is recruiting staff for an internal market-making team that would trade against its own customers, mirroring a controversial feature already used by rival Kalshi that has drawn criticism and legal challenges.

As reported, the New York-based prediction market startup has approached traders, including sports bettors, to join the new unit, people familiar with the matter said, requesting anonymity because the plans remain private.

Prediction Markets Hit $13B in Record Activity

Prediction markets have crossed $13 billion in cumulative trading volume, marking a record high even as broader crypto markets cool.

The surge has drawn in major players across tech and finance, including Fanatics, Coinbase, and MetaMask, all of which have recently launched or expanded event-trading platforms.

Against this backdrop, YZi Labs, the venture firm founded by Binance co-founder Changpeng “CZ” Zhao, has been intensifying its involvement in the sector.

YZi-backed Opinion has emerged as one of the most surprising breakout platforms. Launched on BNB Chain in October, it recorded nearly $1.5 billion in weekly trading volume within its first month, briefly overtaking established names such as Kalshi and Polymarket.

Meanwhile, prediction markets platform Kalshi has secured a major media breakthrough after signing a partnership with CNN, making the company the network’s official prediction markets partner while closing a $1 billion funding round at an $11 billion valuation.

The post MetaMask Enters Prediction Markets With Polymarket Integration appeared first on Cryptonews.

Prediction market platform Polymarket says it has received an Amended Order of Designation from the CFTC.

Prediction market platform Polymarket says it has received an Amended Order of Designation from the CFTC.

(@shayne_coplan)

(@shayne_coplan)  FBI agents have reportedly seized Polymarket CEO Shayne Coplan’s phone and electronics, following a raid at his Manhattan residence.

FBI agents have reportedly seized Polymarket CEO Shayne Coplan’s phone and electronics, following a raid at his Manhattan residence.

Polymarket has received investment from

Polymarket has received investment from