‘Stablecoins Are Here To Stay’: IMF Calls For Global Cooperation To Prevent Financial Risks

As stablecoins continue to gain worldwide momentum, the International Monetary Fund (IMF) has called for global cooperation to avert potential macro financial stability risks related to the rapidly growing sector and to turn the industry “into a force for good.”

Stablecoins To Foster Innovation, Financial Inclusion

On Thursday, the IMF released a 56-page report discussing the growing influence of stablecoins, their potential use cases in mainstream financial markets, and the risks associated with the sector’s varying oversight.

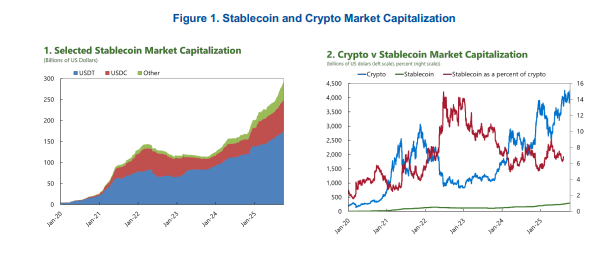

Amid the sector’s rapid growth, the organization highlighted that the two largest stablecoins, USDT and USDC, have tripled their market capitalization since 2023, reaching a combined $260 billion. Meanwhile, their trading volume has increased by around 90% to $23 trillion in 2024, with Asia surpassing North America in stablecoin activity volume.

The IMF noted two major potential benefits from stablecoins. First, they could enable faster and cheaper cross-border payments, especially for remittances, which can cost 20% of the amount being sent and face some delays.

However, “being a single source of information, blockchains can greatly simplify the processes linked with cross-border payments and reduce costs,” the Fund’s economists explained in a blog post.

Second, stablecoins could expand financial access, driving innovation by increasing competition with established payment service providers, therefore, making retail digital payments more accessible to underserved customers.

They could facilitate digital payments in areas where it is costly or not profitable for banks to serve customers. Many developing countries are already leapfrogging traditional banking with the expansion of mobile phones and different forms of digital and tokenized money.

Notably, competition with already established providers could lower costs and lead to enhanced product diversity, “leveraging synergies between digital payments and other digital services.”

IMF Warns Of Fragmented Oversight

Despite their potential benefits, stablecoins also carry significant risks, the IMF explained, including de-pegging and collapsing if the underlying assets lose value or if users lose confidence in the ability to cash out. Per the report, this could also trigger fire sales of the reserve assets and disrupt financial markets.

Stablecoins could also accelerate a “currency substitution” dynamic, where individuals and companies abandon their national currency in favor of a foreign one, like US dollars or euros, due to instability or high inflation.

The organization noted that the dynamic decreases a country’s central bank’s ability to control its monetary policy and serve as the lender of last resort, damaging the financial sovereignty of affected nations.

In addition, the potential to reduce cross-border frictions and make faster and cheaper transactions could be undermined by a lack of interoperability if various networks are unable to connect or are restricted by different regulations and other hurdles.

“Stablecoin regulation is in its infancy, so the ability to mitigate these risks remains uneven across countries,” the organization affirmed, noting that “the IMF and the Financial Stability Board have issued recommendations to safeguard against currency substitution, maintain capital flow controls, address fiscal risks, ensure clear legal treatment and robust regulation, implement financial integrity standards, and strengthen global cooperation.”

As reported by Bitcoinist, the FSB vowed in October to address the evolving threats from private finance and the growing use of stablecoins, promising to increase the global watchdog’s policy response and overhaul its surveillance system to make it more flexible and quicker.

Nonetheless, major jurisdictions have taken different stances in key areas, as the IMF detailed, which could result in the exploitation of gaps between jurisdictions and issuers to locate where oversight is weaker.

All this underscores the need for strong international cooperation to mitigate macrofinancial and spillover risks (…). Tokenization and stablecoins are here to stay. But their future adoption and the outlook for this technology are still mostly unknown.

The organization concluded that “improving the existing global financial infrastructure might be easier than replacing it. Achieving the best possible balance will require close cooperation among policymakers, regulators, and the private sector.”

yesterday.

yesterday.

The United States Army Contracting Command at Rock Island Arsenal has awarded Allied Metal Tech LLC of Greenville, Wisconsin, a contract valued at $272 million for the production of bomb dummy unit-50 (BDU-50) cast ductile iron devices with material handling pallets in support of the U.S. Air Force and potential Foreign Military Sales (FMS) requirements. […]

The United States Army Contracting Command at Rock Island Arsenal has awarded Allied Metal Tech LLC of Greenville, Wisconsin, a contract valued at $272 million for the production of bomb dummy unit-50 (BDU-50) cast ductile iron devices with material handling pallets in support of the U.S. Air Force and potential Foreign Military Sales (FMS) requirements. […]

The ECB warns that stablecoins are growing fast, now topping $280B, with rising spillover risks as USDT and USDC dominate 90% of the market.

The ECB warns that stablecoins are growing fast, now topping $280B, with rising spillover risks as USDT and USDC dominate 90% of the market.