Poland Stalls MiCA-Style Crypto Rules as Lawmakers Fail to Override Presidential Veto

Poland’s efforts to align its crypto market with the European Union’s Markets in Crypto-Assets framework have hit a major political roadblock after lawmakers failed to override a presidential veto on a sweeping digital-asset bill.

This leaves the country as the last EU member without a national MiCA-style regime.

According to a Bloomberg report, the vote was held in the lower house of parliament on Friday, falling short of the three-fifths majority required to overturn President Karol Nawrocki’s decision to reject the legislation.

The outcome halts Prime Minister Donald Tusk’s push to place Poland’s crypto sector under tight regulatory control and forces the government to restart the legislative process from scratch.

Tusk Flags Crypto as National Security Threat Amid Russia Sabotage Claims

Tusk had framed the bill as a national security measure in the days leading up to the vote.

Addressing parliament, he said the unregulated crypto market had become a conduit for money laundering and foreign interference, including activity linked to Russia and Belarus.

He told lawmakers that Polish authorities had identified “several hundred” foreign entities operating in the domestic crypto market and warned that Russian intelligence and organized crime groups were exploiting digital assets for covert financing.

Government officials have tied those concerns to recent security incidents.

Last month, Warsaw blamed Russia for a blast on a key railway route used for supply traffic to Ukraine, an allegation Moscow dismissed.

Polish security services have also cited cases of underground groups allegedly paid in cryptocurrencies to carry out sabotage activities inside the country.

— Cryptonews.com (@cryptonews) October 14, 2025

Russia is using cryptocurrencies to pay saboteurs carrying out hybrid attacks across the European Union, according to a Polish security official. #Russia #Cryptohttps://t.co/MsOjIZjSfu

The veto has deepened an already sharp political confrontation between Nawrocki, a nationalist conservative, and Tusk’s pro-European coalition.

The president rejected the bill earlier this month, arguing that it went far beyond EU requirements and threatened civil liberties, property rights, and the stability of the state.

— Cryptonews.com (@cryptonews) December 2, 2025

Polish President Karol Nawrocki vetoed a sweeping crypto law, saying it threatens property rights and personal freedoms.#Crypto #Regulationhttps://t.co/BXYSh74MPF

The blocked law would have implemented MiCA-style rules in Poland, introducing licensing for crypto-asset service providers, investor protection standards, stablecoin reserve requirements, market abuse bans, and strict anti-money laundering controls.

It also proposed granting authorities the power to block crypto-related websites through administrative orders, a provision the president described as opaque and vulnerable to abuse.

Political Tensions Rise After Poland Blocks Sweeping Crypto Oversight Bill

Nawrocki also criticized the scale of the bill, which exceeded 100 pages, contrasting it with far shorter implementing laws in neighboring Czechia and Slovakia.

He warned that heavy supervisory fees and added domestic restrictions would drive Polish crypto firms to register in other EU countries, costing Poland tax revenue and talent.

His chief of staff, Zbigniew Bogucki, said on Friday that the president is open to regulation as long as future proposals are not excessively restrictive.

The failure to override the veto leaves crypto companies operating in Poland without a clear national legal framework ahead of the EU’s July 1, 2026, MiCA compliance deadline.

The political dispute has increasingly drawn in industry players.

Nawrocki has portrayed himself as a defender of the crypto sector and was endorsed before his election by Kristi Noem, a senior U.S. official, at a conference in southeast Poland sponsored by trading platform Zondacrypto.

— Cryptonews.com (@cryptonews) June 2, 2025

Poland has elected Karol Nawrocki, a conservative who says crypto should be “born in freedom, not buried in red tape.”#poland #cryptohttps://t.co/BVJXhQBnrK

The exchange later stated that it accepts no Russian clients and fully complies with anti-money laundering rules.

Foreign Minister Radosław Sikorski added another dimension to the dispute on Friday, saying on radio RMF FM that the crypto industry sponsors figures across the right wing of Polish politics, explaining the sharp resistance to tighter oversight.

The veto follows months of turbulence around crypto regulation in Poland. In September, lawmakers had initially passed the bill, triggering strong backlash from industry leaders who warned that Poland’s version of MiCA amounted to overregulation.

Zondacrypto’s chief executive at the time described it as a “step backwards” that risked criminalizing core blockchain development activity.

The post Poland Stalls MiCA-Style Crypto Rules as Lawmakers Fail to Override Presidential Veto appeared first on Cryptonews.

↓

↓

(@Gautamguptagg)

(@Gautamguptagg)  ,

,  ) (@JupiterExchange)

) (@JupiterExchange)

Thai police arrest alleged FINTOCH mastermind behind $31 million crypto Ponzi scheme that defrauded investors across multiple Asian countries.

Thai police arrest alleged FINTOCH mastermind behind $31 million crypto Ponzi scheme that defrauded investors across multiple Asian countries.

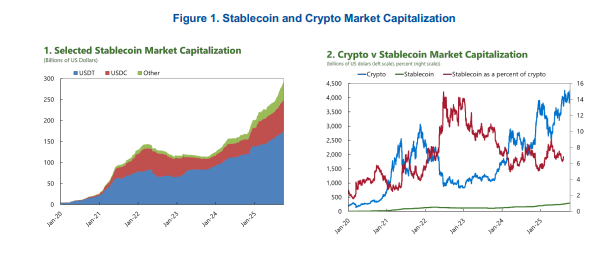

The ECB warns that stablecoins are growing fast, now topping $280B, with rising spillover risks as USDT and USDC dominate 90% of the market.

The ECB warns that stablecoins are growing fast, now topping $280B, with rising spillover risks as USDT and USDC dominate 90% of the market.

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products.

Spot crypto trading is moving closer to mainstream finance after the SEC and CFTC cleared registered exchanges to facilitate certain spot products. The CFTC is reportedly set to approve leveraged crypto trading on regulated U.S. exchanges next month. Acting Chair

The CFTC is reportedly set to approve leveraged crypto trading on regulated U.S. exchanges next month. Acting Chair

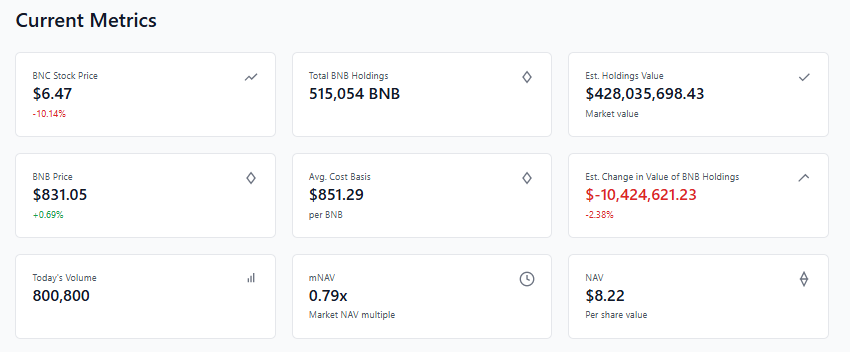

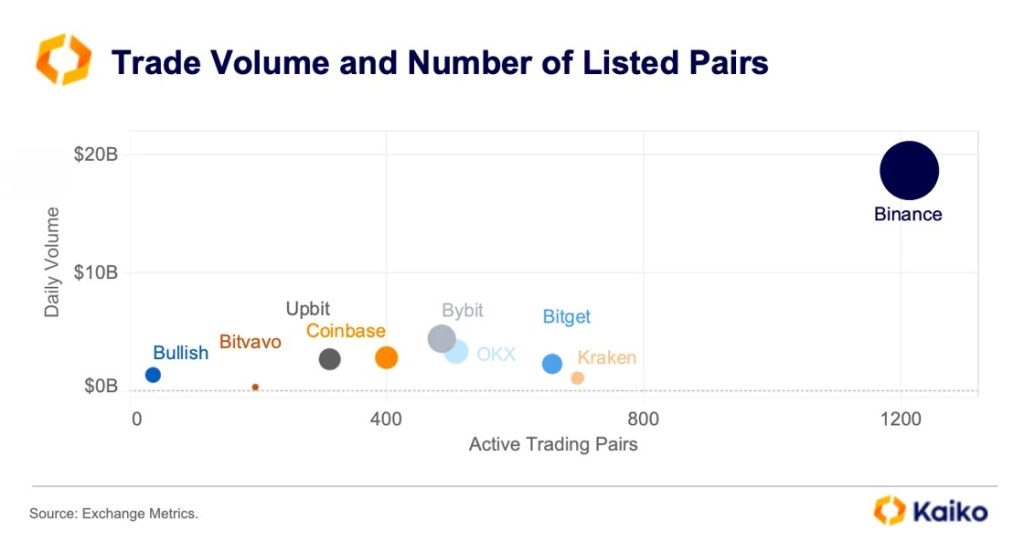

Families of the Hamas 2023 attack victims have sued Binance and CZ for facilitating $1 billion in crypto to the accounts of terror groups.

Families of the Hamas 2023 attack victims have sued Binance and CZ for facilitating $1 billion in crypto to the accounts of terror groups. Binance is trying to dismiss a U.S. class action lawsuit, saying users agreed to arbitration—not court.

Binance is trying to dismiss a U.S. class action lawsuit, saying users agreed to arbitration—not court.

(@shayne_coplan)

(@shayne_coplan)  FBI agents have reportedly seized Polymarket CEO Shayne Coplan’s phone and electronics, following a raid at his Manhattan residence.

FBI agents have reportedly seized Polymarket CEO Shayne Coplan’s phone and electronics, following a raid at his Manhattan residence.

Polymarket has received investment from

Polymarket has received investment from

The SEC’s green light of spot Bitcoin ETFs opens the floodgates for issuers, but Bitcoin's price has so far stayed flat, defying expectations. When will we see bullish price action?

The SEC’s green light of spot Bitcoin ETFs opens the floodgates for issuers, but Bitcoin's price has so far stayed flat, defying expectations. When will we see bullish price action?

Former Olympic snowboarder Ryan Wedding is facing criminal charges in an international crypto-related scheme.

Former Olympic snowboarder Ryan Wedding is facing criminal charges in an international crypto-related scheme. The US DOJ is seeking to seize over $15 million in USDT tied to North Korean state-backed hacking unit APT38.

The US DOJ is seeking to seize over $15 million in USDT tied to North Korean state-backed hacking unit APT38.

The Federal Deposit Insurance Corporation will publish its first US stablecoin rule framework later this month.

The Federal Deposit Insurance Corporation will publish its first US stablecoin rule framework later this month. The U.S. Treasury is calling on the public for feedback on how financial institutions can prevent crypto risks as part of the GENIUS Act.

The U.S. Treasury is calling on the public for feedback on how financial institutions can prevent crypto risks as part of the GENIUS Act.

Two NYPD officers are on modified duty after reports emerged the two detectives may have possible links to last week's crypto kidnapping.

Two NYPD officers are on modified duty after reports emerged the two detectives may have possible links to last week's crypto kidnapping.

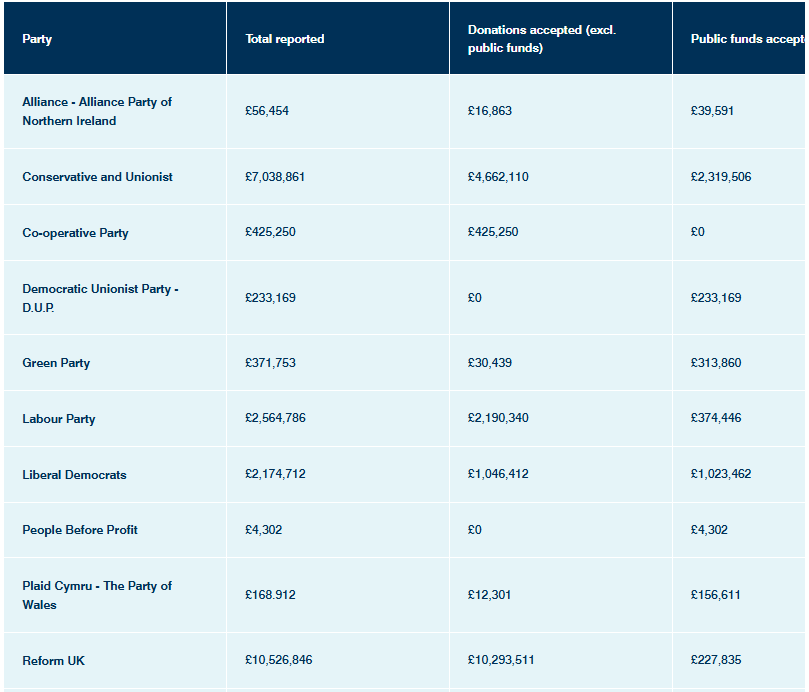

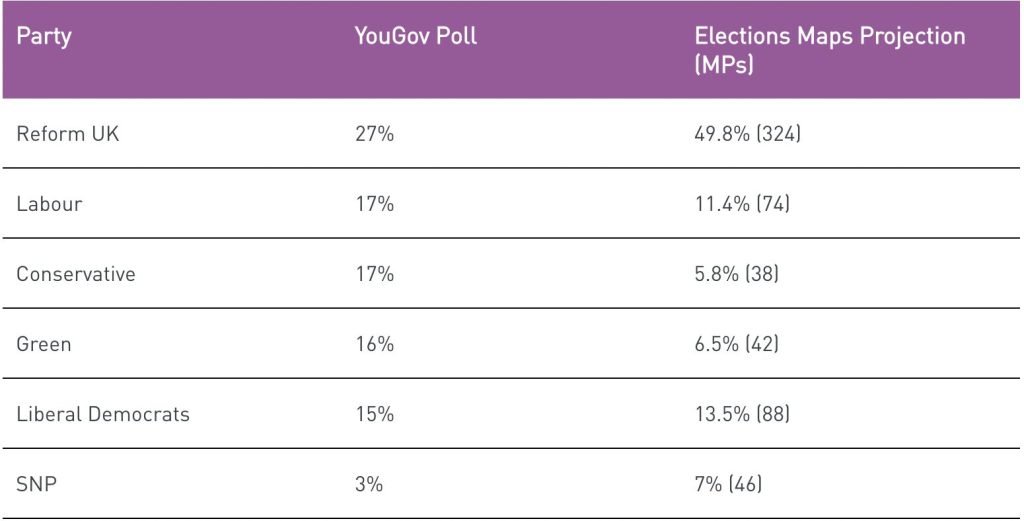

UK Cabinet Office Minister Pat McFadden has called for election officials to consider banning political donations made in digital currencies.

UK Cabinet Office Minister Pat McFadden has called for election officials to consider banning political donations made in digital currencies.  A cryptocurrency-backed super PAC, Fairshake, is heading into the upcoming midterm elections with more than $140 million in the bank.

A cryptocurrency-backed super PAC, Fairshake, is heading into the upcoming midterm elections with more than $140 million in the bank.

Vanguard will allow trading of crypto-focused ETFs and mutual funds starting Tuesday, opening access to Bitcoin, Ether and other tokens for millions of investors.

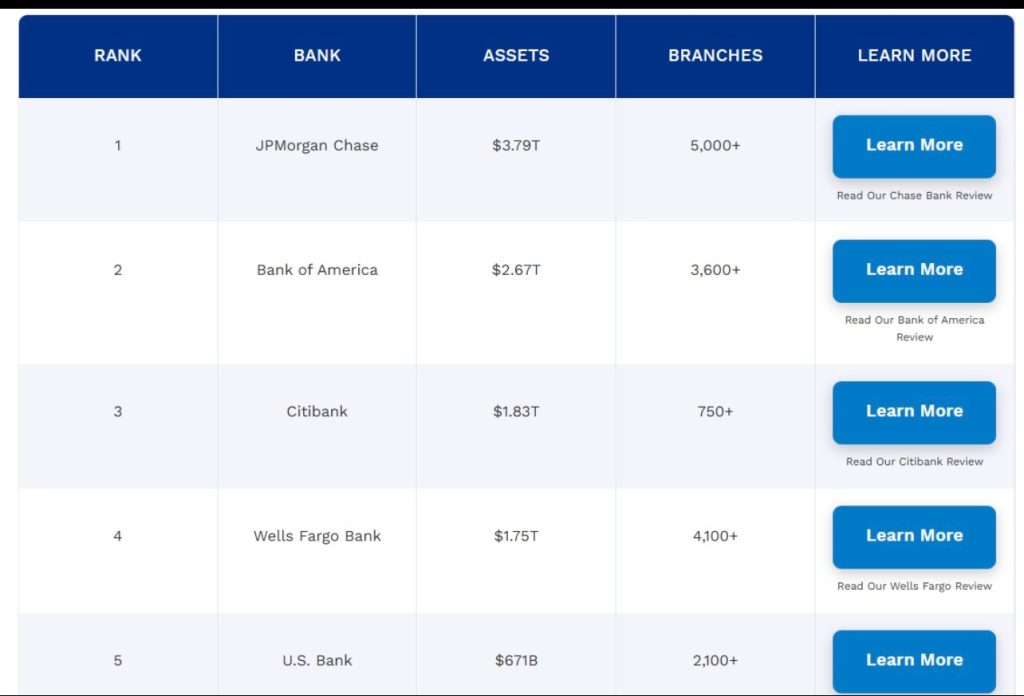

Vanguard will allow trading of crypto-focused ETFs and mutual funds starting Tuesday, opening access to Bitcoin, Ether and other tokens for millions of investors. U.S. banks officially cleared to hold crypto following the

U.S. banks officially cleared to hold crypto following the

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure.

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure.

BNB Hits Second ATH This Month, Crosses $1,300 Barrier

BNB Hits Second ATH This Month, Crosses $1,300 Barrier